A THREAD on how most real estate folks structure deals with outside investors.

Most people utilize the "preferred equity" structure when they raise money from outside investors. They "syndicate" deals.

Here's the basics:

Most people utilize the "preferred equity" structure when they raise money from outside investors. They "syndicate" deals.

Here's the basics:

The person (or team of people) putting the deal together is the "sponsor". Also called general parter. Referred to on twitter as the GP.

They find the property, do all the work, hire the management company and take fees. They often co-sign debt and always secure the financing.

They find the property, do all the work, hire the management company and take fees. They often co-sign debt and always secure the financing.

The investor is generally passive, doing no work and putting in cash. This is the "limited partner". Referred to on twitter as the LP.

They don't co-sign debt. They simply read reports and ask the sponsors questions and cash checks every month (if the deal is going well).

They don't co-sign debt. They simply read reports and ask the sponsors questions and cash checks every month (if the deal is going well).

There are two equity classes.

"Preferred equity" belongs to the LPs. Cash talks, so this is a higher class of shares. They are first in the "capital stack" behind the debt (bank loan).

"Common equity" belongs to the sponsor. They are generally last in the capital stack.

"Preferred equity" belongs to the LPs. Cash talks, so this is a higher class of shares. They are first in the "capital stack" behind the debt (bank loan).

"Common equity" belongs to the sponsor. They are generally last in the capital stack.

Sponsors generally co-invest. That means they hold both equity classes. A 10% co-invest is standard.

That means the GP has skin in the game. His 10% co-invest makes him both an LP and a GP.

That means the GP has skin in the game. His 10% co-invest makes him both an LP and a GP.

The preferred equity LPs have comes with a preferred return. Often called a "pref".

That means they get paid first. The pref signals how much. Its generally 6-12%. That means the LP is entitled to the first 6-12% of profit the project generates.

That means they get paid first. The pref signals how much. Its generally 6-12%. That means the LP is entitled to the first 6-12% of profit the project generates.

The lower the pref the better for the sponsor. Generally lower risk projects can warrant a lower preferred return for the LPs.

New development, or high risk value add projects, generally warrant lower prefs and higher "promotes"

New development, or high risk value add projects, generally warrant lower prefs and higher "promotes"

The "promote" is how the sponsor gets paid. Its often called "carry" or "carried interest".

Its a percentage of profits the sponsor gets AFTER the LPs get their preferred return on their cash.

This ranges from 20% to 50%. It can change based on checkpoints, or "waterfall".

Its a percentage of profits the sponsor gets AFTER the LPs get their preferred return on their cash.

This ranges from 20% to 50%. It can change based on checkpoints, or "waterfall".

Sponsors have different strategies, but most try to return LP capital as soon as possible either through a sale or refinance.

Because every day your LP capital isn't returned its accumulating "preferred returns" that you owe to the LP. The only way to stop it is to return it.

Because every day your LP capital isn't returned its accumulating "preferred returns" that you owe to the LP. The only way to stop it is to return it.

Then you're in waterfall land and you can get 20% or 50% of profits from there on out.

There are often additional waterfalls. 80/20 after an 8 pref and 50/50 after a 20% "hurdle".

A hurdle is a return percentage you need to hit to get into the next level of promote.

There are often additional waterfalls. 80/20 after an 8 pref and 50/50 after a 20% "hurdle".

A hurdle is a return percentage you need to hit to get into the next level of promote.

"IRR" is the gold standard for a lot of LPs.

Internal Rate of Return.

When the deal is done, and my capital is back, what percent return have I earned?

Sponsors hate it because there are so many other factors that are more important to the health of the deal.

Internal Rate of Return.

When the deal is done, and my capital is back, what percent return have I earned?

Sponsors hate it because there are so many other factors that are more important to the health of the deal.

Then there is the "hold period".

How long of a time frame are we on? These deals aren't liquid. LPs can't just ask for their money back.

