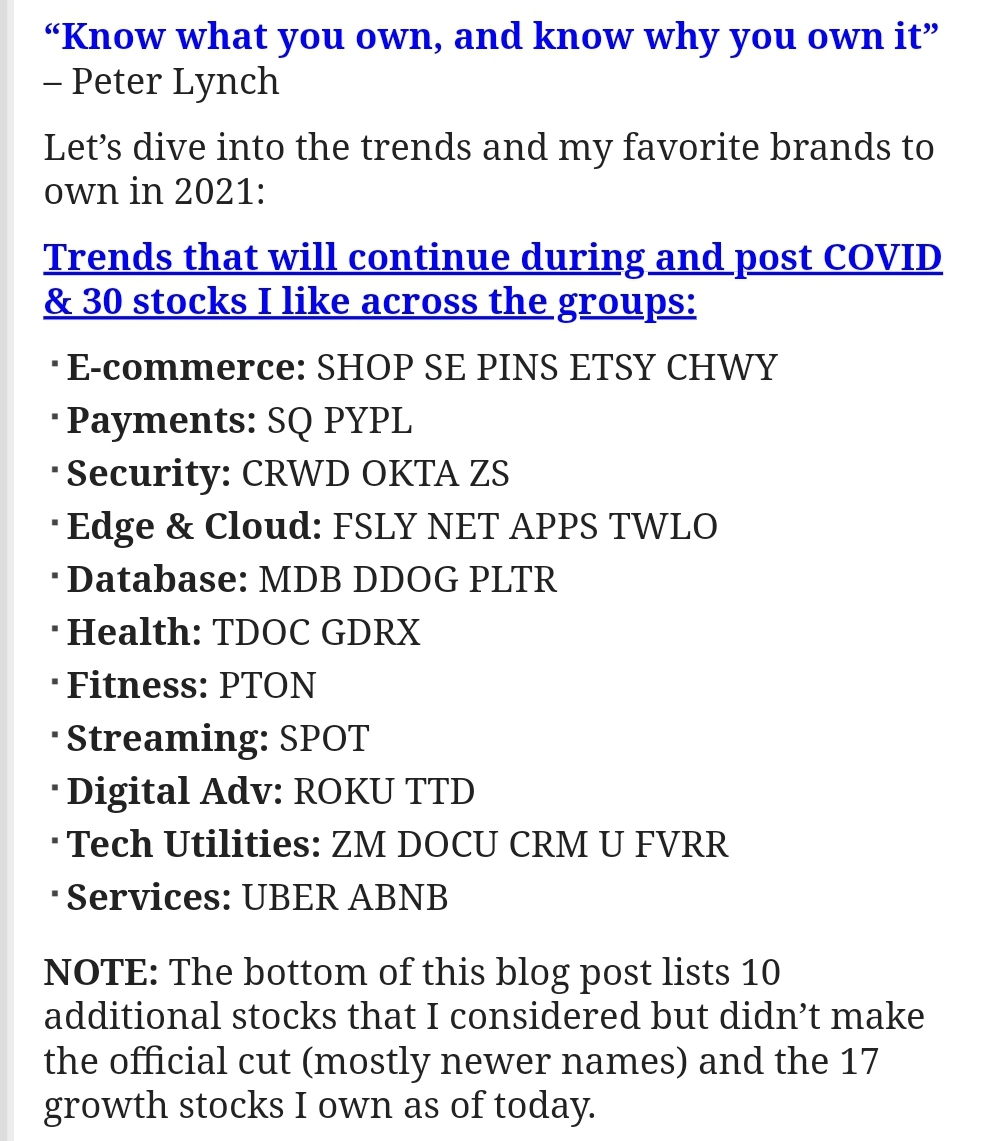

THREAD | Chart Updates

$TDOC

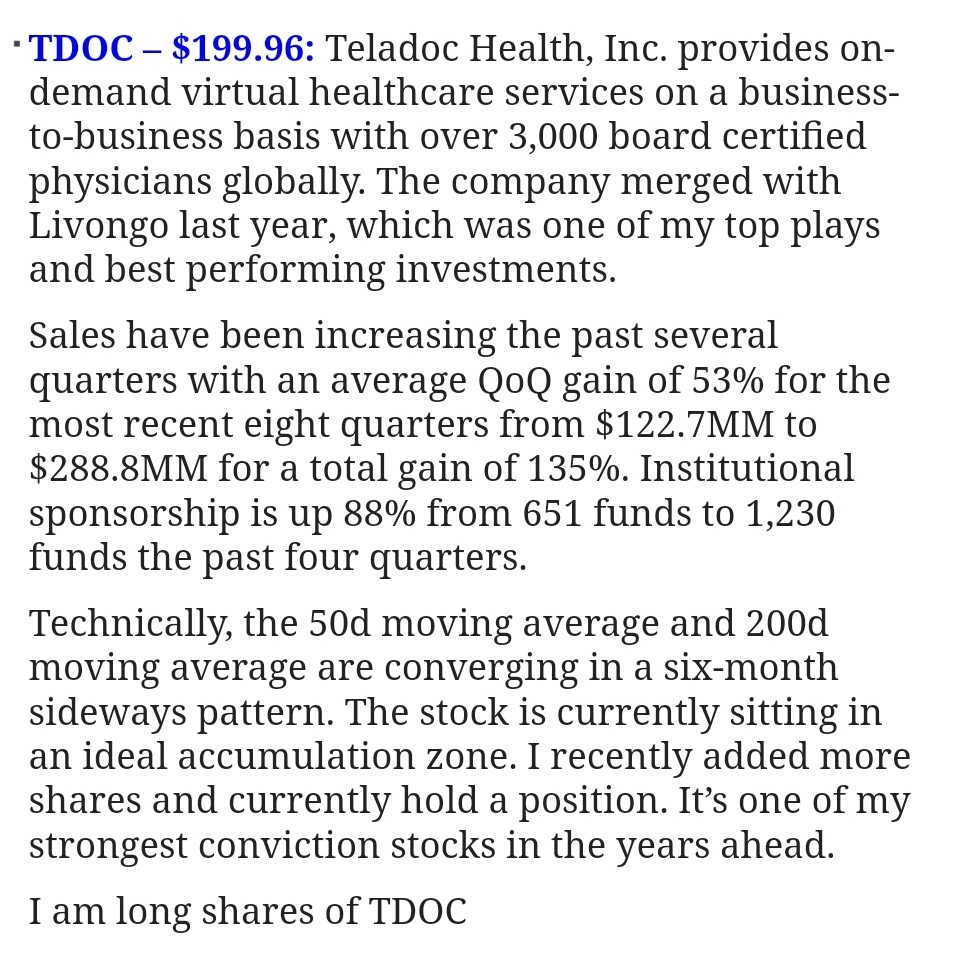

$ROKU

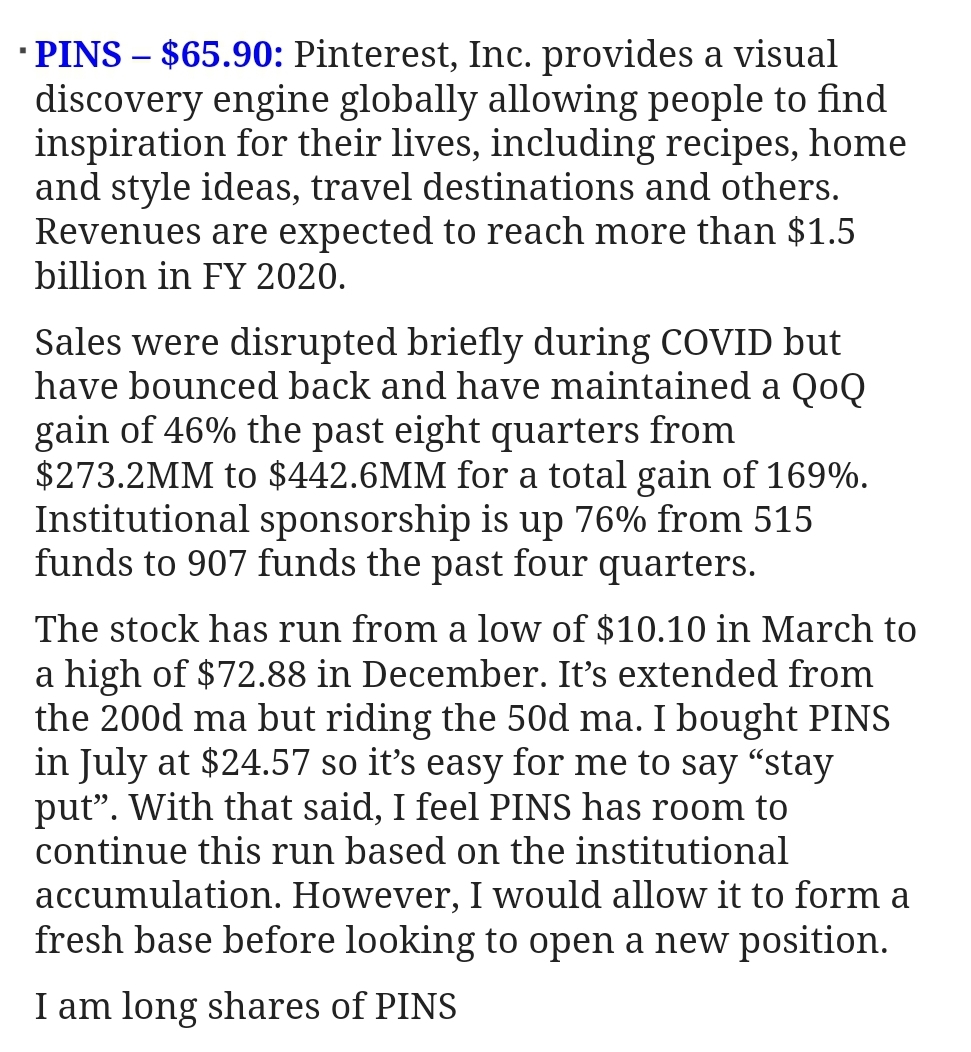

$CGC

$UBER

$GRWG

$TDOC

$ROKU

$CGC

$UBER

$GRWG

1) $TDOC - $228.78, very nice weekly bounce off of the 200d ma, on above average volume this week.

The added buy at $184.70 on 12/16 working out nicely, +24%.

I own shares.

The added buy at $184.70 on 12/16 working out nicely, +24%.

I own shares.

2) $ROKU - $379.29, new all time high closing but note that weekly volume has been decreasing lately. Holding.

I own shares.

I own shares.

3) $CGC - $30.61, looking to end Friday with the highest weekly close since August 2019 (currently the highest close in 17 months.

I own shares.

I own shares.

4) $UBER - $56.13, made a new all time high close today as the pattern continues to play-out from November’s breakout.

I own shares.

I own shares.

5) $GRWG - $46.66, a new all time high close today. The call options bought 9/21 are now up 587% while the stock is up 180%, from $16.65.

I own Jan 21, 2022 $30 call options.

I own Jan 21, 2022 $30 call options.

• • •

Missing some Tweet in this thread? You can try to

force a refresh