Okay, so a few people asked me what's happening with the stock market – specifically with GameStop today. Sure, it's a lot of kids gambling, but it's more than that.

Millennials on Reddit cracked how simple a rigged system is, and are exploiting the hell out of it.

<thread>🧵👇

Millennials on Reddit cracked how simple a rigged system is, and are exploiting the hell out of it.

<thread>🧵👇

2/ First, let's get on the same page. You need to know what liquidity, trade algorithms, and short interest are to get this.

Generally, the bigger the company, the more liquidity. Small caps tend to be less traded, and therefore a marginal buyer has more influence.

Generally, the bigger the company, the more liquidity. Small caps tend to be less traded, and therefore a marginal buyer has more influence.

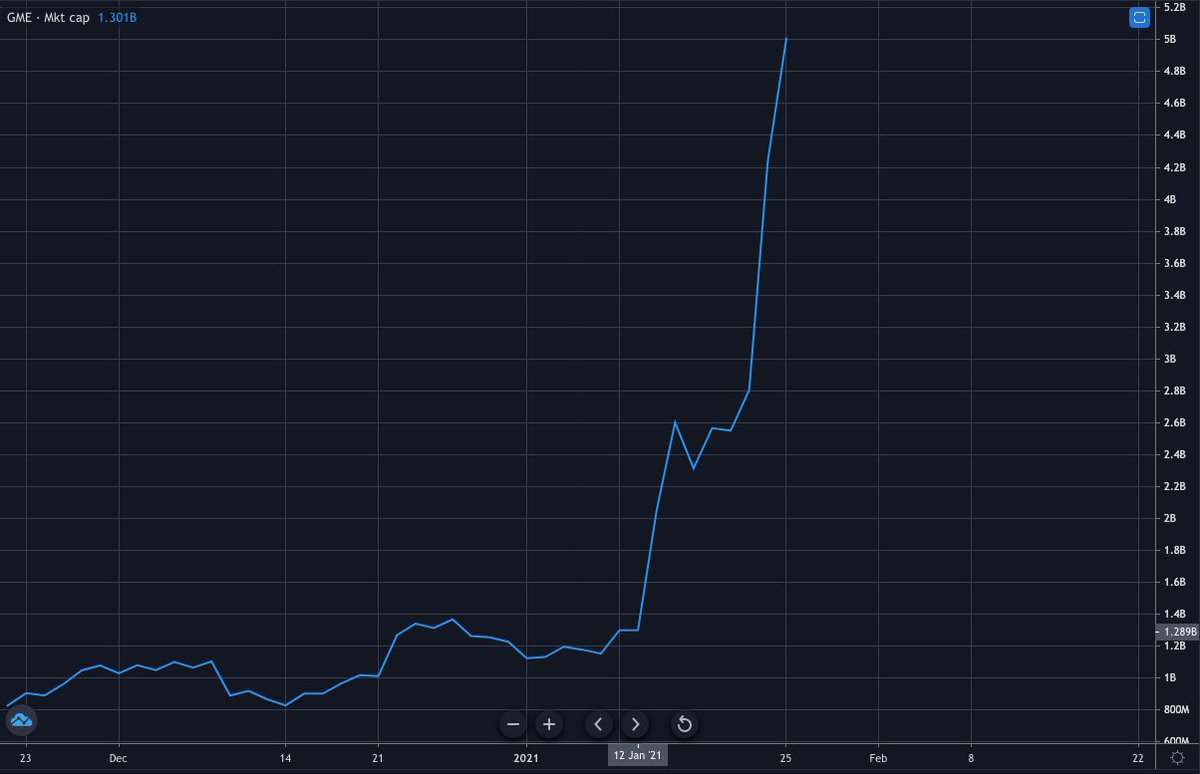

3/ A company like GameStop, with just a billion market cap, is relatively small for the market. If there's a sudden retail trend, prices can climb fast.

But just a few thousand millennials can't send it that high... the issue is with trade algos.

But just a few thousand millennials can't send it that high... the issue is with trade algos.

4/ One assumption the market makes is it's efficient. Any sudden surge in volume must be a result of someone with better information, right? So algos buy.

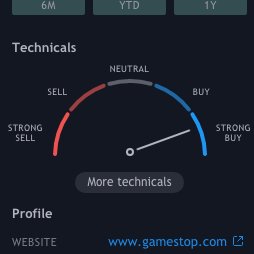

How can it tell if there's better info? It can't. So GameStop became a strong buy on a lot of models. Here's a popular one.

How can it tell if there's better info? It can't. So GameStop became a strong buy on a lot of models. Here's a popular one.

5/ Many algos and traders likely bought because their models said to buy. In many cases, automatically.

Now, this complicated short positions. Shorts are bets a stock price will fall. In the event it rises, shorts need to cover to avoid losses.

Now, this complicated short positions. Shorts are bets a stock price will fall. In the event it rises, shorts need to cover to avoid losses.

6/ Covering is a fancy way to say buy more stock. Now all of those smarty pants that saw a dying business model, and bet against the companies failure?

They were forced to buy more stock. As prices were rising, and others were scrambling to get in. This is known as a squeeze.

They were forced to buy more stock. As prices were rising, and others were scrambling to get in. This is known as a squeeze.

7/ A short squeeze is a situation where a short seller, who may be facing unlimited losses, needs to buy a stock at any price to cover their losses.

The higher it goes, the more they lose, and the more they'll pay to get it.

The higher it goes, the more they lose, and the more they'll pay to get it.

8/ But wait... doesn't that start the cycle again?

Yup. The algos buy because shorts are buying, and the shorts are buying because the algos are buying.

If they didn't know what they're doing, it's a heck of a coincidence they picked a small stock with high short interest.

Yup. The algos buy because shorts are buying, and the shorts are buying because the algos are buying.

If they didn't know what they're doing, it's a heck of a coincidence they picked a small stock with high short interest.

9/ Still here and craving more knowledge on how asset prices are born?

Here’s a quick thread on how a little money laundering can have a big influence on prices, based on exploiting the same gaps in another rigged system.

Here’s a quick thread on how a little money laundering can have a big influence on prices, based on exploiting the same gaps in another rigged system.

https://twitter.com/stephenpunwasi/status/1300222309760811009

• • •

Missing some Tweet in this thread? You can try to

force a refresh