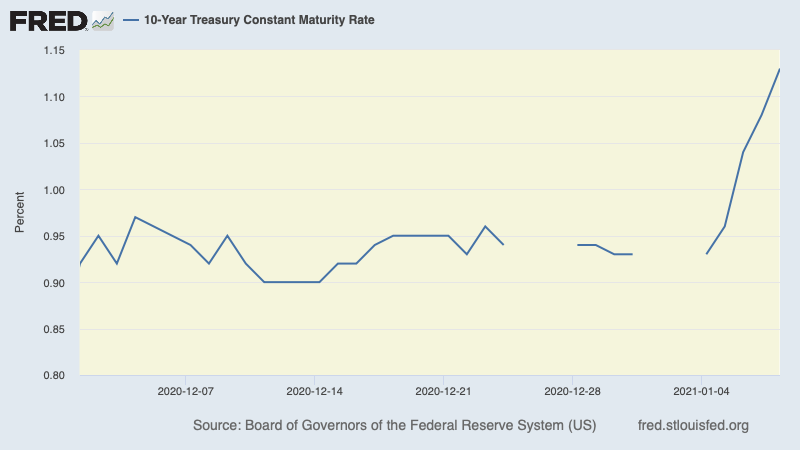

Gonna do a brief (?) wonkish thread on debt sustainability, and why we shouldn't worry about it. Start with the reason many people think it's terrible: they imagine that debt snowballs, because the more debt you have the higher your interest payments, so you run up even more 1/

This happens to individuals and businesses! And it could in principle happen to the U.S. government. But the arithmetic is all wrong — so wrong that even if borrowing costs rise in the future it's just not likely to be an issue 2/

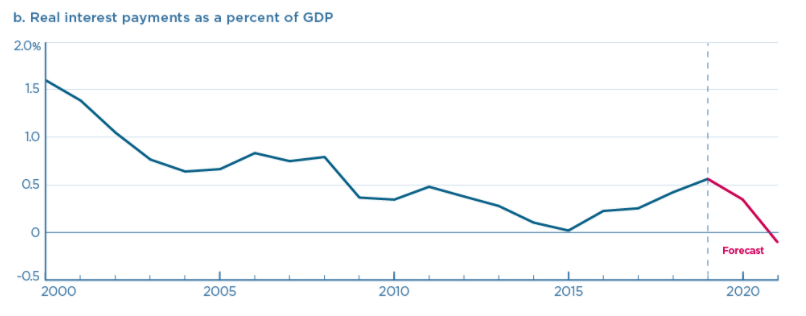

One reason is that the real value of debt is eroded by inflation. Real interest rates are currently negative, and overall real interest payments, as Furman and Summers point out, are at historic lows 3/ piie.com/research/piie-…

But that understates just how sustainable debt is. We don't care about the absolute level of debt; if we worry at all, we worry about the ratio of debt to GDP. And this does the opposite of snowballing — it shrinks, other things equal — if r<g. What? 4/

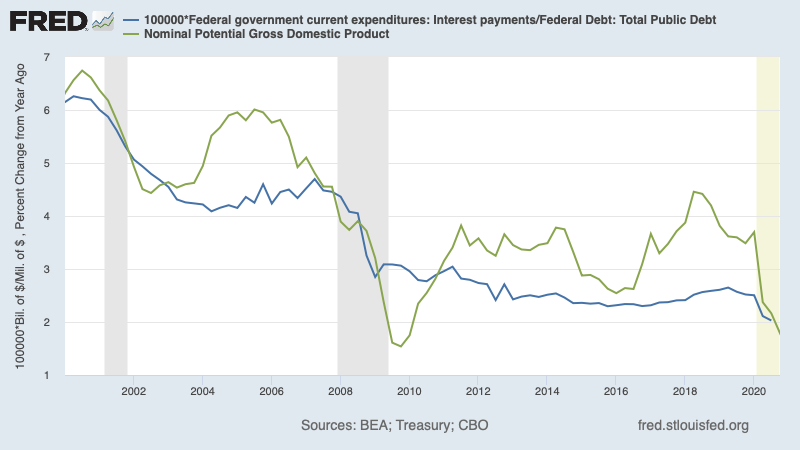

r is the rate of interest on government debt; g the economy's growth rate. You can do either both nominal or real. Let's do nominal, and use CBO's estimate of potential GDP to smooth out business cycles 5/

So snowballization(TM) — I'm putting dibs on the term — has very rarely been an issue over the past 20 years, which Olivier Blanchard documented in much greater detail 6/ nytimes.com/2019/01/09/opi…

The idea that debt is a serious threat may seem hard-headed and, yes, Very Serious, but it's just a prejudice at odds with the facts fin/

• • •

Missing some Tweet in this thread? You can try to

force a refresh