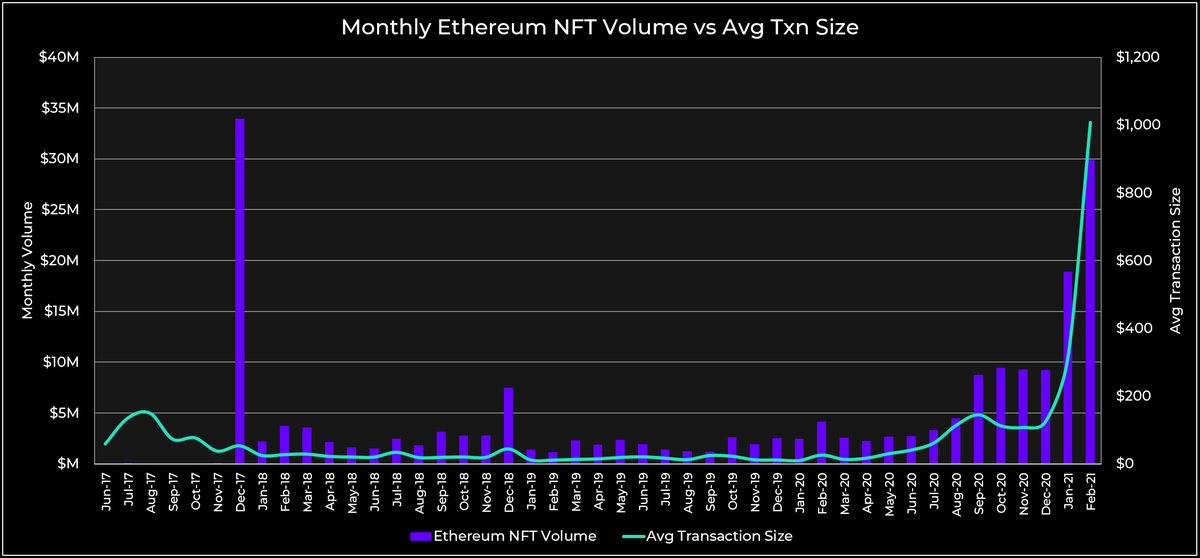

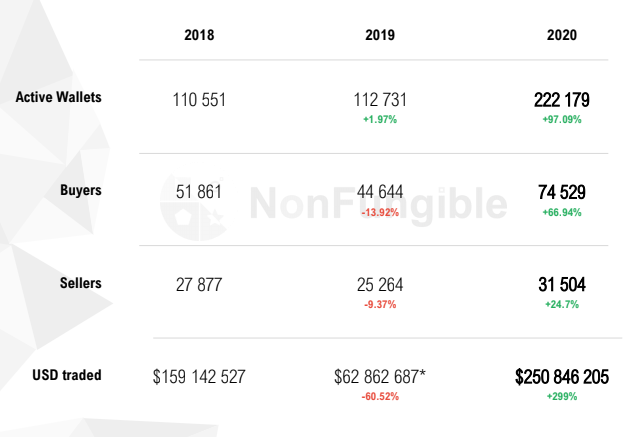

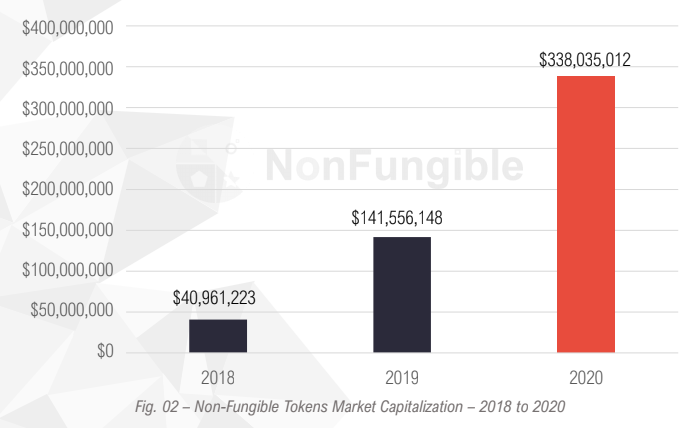

1/ Some crazy data from @nonfungibles Q1 2021 report.

Over $2 BILLION USD has been traded as NFTs on Ethereum ALONE in the first 3 months of this year.

That's 131x more than Q1 2020, and 20x more than than Q4.

Boy did things escalate quickly.

👇

Over $2 BILLION USD has been traded as NFTs on Ethereum ALONE in the first 3 months of this year.

That's 131x more than Q1 2020, and 20x more than than Q4.

Boy did things escalate quickly.

👇

https://twitter.com/pierskicks/status/1350472003120193537?s=20

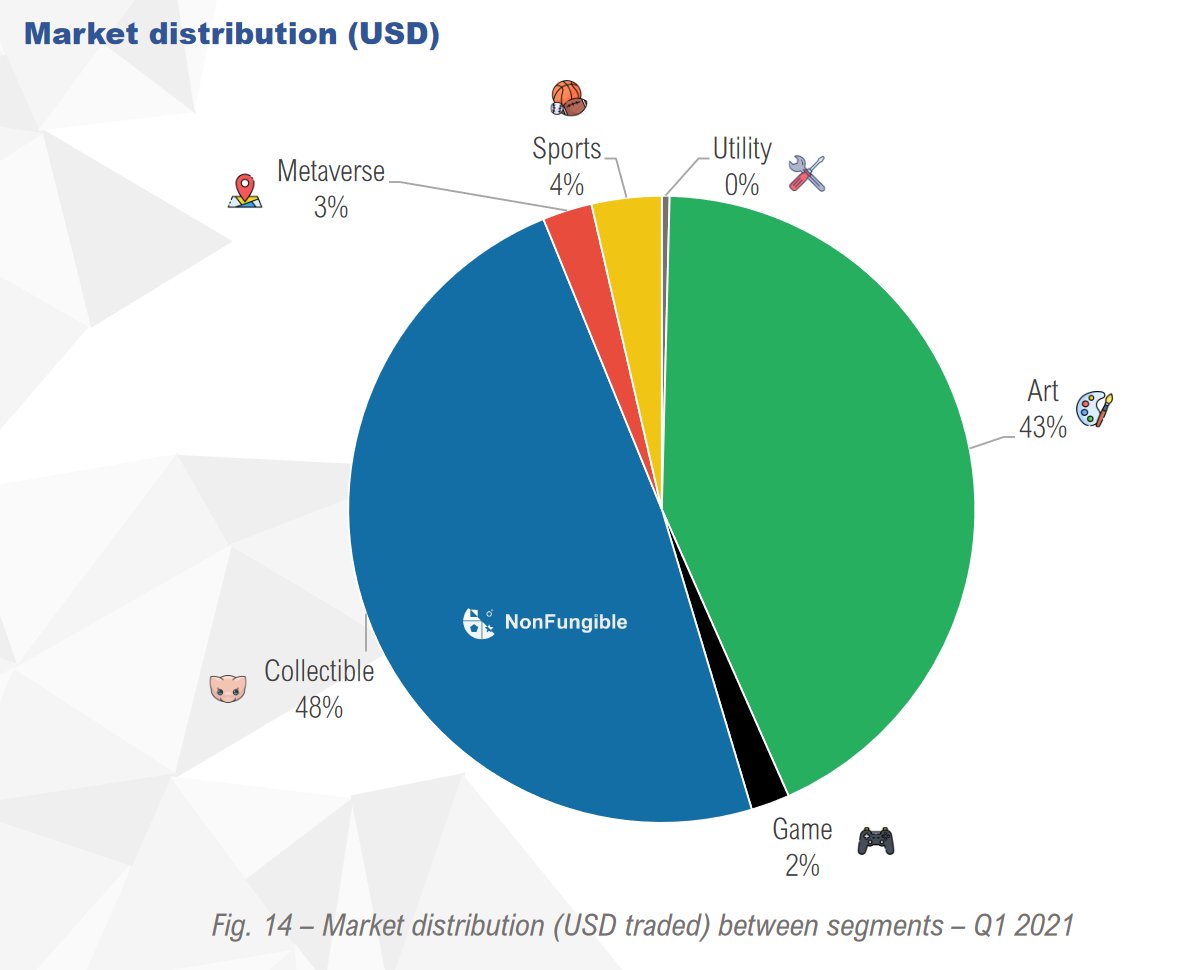

2/ I suspect gaming will be the highest growth sector over the next 5 years.

Maturing infrastructure and growing developer mindshare will drive greater variety and quality of experiences that appeal to the 2.7B strong gamer population.

This will be a primary crypto user funnel.

Maturing infrastructure and growing developer mindshare will drive greater variety and quality of experiences that appeal to the 2.7B strong gamer population.

This will be a primary crypto user funnel.

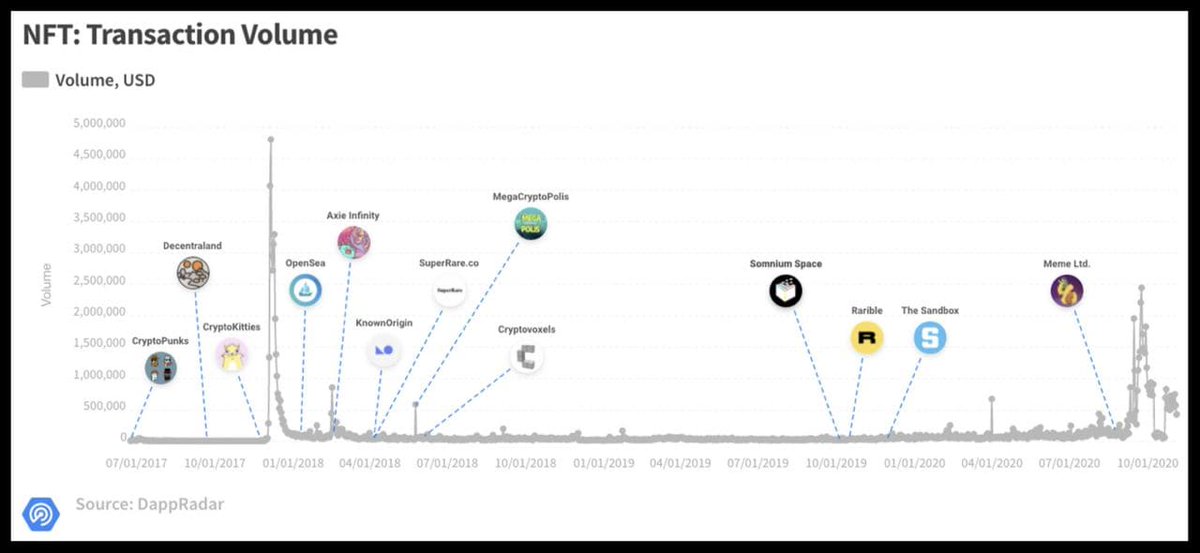

3/ Unsurprisingly, it's the art and collectibles sectors that have led most of the volume spearheaded by @SuperRare and @larvalabs' CryptoPunks.

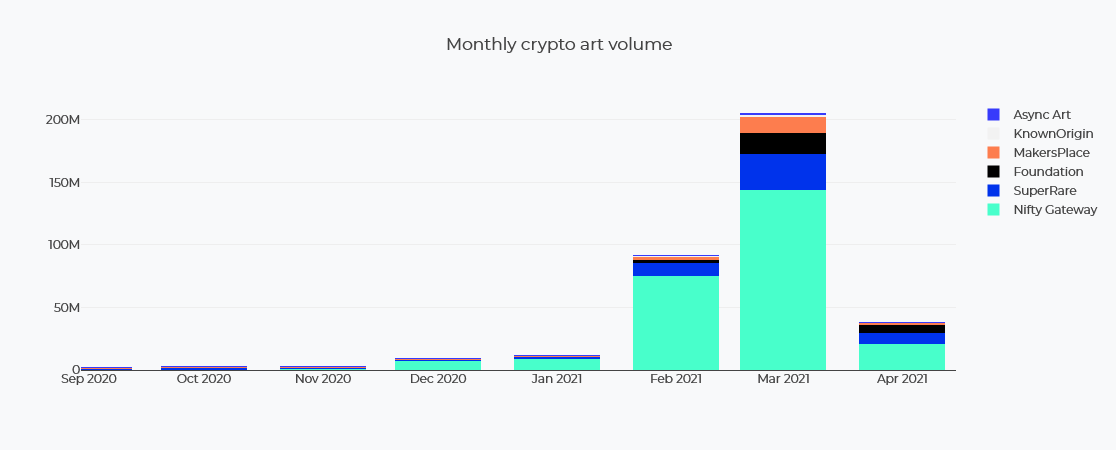

4/ This art data ^ actually excludes @niftygateway volumes which have recently been higher than all of the other platforms combined.

This is attributable to their drop model, fiat gateway, and hosted wallet solutions suitable for web3 n00bs.

h/t @richardchen39 for the charts

This is attributable to their drop model, fiat gateway, and hosted wallet solutions suitable for web3 n00bs.

h/t @richardchen39 for the charts

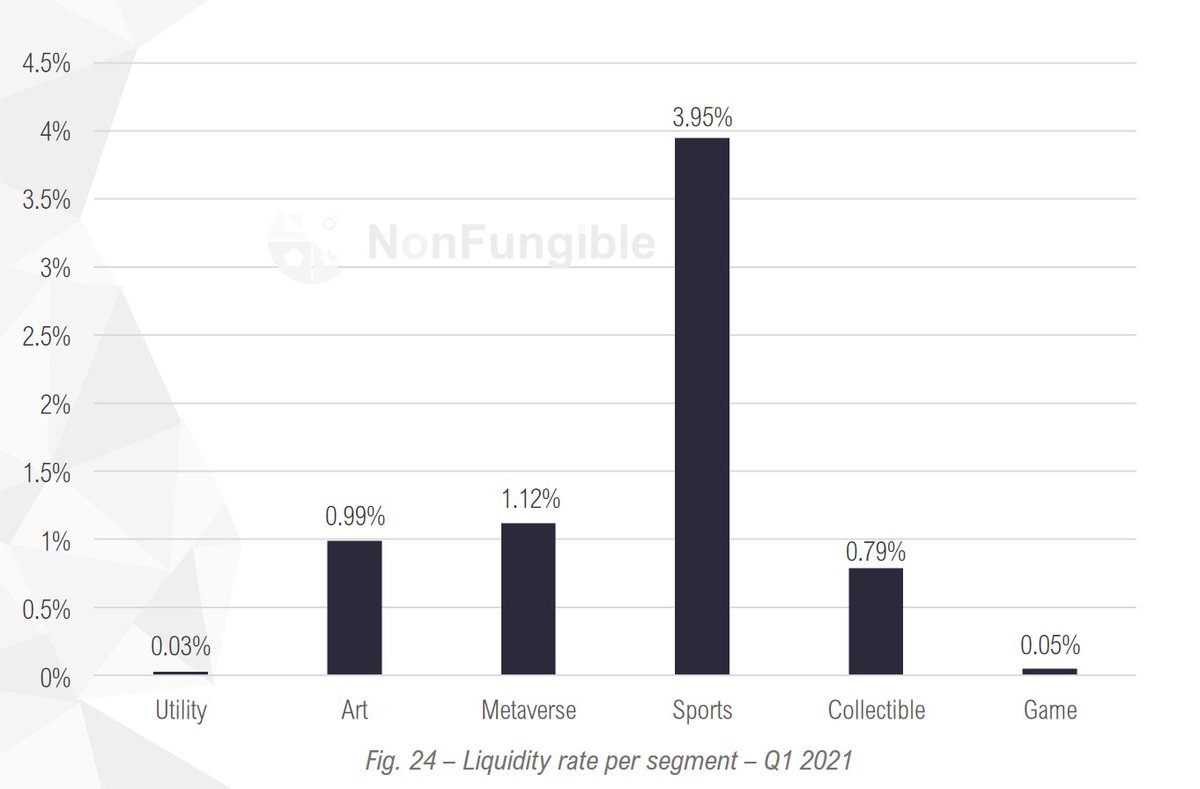

5/ Liquidity rate = unique asset secondary market volume / total supply of each type of asset.

The sports sector led by @SorareHQ takes the cake here by a surprisingly large margin.

Note again: this does not include @nbatopshot volumes on @flow_blockchain which are even higher.

The sports sector led by @SorareHQ takes the cake here by a surprisingly large margin.

Note again: this does not include @nbatopshot volumes on @flow_blockchain which are even higher.

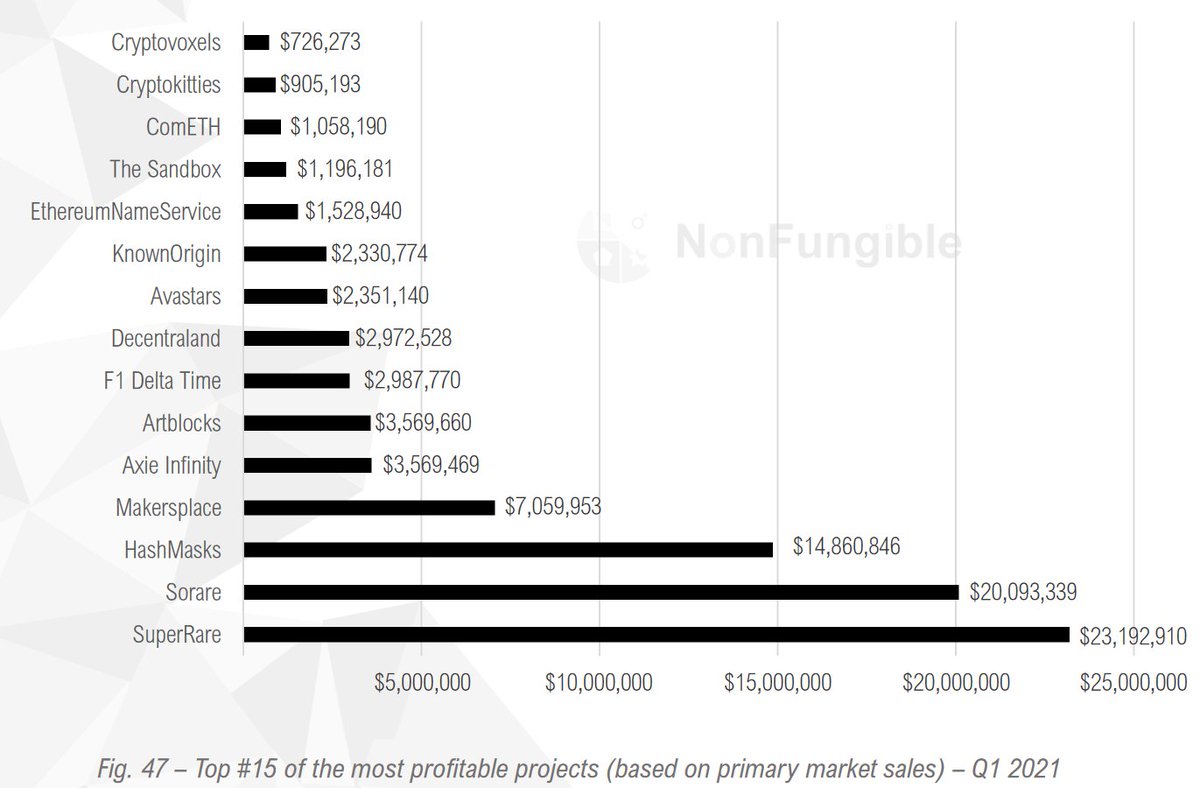

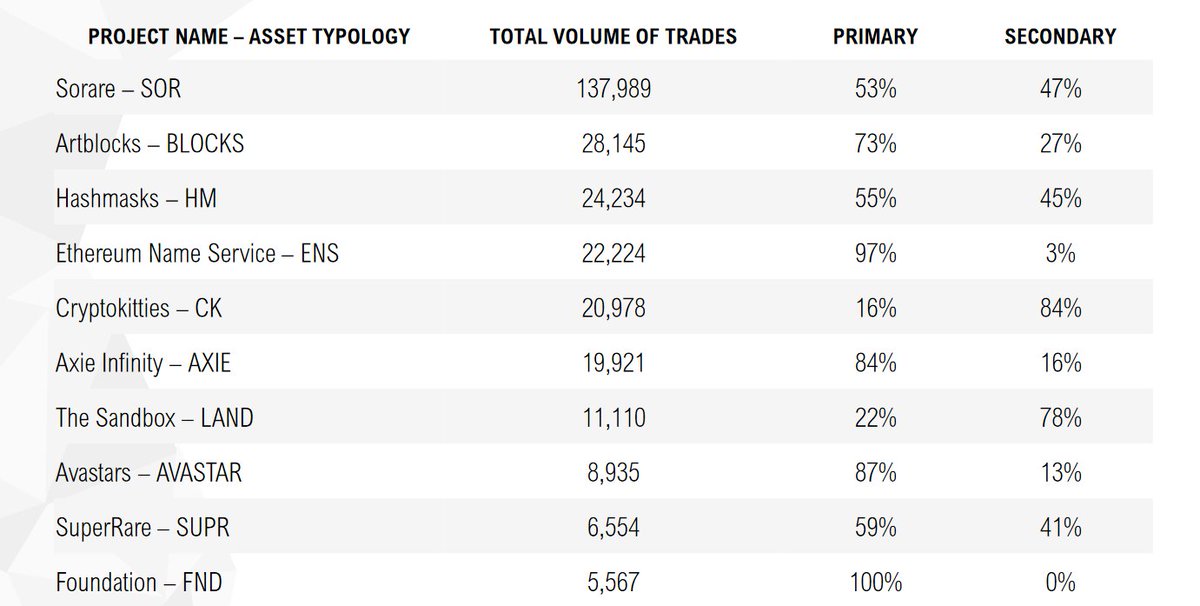

6/ It's pretty interesting to see that the 3 projects which brought in over $10M of PRIMARY sales over the period each belong to different segments (collectibles, sports, art).

I'd love to see more games up there soon... @AxieInfinity @illuviumio @PlayEmberSword

I'd love to see more games up there soon... @AxieInfinity @illuviumio @PlayEmberSword

7/ Do note the ratio of primary to secondary sales for @TheSandboxGame. It's great to see a thriving secondary market before the world has officially launched!

Note that for games such as @AxieInfinity transactions from fresh breeds are also counted as primary market trades.

Note that for games such as @AxieInfinity transactions from fresh breeds are also counted as primary market trades.

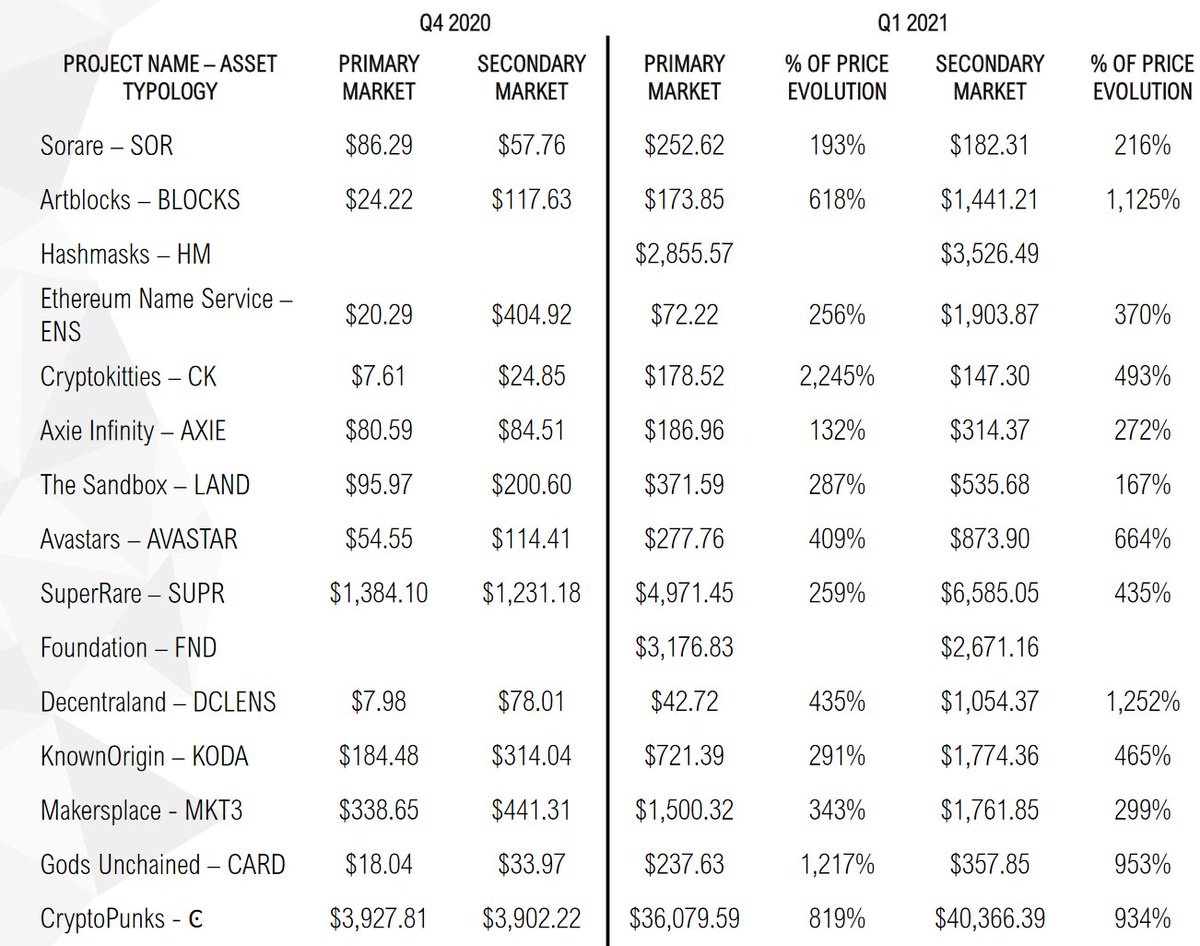

8/ Asset price evolution over time, it's still pretty crazy how quickly some of these have evolved.

People are up almost 10x in 3 months simply by holding digital collectibles / game assets that they love.

@GodsUnchained @artblocks_io @thecryptopunks @decentraland standing out.

People are up almost 10x in 3 months simply by holding digital collectibles / game assets that they love.

@GodsUnchained @artblocks_io @thecryptopunks @decentraland standing out.

8/ I continue to be infuriated by the use of "metaverse" in this context but let's roll with it.

Virtual real estate heating up.

Who sits on the podium in 5 years?

I personally don't think they exist yet.

https://twitter.com/pierskicks/status/1331952221118980096?s=20

Virtual real estate heating up.

Who sits on the podium in 5 years?

I personally don't think they exist yet.

9/ @XCOPYART coming in hot on the non-Nifty Gateway art side.

I wonder where @muratpak ends up with his current ongoing shenanigans.

We could see crypto art beginning to take off from late last summer. It's nuts to see just how far it has come.

I wonder where @muratpak ends up with his current ongoing shenanigans.

We could see crypto art beginning to take off from late last summer. It's nuts to see just how far it has come.

https://twitter.com/pierskicks/status/1313848883693457409?s=20

10/ Unsurprisingly, @beeple demolishes any attempt at competition on price tag.

@ChristiesInc totally crushed it, I'm kind of mindblown they are auctioning off 9 punks next.

Still mad I lost the Beeple auction 🥲

@ChristiesInc totally crushed it, I'm kind of mindblown they are auctioning off 9 punks next.

Still mad I lost the Beeple auction 🥲

https://twitter.com/pierskicks/status/1380126734196961282?s=20

11/ These are pretty much the data points heading into the @ChristiesInc auction which includes a (1/9) Alien Punk.

The last two of which.. well, yeah look for yourself 👀

The last two of which.. well, yeah look for yourself 👀

12/ I'm actually a little surprised by this one.

I would have thought @SorareHQ cards would be in here, but I guess soccer fans aren't trying hard enough.

I would have thought @SorareHQ cards would be in here, but I guess soccer fans aren't trying hard enough.

/fin

What's most crazy is the rate of growth here even from when the markets were ALREADY hot.

For reference, the thread below was written just over two months ago.

Even @NYSE is now dropping NFTs.

Stay safe out there folks.

What's most crazy is the rate of growth here even from when the markets were ALREADY hot.

For reference, the thread below was written just over two months ago.

Even @NYSE is now dropping NFTs.

Stay safe out there folks.

https://twitter.com/pierskicks/status/1361794945116475392?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh