1/Lots of people ask me: "Noah, how much can the U.S. government borrow before bad things start happening?"

In this newsletter, I try to give a definitive answer to that question.

Unfortunately, the answer is: No one knows.

noahpinion.substack.com/p/no-one-knows…

In this newsletter, I try to give a definitive answer to that question.

Unfortunately, the answer is: No one knows.

noahpinion.substack.com/p/no-one-knows…

2/Some people say that we're already heading into the danger zone with respect to debt.

My instinct is that these people are completely wrong, and we're not in danger. But I can't *prove* them wrong, because we don't actually know how much is too much.

ft.com/content/d49b53…

My instinct is that these people are completely wrong, and we're not in danger. But I can't *prove* them wrong, because we don't actually know how much is too much.

ft.com/content/d49b53…

3/How can we think about what the government's borrowing constraint really is?

Well, it helps to do a thought experiment. Let's imagine if the government kept borrowing exponentially more. $100 trillion. $100 quadrillion. Etc.

What would happen?

Well, it helps to do a thought experiment. Let's imagine if the government kept borrowing exponentially more. $100 trillion. $100 quadrillion. Etc.

What would happen?

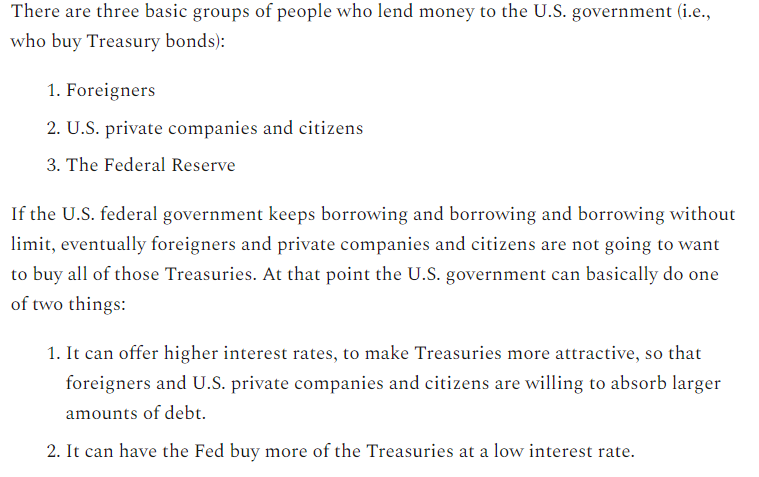

4/Well, here are the three groups of people who lend money to the U.S. government.

If foreigners and private U.S. companies/citizens stop buying U.S. government bonds, we'd need to have the Fed step in.

If foreigners and private U.S. companies/citizens stop buying U.S. government bonds, we'd need to have the Fed step in.

5/If the Fed steps in and starts lending money to the Treasury to spend, it's basically the same thing as if the Treasury just decided to create and spend money without "borrowing" it at all.

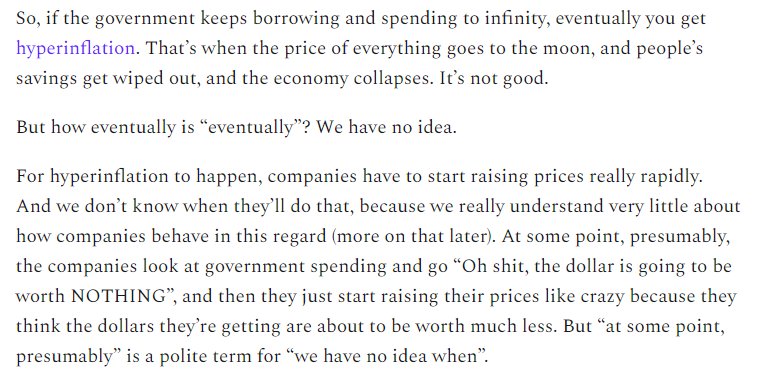

6/But what happens then?

At some point, presumably, you get hyperinflation.

But here's the catch: No one has any idea where that "some point" is!!

At some point, presumably, you get hyperinflation.

But here's the catch: No one has any idea where that "some point" is!!

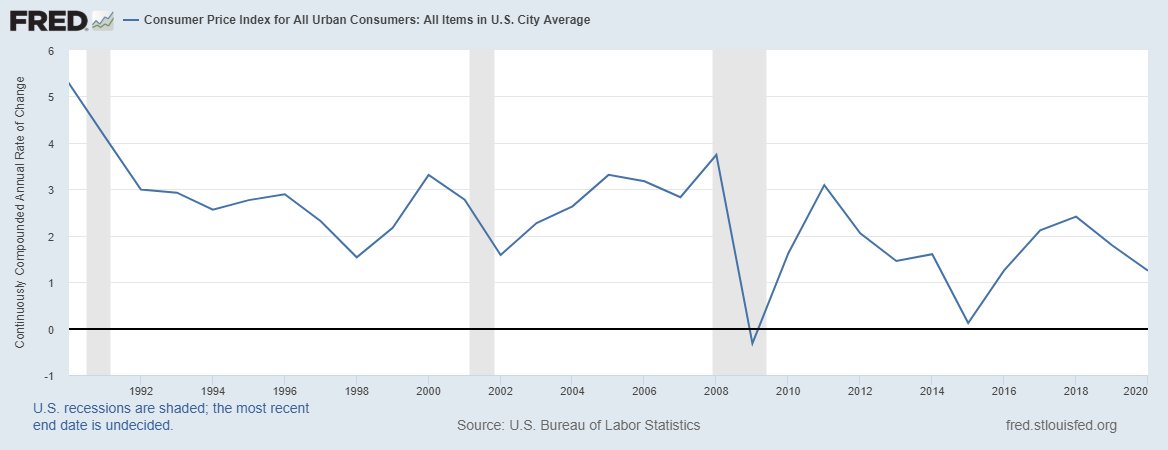

7/Remember when a bunch of people thought Quantitative Easing would lead to inflation during the Great Recession?

