1/ NFTs: The Lay of The Land.

The NFT market is undeniably hot right now, the vast majority of record-breaking sales have happened within the last 30 days.

Millions of $ are changing hands daily across projects both old and new.

delphidigital.io/reports/nfts-t…

The NFT market is undeniably hot right now, the vast majority of record-breaking sales have happened within the last 30 days.

Millions of $ are changing hands daily across projects both old and new.

delphidigital.io/reports/nfts-t…

2/ Record engagement from high-profile figures with big audiences e.g. @mcuban, @MesutOzil1088, and even @lindsaylohan...

Crypto Art pioneer @beeple is back with the 1st ever purely digital art to be sold at the renowned auction house @ChristiesInc.

Crypto Art pioneer @beeple is back with the 1st ever purely digital art to be sold at the renowned auction house @ChristiesInc.

https://twitter.com/pierskicks/status/1338590621217550344

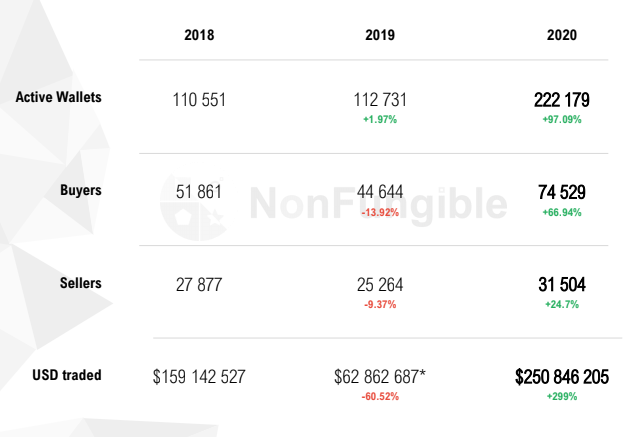

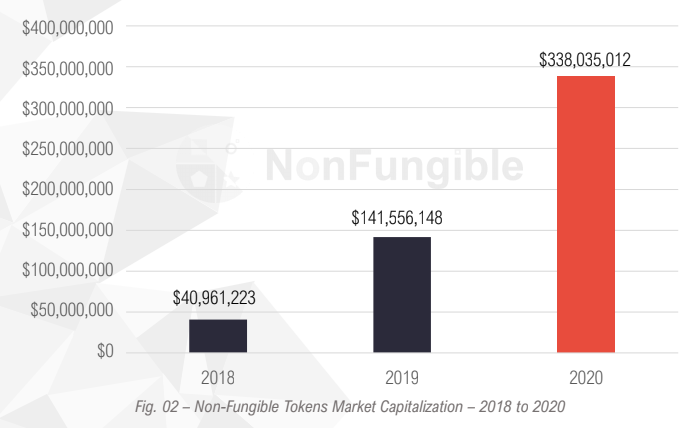

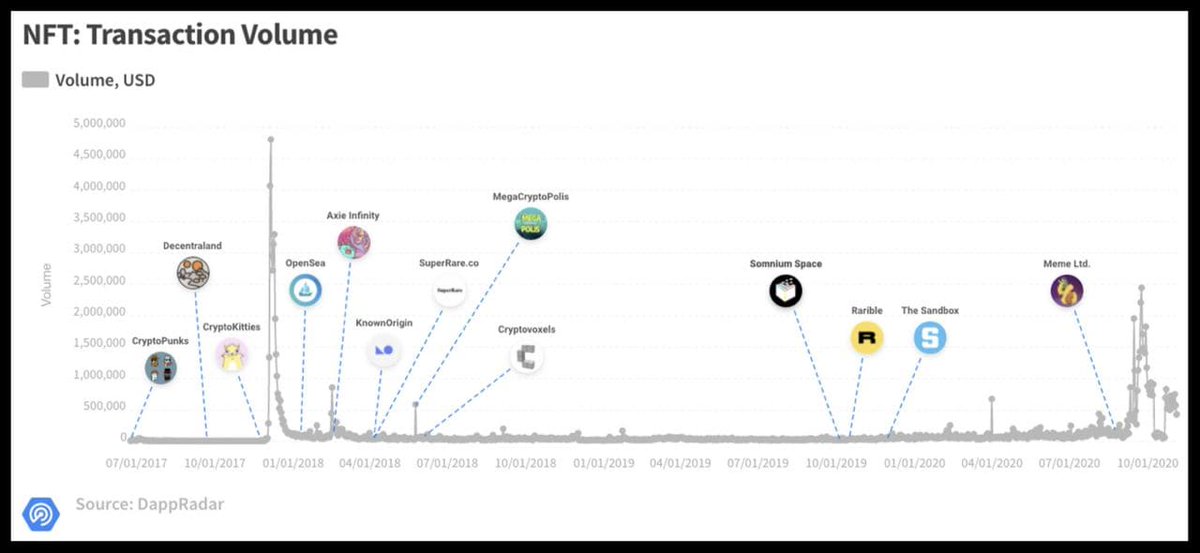

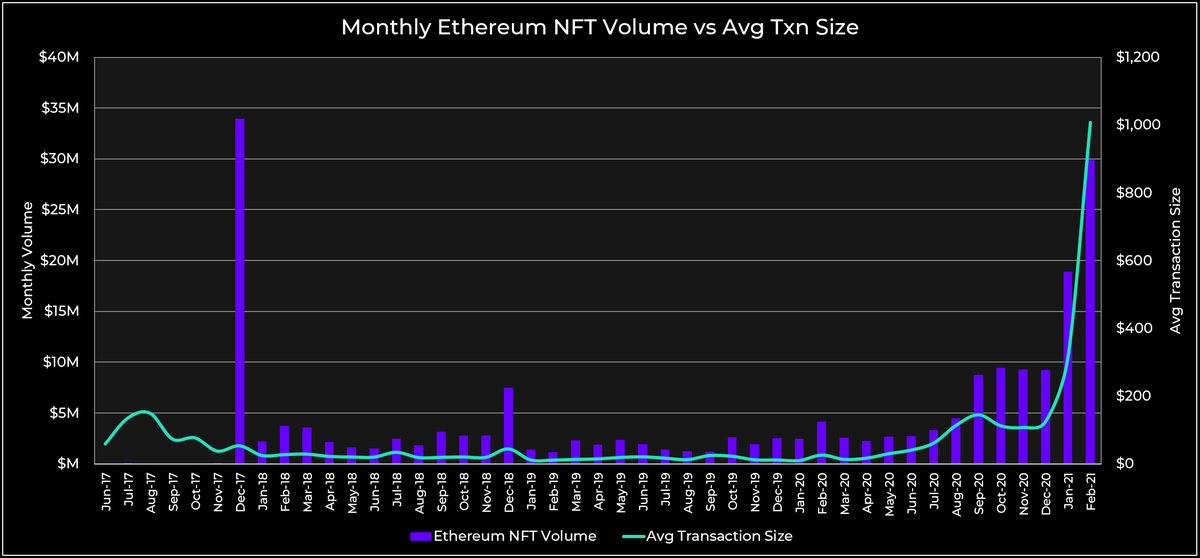

3/ At the base network level, we're seeing unprecedented dollar volumes. At the very peak of the CryptoKitties mania in late 2017, just over $2M changed hands in a 24 hour period.

On Valentines Day this past weekend, more than $6M was traded as NFTs on layer one alone.

On Valentines Day this past weekend, more than $6M was traded as NFTs on layer one alone.

4/ The right side of the first chart shows a dramatic spike in the average NFT transaction value happening on the Ethereum base layer.

Due to increased fees, it has already become impossible to justify smaller transactions.

Due to increased fees, it has already become impossible to justify smaller transactions.

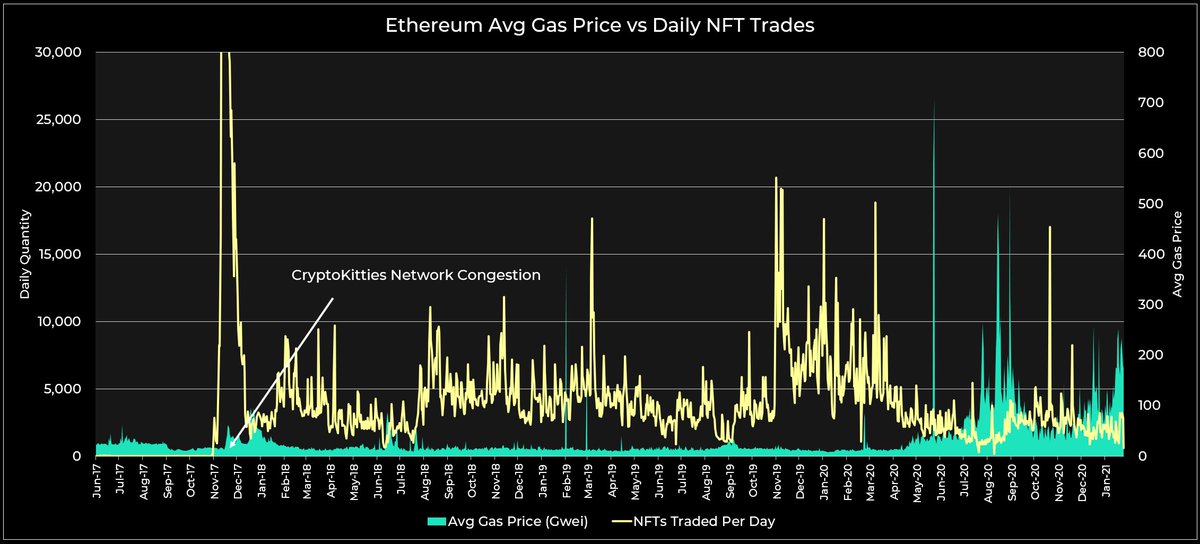

5/ For context, at the peak of the CK congestion with over 50K tx in one day avg gas reached 60 gwei.

At the time, CK accounted for almost 15% of the total tx on Ethereum.

Last week avg gas costs peaked at 250 gwei, a 4x increase over the December 2017 top.

At the time, CK accounted for almost 15% of the total tx on Ethereum.

Last week avg gas costs peaked at 250 gwei, a 4x increase over the December 2017 top.

6/ Whilst this is a good sign for the Ethereum network at large, it is severely hampering many NFT activities and forcing an urgent desire for solutions, which are no longer so simple...

https://twitter.com/CryptoKitties/status/937444644740198400?s=20

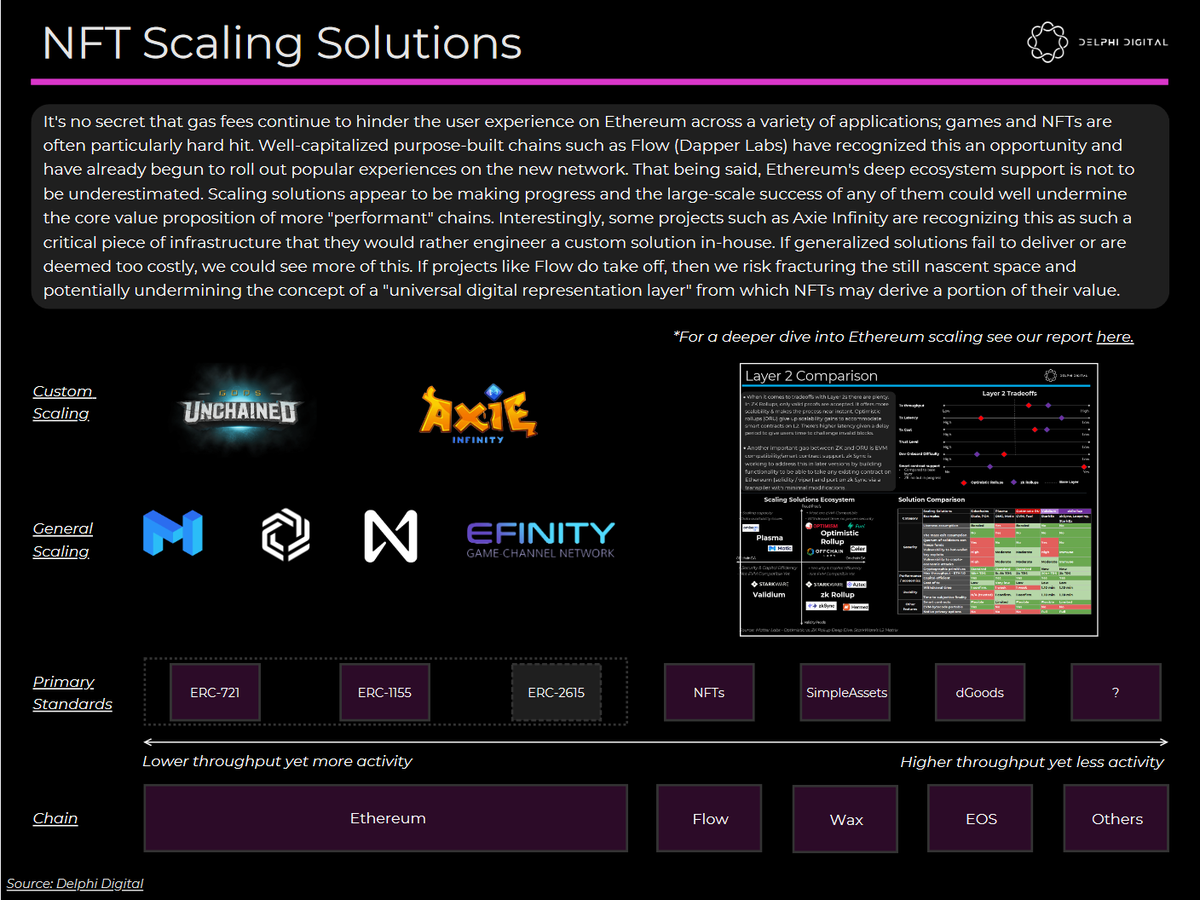

7/ As mentioned in a recent report, multiple scaling solutions are coming to market. The recent fee climate is accelerating the need for them.

Since publishing, @AxieInfinity has successfully launched their custom Ronin sidechain. They are the first project to do so.

Since publishing, @AxieInfinity has successfully launched their custom Ronin sidechain. They are the first project to do so.

8/ In the 20 days since launch, the $AXS token is up over 160% whilst the project has also claimed the largest NFT sale ever.

It would seem the market is fond of such developments.

I suspect Beeple's latest auction will be a worthy challenger...

It would seem the market is fond of such developments.

I suspect Beeple's latest auction will be a worthy challenger...

https://twitter.com/AxieInfinity/status/1358919423763992576?s=20

9/ Aside from custom jobs, generalized scaling solutions like @Immutable & @maticnetwork are Ethereum’s best bet at retaining NFT market share in this rapidly expanding ecosystem.

I've noted @flow_blockchain's early success previously. A real contender.

I've noted @flow_blockchain's early success previously. A real contender.

https://twitter.com/pierskicks/status/1354131138504232964?s=20

10/ Since then, Flow has only further cemented itself as a major force in the ecosystem.

Streamlined fiat gateways, seamless wallet experiences, a budding marketplace, and rumours of another large raise all support its continued growth.

nasdaq.com/articles/nba-t…

Streamlined fiat gateways, seamless wallet experiences, a budding marketplace, and rumours of another large raise all support its continued growth.

nasdaq.com/articles/nba-t…

11/ Already, the game category which typically demands high frequency, low value transactions has begun to crumble at the Ethereum base layer.

Top projects such as @aavegotchi, @decentralgames, and @neondistrictRPG have moved to Matic (Polygon).

Top projects such as @aavegotchi, @decentralgames, and @neondistrictRPG have moved to Matic (Polygon).

12/ Below is Matic’s equivalent of Uniswap called @QuickswapDEX where Aavegotchi’s $GHST token is already the second most liquid pair.

The entire ecosystem is accessible with a simple MetaMask tweak, and so far appears to have been met with enthusiasm.

The entire ecosystem is accessible with a simple MetaMask tweak, and so far appears to have been met with enthusiasm.

13/ @Immutable has already begun to attract highly anticipated projects such as @illuviumio.

They're a promising candidate, as the only team building a generalized Ethereum-based solution who've faced 1st hand the challenge of building a blockchain game at scale @GodsUnchained.

They're a promising candidate, as the only team building a generalized Ethereum-based solution who've faced 1st hand the challenge of building a blockchain game at scale @GodsUnchained.

14/ It’s important to consider the very real possibility that if Ethereum layer 2s fail to deliver a comparable user experience this year they could concede market share to Flow for multiple classes of NFT projects.

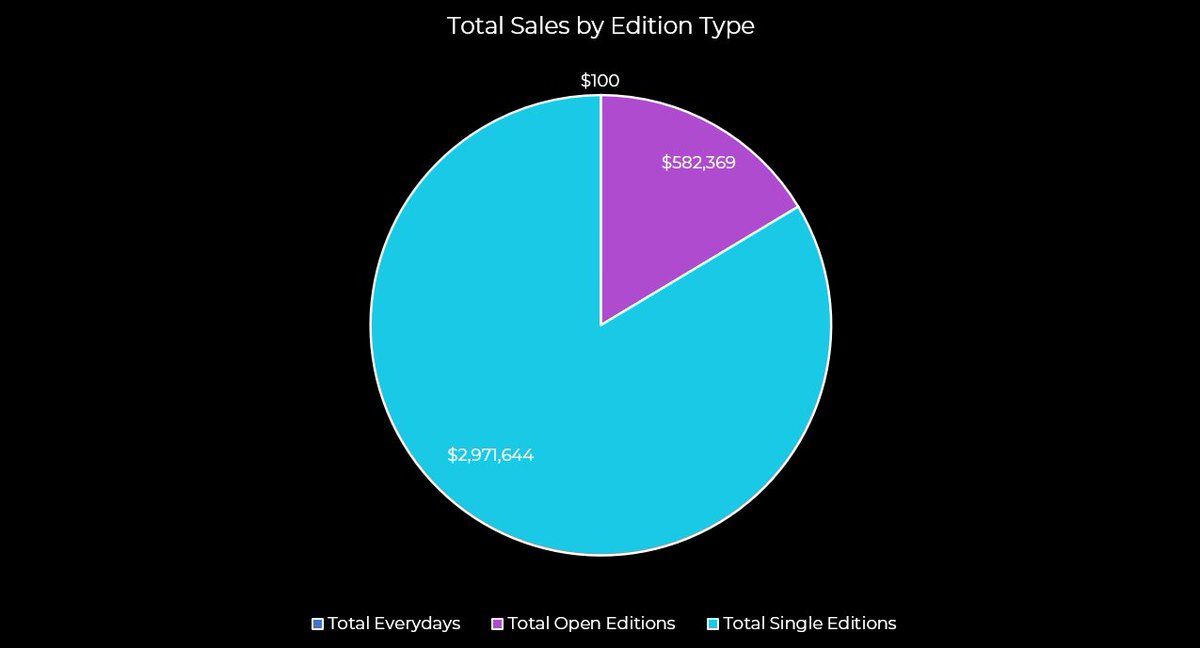

15/ That said, I’m reasonably confident that for low velocity, high price activities such as top-tier collectibles and artwork, the concerns raised are less relevant.

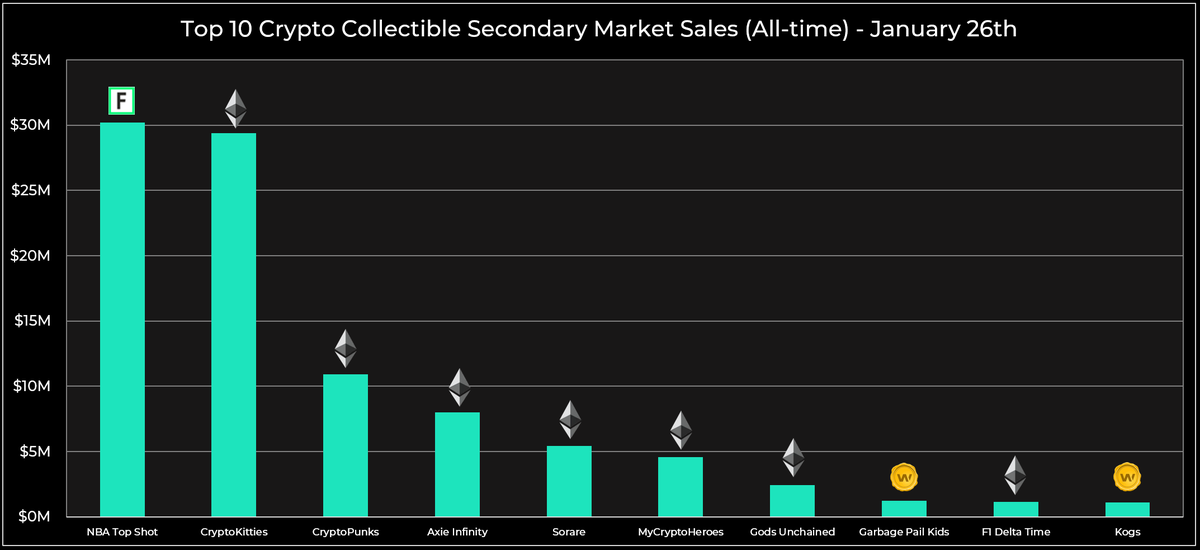

(Chart is January 26th, compare with the following chart from today).

(Chart is January 26th, compare with the following chart from today).

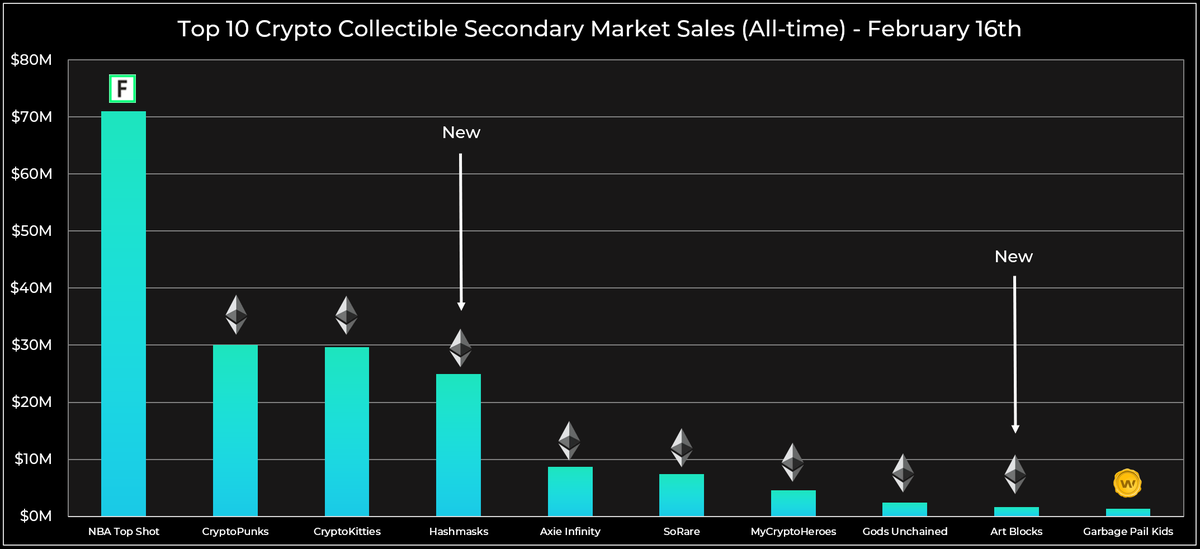

16/ Note the enormous increases in all-time secondary market volumes for some of these projects in less than a month (2.3x for @nba_topshot, 2.7x for @thecryptopunks), as well as the entrance of @TheHashmasks and @artblocks_io to the podium spots.

17/ This market is moving very fast. It’s important to look at prospective plays with a cautious eye in the current climate.

There is a lot of money being thrown around with many NFTs fetching eye-watering prices, just like the CryptoKitties craze in 2017.

There is a lot of money being thrown around with many NFTs fetching eye-watering prices, just like the CryptoKitties craze in 2017.

18/ When the music stops, a lot of these assets could be in for a long cool-off period before changing hands at similar price levels once more.

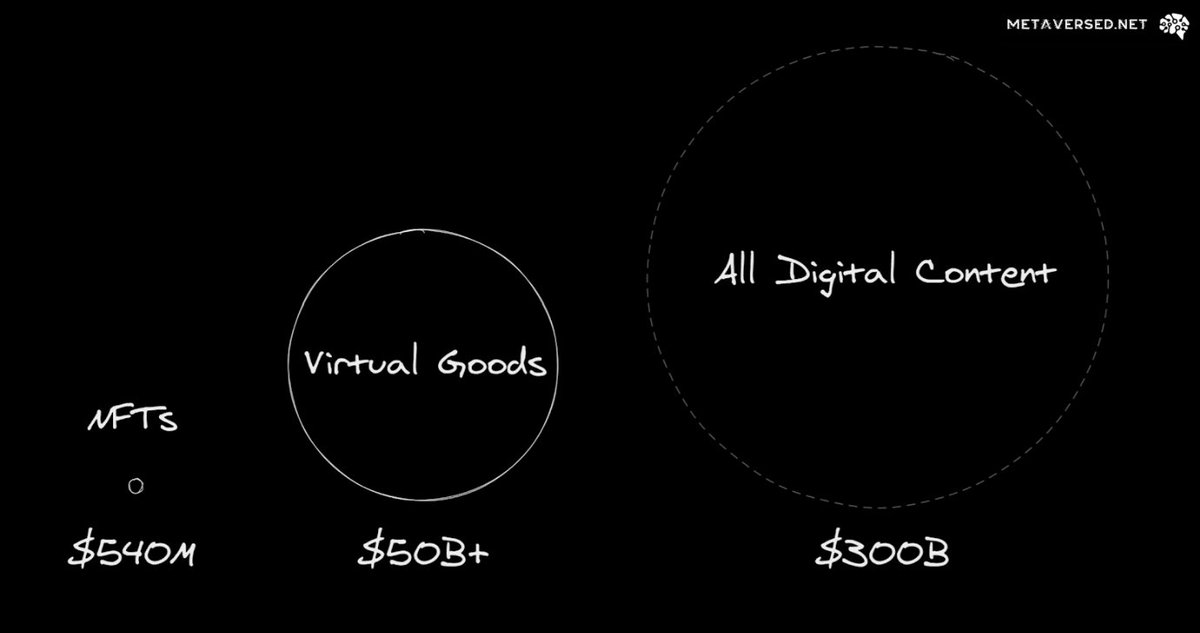

19/ That said, this is an incredible time to be involved with the NFT sector as the interwebs wake up to their enormous potential.

The application of these technologies across gaming, the creator economy, and entirely new forms of IP monetization certainly warrants excitement.

The application of these technologies across gaming, the creator economy, and entirely new forms of IP monetization certainly warrants excitement.

20/ We likely won’t fully deliver on that potential in just the second major NFT hype cycle.

Opportunities are definitely out there, but tempering enthusiasm won’t hurt.

You can't catch them all, and finding projects/creators that resonate with you is your best bet anyway.

Opportunities are definitely out there, but tempering enthusiasm won’t hurt.

You can't catch them all, and finding projects/creators that resonate with you is your best bet anyway.

21/ It’s not just about us who have been here a while, but all those who are only now entering.

Millions of newcomers will enter this space and familizarise with these concepts in the coming months and years.

Millions of newcomers will enter this space and familizarise with these concepts in the coming months and years.

22/ If we want to maximize the chance of converting new interest to supporting long-term consumer-facing blockchain applications at unprecedented scale, we need to act accordingly.

23/ To this day, there is bad blood from the 2017/18 hangover and the hot potato games that came with it.

It is in everyone’s interest to ensure that we’ve learnt from what came before and don’t let ourselves get carried away.

It is in everyone’s interest to ensure that we’ve learnt from what came before and don’t let ourselves get carried away.

24/ The worst-case scenario is that we burn a new generation of users right as real momentum is starting to build.

Now enough doom and gloom from me, you get the point.

Go forth and conquer.

Now enough doom and gloom from me, you get the point.

Go forth and conquer.

fin/ If you want to stay ahead of the game on all things NFTs, DeFi, and crypto more broadly make sure you sub to @Delphi_Digital below. 👇

Creator Economy report coming soon.

delphidigital.io/subscription-p…

Creator Economy report coming soon.

delphidigital.io/subscription-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh