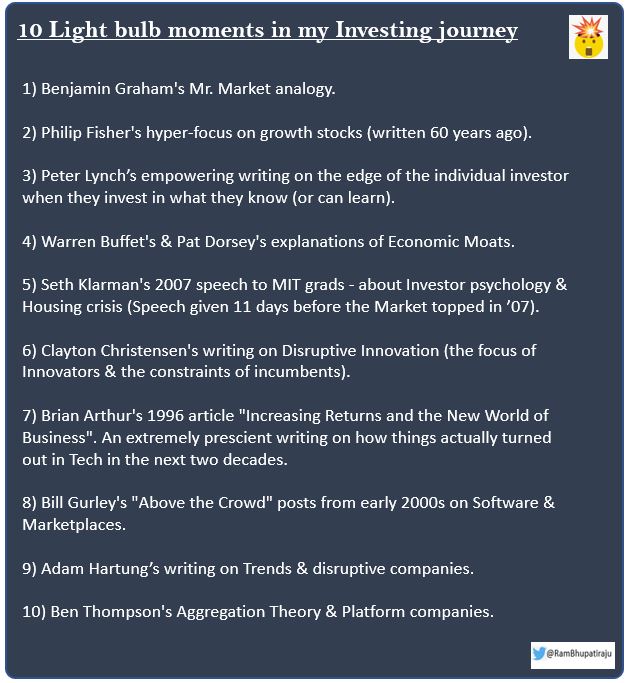

🔟Investing concepts that blew my mind🤯when I read them, and greatly helped my investing journey.

Would love to know about some of yours.

@saxena_puru @BrianFeroldi @GavinSBaker @7Innovator @dhaval_kotecha @Gautam__Baid @richard_chu97 @10kdiver @FromValue @investing_city

Would love to know about some of yours.

@saxena_puru @BrianFeroldi @GavinSBaker @7Innovator @dhaval_kotecha @Gautam__Baid @richard_chu97 @10kdiver @FromValue @investing_city

Below thread has the references to each of these 10 concepts.

Note : Many of these are my past Tweets related to these topics. Not trying to self promote them. Adding them only because they have the original links, added context and my highlights & fav pts.

Let's dive in. ⬇️⬇️

Note : Many of these are my past Tweets related to these topics. Not trying to self promote them. Adding them only because they have the original links, added context and my highlights & fav pts.

Let's dive in. ⬇️⬇️

1⃣ Benjamin Graham's Mr. Market analogy.

An extremely useful concept, especially when

Market is panicking (& throwing out good Co's at bargain prices) & when

Market is too complacent (& awarding high valuations to hype and stories)

An extremely useful concept, especially when

Market is panicking (& throwing out good Co's at bargain prices) & when

Market is too complacent (& awarding high valuations to hype and stories)

https://twitter.com/RamBhupatiraju/status/1264769802511552512

2⃣ Philip Fisher's hyper-focus on growth stocks (written 60 years ago).

Very useful and mostly still applicable stuff on how to deeply analyze Growth Co's (except Stock based Compensation & Adjusted EBITDA of course😄)

Very useful and mostly still applicable stuff on how to deeply analyze Growth Co's (except Stock based Compensation & Adjusted EBITDA of course😄)

https://twitter.com/RamBhupatiraju/status/1268393671982006274

3⃣ Peter Lynch’s empowering writing on the edge of the individual investor when they invest in what they know (or can learn).

https://twitter.com/RamBhupatiraju/status/1331466853387038725

https://twitter.com/RamBhupatiraju/status/1335802585727574016

4⃣ Warren Buffet's & Pat Dorsey's explanations of Economic Moats.

https://twitter.com/RamBhupatiraju/status/1228889186708738049

5⃣ Seth Klarman's 2007 speech to MIT grads - about Investor psychology & Housing crisis (Speech given 11 days before the Market topped in ’07).

I read this in early Sep 2008, which clearly explained what was going on even as the events were unfolding.

grahamanddoddsville.net/wordpress/File…

I read this in early Sep 2008, which clearly explained what was going on even as the events were unfolding.

grahamanddoddsville.net/wordpress/File…

6⃣ Clayton Christensen's writing on Disruptive Innovation (the focus of Innovators & the constraints of incumbents).

Excellent Summary ⬇️

medium.com/@duartem/summa…

Excellent Summary ⬇️

medium.com/@duartem/summa…

7⃣ Brian Arthur's 1996 article "Increasing Returns and the New World of Business".

An extremely prescient writing on how things actually turned out in Tech in the next two decades.

An extremely prescient writing on how things actually turned out in Tech in the next two decades.

https://twitter.com/RamBhupatiraju/status/1261721541793980419

8⃣ Bill Gurley's "Above the Crowd" posts from early 2000s on Software & Marketplaces.

abovethecrowd.com/archives/

abovethecrowd.com/archives/

https://twitter.com/RamBhupatiraju/status/1225780193790513152

9⃣ Adam Hartung’s writing on Trends & disruptive companies.

His writing helped me to observe and give more importance to strong/sustainable ongoing trends, and in identifying/analyzing the Winners.

adamhartung.com/adams-blog/

His writing helped me to observe and give more importance to strong/sustainable ongoing trends, and in identifying/analyzing the Winners.

adamhartung.com/adams-blog/

🔟 Ben Thompson's Aggregation Theory & Platform companies.

Helped me truly understand the power of Digital & how these Winners are different from past.

Defining Aggregators

stratechery.com/2017/defining-…

Moat Map

stratechery.com/2018/the-moat-…

Aggregation Theory

stratechery.com/2015/aggregati…

Helped me truly understand the power of Digital & how these Winners are different from past.

Defining Aggregators

stratechery.com/2017/defining-…

Moat Map

stratechery.com/2018/the-moat-…

Aggregation Theory

stratechery.com/2015/aggregati…

Good returns are what we're after (in the end) but investing is much more fun when you learn the best concepts out there (from the great investors & business thinkers), blend them in to your own process to make it better.

Strong basics/concepts, pattern recognition and keeping your process updated is the recipe for good and sustainable results.

Anyway, this is a thread I enjoyed thinking about the putting together. Hope some people find it useful.

/END.

Anyway, this is a thread I enjoyed thinking about the putting together. Hope some people find it useful.

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh