alright, been getting a lot of DMs with syndicate questions (and even one that I inspired an investor to launch her first syndicate deal!) so i wanted to dig into syndicate deals & their relevance to founders, investors, and aspiring leads as well as FAQs...[a thread]

first off - hi, i’m Paige, a dev success engineer at @WorkOS, author of Seed to Harvest: A Simple Explanation of VC and an early stage syndicate lead. I’m passionate about democratizing access to info and capital for founders, technologists, creators, and aspiring investors.

1/ to get started - what is a syndicate?

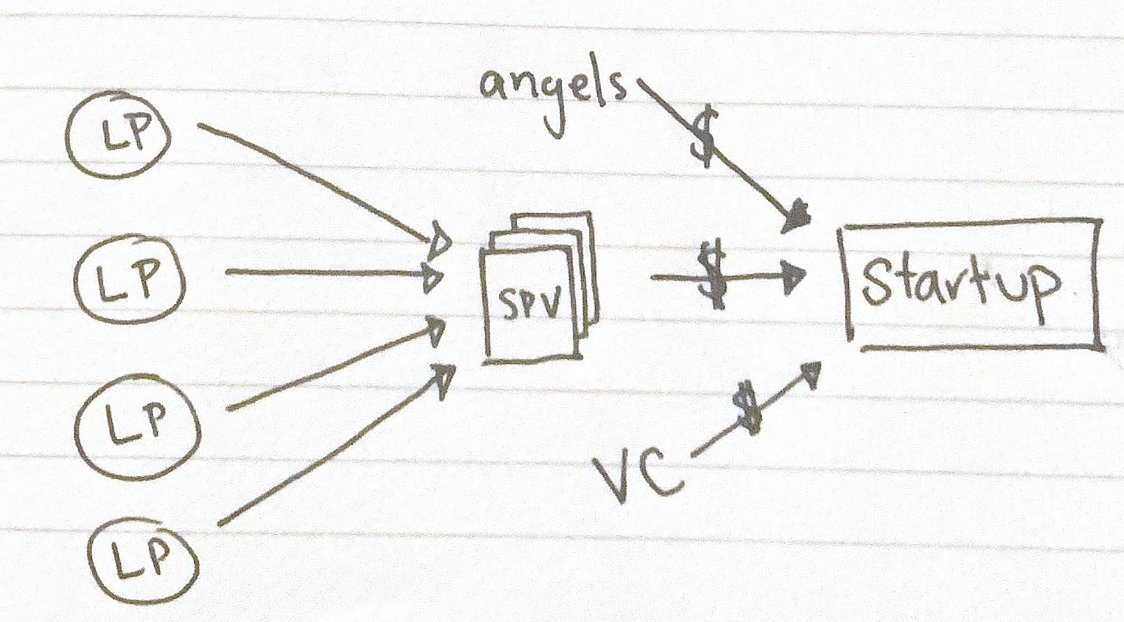

basically a deal by deal vc firm. It’s composed of an organizer(s) who get allocation and make investment decisions, and backed by angel investors or high net-worth individuals who contribute capital(referred to as limited partners/LPs)

basically a deal by deal vc firm. It’s composed of an organizer(s) who get allocation and make investment decisions, and backed by angel investors or high net-worth individuals who contribute capital(referred to as limited partners/LPs)

2/ the main difference between a traditional fund and a syndicate is that LPs have the option to ✨opt in✨on a deal-by-deal basis, instead of making a commitment up front to a traditional fund. they also (usually) don't have management fees associated with the deals done.

3/ so how does a syndicate work? there's four main parts:

✨getting allocation in a startup

✨due diligence

✨investor commitments

✨ closing / post investment support

✨getting allocation in a startup

✨due diligence

✨investor commitments

✨ closing / post investment support

4/ getting allocation = a piece of the round

A syndicate lead secures allocation either from inbound interest or cold outreach. ex: my first deal came from a community number where i share updates for my book. more on the lessons I learned here:

A syndicate lead secures allocation either from inbound interest or cold outreach. ex: my first deal came from a community number where i share updates for my book. more on the lessons I learned here:

https://twitter.com/paigefinnn/status/1334325969566322688?s=20

5/ to get into a deal as a syndicate lead, you’ll most often punch above your weight in what @harryhurst, the CEO of @pipe, coined the “Check Size : Helpfulness” ratio.

https://twitter.com/harryhurst/status/1280165358255538179?s=20

6/ ✨due diligence✨

investors due diligence companies in many different ways. this is one of my favorite frameworks that I was taught when I completed in the venture capital investment competition: vcrazor.com/vc-razor/amp/

investors due diligence companies in many different ways. this is one of my favorite frameworks that I was taught when I completed in the venture capital investment competition: vcrazor.com/vc-razor/amp/

7/ after going through a process of due diligence, a syndicate lead will negotiate allocation after deciding to invest in the company. Syndicate allocations, according to AngelList, on average range from 200k-300k, but I’ve seen a range from 50k - 400k.

8/ ✨investor commitments

From here, each syndicate organizer runs their process differently. My syndicate is private, so I send an update email out to the accredited investors on my syndicate list, which are tagged by area of interest & check size, alerting them of the new deal

From here, each syndicate organizer runs their process differently. My syndicate is private, so I send an update email out to the accredited investors on my syndicate list, which are tagged by area of interest & check size, alerting them of the new deal

9/ LPs usually reply with more questions, or a yes or no. I've taken to setting up notion FAQs with founders I work with to streamline things. these yes’s (and their associated check sizes) are called commitments. allocation can fill as fast as a couple days or a couple weeks.

10/ closing ✨

I use @assureco to manage back office, decreasing traditional fund admin by as much as 90%. Assure handles creating a legal entity, a bank account, taxes and all the other things associated with the Special Purpose Vehicle (SPV). DM @LandonAinge with questions!

I use @assureco to manage back office, decreasing traditional fund admin by as much as 90%. Assure handles creating a legal entity, a bank account, taxes and all the other things associated with the Special Purpose Vehicle (SPV). DM @LandonAinge with questions!

11/ depending on the size of the round, this process from securing allocation to “close” has taken me ~3 weeks. Most time is spent waiting for the bank account opening & the wire confirmations from investors. After close, I sent out an intro email to all my LPs & the founders.

12/ so why would you back a syndicate as an investor?

early stage deals are getting really competitive - which I've seen affect both smaller and larger LPs 👇

early stage deals are getting really competitive - which I've seen affect both smaller and larger LPs 👇

13/ on the smaller side, maybe you’re starting out & want to write $1k-$5k checks, which most founders with whom you don’t know already won’t accept directly. however, you can get into competitive deals through a syndicate lead with a smaller minimum check size.

14/ on the larger side, many LPs have large amounts of capital and want to get involved with early stage startups, but don't necessarily know where to dig in. syndicate leads can be a helpful guide in the ecosystem.

15/ investing in a syndicate also bolsters involvement in the ecosystem & supports the next generation of emerging managers and founders who bring a diverse perspective to startup funding, which has been shown to generate higher returns

16/ social capital can also be a benefit. @sama described how seed investing is the status symbol of Silicon Valley, "Most people don't want Ferraris, they want a winning seed investment" nytimes.com/2015/07/07/tec…

17/ additionally, there are often no management fees associated with a syndicate vs working with a fund (only carry) and you have the ability to opt into deals that you’re excited about and pass on those you’re not

18/ So why would you want to work with a syndicate as a founder?

Leverage is really important in a fundraise, so as a founder it can be helpful to enlist a syndicate lead to abstract some of the relationship management while you focus on large check sizes.

Leverage is really important in a fundraise, so as a founder it can be helpful to enlist a syndicate lead to abstract some of the relationship management while you focus on large check sizes.

19/ you can work with syndicate leads in two different ways

1. A Syndicate Lead raising a chunk of your round for you: gives them the ability to pinpoint specific investor personas who would be the most helpful since the investors on every SPV are different

1. A Syndicate Lead raising a chunk of your round for you: gives them the ability to pinpoint specific investor personas who would be the most helpful since the investors on every SPV are different

2. What I call a 'Syndicate as a Service': handling smaller check sizes for you(under 50k) from inbound interest you’ve generated (keeps your cap table clean while still be able to accept smaller check-size angels & democratize your cap table)

20/ Beyond this, syndicate leads can extend your existing talent, investor and operator networks & add their social capital to your round.

21/ Why is organizing a syndicate interesting for an aspiring investor?

There's no better way to learn than by doing.

There's no better way to learn than by doing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh