Exactly. The most important reason Ds got shellacked in 2010 was that the Obama stimulus was underpowered given the severity of the crisis, largely because of the desire to be bipartisan and not use reconciliation 1/

https://twitter.com/Nate_Cohn/status/1349379762481987587

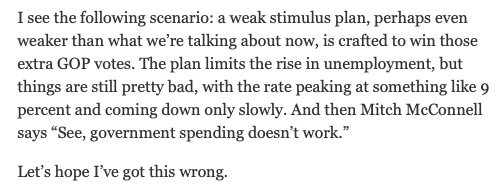

Not hindsight. What I wrote in January 2009 krugman.blogs.nytimes.com/2009/01/06/sti…

Voters don't care, or by and large even know about, process. They won't be outraged if Biden uses aggressive tactics to enact stimulus. They will, however, punish his party if they don't see concrete economic gains 3/

It's OK if Biden spends a couple of days urging Rs to support his agenda. But when they don't, go big and fast; get money out the door. 4/

• • •

Missing some Tweet in this thread? You can try to

force a refresh