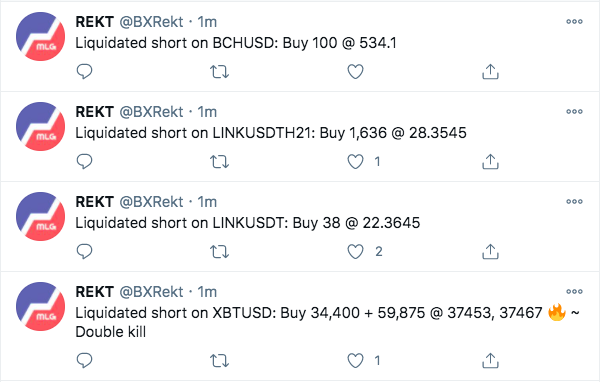

Today you’re going to see what happens when liquidity disappears. When you can no longer close a position. When participants stop trusting one another.

USDT printing was good while it lasted. Now Bitcoin is on it’s own. Just overleveraged bagholders trying to sell to one another.

USDT printing was good while it lasted. Now Bitcoin is on it’s own. Just overleveraged bagholders trying to sell to one another.

When subprime mortgages started defaulting en masse in April/May 2007, and it was clear subprime ABSs were toast, banks initially pumped the price of those ABSs on the markets, to entice more investors to buy, and offload their bags.

Still wonder why Bitcoin pumped to new ATHs?

Still wonder why Bitcoin pumped to new ATHs?

The writing was on the wall for a long time. Regulation of crypto coupled with Tether being a fraudster's den.

You had warning shots: STABLE act, self-hosted wallet KYC, NYAG lawsuit. You had bombshell revelations of money laundering.

NOBODY LISTENED BECAUSE NUMBER WAS GOING UP.

You had warning shots: STABLE act, self-hosted wallet KYC, NYAG lawsuit. You had bombshell revelations of money laundering.

NOBODY LISTENED BECAUSE NUMBER WAS GOING UP.

It was always that simple. Crypto attracted unsophisticated investors. Institutional money was anecdotal at best. A few smart guys who just wanted to also sheer some muppets while the going was good.

Retail just watched number go up and went all in. No research, no common sense.

Retail just watched number go up and went all in. No research, no common sense.

There's nothing behind Bitcoin. It's database entries that represent nothing. Most of on-chain volume is paper shuffling. It was never going to be money. As for store of value, it burns billions of dollars every year just for the sake of it, because it was designed to burn money.

• • •

Missing some Tweet in this thread? You can try to

force a refresh