1/ Some people believe on Tuesday, the December quarter "earnings season" kicks into a higher gear.

Smart investors know this is actually the "free cash flow season" and their better investing outcomes reflect that realization.

Why the focus on earnings? People are lazy.

Smart investors know this is actually the "free cash flow season" and their better investing outcomes reflect that realization.

Why the focus on earnings? People are lazy.

2/ Justifying your professional existence is hard. Early securities analysts had to find ways to convince customers they could predict which stocks would outperform others. They naturally were attracted to "earnings" due to a mental bias Charlie Munger calls "overcounting."

3/ Everyone knows the history of depreciation and why tax laws are focused on earnings. home.treasury.gov/system/files/1… The good news for everyone is that they can decide to invest based based on the metric which actually determines value (AKA, free cash flow). Differential advantage!

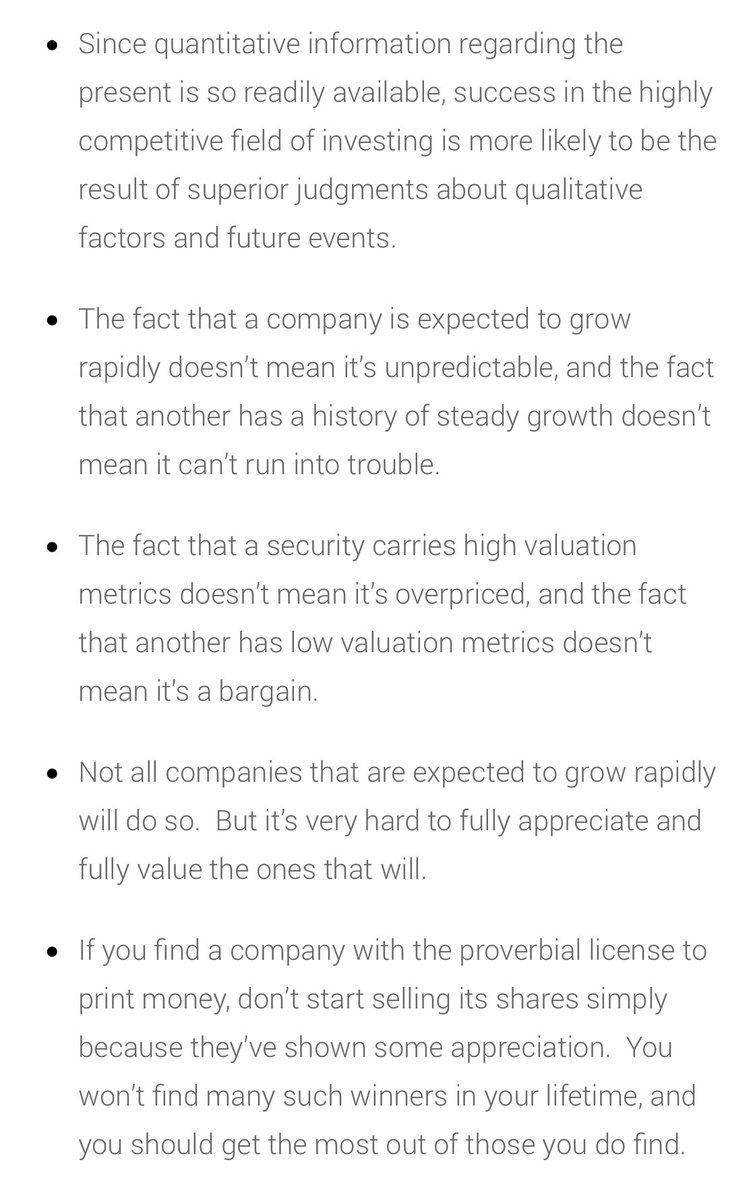

4/ Edge can come from informational, analytical or behavioral sources. Get:

1) better information

2) the same information sooner or

3) analyze that information differently in ways that lead to variant perceptions about an asset’s value.

Chasing the crowd = lousy outcomes.

1) better information

2) the same information sooner or

3) analyze that information differently in ways that lead to variant perceptions about an asset’s value.

Chasing the crowd = lousy outcomes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh