1/ Last year I invested $1M+ in startups.

I was reflecting on missed deals this past week. Every deal I missed was ultimately because of one of three reasons.

I came up with a framework to dissect these 3 reasons and how they are related to one another. Let’s dig in 👇👇👇

I was reflecting on missed deals this past week. Every deal I missed was ultimately because of one of three reasons.

I came up with a framework to dissect these 3 reasons and how they are related to one another. Let’s dig in 👇👇👇

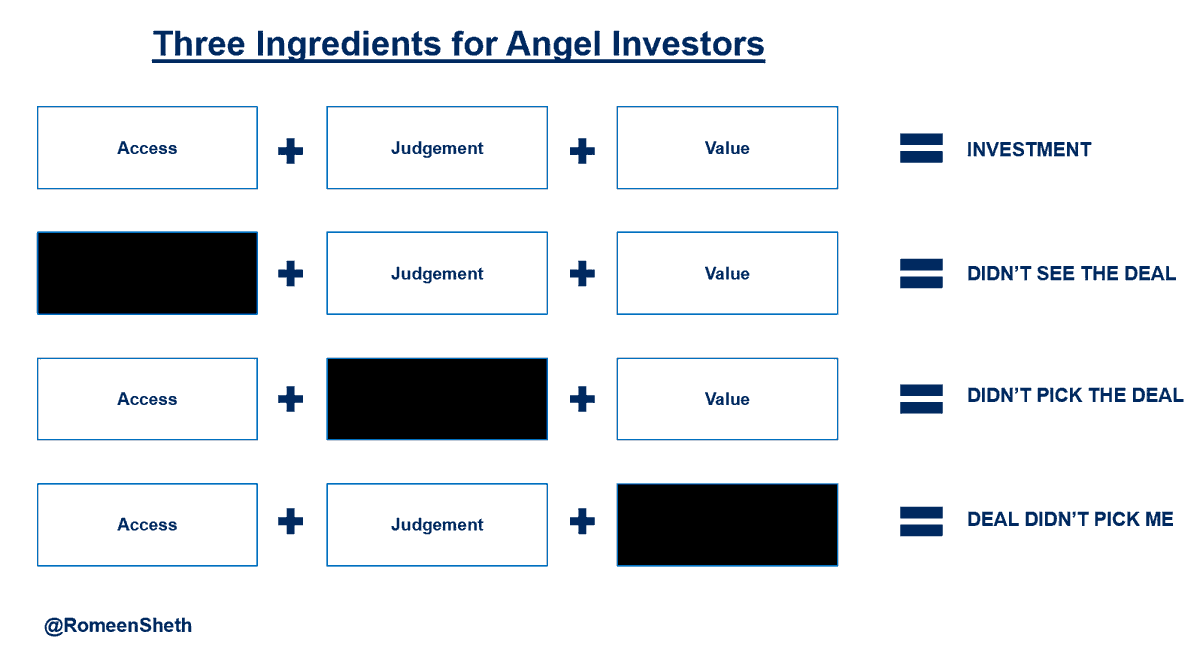

2/ Angel investing can be broken down into three phases

Phase I: Did I see the company? Speaks to my access

Phase II: Did I say yes? Speaks to my judgement

Phase III: Did they say yes? Speaks to my value

You have to hit all 3 to get a deal done. 2 out of 3 isn’t good enough.

Phase I: Did I see the company? Speaks to my access

Phase II: Did I say yes? Speaks to my judgement

Phase III: Did they say yes? Speaks to my value

You have to hit all 3 to get a deal done. 2 out of 3 isn’t good enough.

3/ Phase I is all about access.

This is your "top of the funnel." You can be the best picker / fit for a company, but if you don't see it it's irrelevant.

Like anything, getting started is tough, but once you start investing and participating in deals, this compounds quickly.

This is your "top of the funnel." You can be the best picker / fit for a company, but if you don't see it it's irrelevant.

Like anything, getting started is tough, but once you start investing and participating in deals, this compounds quickly.

3/ Phase II is all about judgement.

The easiest way to develop good judgement is to start within your circle of competence and then expand from the inside out.

more deals = better pattern recognition = better questions = deeper understanding = better judgement.

The easiest way to develop good judgement is to start within your circle of competence and then expand from the inside out.

more deals = better pattern recognition = better questions = deeper understanding = better judgement.

4/ Phase III is all about value

The more value you can provide beyond capital - e.g. expertise, relationships, audience- the higher your likelihood of getting in.

Warning - This can be the most painful phase! You see it, you know it's going to win and you don't get in.

The more value you can provide beyond capital - e.g. expertise, relationships, audience- the higher your likelihood of getting in.

Warning - This can be the most painful phase! You see it, you know it's going to win and you don't get in.

5/ Ok so, what about the chicken and the egg question:

"If I have no access, how do I develop judgement / add value?"

Focus on value. Value opens the door to access and access helps refine judgement.

"If I have no access, how do I develop judgement / add value?"

Focus on value. Value opens the door to access and access helps refine judgement.

6/ To be a successful angel investor, you have to nail all 3.

Find which of the 3 is your sweet spot (every good angel I know has a spike) and use it to develop the other 2.

Keep the relationship between all 3 tight. It compounds quickly.

Happy investing :)

Find which of the 3 is your sweet spot (every good angel I know has a spike) and use it to develop the other 2.

Keep the relationship between all 3 tight. It compounds quickly.

Happy investing :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh