Thread/

The US stock market is expensive.

The bad news: future returns of your “US index of choice” are likely to be low

The good news: Value stocks are the answer. “Value decade” (trademark to @RyanPKirlin) is coming!

#ValueInvesting

The US stock market is expensive.

The bad news: future returns of your “US index of choice” are likely to be low

The good news: Value stocks are the answer. “Value decade” (trademark to @RyanPKirlin) is coming!

#ValueInvesting

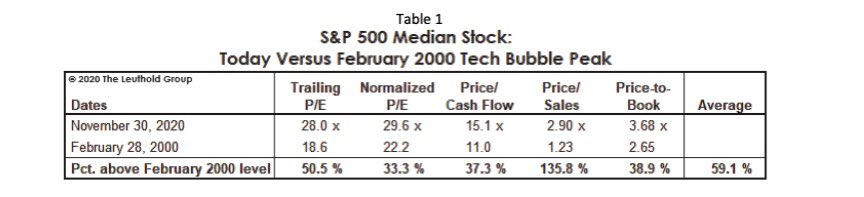

First, the market being expensive (from @LeutholdGroup)... Compare the “median stock” in the S&P from February 2000 to November 2020. Pricey!

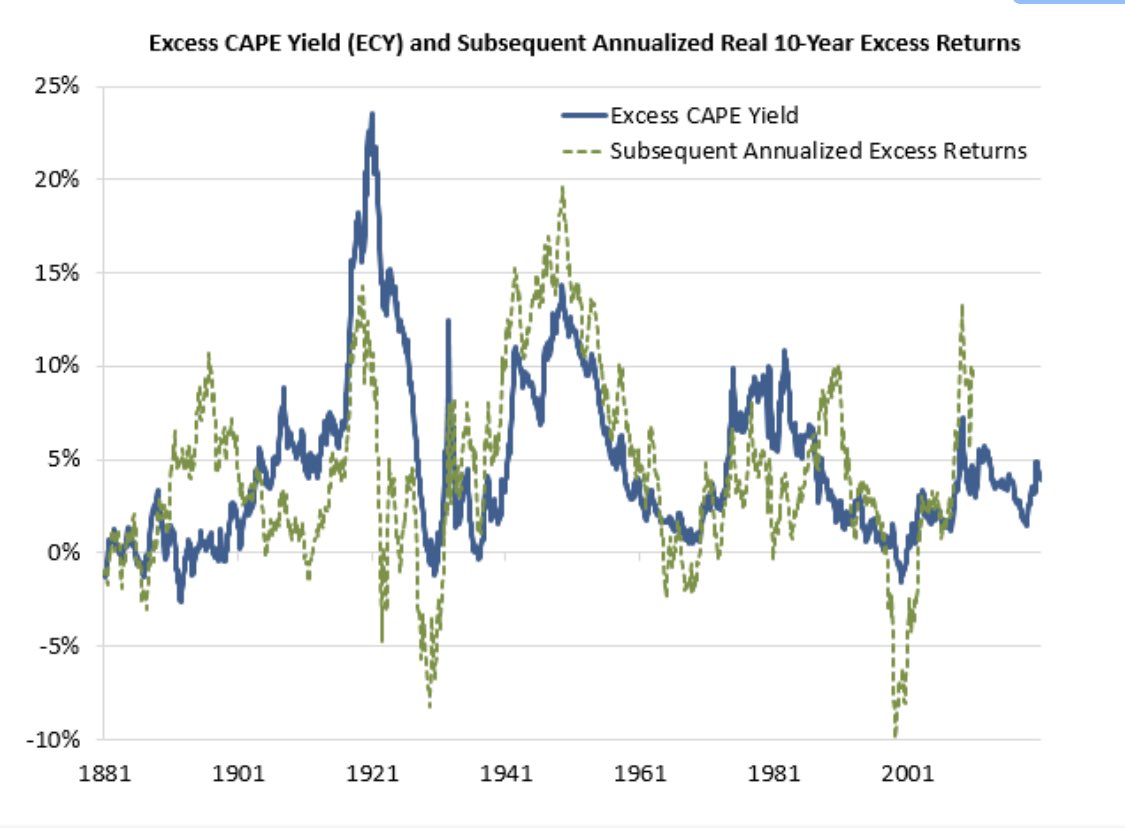

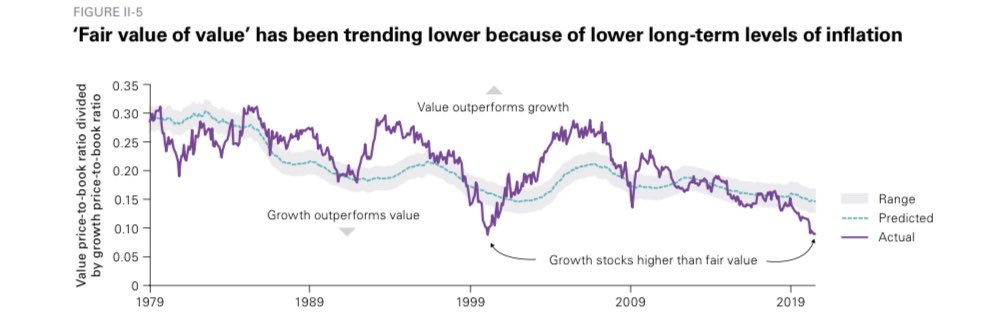

Of course, interest rates are insanely low. So low, Schiller update his CAPE model to try to account for low interest rates. bloomberg.com/opinion/articl…

But regardless of interest rates, things are expensive. And the price you pay matters.

NEVER BUY EXPENSIVE STOCKS

NEVER BUY EXPENSIVE STOCKS

https://twitter.com/MebFaber/status/1346541971981045760

Even a non-traditional metric shows how crazy things are. For about 15 years, I’ve ran Benjamin Graham Defensive investor screens.

Typically 5-20 stocks meet this criteria. Right now, one! $TDS

Typically 5-20 stocks meet this criteria. Right now, one! $TDS

https://twitter.com/kipmccauley/status/1055505798108008450

More Graham info here:

(And much more available by request just ask)

(And much more available by request just ask)

https://twitter.com/kipmccauley/status/1024852537050976256

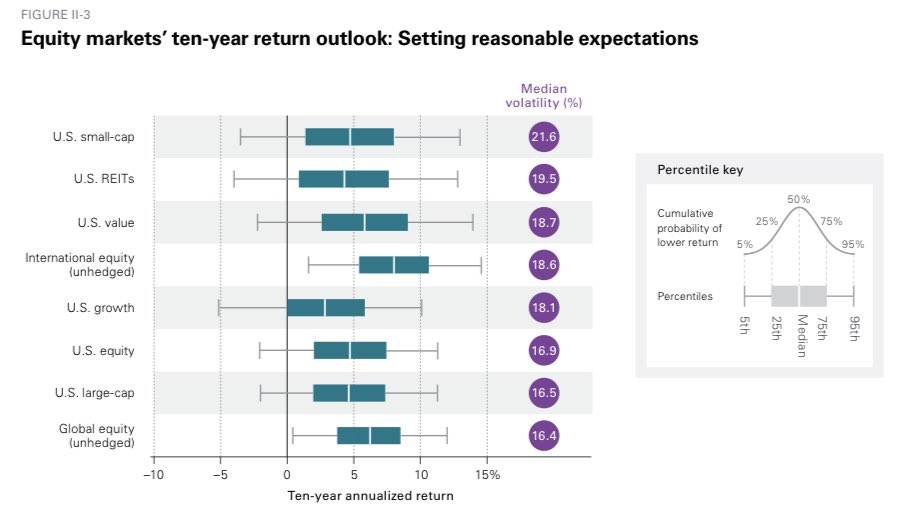

Next, change your strategy of adjust your expectations of future returns.

mcusercontent.com/6750faf5c6091b… (@Vanguard_Group)

mcusercontent.com/6750faf5c6091b… (@Vanguard_Group)

Everyone is trying to compare today to the past. Is this 1999? Are we Japan in the late 80’s? Of course, people only do this to try and predict the future (which is a bad idea), but let’s do the thought exercise regardless.

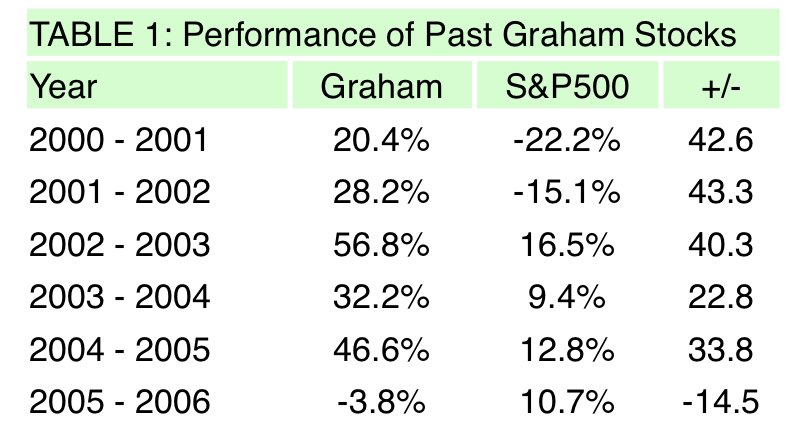

What worked well in the early 2000’s? Concentrated Value Stocks. ndir.com/SI/articles/11… (via @NormanRothery)

What worked well in Japan even as the stock market was collapsing? Value stocks! greenbackd.com/2013/07/23/has… (via @Greenbackd)

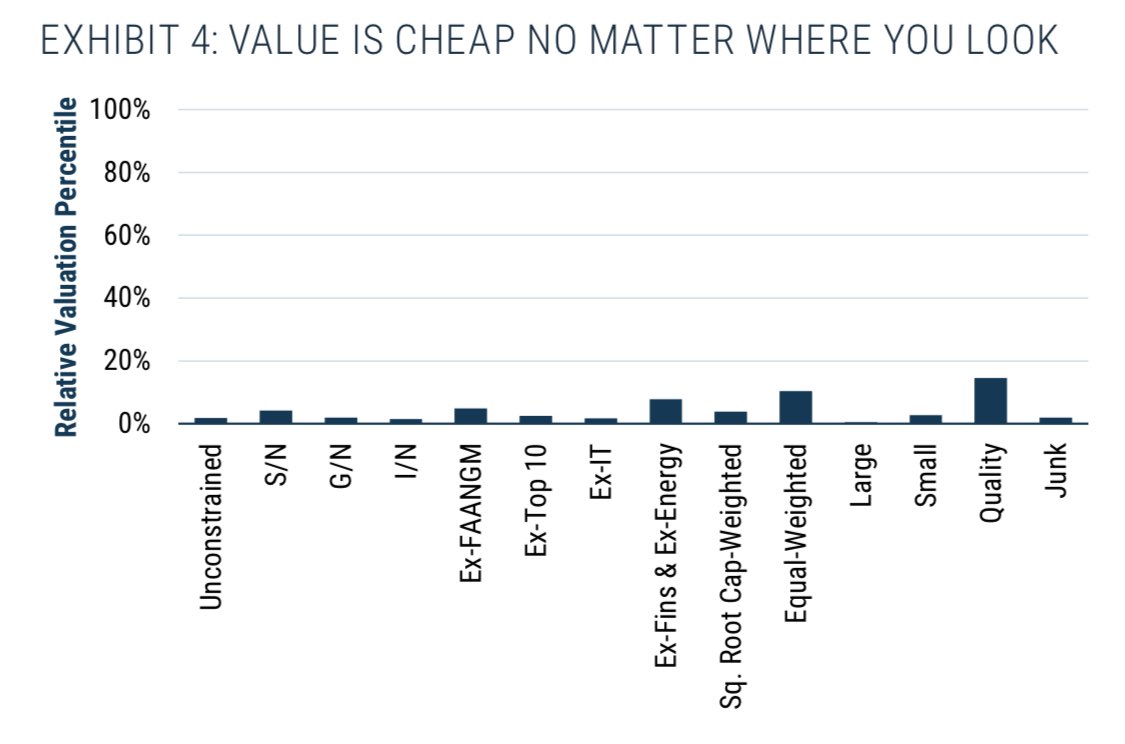

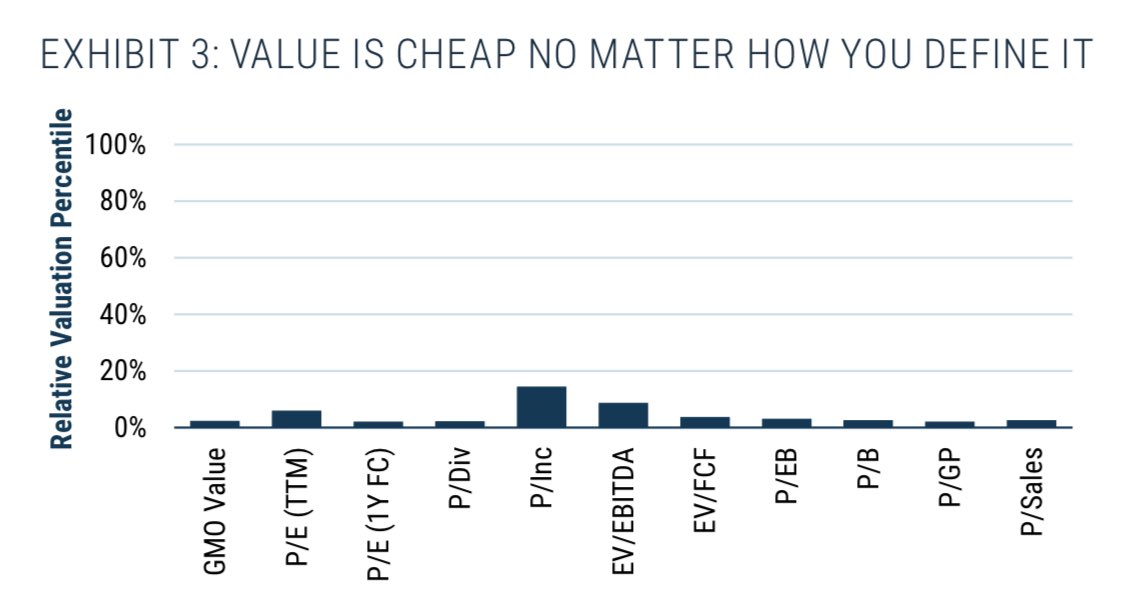

And what is under valued right now? Value stocks (especially international value stocks). #valuedecade #valuedecade #valuedecade #investing

• • •

Missing some Tweet in this thread? You can try to

force a refresh