PM @ Segra Capital Managment (@segracapital). Focused on niche & under-followed investment opportunities. Strong advocate for Nuclear Power.

3 subscribers

How to get URL link on X (Twitter) App

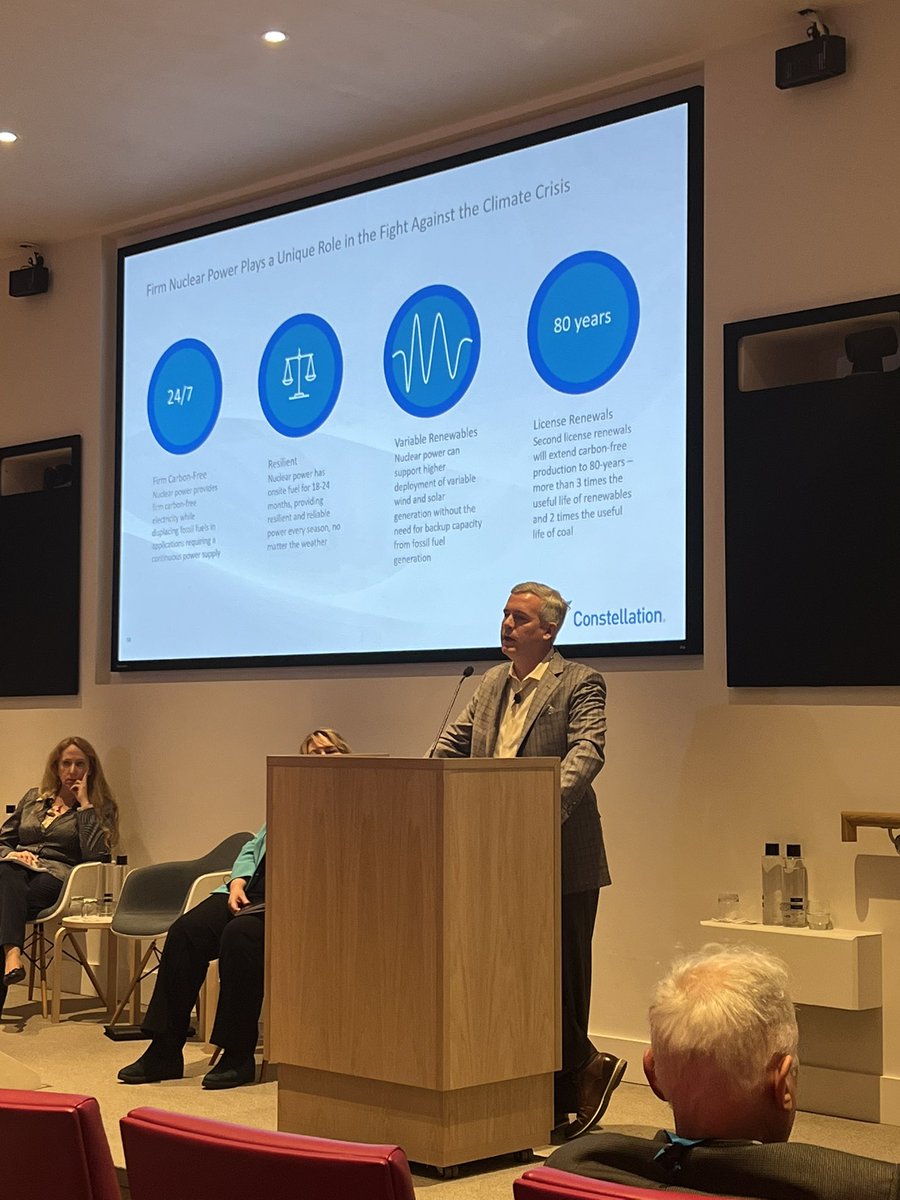

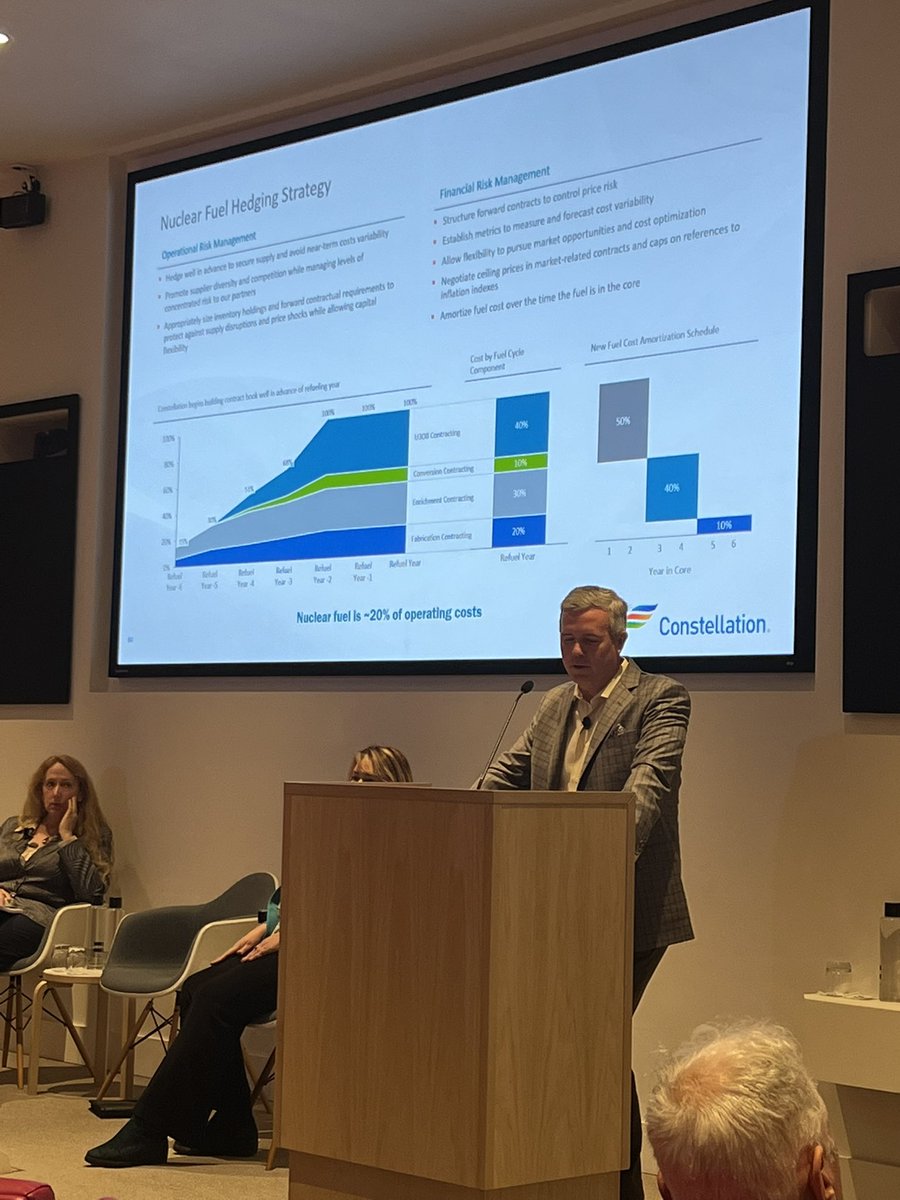

Jason Murphy from @ConstellationEG giving a great talk on the company’s #nuclear fleet - very impressive stats all around. Emphasized that the company intends to pursue life extensions to 80 years for the whole fleet. Also- contracting strategy starts 6 years before any reload!

Jason Murphy from @ConstellationEG giving a great talk on the company’s #nuclear fleet - very impressive stats all around. Emphasized that the company intends to pursue life extensions to 80 years for the whole fleet. Also- contracting strategy starts 6 years before any reload!

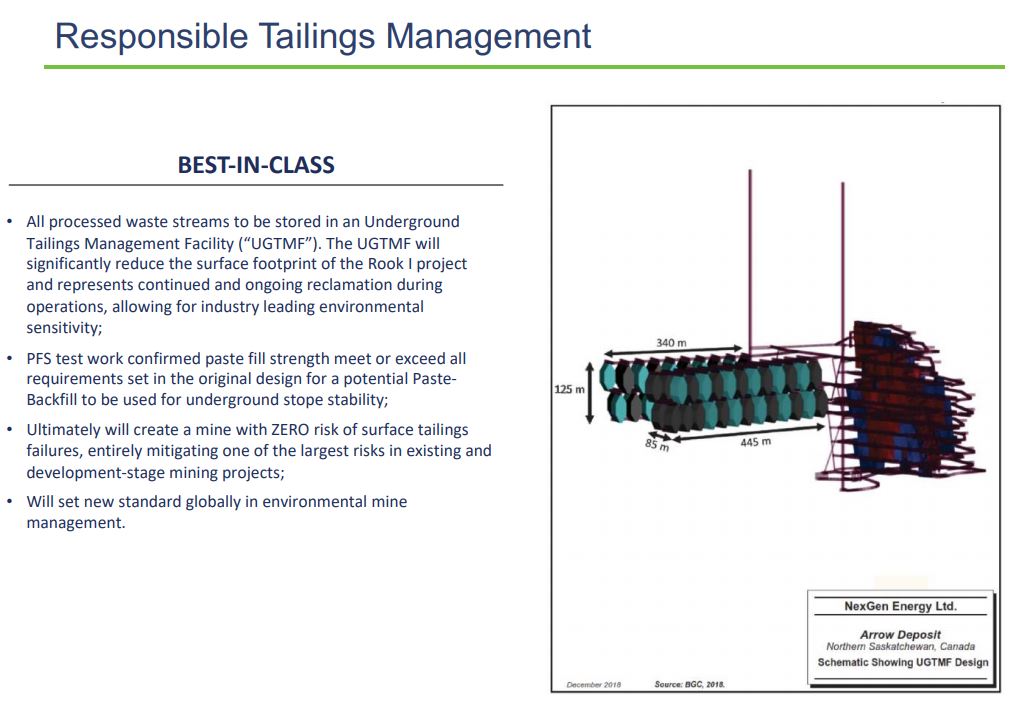

https://twitter.com/_/status/13524477767984209932/ Given the scale and cost structure of Arrow, it makes sense that investors are intensely focused on its delivery timeline. This thread will discuss possible timelines, current market expectations (i.e., what’s “priced in”) & how different Arrow scenarios will impact the mkt.

https://twitter.com/JekyllCapital/status/1347364486336884736As I noted in several responses to my initial Encore tweet, the goal was not to attack management. While we do not have much of a relationship with Bill, we like and respect Paul and have known him for years.