Sponsors lay out the investment timeline and let everyone know how long this thing is expected to go.

How long of a time frame are we on? These deals aren't liquid. LPs can't just ask for their money back.

Sponsors lay out the investment timeline and let everyone know how long this thing is expected to go.

There are also acquisition fees and AUM (assets under management) fees charged by most sponsors.

Acquisition fees can be anywhere from 1-5%.

AUM fees are generally .5-2%.

The market sets these fees (as well as the pref and promote). If you have a track record, more fees.

Acquisition fees can be anywhere from 1-5%.

AUM fees are generally .5-2%.

The market sets these fees (as well as the pref and promote). If you have a track record, more fees.

Let's do an example deal here to paint the picture.

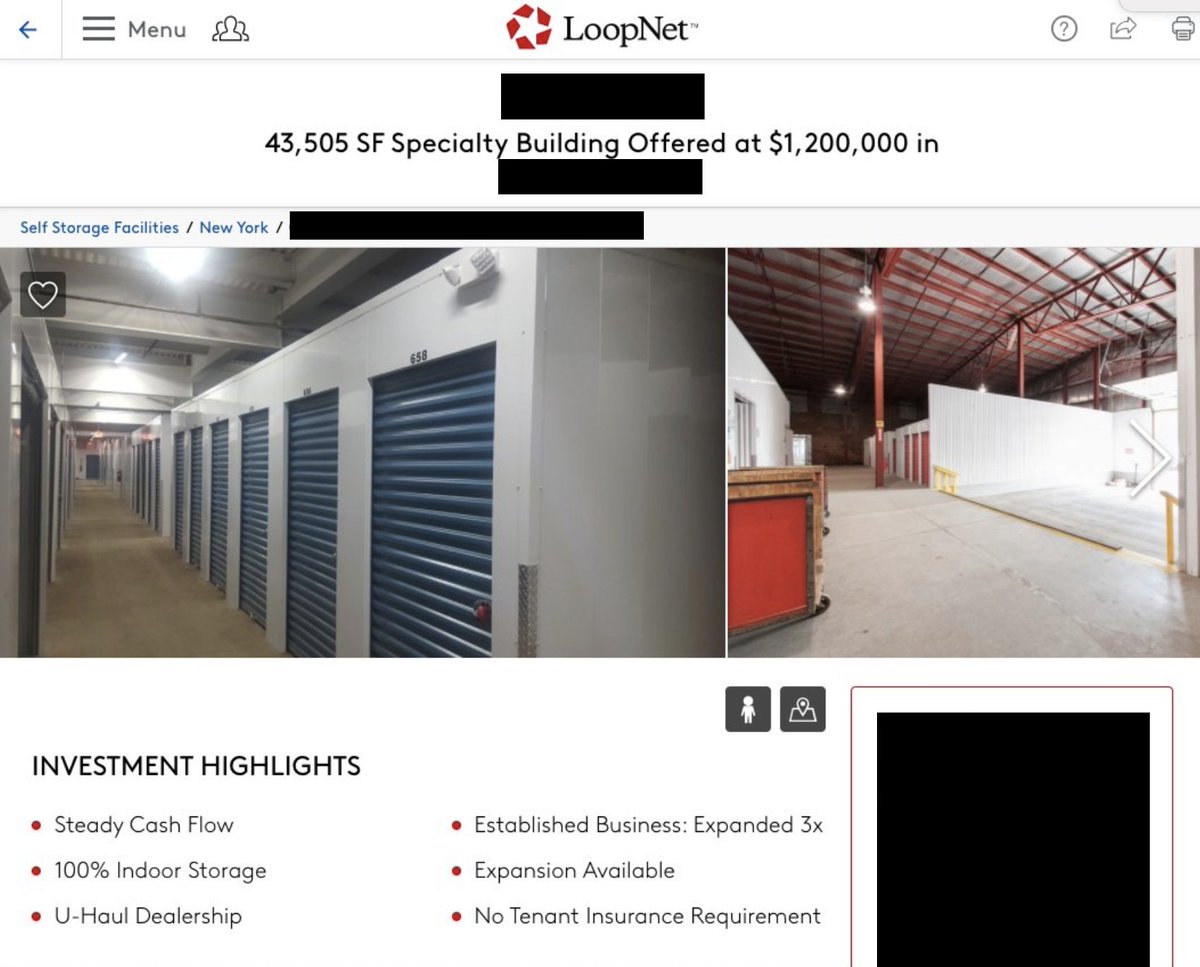

I buy storage facilities so lets say we have a $1MM operational facility already at 90% occupancy.

Its (relatively) low risk so lets say the structure is 7 pref and 50% promote thereafter. No waterfalls.

I buy storage facilities so lets say we have a $1MM operational facility already at 90% occupancy.

Its (relatively) low risk so lets say the structure is 7 pref and 50% promote thereafter. No waterfalls.

We bank finance 70% or $700k. Thats first in the capital stack. If things go sideways the bank gets paid first.

We raise 300k from outside LPs to close out the deal. No co-invest to keep the math simple.

Starting on day 1 we owe the LPs a 7% annual rate (pref) on the $300k.

We raise 300k from outside LPs to close out the deal. No co-invest to keep the math simple.

Starting on day 1 we owe the LPs a 7% annual rate (pref) on the $300k.

Lets say we have a 5% acquisition fee.

I would get paid $50k on day one to buy the deal and get it under ownership.

To keep the math simple we aren't building this in, but keep it in mind.

The 1% AUM fee would be $3,000 a year on the $300k.

That goes to the sponsor.

I would get paid $50k on day one to buy the deal and get it under ownership.

To keep the math simple we aren't building this in, but keep it in mind.

The 1% AUM fee would be $3,000 a year on the $300k.

That goes to the sponsor.

We buy it at a 8 cap, meaning NOI is 8% of the overall purchase price, or $70k.

Our cash on cash would be around 15% or higher if we can secure Interest Only debt (not paying principle for the first period of time).

That means on day one I'm hitting the hurdle and getting paid

Our cash on cash would be around 15% or higher if we can secure Interest Only debt (not paying principle for the first period of time).

That means on day one I'm hitting the hurdle and getting paid

The first 7% goes to the LPs, or $21k a year.

But we have $45k in cashflow, or $24k after the pref.

That money is split 50/50 between the GP and the LPs because we have a 50% promote.

Yr 1 the LPs get $21k+$12k for $33k. 11% IRR pace.

But we have $45k in cashflow, or $24k after the pref.

That money is split 50/50 between the GP and the LPs because we have a 50% promote.

Yr 1 the LPs get $21k+$12k for $33k. 11% IRR pace.

But the sponsor has a plan to add value. They raise NOI from $70k to $100k over 12 months.

Yr 2 cashflow is even higher, $45k+$30k for $75k.

LPs are owed $21k as their pref and we have more to split up between the sponsor and LPs. LPs get another $27k and Sponsors get $27k.

Yr 2 cashflow is even higher, $45k+$30k for $75k.

LPs are owed $21k as their pref and we have more to split up between the sponsor and LPs. LPs get another $27k and Sponsors get $27k.

But here comes the cash-out-refinance or sale.

Lets do a sale first. Our property might be worth a 7 cap on the new NOI, or $1.428MM. Lets say $1.5 for simple math.

We sell it for $1.5M at the 24 month mark. Home run deal.

Lets do a sale first. Our property might be worth a 7 cap on the new NOI, or $1.428MM. Lets say $1.5 for simple math.

We sell it for $1.5M at the 24 month mark. Home run deal.

Lets go down the capital stack and pay the pipers:

Bank gets their $700k back first.

LPs get their $300k back next.

They've already been getting their pref from day 1 so we don't have a preferred return to "catch up" when we sell. So its 50/50 from here.

Bank gets their $700k back first.

LPs get their $300k back next.

They've already been getting their pref from day 1 so we don't have a preferred return to "catch up" when we sell. So its 50/50 from here.

Sponsor gets $250k, LPs get $250k. Boom baby!

In 24 months the LPs made $81k in cashflow (or 13.5% per year).

That means the targeted cash yield on the deal should have been around 13.5% if the sponsors projections were correct. Cash yield doesn't account for sale, only ops.

In 24 months the LPs made $81k in cashflow (or 13.5% per year).

That means the targeted cash yield on the deal should have been around 13.5% if the sponsors projections were correct. Cash yield doesn't account for sale, only ops.

At closing the LPs got a check for $550k ($300k was return of capital) and they made $81k in cashflow.

A $331k total profit. In 2 yrs.

IRR: 55.16%

Equity Multiple: 2.1x

Add it to your resume, pay a bunch of taxes, and do a bigger deal!

A $331k total profit. In 2 yrs.

IRR: 55.16%

Equity Multiple: 2.1x

Add it to your resume, pay a bunch of taxes, and do a bigger deal!

But heres the magic trick - the cash-out-refinance.

Instead of selling the property for $1.5MM and paying a bunch of taxes and being stuck with $500k in capital that is earning nothing and needs re-deployed, lets hold the asset and put more debt on it.

Instead of selling the property for $1.5MM and paying a bunch of taxes and being stuck with $500k in capital that is earning nothing and needs re-deployed, lets hold the asset and put more debt on it.

Banks don't care what you paid for an asset. They care about how much money it makes.

They get the property appraised for $1.5MM, look at the debt service coverage ratio, and agree to lend 75% of the new value.

That means you can take $1,125,000 in new debt.

They get the property appraised for $1.5MM, look at the debt service coverage ratio, and agree to lend 75% of the new value.

That means you can take $1,125,000 in new debt.

Lets pay the piper, in order of the capital stack:

Bank gets paid $700k (original debt is cleared).

LPs get paid $300k (original investment, pref is no longer accruing)

You have $125k left over. Sponsor gets 50%. LPs get 50%.

Bank gets paid $700k (original debt is cleared).

LPs get paid $300k (original investment, pref is no longer accruing)

You have $125k left over. Sponsor gets 50%. LPs get 50%.

You've returned all the capital.

EVERYTHING FROM HERE IS BUTTER.

The property still cashflows. You didn't pay a bunch of taxes. You still got LPs their money back and they're ready to do another deal with you.

You as the sponsor, now own 50% of a building you put $0 into.

EVERYTHING FROM HERE IS BUTTER.

The property still cashflows. You didn't pay a bunch of taxes. You still got LPs their money back and they're ready to do another deal with you.

You as the sponsor, now own 50% of a building you put $0 into.

Disclosure:

I'm not a pro at this. Looking forward to getting corrected where I missed something.

There are thousands of ways to do this and terms and factors I didn't mention.

I just wish I could have read something like this a year ago when I first started on ReTwit.

I'm not a pro at this. Looking forward to getting corrected where I missed something.

There are thousands of ways to do this and terms and factors I didn't mention.

I just wish I could have read something like this a year ago when I first started on ReTwit.

Also this is a good site to look at deals, explore structures, and learn about different aspects of real estate private equity:

crowdstreet.com

crowdstreet.com

And reporting, calculating, distributing is all complicated, especially with 5+ LPs in a deal.

I use @GroundbreakerCo to manage my LPs. Same thing as Juniper Square except 1/5 the cost. Love it.

I use @GroundbreakerCo to manage my LPs. Same thing as Juniper Square except 1/5 the cost. Love it.

If you're into this stuff and want to learn more about real estate - join my mailing list here:

sweatystartup.substack.com

sweatystartup.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh