1/ Observations of a dHedge fund manager

Whilst it has its drawbacks, I find myself interacting with the dHedge platform frequently.

For the uninitiated, @dHedgeOrg is a non-custodial copy trading protocol built on top of the @synthetix_io ecosystem.

app.dhedge.org

Whilst it has its drawbacks, I find myself interacting with the dHedge platform frequently.

For the uninitiated, @dHedgeOrg is a non-custodial copy trading protocol built on top of the @synthetix_io ecosystem.

app.dhedge.org

2/ dHedge's value proposition is simple. It provides a platform for active fund managers to showcase their trading prowess, with a transparent scoreboard for all to see.

Managers can also interact with their investors via public and private posts

Managers can also interact with their investors via public and private posts

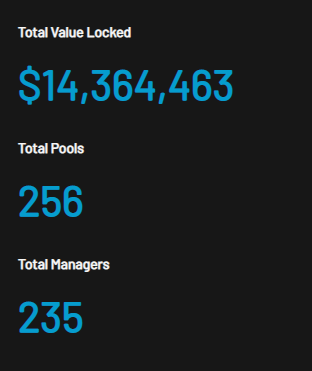

3/ Since Mainnet launch in late Oct 2020, dHedge's traction has been growing steadily with ~14m TVL today and over 200 active managers.

Cumulative trading vol on the platform stand at $87m, providing a nice boost to the underlying SNX system as well.

Cumulative trading vol on the platform stand at $87m, providing a nice boost to the underlying SNX system as well.

4/ However there are multiple pain points that will hopefully be solved in 2021.

1. Gas fees are ridiculously high (avg trade costing $50-100)

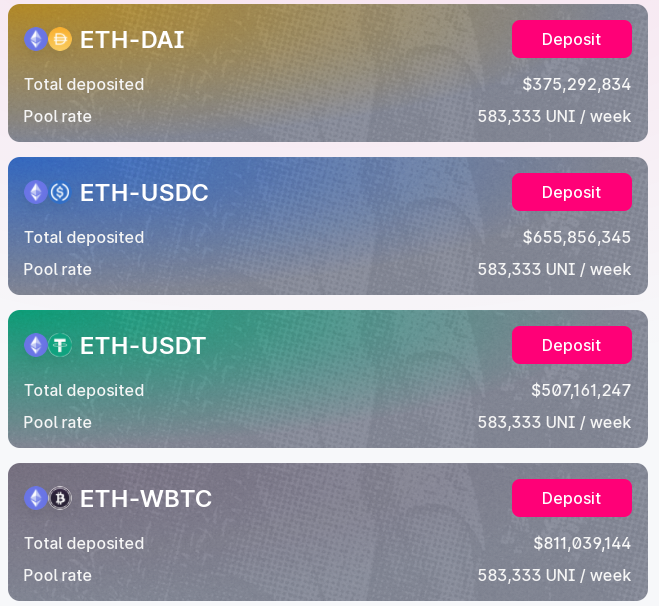

2. Asset selection universe (being limited by SNX's asset selection is horrendous)

3. Capital inefficiency (underlying assets are idle)

1. Gas fees are ridiculously high (avg trade costing $50-100)

2. Asset selection universe (being limited by SNX's asset selection is horrendous)

3. Capital inefficiency (underlying assets are idle)

5/ If dHedge can get around those pain points, myself as a user would be extremely enthusiastic.

The decentralisation of fund management with increased transparency is definitely a pillar of DeFi that will thrive when the entire ecosystem takes off.

The decentralisation of fund management with increased transparency is definitely a pillar of DeFi that will thrive when the entire ecosystem takes off.

6/ Fundamentally I think that this vertical is very nascent with multiple low-hanging fruits for protocols to significantly grow the total market

In a steady state, I would imagine the market structure to be oligopolistic with incumbents enjoying strong competitive moats

In a steady state, I would imagine the market structure to be oligopolistic with incumbents enjoying strong competitive moats

7/ For now, I am excited to see how dHedge develops.

2 months ago I started my own fund sort of like a side project, and am pleased to see it develop into something meaningful.

If you would like to check it out, click here: app.dhedge.org/pool/0x555d9af…

2 months ago I started my own fund sort of like a side project, and am pleased to see it develop into something meaningful.

If you would like to check it out, click here: app.dhedge.org/pool/0x555d9af…

8/ Disclaimer: This is not financial advice, please DYOR.

• • •

Missing some Tweet in this thread? You can try to

force a refresh