SurveyMonkey is one of the most long-lived SaaS apps, founded 21 years ago!

We all use it and have used it. It just works.

And it's now at $400m in ARR

5 Interesting Learnings:

We all use it and have used it. It just works.

And it's now at $400m in ARR

5 Interesting Learnings:

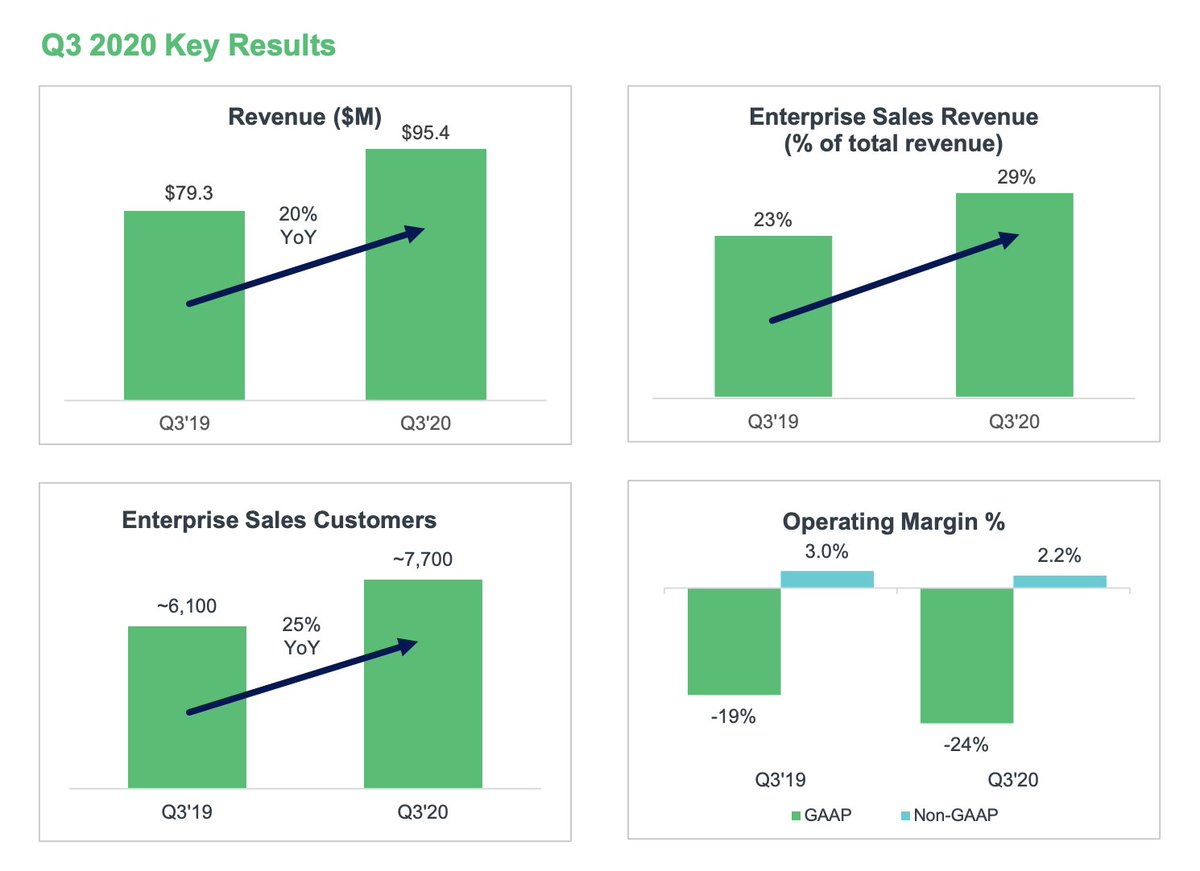

#1. Eventually, most of us go upmarket.

SurveyMonkey was relatively slow to go enterprise, which suited it well for a long time.

But since it started to march into bigger deals more recently, growth >re-accelerated< ... from 17% at IPO to 20% today

SurveyMonkey was relatively slow to go enterprise, which suited it well for a long time.

But since it started to march into bigger deals more recently, growth >re-accelerated< ... from 17% at IPO to 20% today

#2. Enterprise is now growing 53% YoY and accounts for 29% of total revenue, so the tilt upmarket clearly worked and was the right thing

Yet, self-serve is >still< growing 11% at $400m in ARR

So don't leave the small folks behind

Yet, self-serve is >still< growing 11% at $400m in ARR

So don't leave the small folks behind

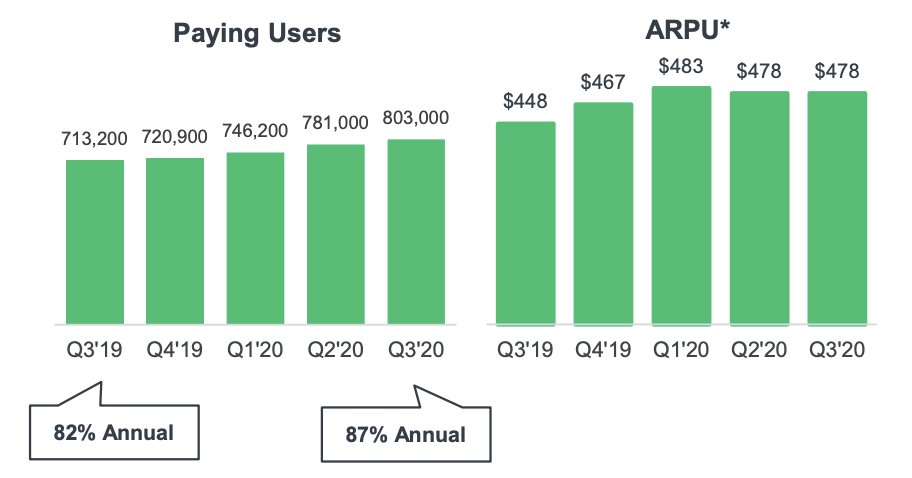

#3. Price Increases Do Work at Scale.

The other thing that worked for SurveyMonkey was price increases for SMBs.

At IPO, about half of its growth came from pricing increases. We've also seen this with Dropbox

Of course, you can't do that forever ;)

The other thing that worked for SurveyMonkey was price increases for SMBs.

At IPO, about half of its growth came from pricing increases. We've also seen this with Dropbox

Of course, you can't do that forever ;)

#4. 78% Annual payments at IPO ... but 22% Monthly

As we saw with Zoom, don’t force it. Let customers pick. They are driving this up to 90% as they go more enterprise.

But let SMBs buy how they want to

As we saw with Zoom, don’t force it. Let customers pick. They are driving this up to 90% as they go more enterprise.

But let SMBs buy how they want to

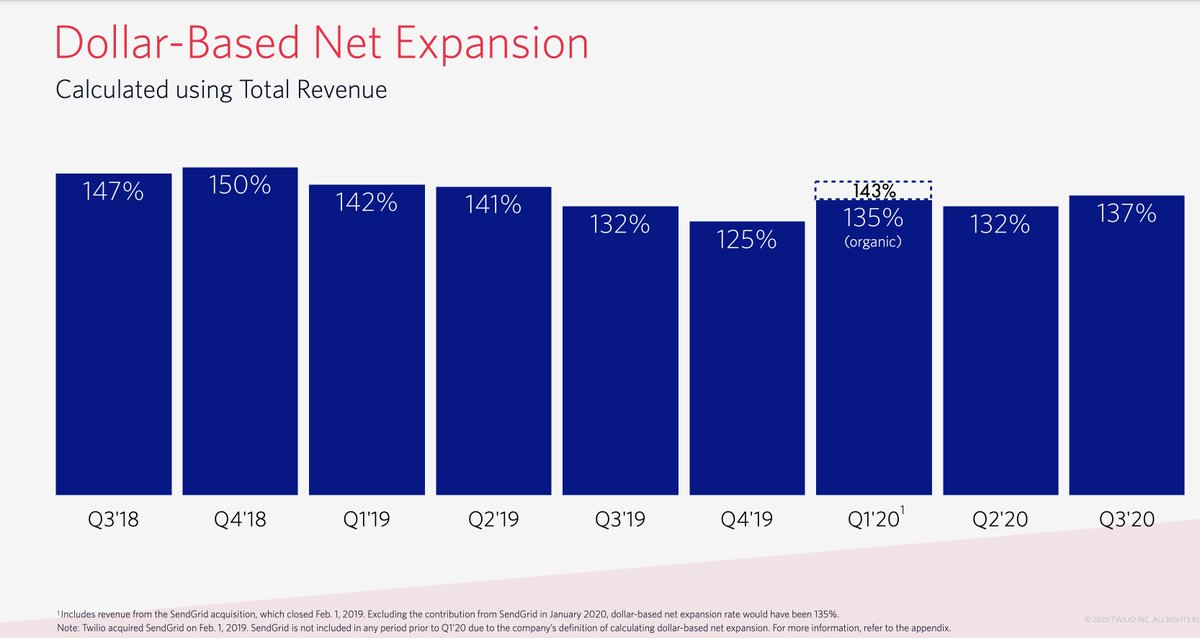

#5. 100% Dollar-Based Retention for SMBs at IPO.

While not the 120%-140% we've seen with some that sell more B2D like PagerDuty + Slack, this is in-line with Shopify

So yes, you can do 100% NRR with SMBs

While not the 120%-140% we've seen with some that sell more B2D like PagerDuty + Slack, this is in-line with Shopify

So yes, you can do 100% NRR with SMBs

• • •

Missing some Tweet in this thread? You can try to

force a refresh