Good morning: Some good news from Singapore regarding trade in December (China had that last week). Today is China data dump (comes out in 17 mins) and GDP (lagging indicator) should bounce & eyes are on retail sales for December as well as FAI.

Consensus expectations of China retail sales in December is 5.5% & we know the US underwhelmed w/ 2.9% (direction is downward as stimulus fades & suppression measures intensify as well as worse job condition). People are waiting on what Biden et al will do, esp US 10yr & stocks!

China retail sales in December rose less than expected by 4.6%YoY, expectations 5.5% 😬

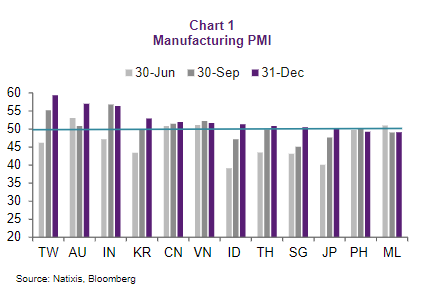

GDP beats estimate in Q4 at 6.5%YoY vs es of 6.2% which makes the year +2.3% for China, one of the few economies w/ positive GDP growth (Vietnam & Taiwan are others).

That said, data from December tells us that demand side growth not as great as supply side still.

That said, data from December tells us that demand side growth not as great as supply side still.

Let's put this another way, in 2020: China GDP rose +2.3%YoY (real). Nominally, retail sales fell -3.9%. Only discloses expenditure details at an annual level & u do not know on the expenditure side in real term what the 6.5% real Q4 made of . Even in stats, it favors supply side

Let's put it another way, in December: Industrial output (supply-side) grew +7.3%YoY, higher than expectations Retail sales (demand-side) slowed to 4.6%YoY, lower than expectations. Meaning, trends of 2020 carry into end 2020 & likely 2021

• • •

Missing some Tweet in this thread? You can try to

force a refresh