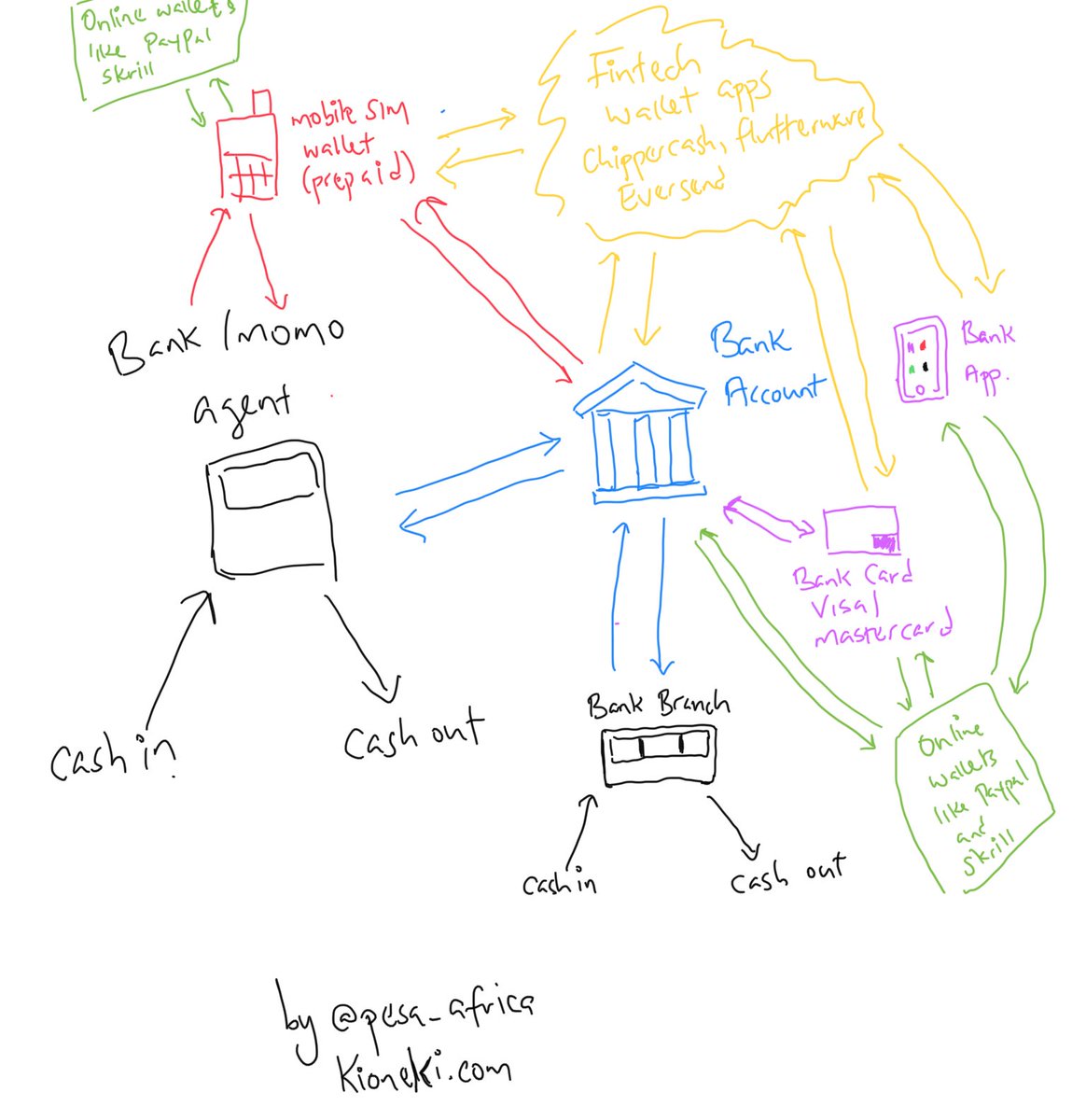

My MPESA agent friends are now calling to ask about how to get into the business of dealing bitcoins and cryptocurrencies. I am quite pleased, Mpesa agents are well suited for the business of exchanging cryptocurrencies and local currencies

For them, it's an avenue to earn more from additional business lines. They already have the experience of managing electronic money inventory for cash in cash out business, dealing cryptocurrencies is a natural extension of their experience

What's more, dealing cryptocurrencies does not require a license, or renting out a physical space, and minimum capital requirements to get started are fractions lower than Mpesa agency business. Commissions are better and work can be remote

In contrast, the business of Mpesa agency comes with cumbersome licensing requirements - minimum capital requirements, physical space required, fixed location etc

With the current state of the economy, everyone is looking for new avenues to earn, dealing cryptocurrencies as a vendor on P2p platforms like Paxful and localbitcoins and Localcryptos is a worthwhile venture

I would like to see the formalization of such business, so people can access cryptocurrencies at any agent of their choice. Like buying bitcoin at your favorite Mpesa agent

In short, I'd like to see a formalization of the business of dealing cryptocurrencies by agents in this market

But I've been told I am naive.

But I've been told I am naive.

Regardless of whether formalization happens or not, the proliferation of Informal cryptocurrency dealers will continue and government will continue to lose to hidden transactions.

I on the other hand, have nothing to lose.

I on the other hand, have nothing to lose.

Read 1 kioneki.com/2020/05/11/how…

Read 2 kioneki.com/2017/10/16/why…

Read 3 kioneki.com/2017/10/09/why…

Read 4 kioneki.com/2018/09/10/how…

The number 1 cause for increasing interest in bitcoin and cryptocurrencies is the poor state of the economy.

https://twitter.com/pesa_africa/status/1351789721484218368?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh