🧵While we in Fintech are Hoping for Challenger/Neo Banking Licences from RBI. Let's understand more about Small Finance Bank and from their success, try to see if a balance between Profitability (for business) and Financial Inclusion (for RBI) can be made for future usecase?👇

Since Independence, Financial Inclusion has been a top policy agenda for the central govt and hence for the RBI also, Post 90s, the accent was more on demand-led private initiatives through self-help groups, followed by the Grameen Bank model of microfinance in India.

Then, in 2015, the RBI granted licenses to two differentiated banks (SFB and Payments Banks) for pushing the financial inclusion. PB had been a mystery category, with no clear business model to operate. SFB was to cater to the diverse needs of the low-income group.

The two KEY expectation was:

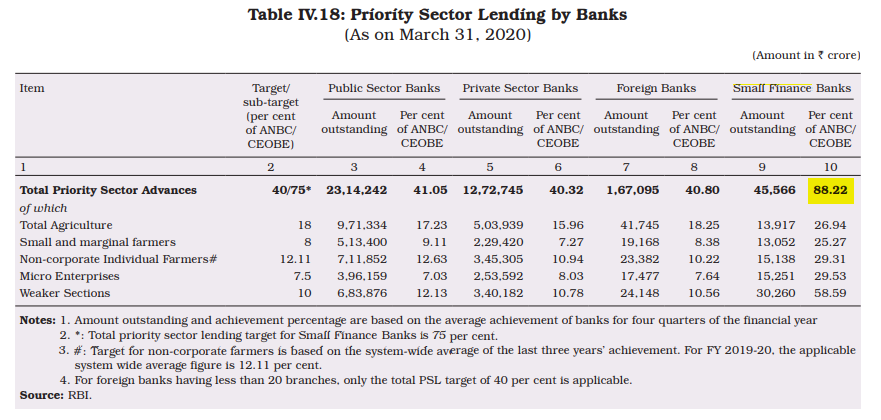

1. Priority Sector Lending (75% of their total lending) and 2. Branches for Unbanked (SFB were required to have 25% of their branches in rural unbanked centres (population shall be less than 10,000)

1. Priority Sector Lending (75% of their total lending) and 2. Branches for Unbanked (SFB were required to have 25% of their branches in rural unbanked centres (population shall be less than 10,000)

Most (8/10) of the SFBs were previously microfinance institutions (MFIs) with a few notable exceptions, such as the Capital Small Finance Bank which was a local area bank. So, achieving the above TWO pointers was not a thought ask for them.

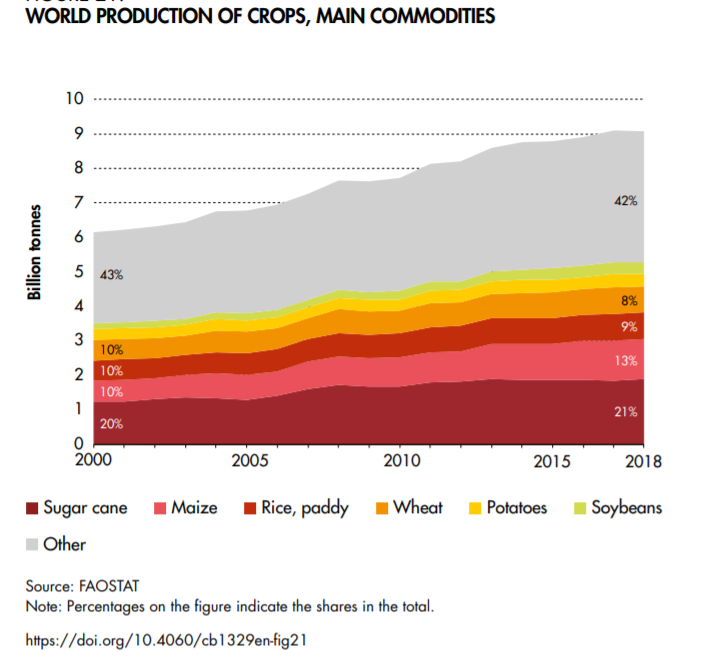

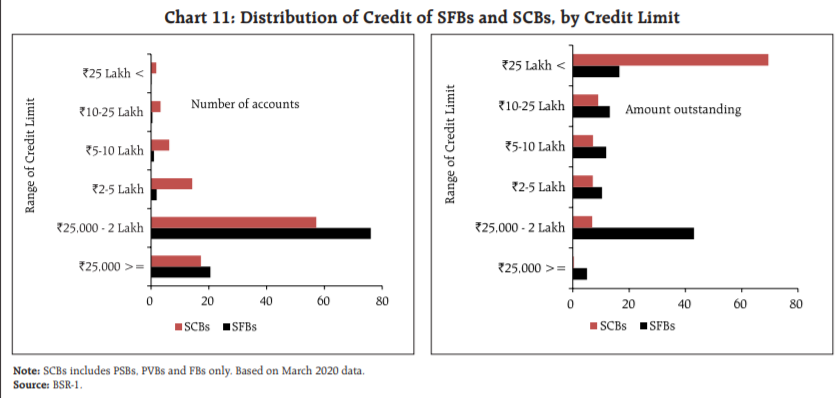

On the PSL front, they seem to be doing quite good. Primarily for Agricultural purpose and MSMEs, there is a recent surge in the share of housing loans also.

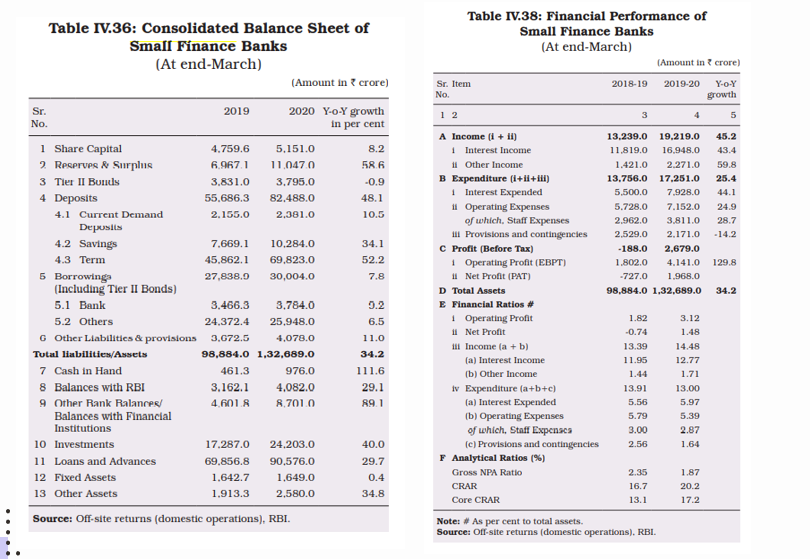

Given they took some time in gaining Public Confidence in the deposits, at the start they were funded by Banks. However, in FY20 deposits contributing ~60% of liabilities, with a 48.1 Y-o-Y growth.

While the deposit base of SFBs has been expanding, they still have a long distance to cover as compared to other SCBs in the mobilisation of CASA (current and savings accounts). This highlight the growth opportunities.

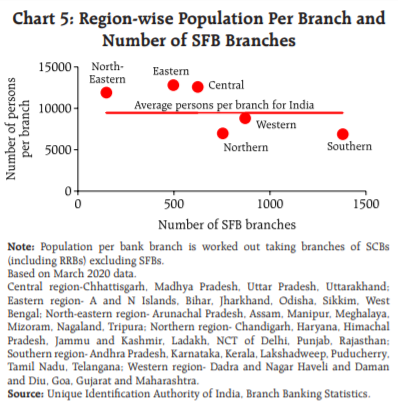

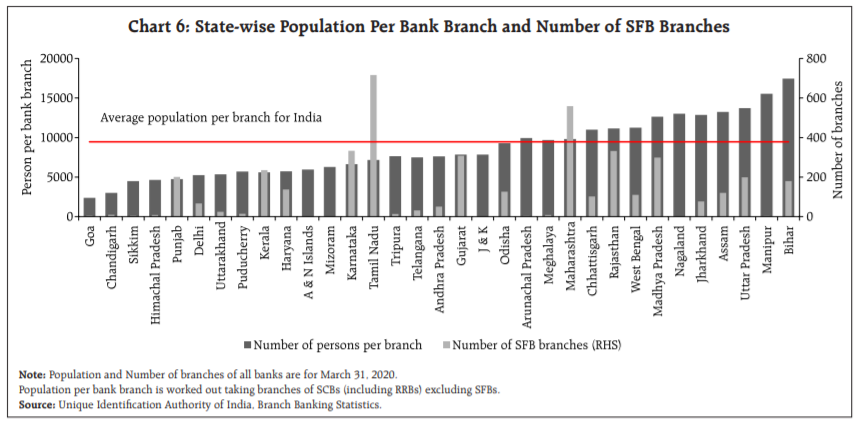

But then there is a concentration risk also. Top-two/three SFBs accounted for 46%/60% of total assets of all SFBs as of FY20. And, hence there is a Regional concentration also.

While some of the under-served states like MP and Rajasthan are served well. Still, SFB continues to be concentrated in Tamil Nadu, Maharashtra and Karnataka.

Share of SFBs in Total Assets and Banking Business are still too small. Liabilities ramp-up is quite good and their collections ability is quite good, given most of them were MFIs.

The growth of some of these SFB is quite good (esp the 3 listed players). Now, this could work as a template for Future Banking Licences in India. SFB will play the most important role in the RBI's action plan of “providing banking access to every village within a 5 KM radius"

• • •

Missing some Tweet in this thread? You can try to

force a refresh