MOFCOM just issued some interesting clarification on the Chinese Blocking Statute:

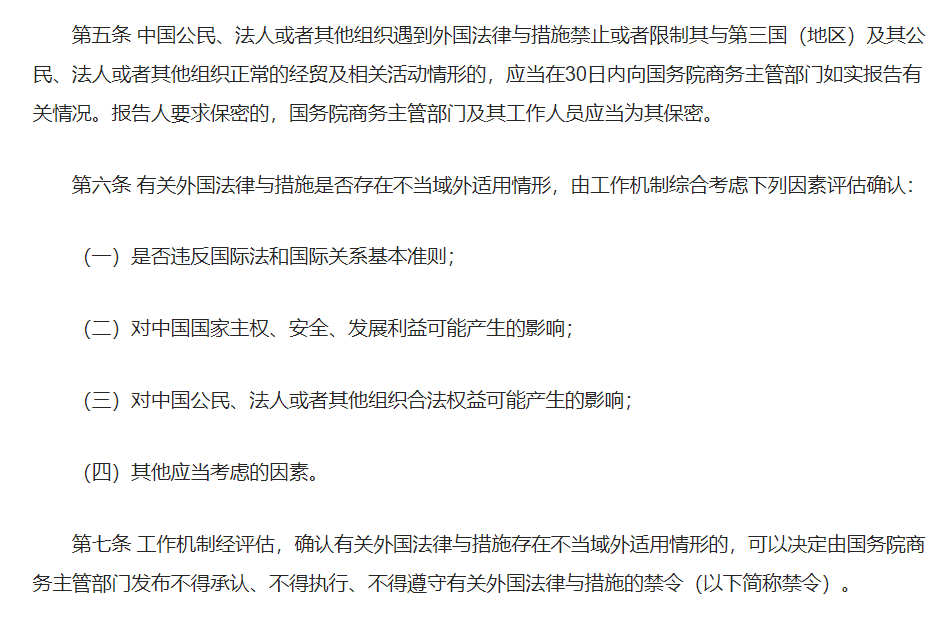

1. Injunctions prohibiting firms and individuals from recognizing, enforcing and complying with foreign sanctions only apply to Chines entities, NOT foreign entities;

1. Injunctions prohibiting firms and individuals from recognizing, enforcing and complying with foreign sanctions only apply to Chines entities, NOT foreign entities;

https://twitter.com/henrysgao/status/1347745529447342086

2. Entities harming interests of Chinese entities by complying with foreign sanctions only include Chinese entities;

3. But entities benefiting from foreign judgments include both Chinese and third-country entities.

3. But entities benefiting from foreign judgments include both Chinese and third-country entities.

To illustrate with examples:

1. US issues sanctions against Chinese entity A dealing with third-country entities B. MOFCOM issues injunction against compliance with the sanction. Only Chinese entity C is required to comply with the injunction. But not third-country entity D.

1. US issues sanctions against Chinese entity A dealing with third-country entities B. MOFCOM issues injunction against compliance with the sanction. Only Chinese entity C is required to comply with the injunction. But not third-country entity D.

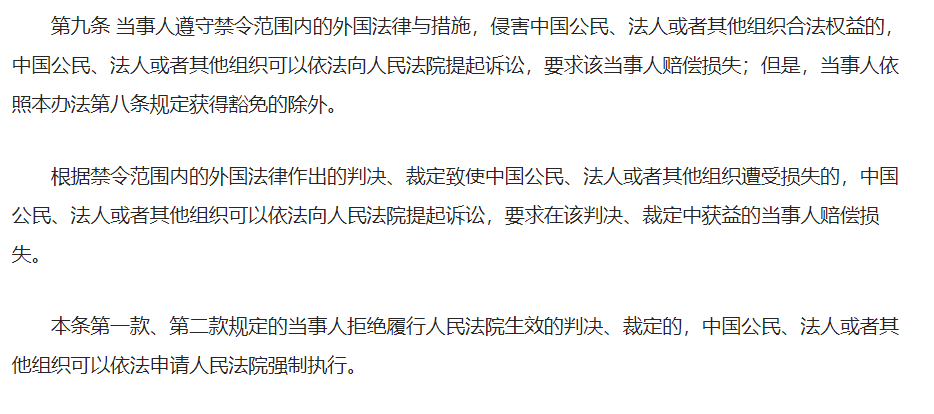

2. Both Chinese entity C and third-country entity D refused to comply with the injunction and caused damage to Chinese entity A. A can only sue C in a Chinese court, but not D.

3. D gets a judgement in US court against A for contractual damage. Now A can sue D in Chinese court.

3. D gets a judgement in US court against A for contractual damage. Now A can sue D in Chinese court.

So overall, the impact of the new regulations seems mostly limited to Chinese entities, but not foreign entities (except #3 mentioned above). But foreign-invested entities in China are also considered to be Chinese entities, which includes China subsidiaries of foreign companies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh