When people say "Valuation doesn't matter" is precisely the time we need to be more cautious and know the difference between (Intrinsic) Value & (Mkt) Price.

Excellent Site based on A. Damodaran's "The Little Book of Valuation"👏

@dmuthuk @Gautam__Baid

people.stern.nyu.edu/adamodar/New_H…

Excellent Site based on A. Damodaran's "The Little Book of Valuation"👏

@dmuthuk @Gautam__Baid

people.stern.nyu.edu/adamodar/New_H…

Topics ⬇️

✔️Intrinsic versus Relative Value

✔️Time Value of Money and concept of Discounting

✔️Accounting 101

✔️Mechanics of using Intrinsic Value versus Relative Value

✔️Intrinsic versus Relative Value

✔️Time Value of Money and concept of Discounting

✔️Accounting 101

✔️Mechanics of using Intrinsic Value versus Relative Value

Characteristics, Value Drivers & how to Value Co.'s in various stages of their Life Cycle

✔️Young Growth Co.'s

✔️Growth Co.'s

✔️Mature Co.'s

✔️Declining & Distressed Co.'s

Valuing Co.'s in few other Sectors

✔️Financial Services

✔️Commodities & Cyclicals

✔️High Intangible Assets

✔️Young Growth Co.'s

✔️Growth Co.'s

✔️Mature Co.'s

✔️Declining & Distressed Co.'s

Valuing Co.'s in few other Sectors

✔️Financial Services

✔️Commodities & Cyclicals

✔️High Intangible Assets

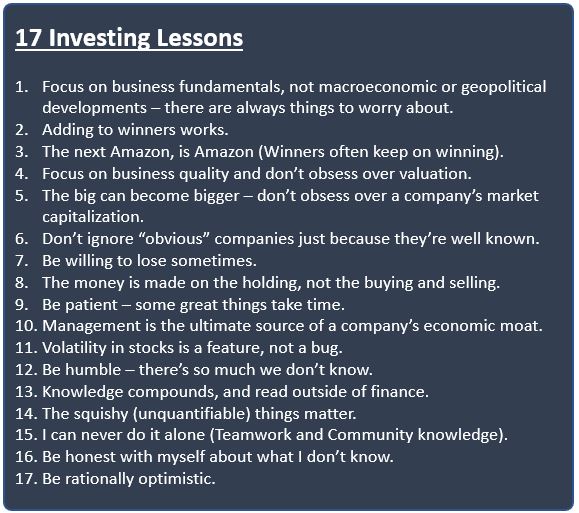

For those really interested in long-term investing in Individual Businesses, after few years of learning and experience in particular sector, you can get better at identifying quality Companies/Management.

What trips Investors up and is more impactful over the long-term is

1⃣ When you invest for a low valuation, purely based on backward looking Financials w/o giving enough importance to it's quality and future.

1⃣ When you invest for a low valuation, purely based on backward looking Financials w/o giving enough importance to it's quality and future.

2⃣ When you don't invest in High Quality and high growth Company that you understand well, only due to seemingly high valuation (and still don't invest in it realizing your mistake, just because it has already run up a lot since you first looked at it).

Two things to keep in mind w.r.t Valuation are

1⃣It's highly dependent on the Industry, Life stage of the Co,Quality of the Business/Mgmt, growth rates etc. So quickly concluding something is cheap/expensive (based on the Price multiple) while ignoring everything else is silly.

1⃣It's highly dependent on the Industry, Life stage of the Co,Quality of the Business/Mgmt, growth rates etc. So quickly concluding something is cheap/expensive (based on the Price multiple) while ignoring everything else is silly.

2⃣Even if the stock price is supposed to be focused on the cash flows over the long-term from that specific Business, the short term valuation can be all over the place depending on the Market sentiment, Fed/Gov policy, momentum/hype etc.

Understanding all these nuances can help investors avoid the daily noise, focus in stable/quality/growth areas, & act when Price is favorable vs Intrinsic Value.

Overall, the above link is fantastic for those patient & independent enough to learn the Core concepts. 👍

/END

Overall, the above link is fantastic for those patient & independent enough to learn the Core concepts. 👍

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh