1) We are short CleanSpark $CLSK. Our full report is now available at culperresearch.com

2) CleanSpark $CLSK claims to be a clean energy software company which is "changing the face of energy markets globally." We think CleanSpark has habitually lied about its supposed customers and contracts, many of which we've found simply do not exist.

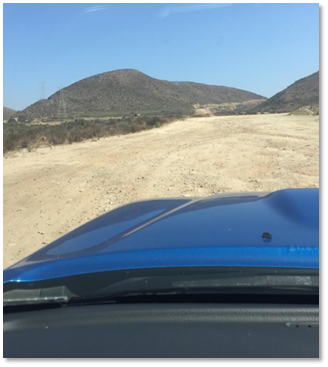

3) In August, $CLSK claimed "project deployments to be executed as part their exclusive [ILAL] agreement" to install microgrids for 252 homes in Valle Divino, Mexico. We visited Valle Divino and found an empty wasteland, emblematic of CleanSpark's promises to investors.

4) Similarly in January 2020, $CLSK touted a contract with Shoreline Schools, which analysts now estimate could lead to $3M in revenues. We simply asked Shoreline, whose rep told us that the plans contemplate just $300,000 worth of revenue, a mere 10% of these claims.

5) This is nothing new; $CLSK once claimed to have "designed a best in class microgrid solution" for Green Dragon, a cannabis operator. We again reached out to Green Dragon who told us, point blank, that no business was ever done and $CLSK fabricated it. We include those emails.

6) Of $CLSK's paltry business which isn't apparently fabricated, we find it rife with undisclosed related party transactions. In October, $CLSK claimed a $1M contract with LAWCLERK. Yet $CLSK CRO Amer Tadayon is also listed on LAWCLERK's website as their Chief Product Officer.

7) In February 2020, $CLSK acquired p2k Labs, yet CleanSpark CFO Lori Love was listed on p2k documents as early as November 2018. In effect, $CLSK appears to have purchased the side business of its CFO, with zero relevance to the Company's supposed "green energy" mission.

8) Finally, $CLSK subsidiary p2k itself appears to also fake its customers, as customers listed as "case studies" on its site appear to exist only on paper, while being controlled by $CLSK CFO Lori Love and $CLSK CRO Amer Tadayon.

9) $CLSK bought ATL Data Centers in December and consistently touts its low cost to mine. However, we think $CLSK hasn't disclosed that ATL's subsidized power agreement may be set to expire in less than 3 years, leaving $CLSK investors holding the bag.

10/10) In 2017, $CLSK claimed it could do $133M in 2020 revenues. It did just $10M, while burning $15M of cash, much of which was in executive compensation. We think CEO Bradford and Chairman Schultz cannot be trusted, and view $CLSK shares as worthless.

• • •

Missing some Tweet in this thread? You can try to

force a refresh