How'd that one turn out?

delong.typepad.com/sdj/2014/05/op…

How'd that one turn out?

delong.typepad.com/sdj/2014/05/op…

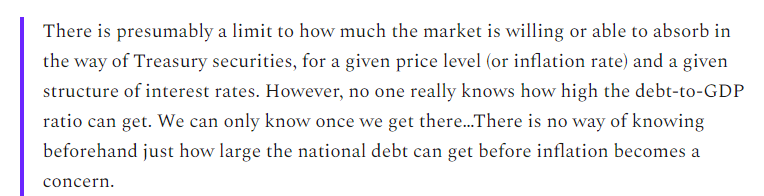

8/In this excellent blog post about debt sustainability, @dandolfa tells the hard truth: We just don't know how much borrowing it would take to cause hyperinflation.

medium.com/st-louis-fed/d…

medium.com/st-louis-fed/d…

9/The "borrow until you hit hyperinflation" strategy is like walking down an infinite corridor toward an invisible pit.

We know the pit is out there...we just don't know if it's ten steps ahead or a million steps ahead.

We know the pit is out there...we just don't know if it's ten steps ahead or a million steps ahead.

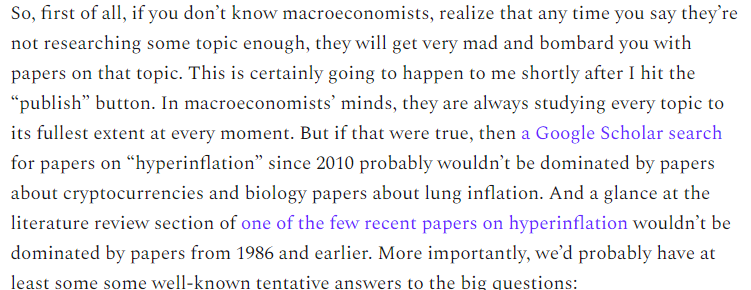

11/So you'd think macroeconomists would be scrambling to study this, right? After all, hyperinflation is one of the worst economic catastrophes that can happen.

And yet...they almost completely ignore the topic.

And yet...they almost completely ignore the topic.

12/There was one famous paper about hyperinflation in 1982, by Thomas Sargent. Unfortunately, it focuses on the end of inflation rather than the beginning, it doesn't have much data, and all its examples are from post-WW1 Europe.

nber.org/system/files/c…

nber.org/system/files/c…

13/Sargent does add one interesting idea, which is the theory that policy "regime changes" -- not just new policies, but widespread perceptions that the WAY policy is being made has changed -- could trigger hyperinflation.

But he can't test this theory.

But he can't test this theory.

14/More recent papers about hyperinflation tend to be very theory-heavy and not really useful, since the theories are generally impossible to test, and don't make firm predictions anyway.

ncbi.nlm.nih.gov/pmc/articles/P…

ncbi.nlm.nih.gov/pmc/articles/P…

15/But I did manage to find ONE recent interesting cool paper on hyperinflation. It's an IMF working paper by @picosyvalles. Heroic!!

imf.org/en/Publication…

imf.org/en/Publication…

16/Most of the common characteristics of hyperinflation that the author finds are characteristics of resource-dependent emerging markets. That's not super helpful for the U.S. case...

17/BUT, he does find one important helpful useful empirical regularity.

When hyperinflation starts, it tends not to start all at once! There are a few years when inflation is high but not "hyper".

When hyperinflation starts, it tends not to start all at once! There are a few years when inflation is high but not "hyper".

18/In other words, we'll probably get SOME warning before complete disaster strikes. If we start to see inflation rise significantly, we should pull back. I'm not talking like 4% inflation, but more like 15% or higher.

19/Anyway, this is one of the most important topics in macroeconomics, so economists need to be studying it a lot more.

Don't just fight the last war! Don't wait for disaster to strike before you admit the possibility of disaster, like you did with the financial crisis!

Don't just fight the last war! Don't wait for disaster to strike before you admit the possibility of disaster, like you did with the financial crisis!

21/I can't tell you how much the government can safely borrow -- no one can.

But we're not there yet.

And if we start to get there, inflation will probably give us a heads-up.

(end)

noahpinion.substack.com/p/no-one-knows…

But we're not there yet.

And if we start to get there, inflation will probably give us a heads-up.

(end)

noahpinion.substack.com/p/no-one-knows…

Anyway, if you like this kind of stuff, you can sign up for my newsletter's free email list, and get it delivered directly to your inbox!

noahpinion.substack.com

noahpinion.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh