1/ Dapper Does It Again.

I just dropped a note covering the historic rise of @nba_topshot, @flow_blockchain's flagship experience on their new chain.

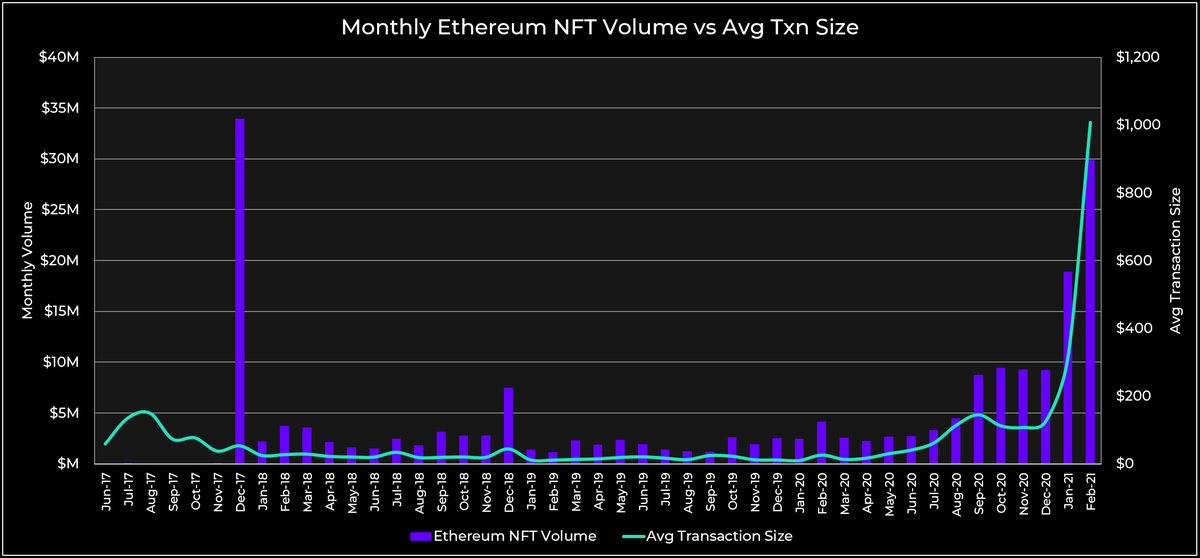

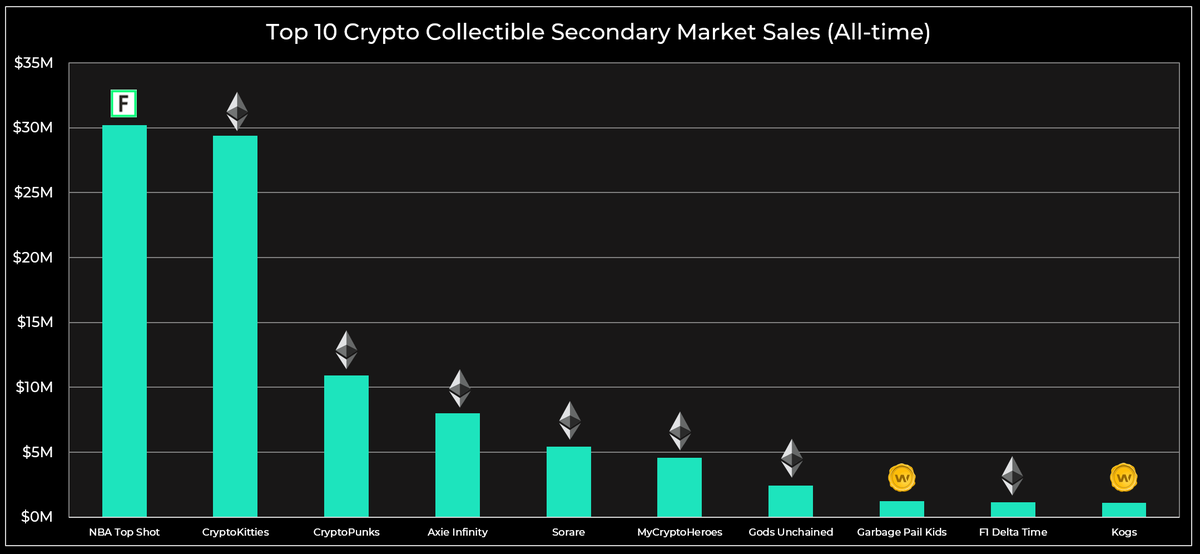

In the last 24 hours, NBA Top Shot has eclipsed the CryptoKitties all-time secondary market volume.

delphidigital.io/reports/dapper…

I just dropped a note covering the historic rise of @nba_topshot, @flow_blockchain's flagship experience on their new chain.

In the last 24 hours, NBA Top Shot has eclipsed the CryptoKitties all-time secondary market volume.

delphidigital.io/reports/dapper…

2/ Dapper has now built the two largest collectibles experiences to date.

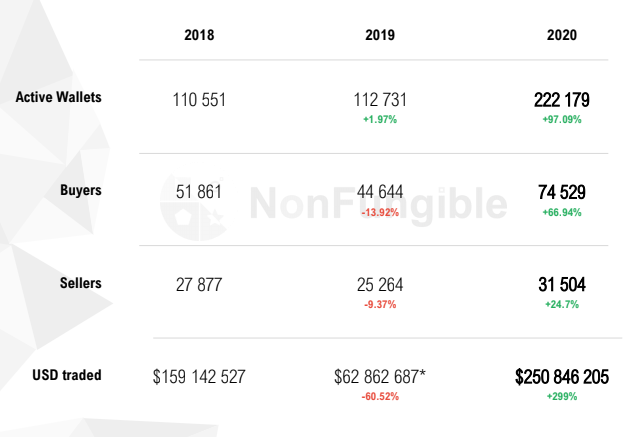

Yesterday we saw $7M of volume in just 24 hours, across 7K buyers and ~50K transactions.

In and amongst those sales were two moments that went for over $100,000 each (pictured below).

Yesterday we saw $7M of volume in just 24 hours, across 7K buyers and ~50K transactions.

In and amongst those sales were two moments that went for over $100,000 each (pictured below).

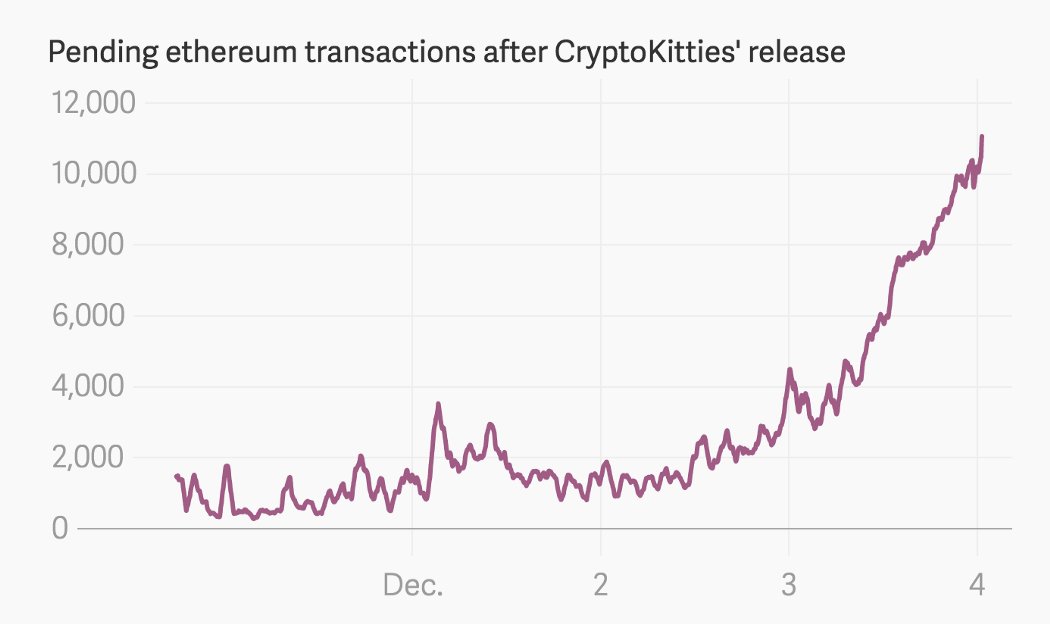

3/ Just 3 short years ago it was CryptoKitties that stole the limelight and began to drawn attention from beyond crypto.

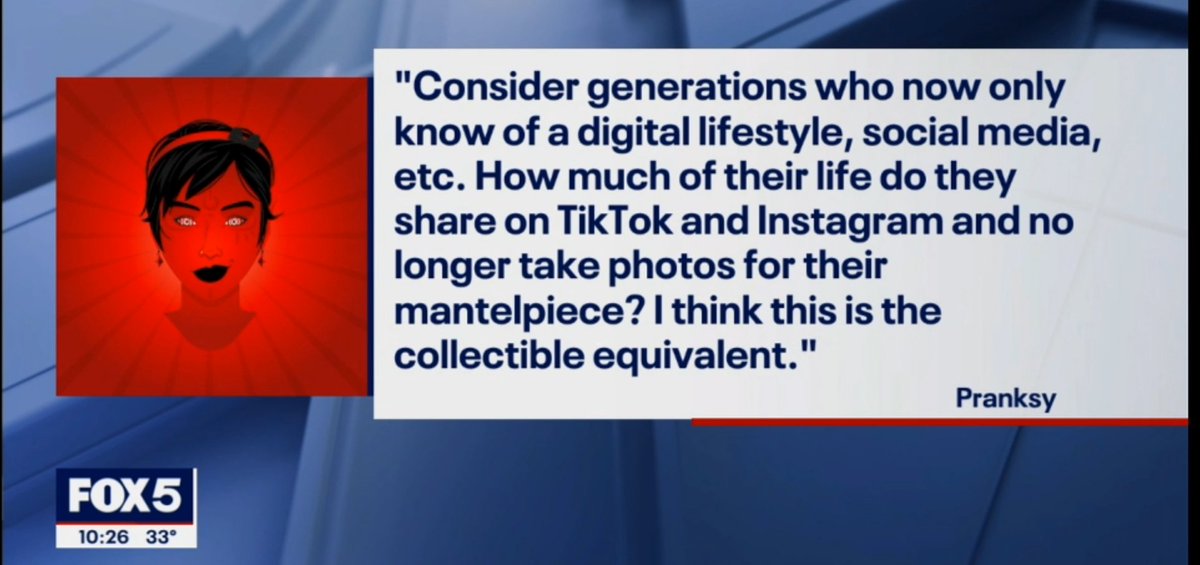

It’s exciting to see Dapper Labs drawing in crowds once again with coverage from @business and even @fox5ny with @PranksyNFT quote.

It’s exciting to see Dapper Labs drawing in crowds once again with coverage from @business and even @fox5ny with @PranksyNFT quote.

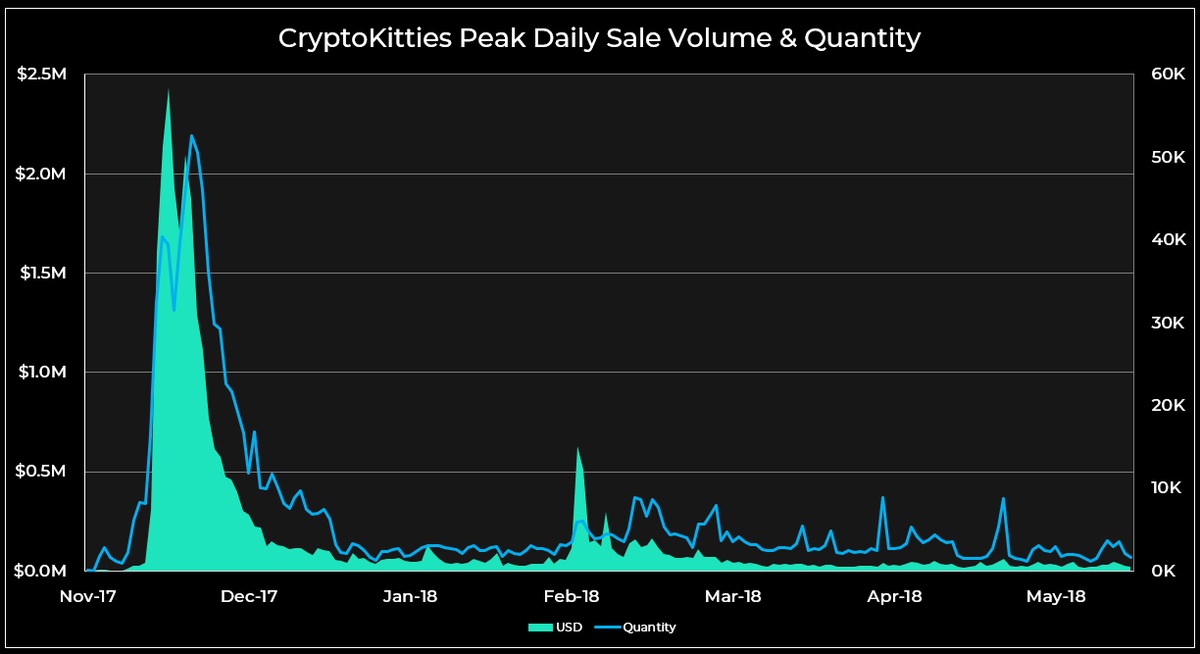

4/ Whilst enthusiasm is warranted, now that they’ve achieved escape velocity they'll need to shift focus to whether or not they can build long-term engagement this time around.

Retention in CK left something to be desired, and it wasn't only gas fees that contributed.

Retention in CK left something to be desired, and it wasn't only gas fees that contributed.

5/ For example, other licensed collectibles such as @SorareHQ have built solid utility around their assets.

Soccer teams can be assembled and partake in a global fantasy football league in order to earn yield.

Collectives like @BlackpoolHQ have emerged.

Soccer teams can be assembled and partake in a global fantasy football league in order to earn yield.

Collectives like @BlackpoolHQ have emerged.

6/ With focus on moments rather than individual players, it'll be interesting to see the direction Dapper takes the project in order ensure its longevity.

Community-driven layers of utility such as @swyysh are emerging ahead of the official @nba_topshot release of "Hardcourt".

Community-driven layers of utility such as @swyysh are emerging ahead of the official @nba_topshot release of "Hardcourt".

7/ It certainly looks as though Flow's technology is capable of supporting a mainstream-facing application at scale this time round.

That said, the rise of successful layer 2 solutions like @Immutable and @maticnetwork on Ethereum could undermine their core value proposition.

That said, the rise of successful layer 2 solutions like @Immutable and @maticnetwork on Ethereum could undermine their core value proposition.

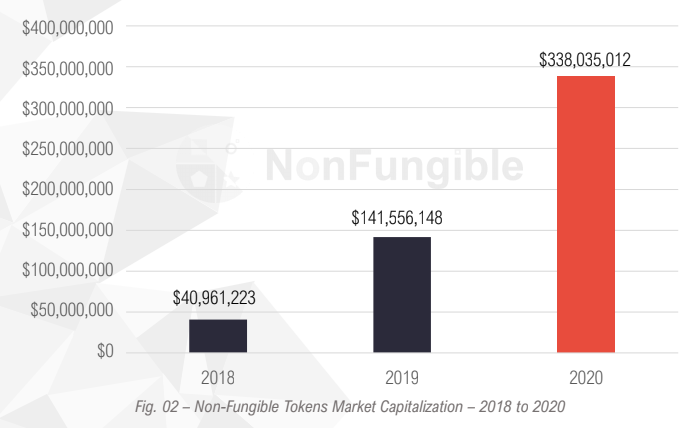

8/ While paper trading cards satisfied an earlier generation, NFT collectibles could be the medium of choice for future generations.

No need to worry about wear and tear of physical cards, PSA grading turnaround times, shipping costs, or authenticity.

No need to worry about wear and tear of physical cards, PSA grading turnaround times, shipping costs, or authenticity.

9/ With digital trading cards, there is a liquid secondary marketplace along with a universe of users building tools &products that support the ecosystem.

Beyond their attractive charateristics, they are unbound by physics and enable a greater variety and dynamism of experience.

Beyond their attractive charateristics, they are unbound by physics and enable a greater variety and dynamism of experience.

fin/ If you ain't subbed, get subbed.

Everyone knows @Delphi_Digital subscribers stay ahead of the game.

Flow's launch as well as NBA Top Shot was flagged in a note from October 2020.

😎

delphidigital.io/research/

Everyone knows @Delphi_Digital subscribers stay ahead of the game.

Flow's launch as well as NBA Top Shot was flagged in a note from October 2020.

😎

delphidigital.io/research/

• • •

Missing some Tweet in this thread? You can try to

force a refresh