TSMC $TSM projecting capital expenses of 25-28B USD in 2021. 80% allocated for advanced process tech, 3, 5, 7nm. 10% advanced packaging and mask making, 10% other. 2020 capex, originally slated at $15B, was over $17B. For context $AMD's entire revenue for 2020 estimated at $9.5B

Management sees a growing market and TSMC growing faster than the market, with a 2020-2025 CAGR of 10-15%. In 2019 capex was initially estimated at $10-11B and then revised up to $15B. They are expanding fast, and newer nodes are more capital intensive.

3nm looking good and has strong customer interest, production in 2H 2022.

All this, especially the capex, in line with suggestions Intel will be increasing their use of TSMC fabs, or else AMD making really large increases (or both), but they also project a lot of growth in phones

All this, especially the capex, in line with suggestions Intel will be increasing their use of TSMC fabs, or else AMD making really large increases (or both), but they also project a lot of growth in phones

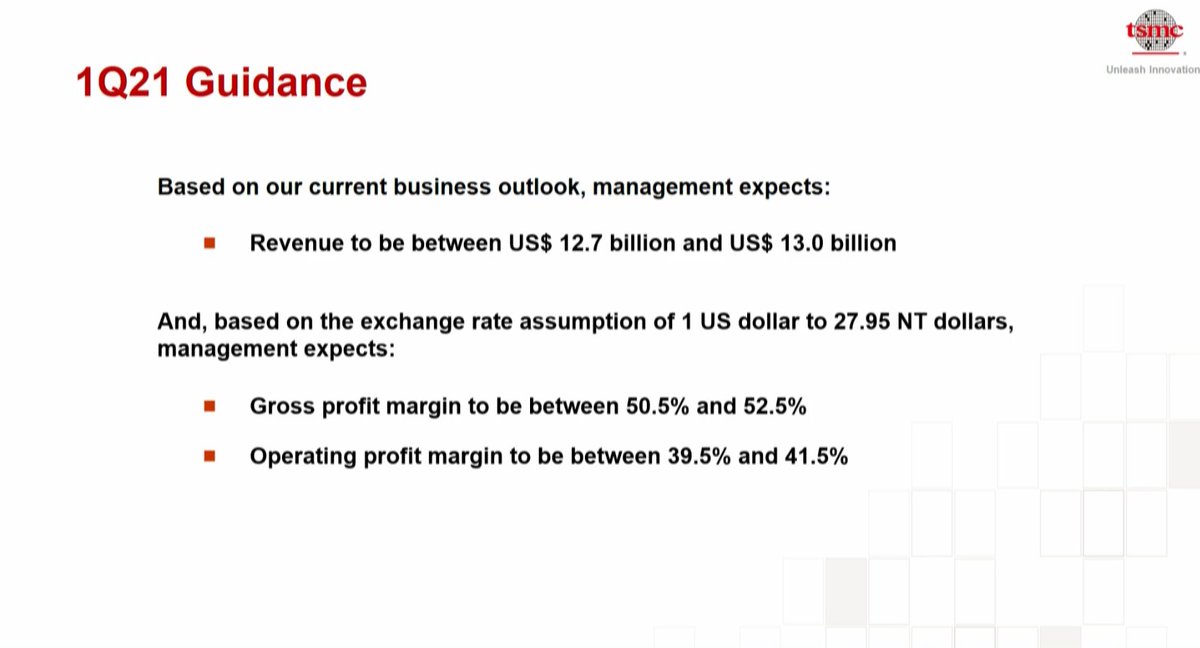

TSMC utilization rate is very high, and they expect it to remain high in Q1. They expect more revenue in Q1 than in Q4. Margin is hit by the weak USD and the large capex, but they still think a 50% gross margin is reasonable, long term.

Analyst on call surprised at raise in capex, says it is above consensus. Hmmm $INTC?

As usual, since TSMC reports before other companies, the analysts are repeatedly trying to get TSMC to give them hints about what their clients are doing, particularly to confirm what Intel is doing. TSMC management isn't answering those of course.

I'm going to need to relisten to Roland's question on the call, I might have missed a bit. Sounded like TSMC denying that they do long term supply contracts but they always "work with their customers" and build out capacity they think the market is demanding.

Interesting b/c you'd think that if Intel came in for CPUs, might contract with TSMC, i.e. build a fab and give us everything out of it. Others might also prefer this approach, but seems to be regarding Intel. TSMC made clear they don't work that way. But I didn't catch it all.

Interesting comment: TSMC used to fab mostly for phones. Starting from 2020 on, HPC jumps on, moderates seasonality with multiple big customers and market segments. Gives them confidence to increase capex.

Wow, the worst shortages are in the mature nodes, not N7 and N5. F autos, IoT, etc

I expect some inflation for autos and appliances as production is limited by the silicon shortage. Not like these fabs want to build more capacity at these nodes.

I expect some inflation for autos and appliances as production is limited by the silicon shortage. Not like these fabs want to build more capacity at these nodes.

Another analyst surprised by "really huge capex", management indicates it is for increased capacity 2022, not for 2021.

Ok, I'm sold. These analysts are so blatant in asking questions that would only apply to Intel. But the sensitivity to *not* be able to answer a question about whether a customer would need to redesign a chip from their own process to TSMC, makes me really think rumors are true.

I mean, I've never done it but I would assume that definitely Intel would need to send over a specific design made for TSMC. Not being willing to blanket make that clear, I mean obviously something is up.

TSMC US fab starts construction in 2021.

Now talking about a longer lead time for EUV tools, they are buying them in advance. Good luck to anyone else getting them, I can't imagine what the lead time is after TSMC is done with their new orders.

TSMC long term plan is a mega-scale production site in Phoenix Arizona (USA), but starting with phase 1 plan of 20,000 wafers per month.

They still plan on continuing to expand in China, but a reset on the leading edge.

They still plan on continuing to expand in China, but a reset on the leading edge.

HPC will be the major growth driver for TSMC. Exciting changes happening, multiple architectures fighting. On N3 and N5. Not counting on cryptocurrency.

TSMC dividend will be steadily increasing. Ok, that's it, call over. Sorry if I stole your thunder @cyw60 , if you post a thread I'll link it here.

I've found @cyw60's notes to be helpful in the past

https://twitter.com/cyw60/status/1349619347539386369

After sleeping on this, I'd like to say Intel fabbing CPUs at TSMC is not confirmed yet. There was an article from Trendforce with no sources, large capex at TSMC, and defensive answers to questions. But Trendforce could be wrong and other things could have alternate explanations

Just want to say that because the market is going to move company valuations around depending on whether or not it is true. I know that my thesis will change. If Intel is *not* fabbing CPUs (already doing other chips), there are big implications of the huge increase in capex.

• • •

Missing some Tweet in this thread? You can try to

force a refresh