Hyundai Motor said Tuesday it will launch four electric vehicle models this year, after revealing earlier this month it is in talks with Apple and other companies to develop self-driving EVs

asia.nikkei.com/Business/Autom…

asia.nikkei.com/Business/Autom…

South Korea's largest auto manufacturer, which reported robust fourth quarter earnings the same day, said it will add four EV models to its lineup in 2021, including one in China and another in Europe

Hyundai sold 100,000 electric cars last year, up 55% from a year ago, giving it a 5% share of the global market

"In China, we will launch the Mistra EV, and in late March, we will launch the Ioniq 5 in Europe," said Koo Zayong, a vice president at Hyundai, in an earnings call

"In China, we will launch the Mistra EV, and in late March, we will launch the Ioniq 5 in Europe," said Koo Zayong, a vice president at Hyundai, in an earnings call

The Ioniq 5 is the first vehicle to use Hyundai's electric-global modular platform, a system made exclusively for next-generation battery EVs and a key part of the company's "clean mobility" strategy

Hyundai said that it will concentrate on its cutting-edge operations, including electric vehicles, urban air mobility, robotics and fuel cell systems

“In particular, the company plans to cement EV market leadership with its first dedicated EV model the Ioniq 5," the company said

“In particular, the company plans to cement EV market leadership with its first dedicated EV model the Ioniq 5," the company said

The comments come just weeks after Hyundai said it is in talks with Apple and other companies to jointly develop self-driving EVs, although the company later clarified that talks are in the early stages

Analysts say Hyundai aims to eventually operate its own fully fledged mobility services business rather than simply supplying Apple and other tech companies looking to break into the carmaking business

“It is the ideal scenario. Hyundai wants to develop its own artificial intelligence capabilities, based on data collected from its cars," said Kim Joon-sung, an analyst at Meritz Securities

“For this, Hyundai Motor will lead the group's technology investment and development while its sister company, Kia Motors, will play the role of device supplier cooperating with tech companies”

Hyundai said its operating profit jumped +40.9% to 1.6 trillion won $1.4 billion in the fourth quarter from a year ago, led by the company's sport utility vehicles and luxury Genesis models

Its sales rose +5.1% to 29.2 trillion won during the same period

Its sales rose +5.1% to 29.2 trillion won during the same period

"Robust sales of SUV models and Genesis luxury models, as well as declining incentives, helped lift revenue in the fourth quarter despite an adverse economic environment and an unfavorable exchange rate," Hyundai said

“Sales recovery and market share expansion in North America, India and Russia also contributed to higher revenue”

The company plans to pay a year-end dividend of 3,000 won per share for 2020, the same as for 2019

The company plans to pay a year-end dividend of 3,000 won per share for 2020, the same as for 2019

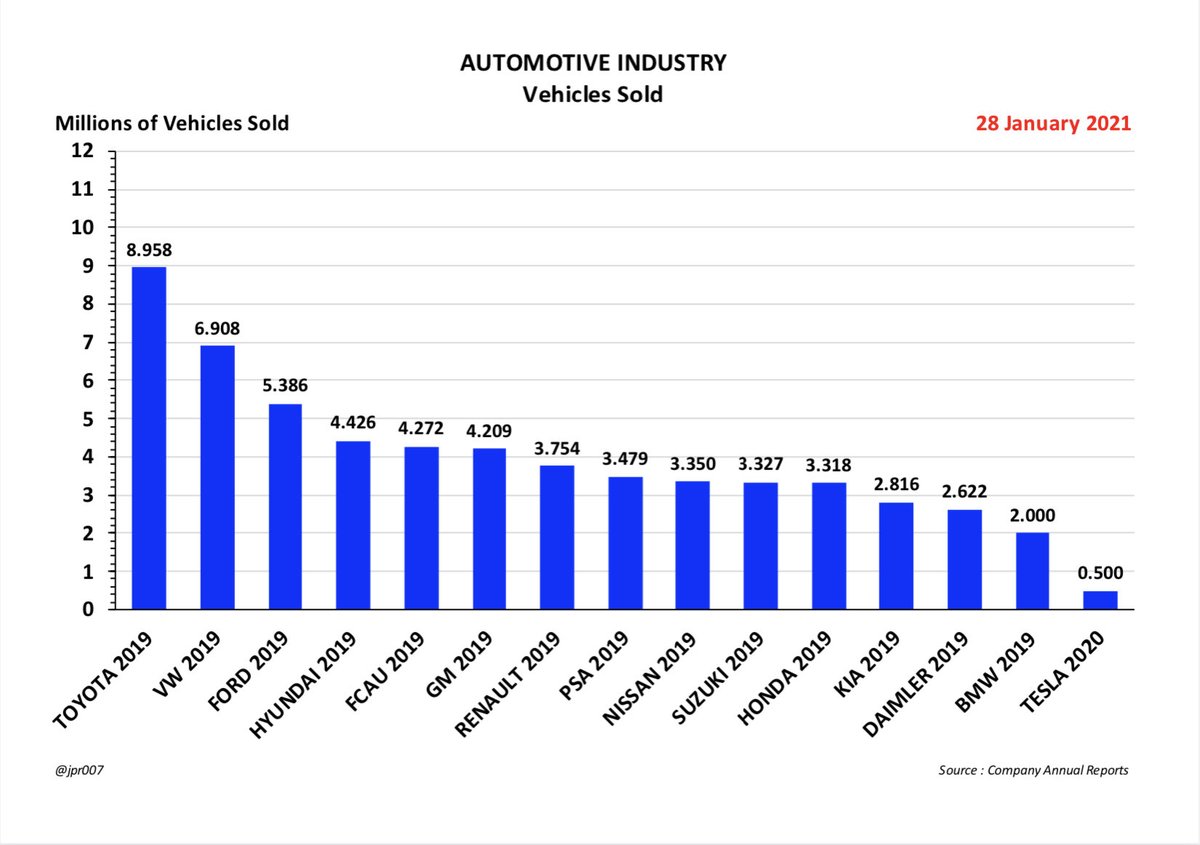

Hyundai said that it aims to sell 4.16 million cars this year, up from 3.75 million in the previous year, with 4% to 5% operating profit margin

In 2020, Hyundai's operating profit tumbled -22.9% to 2.8 trillion won, with revenue declining 1.7% to 104 trillion won

In 2020, Hyundai's operating profit tumbled -22.9% to 2.8 trillion won, with revenue declining 1.7% to 104 trillion won

The company's net profit slid -33.5% to 2.1 trillion won

Shares in the automaker fell -3.3% to 251,500 won on Tuesday, while the benchmark Kospi index dropped -2.1% to 3,140.31

Shares in the automaker fell -3.3% to 251,500 won on Tuesday, while the benchmark Kospi index dropped -2.1% to 3,140.31

• • •

Missing some Tweet in this thread? You can try to

force a refresh