Starting to collect important questions for 2021 and beyond in this thread.

Please send questions you are interested in too!

1. Will demand for compute continue to double every few months? Tons of implications for semiconductor design and manufacture. mule.substack.com/p/gpt-3-and-th…

Please send questions you are interested in too!

1. Will demand for compute continue to double every few months? Tons of implications for semiconductor design and manufacture. mule.substack.com/p/gpt-3-and-th…

2. What will be the next major use of mRNA vaccines? What will our new understanding of protein folding lead to?

deepmind.com/blog/article/a…

deepmind.com/blog/article/a…

3. How will better data and workflows improve our health care system (prediction, prevention, price of care, outcomes, compliance)?

4. Will we fully unbundle undergrad and graduate school into the information/learning component (which should be a fraction the cost for multiples the quality) and the networking component?

5. Digital art creation and collection make sense to me, but how will digital art be displayed?

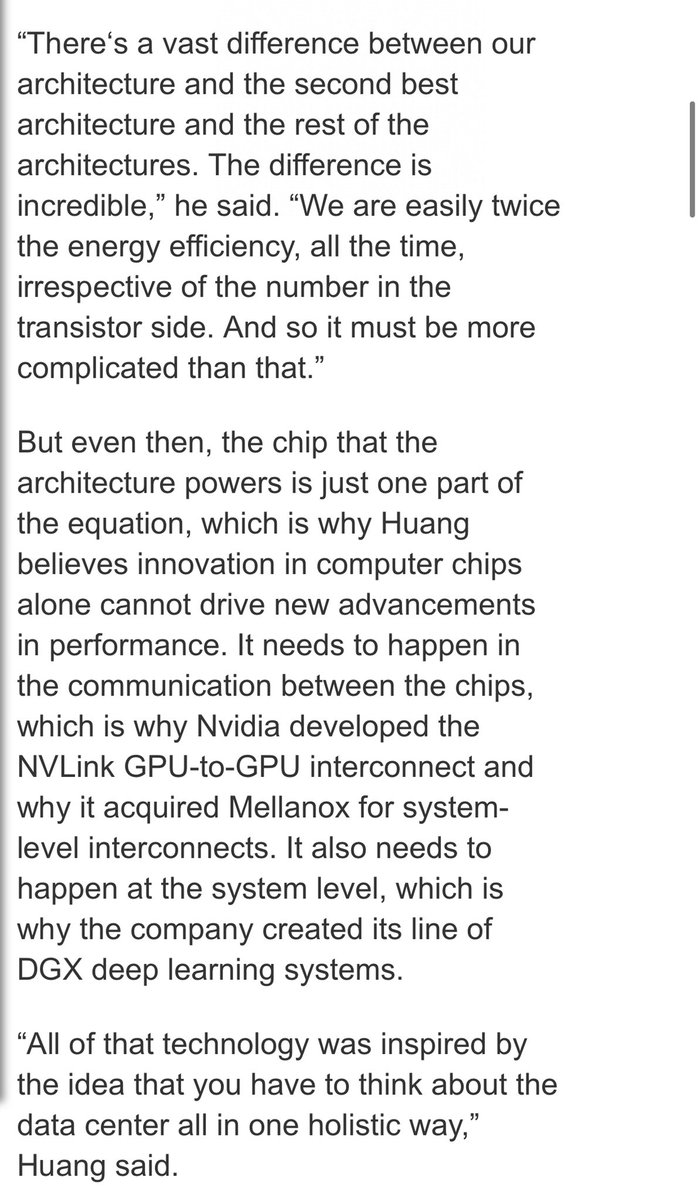

6. What are the primary implications of Jensen Huang’s idea that “the data center is the computer”? What will serverless building unlock?

7. Will we see a challenger app platform to iOS and google play?

8. What percent reversal will we see to in-office work and business related travel?

(we are likely almost all remote and plan work travel to be down >75%)

(we are likely almost all remote and plan work travel to be down >75%)

9. Will a city emerge, built and organized by a single company, that fully blends work and life?

10. Will we see a major shift if methods like direct air capture to actually reverse carbon load in atmosphere?

11. What will the demand look like for starship payload placement? How much of the market can/will starlink serve?

12. What will drive per capita GDP growth in frontier/developing markets? I’m excited to watch India, Africa, Latin America break out and take advantage of brain power, demographics, remote work etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh