What's your "Moat" in SaaS? Do most SaaS companies even have a moat?

10 potential Moats:

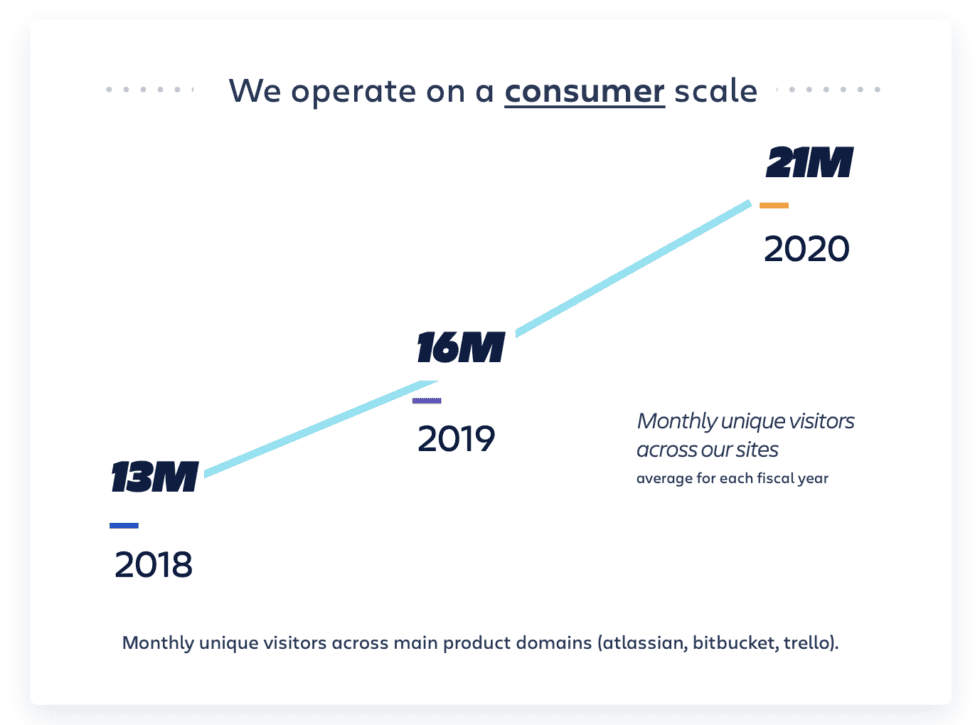

#1. Brand.

Brand can be a big moat in SaaS.

Most customers just want to pick the app they’ve used and heard of. We all underestimated this in the earlier days of SaaS.

10 potential Moats:

#1. Brand.

Brand can be a big moat in SaaS.

Most customers just want to pick the app they’ve used and heard of. We all underestimated this in the earlier days of SaaS.

#2. Data.

Data lock is real. LinkedIn owns the human record. Getting your data out of Salesforce in a >structured< format is really hard.

Build more analytics, more connections, more worflows on customer data.

Data lock is real. LinkedIn owns the human record. Getting your data out of Salesforce in a >structured< format is really hard.

Build more analytics, more connections, more worflows on customer data.

#3. Structured Data.

Even if data resides in many silos, structuring makes it unique.

And aggregating multiple cloud datasets into one set of data is a moat.

Even if data resides in many silos, structuring makes it unique.

And aggregating multiple cloud datasets into one set of data is a moat.

#4. Partners + Ecosystem. The top partners in the Salesforce, Shopify, etc. ecosystems do get most of the leads. And top APIs attract most devs.

And this compounds over time.

The AEs, the biz dev folks, tend to send deals to the partner everyone trusts and knows.

And this compounds over time.

The AEs, the biz dev folks, tend to send deals to the partner everyone trusts and knows.

#5. Integrations.

Most vendors only integrate one third party in each category, maybe two.

Zapier is integrated everywhere. Maybe 10x more than anyone else … So also, build more of them.

Before someone else does.

Most vendors only integrate one third party in each category, maybe two.

Zapier is integrated everywhere. Maybe 10x more than anyone else … So also, build more of them.

Before someone else does.

#6. Agencies and Implementation Partners.

Third parties want to specialize in helping customers deploy just a handful of top apps. This is a big part of Hubspot’s GTM, Shopify's, and Atlassian's ecosystem. Own agency relationships, & it’s really tough for others to break in.

Third parties want to specialize in helping customers deploy just a handful of top apps. This is a big part of Hubspot’s GTM, Shopify's, and Atlassian's ecosystem. Own agency relationships, & it’s really tough for others to break in.

#7. Long-Term Contracts.

Yes, we all hate this.

But getting customers to sign 3+ year contracts does work. It's not a perfect moat. Others can buy out these contracts, and break them. But 3+ year contracts are a partial moat.

Yes, we all hate this.

But getting customers to sign 3+ year contracts does work. It's not a perfect moat. Others can buy out these contracts, and break them. But 3+ year contracts are a partial moat.

#8. Using Massive Amounts of Capital To Play In >Every< Segment.

"Dominant-dominant" strategy is tough to play well, but being in every single segment when the competition can’t afford to be is a form of moat.

Most focus where they are strong.

"Dominant-dominant" strategy is tough to play well, but being in every single segment when the competition can’t afford to be is a form of moat.

Most focus where they are strong.

#9. “Most Enterprise” Vendor.

This really works, done right. If you are the most secured, most trusted, most 2FA, most HIPAA, most SOC-2, most everything vendor … you will win where that matters.

See our convo with CEO Okta on this:

This really works, done right. If you are the most secured, most trusted, most 2FA, most HIPAA, most SOC-2, most everything vendor … you will win where that matters.

See our convo with CEO Okta on this:

#10. No Contract At All.

Yes, a long-term contract is a “stick” moat.

But there’s a “carrot” flip-side: making it 10x easier to onboard than the competition does.

You win the ease-of-use crowd.

Like, say, Zoom and Slack did.

Yes, a long-term contract is a “stick” moat.

But there’s a “carrot” flip-side: making it 10x easier to onboard than the competition does.

You win the ease-of-use crowd.

Like, say, Zoom and Slack did.

Ask your team.

Ask your team what your moat is, or is becoming, or will be, or should be.

It will change and inform your roadmap for 2021+

Ask your team what your moat is, or is becoming, or will be, or should be.

It will change and inform your roadmap for 2021+

• • •

Missing some Tweet in this thread? You can try to

force a refresh