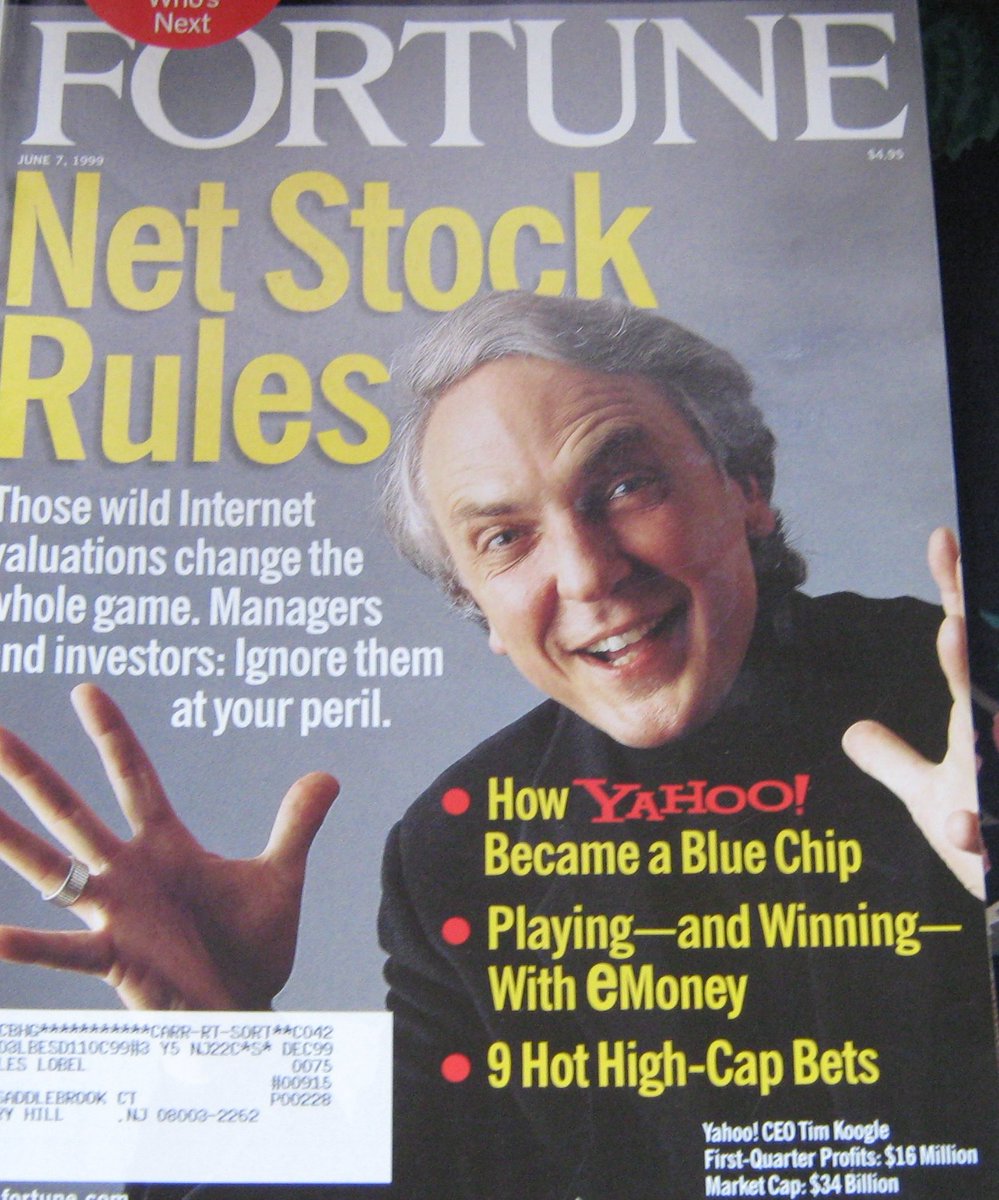

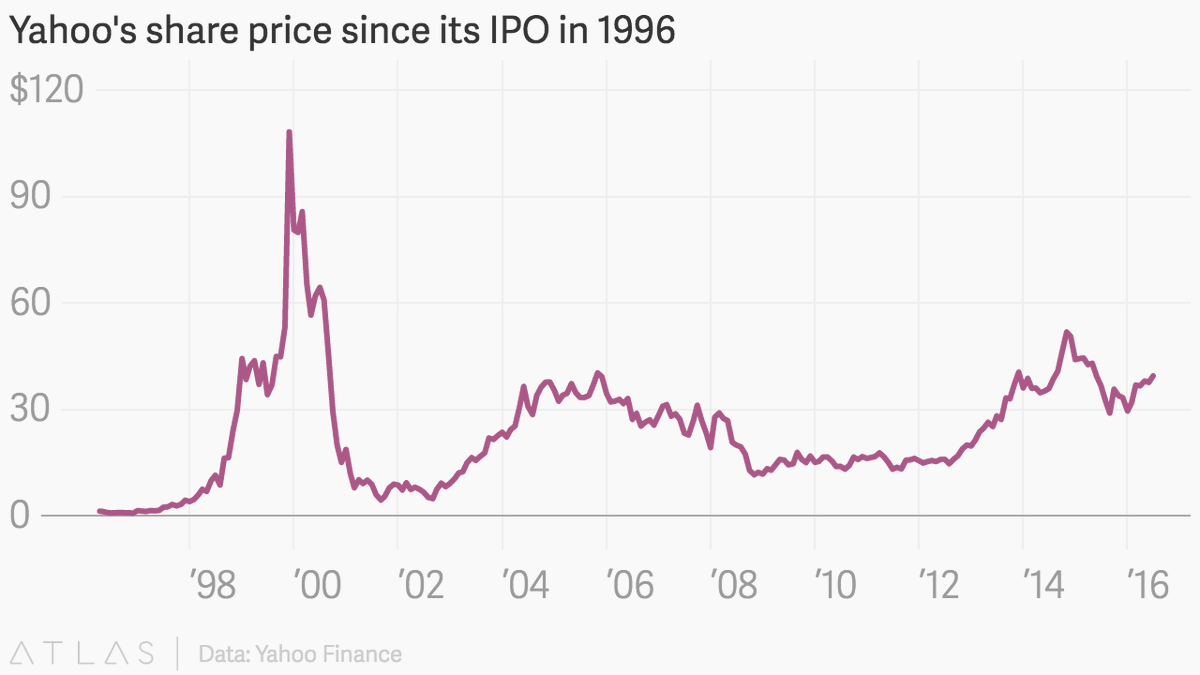

1999 article on Yahoo for a glance at the dotcom bubble mindset.

It's not that investors didn't understand valuation. They accepted it reluctantly because internet stocks were ripping and they had to show relative performance.

archive.fortune.com/magazines/fort…

It's not that investors didn't understand valuation. They accepted it reluctantly because internet stocks were ripping and they had to show relative performance.

archive.fortune.com/magazines/fort…

"Yahoo has taken the final step on its journey to blue-chip status: It has become a "must" for mutual funds and other big institutional buyers of stock"

"If you don't own some of these stocks, you're being fiduciarily irresponsible."

"If you don't own some of these stocks, you're being fiduciarily irresponsible."

"Watching short-sellers being kicked in the stomach by...Yahoo, it's difficult for us to say one should have any regard for valuations when it comes to high-profile stocks"

"As everyone that has tried to short the stock will tell you, it is very difficult to fight the momentum."

"As everyone that has tried to short the stock will tell you, it is very difficult to fight the momentum."

Fortune argued that small float was crucial at the IPO. "When Yahoo went public the "float" was tiny. Only 10% of shares went to the public."

"I want to be in a stock with a two-million-share float," says a day trader, "all you need is the littlest hype, and it will run up."

"I want to be in a stock with a two-million-share float," says a day trader, "all you need is the littlest hype, and it will run up."

"Once you reach the conclusion that it is the supply-demand equation that is moving these stocks, and not valuation, you have to make a choice," Walberg says. "You can ignore what is driving the stocks and opt out of the game. Or you can ignore valuation and stay in the game.

Go ahead, be negative on Yahoo and look like an idiot:

"It was a big mistake." By the time he finally upgraded the stock, it had more than tripled. Now, if you ask him about valuation, he'll give the same answer as Mayer Offman and Bob Walberg: "Valuation is meaningless."

"It was a big mistake." By the time he finally upgraded the stock, it had more than tripled. Now, if you ask him about valuation, he'll give the same answer as Mayer Offman and Bob Walberg: "Valuation is meaningless."

Let's make valuation fun again:

"Broadcasting is 8-12x times cash flow. But we don't have any comparable way to gauge Internet stocks. What if I took the market value of an Internet company and divided it by monthly page views?"

"Broadcasting is 8-12x times cash flow. But we don't have any comparable way to gauge Internet stocks. What if I took the market value of an Internet company and divided it by monthly page views?"

"Having decided that this was a useful exercise, Harmon created other measures: Market cap/users; market cap/ad views; revenue/subscriber; market cap/potential market share, and a half dozen others."

Was he the first to figure out market cap/TAM🤔

Was he the first to figure out market cap/TAM🤔

The key quote: "Do you know why people like me own this stock?" asks Roger McNamee. "We own it because we have no choice."

"I buy these stocks because I live in a competitive universe, and I can't beat my benchmarks without them."

"I buy these stocks because I live in a competitive universe, and I can't beat my benchmarks without them."

"You either participate in this mania, or you go out of business," he says. "It's a matter of self-preservation."

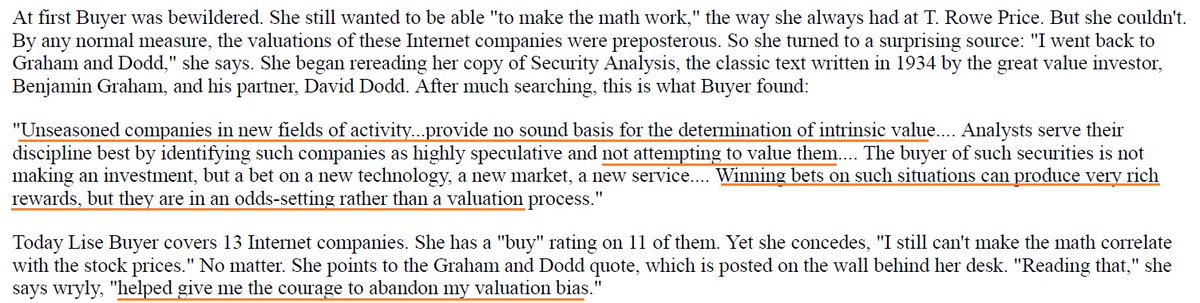

One more interesting nugget: an analyst was interested in Yahoo "I just thought it had incredible potential" but couldn't make sense of valuation. So she went back to Graham and Dodd, 1934 edition.

"Unseasoned companies in new fields of activity provide no sound basis for the determination of intrinsic value.

Winning bets on such situations can produce very rich rewards, but they are in an odds-setting rather than a valuation process."

Winning bets on such situations can produce very rich rewards, but they are in an odds-setting rather than a valuation process."

"I still can't make the math correlate with the stock prices. Reading that, helped give me the courage to abandon my valuation bias."

• • •

Missing some Tweet in this thread? You can try to

force a refresh