HOW FnF REFINANCE THE JPS ON THEIR OWN

FnF redeem them at their par-value($25/$50)and issue new JPS.The closest Redemption Date now is Dec 2025.

The div resumes at 7.75%.Better use the @FHFA-C's Inc Power today"in the best interests of FnF".#Fanniegate @TheJusticeDept @USTreasury

FnF redeem them at their par-value($25/$50)and issue new JPS.The closest Redemption Date now is Dec 2025.

The div resumes at 7.75%.Better use the @FHFA-C's Inc Power today"in the best interests of FnF".#Fanniegate @TheJusticeDept @USTreasury

https://twitter.com/CarlosVignote/status/1345002606314352640

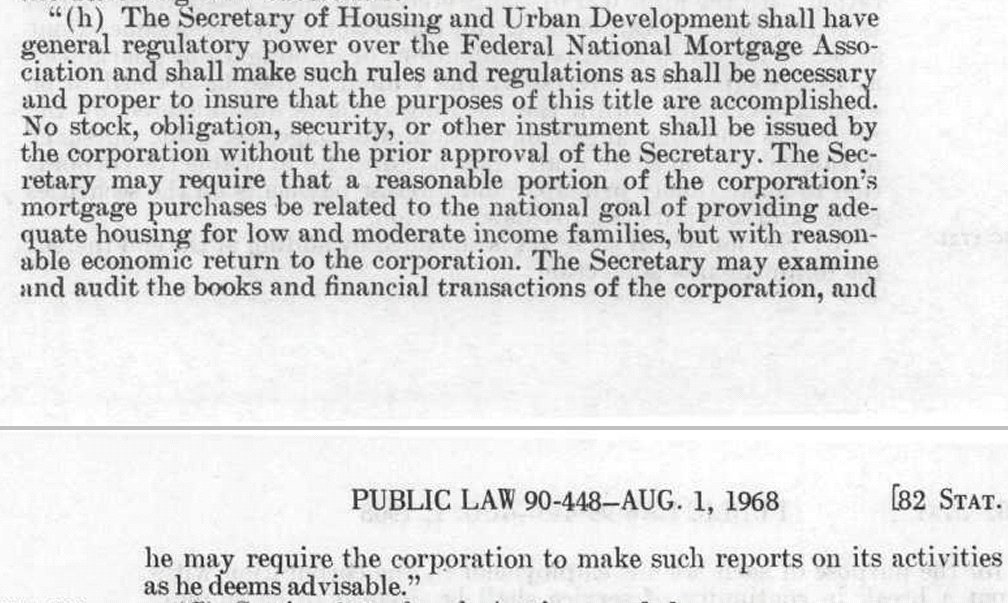

$FNMAS prospectus.

Other theme is that the @FHFA-C has to use its authority to regroup all series of JPS into just two series($25/$50)

We have Calabria writing regulation,even related to the case of Receivership, instead of doing his job as Conservator. Lack of empathy & a crime.

Other theme is that the @FHFA-C has to use its authority to regroup all series of JPS into just two series($25/$50)

We have Calabria writing regulation,even related to the case of Receivership, instead of doing his job as Conservator. Lack of empathy & a crime.

The idea that the JPS's div payments don't resume till FnF build a Capital Surplus(beyond the Adeq Capitalized threshold),contemplated in the recent rule of Capital requirement,is insane.

JPS holders are outsiders,not shareholders.Role of recap upon undercap.

Calabria,illiterate.

JPS holders are outsiders,not shareholders.Role of recap upon undercap.

Calabria,illiterate.

Once FnF are Adeq Capitalized,the JPS's role ends & they get their div back.

A Capital Surplus is solely for the Common Stocks,primarily due to a recap via Retained Earnings acct,this acct is shareholders' money.

I requested to fine-tune the Table8 that prohibits payouts ≤25%CS.

A Capital Surplus is solely for the Common Stocks,primarily due to a recap via Retained Earnings acct,this acct is shareholders' money.

I requested to fine-tune the Table8 that prohibits payouts ≤25%CS.

It's the heart of the matter.The attempt to treat the JPS as common stocks:

-Call the JPS holders "shareholders".

-A Secret Plan,so that the JPS mimic the commons' performance,when the latter plummeted due to the warrant 79.9%Commons at $0.00001ps & the former are discount notes.

-Call the JPS holders "shareholders".

-A Secret Plan,so that the JPS mimic the commons' performance,when the latter plummeted due to the warrant 79.9%Commons at $0.00001ps & the former are discount notes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh