1/ A thread on Nexgen’s Arrow & the #uranium cycle ($NXE)

https://twitter.com/_/status/1352447776798420993

2/ Given the scale and cost structure of Arrow, it makes sense that investors are intensely focused on its delivery timeline. This thread will discuss possible timelines, current market expectations (i.e., what’s “priced in”) & how different Arrow scenarios will impact the mkt.

3/ As you can see from the litany of responses to Michael’s tweet, there is great skepticism in the market regarding Arrow’s timeline. This is largely due to a bearish narrative conveyed by competing CEO’s whose assets only hold value if Arrow is substantially delayed.

4/ Those who played “King of the Hill” as a child would remember that it is the person at the top who is constantly attacked, not the kid sitting at the bottom of the hill in the mud. No one cares enough about that kid to attack them. This is a good parable for $NXE & Uranium.

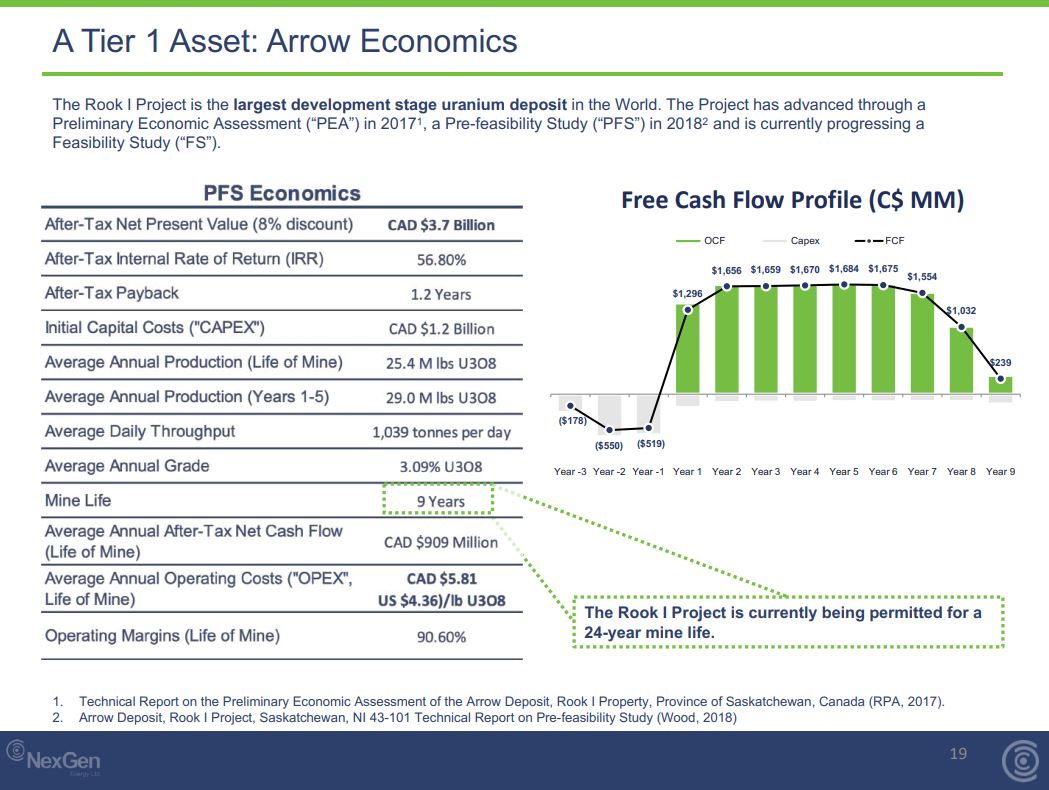

5/ First a quick note on “this cycle” – Segra generally defines this cycle as the deficits forecasted from the mid-2020s to late-2030s. When people imply an asset producing in the mid-to-late 2020s will “miss the cycle”, they clearly have not done any real S/D modelling.

6/ While we may be in sustained deficits at current prices, the C&M assets in existence could balance things short term at the right prices. It is the 2025– 2040 period that matters for new assets– that is the period Riaz refers to when he discusses needing 2 new Kazatomproms.

7/ For the purpose of this discussion, I will outline 3 scenarios for Arrow’s delivery (all dates are for first production): A bull case with delivery ranges from (2025 – 2026), a neutral case (2027 – 2029) and a bear case (2030+).

8/ First what has the company said? Mgmt has been openly stated at investor roadshows for over a year that it is their goal to produce uranium from Arrow in the “middle portion of this decade”. Is this possible? Is this probable? How should we analyze it?

9/ First – Arrow will be permitted under the CEAA 2012, which is a huge benefit to the project (and also to $DML’s Phoenix who were in under the same deadline). If you look at other projects under this framework, permitting averages under 2 years post EIS (~70 examples).

10/ Clearly, beginning community engagement and ideally having any required IBA’s signed before EIS submission drastically reduces social license risk (the main argument for the permitting bears in this case). $NXE has done incredible work here, in our view.

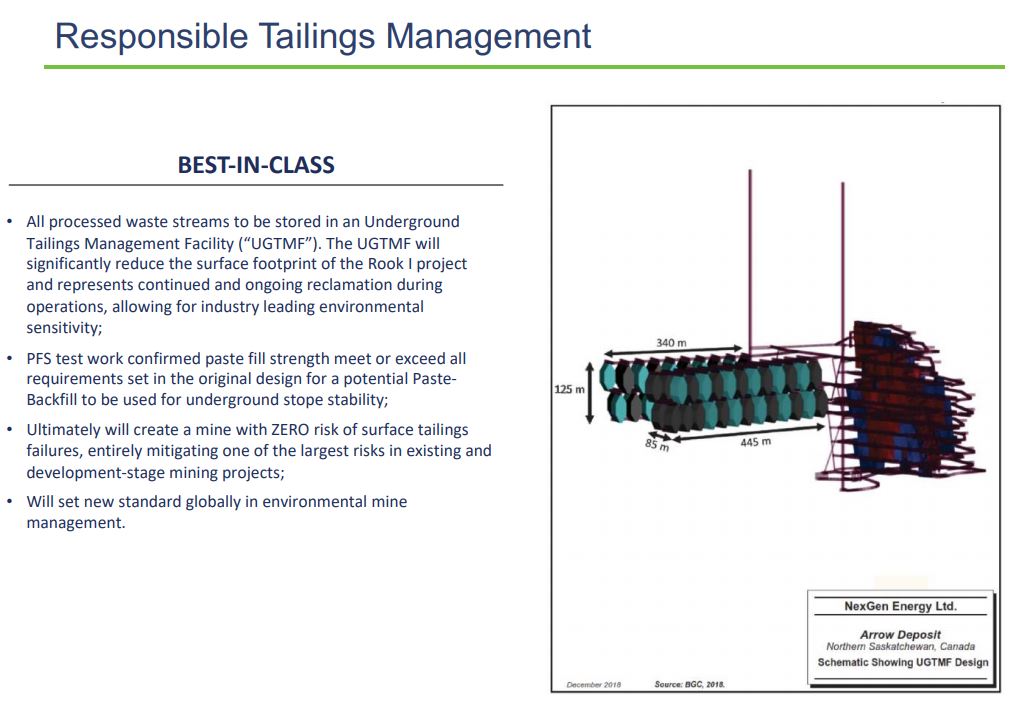

11/ If you look at the environmental aspects of this project (tailings management, mine footprint, etc.), we believe there are many reasons for the Canadian government to view the project as best in class, and that’s before you recognize its economic impact on the province.

12/ Taken together, we believe that a 2-year timeline for permitting the asset is POSSIBLE. Are we willing to argue with certainty that it will take two years? No – this is mining. It is also why management uses “Year X” in their presentation rather than defined dates.

13/ It may be easy to make snarky comments about the “Year X”, implying that mgmt has been unclear. I would much rather have mgmt be upfront about realistic timelines, than put an exact date out only to revise it out year after year (as many peers have done).

14/ Permitting takes longer in Canada than in Kaz, Russia or Africa – no one argues it doesn’t. In exchange, markets will generally value Canadian assets at higher multiples when producing given lower perceived risks re: policy, legal, safety (Look at $CCJ multiples vs. $KAP)

15/ To us, nothing about the mine design suggests an elongated build vs. company estimates of 2.5 – 3 years. Arrow does not have many of the complexities of McArthur or Cigar (freezing, etc). and some of the initial infrastructure work can progress during permitting.

16/ Additionally, once permitted the company will likely be much more active in the contracting market, meaning they are able to de-risk by base loading the asset well before production actually starts (this is when asset value tends to re-rate, not after production begins).

17/ A quick side note to anyone who chimes in with “and they need a mill!” – please read the technical reports and look through the processing costs – what do you think that is? It’s comments like this that show the horsepower much of twitter is working with…

18/ So overall, while getting to the bull case of delivering pounds in 2025 – 2026 isn’t guaranteed, we do see that scenario as feasible. What’s clear is that the broader market is very skeptical. Sell side analysts put production in the 2027-2029 range.

19/ Trade tech and UXC also push the asset out vs. our expectations. Twitter and the retail community clearly have even more bearish expectations of delivery (“2055”, “Next Cycle”, Tumbleweeds!). So, let me walk you through why this is the best possible set up for $NXE.

20/ As many of you know, the stock market is a discounting mechanism and asset returns often move inversely with market expectations. Another way of saying this – right now the scenario priced into Nexgen’s stock is one of skepticism and unachievable timelines.

21/ I would be incredibly nervous if all the responses to Michael’s question were “2024”. That would only leave room for management to disappoint, whereas right now any overachievement on permitting vs. market expectations should result in a re-rating higher.

22/ But what are the market implications of an earlier or later start date? How does Arrow’s impact on broader supply and demand change the value proposition not just for other players, but for $NXE? This is why $NXE can act as a counterbalance to a basket of U equities.

23/ Walking through our delivery scenarios – If NXE runs into major permitting issues and does not begin delivering until the 2030s, one thing is clear: uranium prices need to go a whole lot higher. It is highly unlikely enough projects will be financed and built to offset it.

24/ Barring a permitting issue which makes mining Arrow impossible (i.e., Canada stops uranium mining), how do you think equity of the largest, lowest cost undeveloped asset in the world will react if project delays force uranium prices into a right tail event ($80+)?

25/ Now let’s say that the Nexgen team surprises the market by achieving permitting and operation by the middle of the decade – Arrow now becomes the dominant asset in the space with better margins than Kazatomprom and enough volume to drive major contracting.

26/ By being long a basket of higher cost (though potentially quicker to permit) assets and having no exposure to $NXE, you are inherently long the first instance, and short the second. By having an overweight in $NXE within a broader basket, you benefit in both scenarios.

27/ If you own a basket of U stocks which would be significantly less valuable (or potentially even short opportunities) if Arrow’s permitting process goes better than expected, understand that risk. If you assume you will have sold by then, you are dependent on greater fools.

28/ Generally, tier one, cycle defining assets trade at premiums rather than discounts due to their strategic nature. Will $NXE be allowed to develop the deposit independently or is the asset worth more to another party? That’s likely a topic for another thread… Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh