On Sep 3rd 2020 we closed on a 120k sf glove factory built in 1890 in a small NY town.

Has 45k sf of self storage inside and had $14k a month of net operating income at closing.

Let's breakdown this deal.

A THREAD on creating $2 million out of thin air in 18 months...

👇👇

Has 45k sf of self storage inside and had $14k a month of net operating income at closing.

Let's breakdown this deal.

A THREAD on creating $2 million out of thin air in 18 months...

👇👇

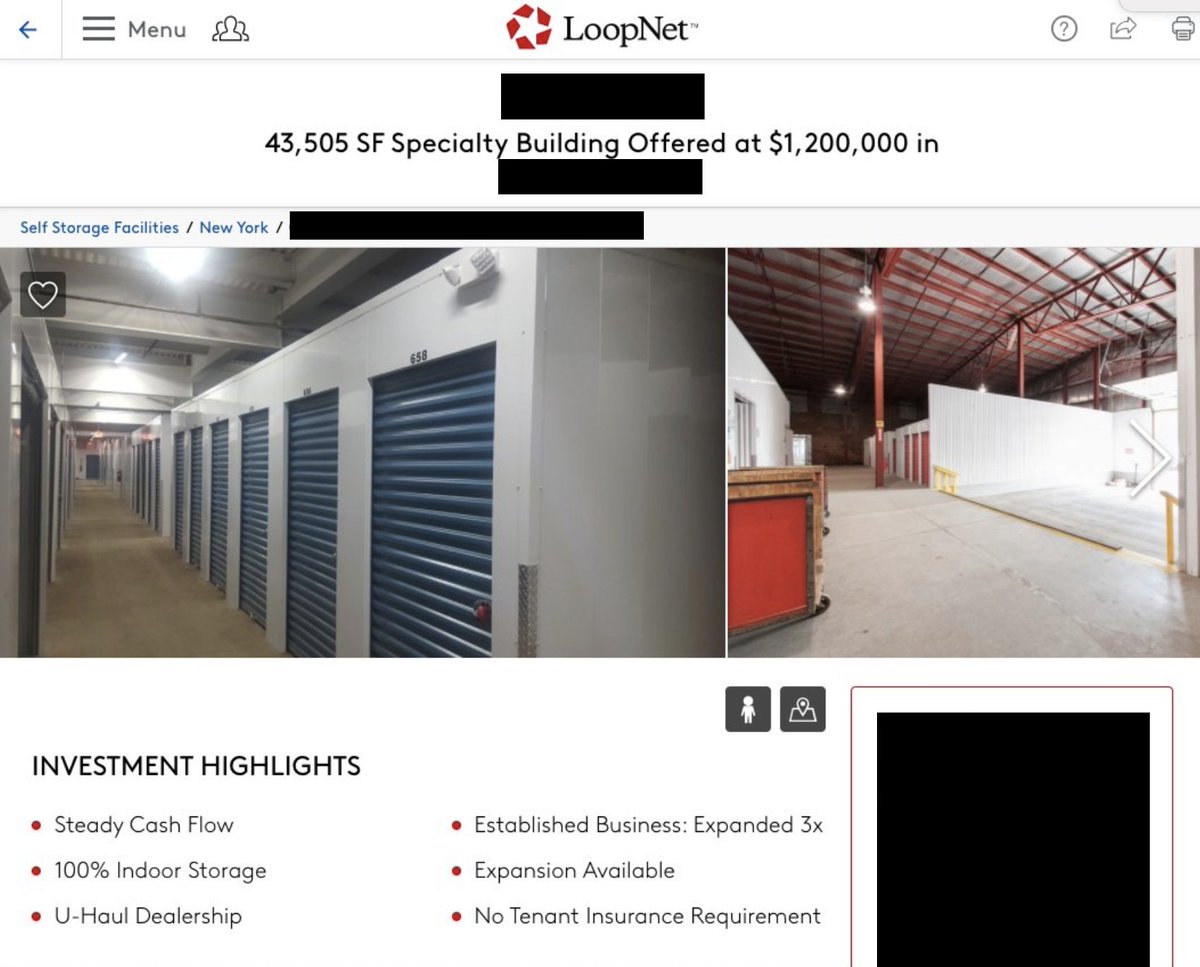

First saw the property on Loopnet in mid 2018. I ignored it. Who wants to try to operate a business in an old factory in a dying NY town.

A few months later I reached out. Broker sent me financials. They were good. $24k a month in revenue and $10k in expenses.

A few months later I reached out. Broker sent me financials. They were good. $24k a month in revenue and $10k in expenses.

So I visited the property. It was old. Needed a new roof. Full time manager. Only accessible to customers 9am-5pm M-S. No autopay. A lot of folks paying 1/2 market rent.

I loved everything about it.

I loved everything about it.

But I knew they were going to have trouble selling this thing no matter the profitability, so on July 1 2018 I made a low offer. $750k + seller pays for new $250k roof + $20k in environmental work.

Countered at asking price + $100k credit towards roof.

I ignored the response.

Countered at asking price + $100k credit towards roof.

I ignored the response.

Broker called me back mid September of 2018. Make another offer, he urged.

I knew it was a good biz so I got more aggressive - $1MM + seller pays for roof / environmental.

Declined. Countered with $1.2MM but they'd give me a new roof and do the environmental.

I knew it was a good biz so I got more aggressive - $1MM + seller pays for roof / environmental.

Declined. Countered with $1.2MM but they'd give me a new roof and do the environmental.

The next day I offered them their price, but said they'd need to hold $300k of paper in the form of a second mortgage. 5% rate, 20 yr term.

They agreed and we signed a deal.

More on seller financing here:

They agreed and we signed a deal.

More on seller financing here:

https://twitter.com/sweatystartup/status/1352218512962580480?s=20

I convinced my bank to loan me 67.5% LTV at 3.5% with 12 mo interest only.

They replaced roof. Did environmental. A few other things that came up in inspection.

It had $168k in NOI so appraisal came back at $1.85MM.

My bank: $950k

Sellers: $300k

Purchase price: $1.2MM

They replaced roof. Did environmental. A few other things that came up in inspection.

It had $168k in NOI so appraisal came back at $1.85MM.

My bank: $950k

Sellers: $300k

Purchase price: $1.2MM

On closing day we remembered the property had a house on it. There is a tunnel right into the 2nd floor of the factory from the upstairs dormer. Needs $75k worth of work to be livable. Likely not worth it.

Changes we made right away:

New security system ($12k)

Automatic / wifi overhead doors ($5k)

12 hr / 7 day access

No office (keeping manager on team though)

Rent increase to get customers up to market rate

New security system ($12k)

Automatic / wifi overhead doors ($5k)

12 hr / 7 day access

No office (keeping manager on team though)

Rent increase to get customers up to market rate

The manager who was working 50 hours a week from the office on site went remote (work from home nearby) on October 15th as soon as the automated doors and security system were finished.

She now answers phones and does admin for 3 other facilities in addition to this one.

She now answers phones and does admin for 3 other facilities in addition to this one.

Things have been going well to say the least.

In October we increased revenue from $24.8k in September to $30k. November and December were just shy of $30k as well.

Occupancy is up. Economic occupancy is WAY up.

In October we increased revenue from $24.8k in September to $30k. November and December were just shy of $30k as well.

Occupancy is up. Economic occupancy is WAY up.

And from an expense perspective we've leaned out and we took the expenses from $10k to $8.5k.

Marketing: $1k

Payroll (1/4 of manager pay): $1k

Utilities / Software / Mis: $1.25k

Snow removal / Lawn: $750

Supplies: $500

Maintenance: $1k

Management fee: 1.5k

Taxes / Ins: $1.5k

Marketing: $1k

Payroll (1/4 of manager pay): $1k

Utilities / Software / Mis: $1.25k

Snow removal / Lawn: $750

Supplies: $500

Maintenance: $1k

Management fee: 1.5k

Taxes / Ins: $1.5k

So now we have $30k in revenue and $8.5k in expenses for $21.5k in net operating income.

On an annualized basis thats $258k in net operating income.

On an annualized basis thats $258k in net operating income.

Then what? Sell it? How much will someone pay for it?

Let me tell you why I don't care how much someone will pay.

If I sell it I'll have about $3.5MM in capital gains. 25% of that will go to uncle sam. And I'll be left trying to figure out what to do with the remaining 2.5MM.

Let me tell you why I don't care how much someone will pay.

If I sell it I'll have about $3.5MM in capital gains. 25% of that will go to uncle sam. And I'll be left trying to figure out what to do with the remaining 2.5MM.

And I don't need to sell it to realize 80% of that gain while keeping a money-making asset and not having to redeploy any capital or give a chunk to the government.

Here's how:

Here's how:

At the 18 month mark we plan to be around $40k a month in rev (after expansion) on $9k in exp for an NOI figure around $370k.

Then we'll go back to our bank and get the thing reappraised. We expect it to be valued at about $4.5MM.

The bank will lend 75% of that value to us.

Then we'll go back to our bank and get the thing reappraised. We expect it to be valued at about $4.5MM.

The bank will lend 75% of that value to us.

As long as our monthly operating income covers the debt by 1.5x or more, we'll lever up, taking $3.375MM in new loans on the building.

After $1.25MM goes to clear seller financing and original loan, we'll have $2.125MM in cash go into our checking accounts.

And the best part...

After $1.25MM goes to clear seller financing and original loan, we'll have $2.125MM in cash go into our checking accounts.

And the best part...

We still own the building and its $150k a year in cashflow.

We paid no taxes.

In the sell scenario: We trade our building for $2.5MM cash.

In the ReFi scenario: We keep our building and get $2.125MM cash.

I'll take #2 all day. And thats our plan with every building we buy!

We paid no taxes.

In the sell scenario: We trade our building for $2.5MM cash.

In the ReFi scenario: We keep our building and get $2.125MM cash.

I'll take #2 all day. And thats our plan with every building we buy!

If you'd like to understand the dynamics of real estate deals like this and see more deal examples. Sign up for my email newsletter:

sweatystartup.substack.com

sweatystartup.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh