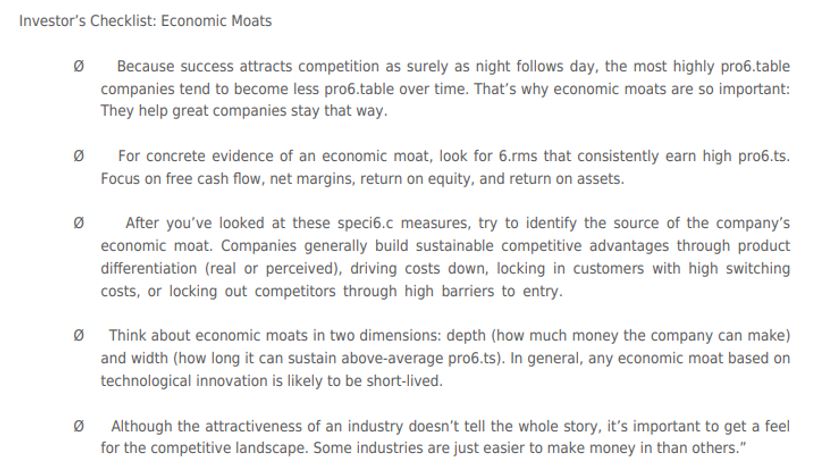

Excellent document on "Moats" based on Pat Dorsey's frameworks. An incredibly important concept for investors picking individual stocks.

@dmuthuk @saxena_puru @Gautam__Baid

Thread below with my fav parts summarized.

capitalideasonline.com/wordpress/econ…

@dmuthuk @saxena_puru @Gautam__Baid

Thread below with my fav parts summarized.

capitalideasonline.com/wordpress/econ…

Note : Doc is old (2003), some of the examples obviously no longer apply, but the concepts are still very valid.

1⃣ Product differentiation through Technology

2⃣ Product differentiation through Brand

3⃣ Cost Advantages

and what to watch out for.

2⃣ Product differentiation through Brand

3⃣ Cost Advantages

and what to watch out for.

Using "Moats" as one of the steps in analyzing individual business to check the presence/emergence, width/depth, sustainability/direction, can be incredibly rewarding down the road, by helping you stay with the best Companies for a long time, thereby reaping the rewards.

/END 👍

/END 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh