Tesla's no-nonsense finance chief tallies profit surge

Tesla is widely expected to report its sixth consecutive quarterly profit Wednesday -- and potentially its first $1-billion quarter

autonews.com/automakers-sup…

Tesla is widely expected to report its sixth consecutive quarterly profit Wednesday -- and potentially its first $1-billion quarter

autonews.com/automakers-sup…

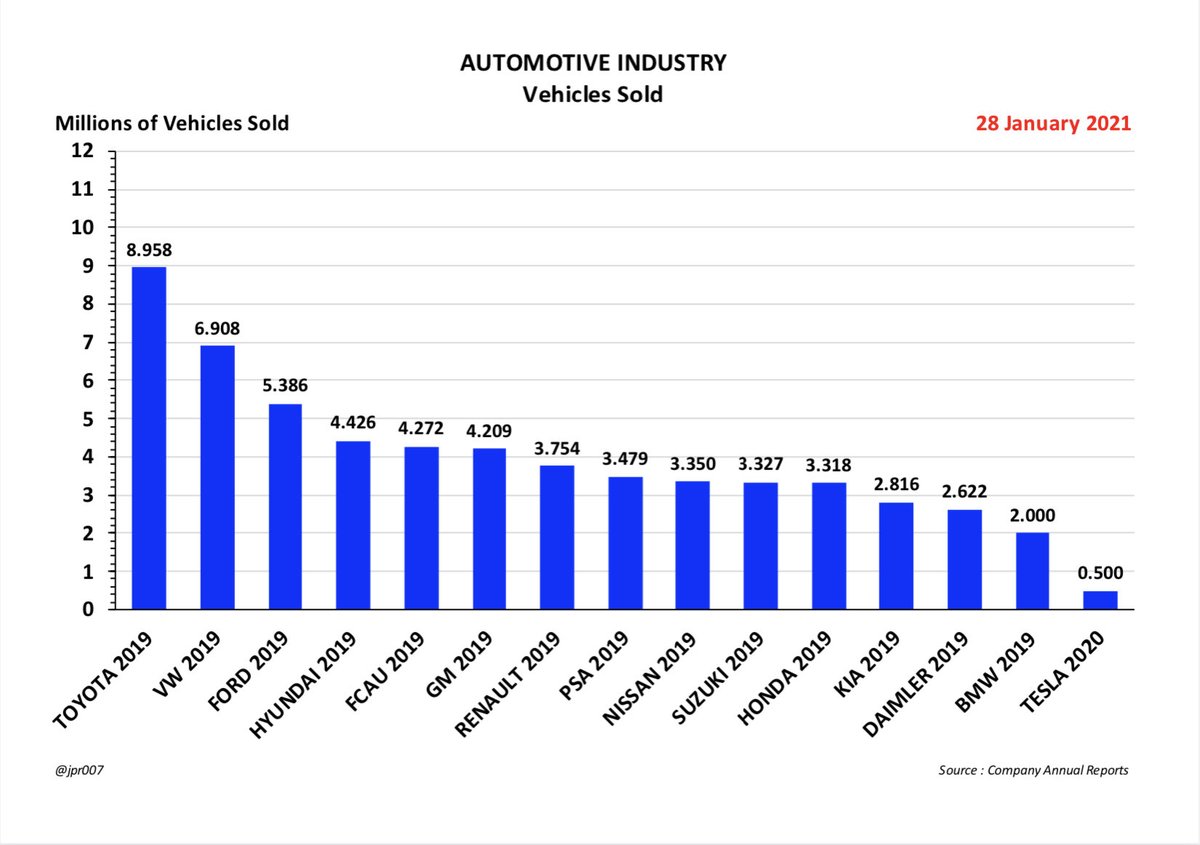

That follows a remarkable year when Tesla’s stock split and skyrocketed, the company joined the S&P 500 Index and it sold almost half a million cars

Two years ago the world’s leading electric vehicle maker was going through a rough patch

Two years ago the world’s leading electric vehicle maker was going through a rough patch

Elon Musk, Tesla’s CEO, informed employees in a January 2019 open letter that the company had to reduce headcount by -7% and boost Model 3 production rates to survive

Later that month, the CEO told analysts Tesla needed to cut costs and its vehicle prices to avoid bankruptcy

Later that month, the CEO told analysts Tesla needed to cut costs and its vehicle prices to avoid bankruptcy

And there was one more thing

As the earnings call drew to a close, Musk dropped a bombshell

- Deepak Ahuja, the longtime finance chief who previously worked at Ford Motor Co., was retiring again

As the earnings call drew to a close, Musk dropped a bombshell

- Deepak Ahuja, the longtime finance chief who previously worked at Ford Motor Co., was retiring again

A then-unknown protégé from the finance team, Zachary Kirkhorn, would replace him after a short transition period

Investors worried :

Was Ahuja’s departure another sign of turmoil and executive talent running for the exits ?

Investors worried :

Was Ahuja’s departure another sign of turmoil and executive talent running for the exits ?

Tesla’s PR team at the time didn’t have a basic bio or photograph of Kirkhorn at the ready

The surprise announcement sent shares tumbling

Kirkhorn, 36, remains a bit of a mystery to the average investor, but he has made his mark

The surprise announcement sent shares tumbling

Kirkhorn, 36, remains a bit of a mystery to the average investor, but he has made his mark

He has shored up Tesla’s balance sheet with a string of successful capital raises, introduced a more conservative approach to forecasting and provided greater discipline in cost-cutting that has helped Tesla act more like the S&P 500 company it has become

“People still don’t really know who Zach is, but they know what he’s done,” said Gene Munster, managing partner at Loup Ventures

“He’s a shy person and I don’t think he likes to speak publicly. But it’s been a remarkable turnaround”

“He’s a shy person and I don’t think he likes to speak publicly. But it’s been a remarkable turnaround”

Though he participates in all of Tesla’s earnings calls, he’s not a conference-goer

Several sell-side analysts said they’ve never talked with him on the phone

Tesla executives did not respond to an email about this story

But the numbers speak for themselves

Several sell-side analysts said they’ve never talked with him on the phone

Tesla executives did not respond to an email about this story

But the numbers speak for themselves

By the yardsticks that measure most CFOs, he has excelled

Tesla shares have risen more than +1,300% during his tenure

Tesla shares have risen more than +1,300% during his tenure

On 30 January 2019, the day that Musk announced that Kirkhorn would be taking over, Tesla’s market capitalization was $53 billion

It was about $835 billion at Monday’s close

At this pace, a trillion-dollar valuation may not be far off

It was about $835 billion at Monday’s close

At this pace, a trillion-dollar valuation may not be far off

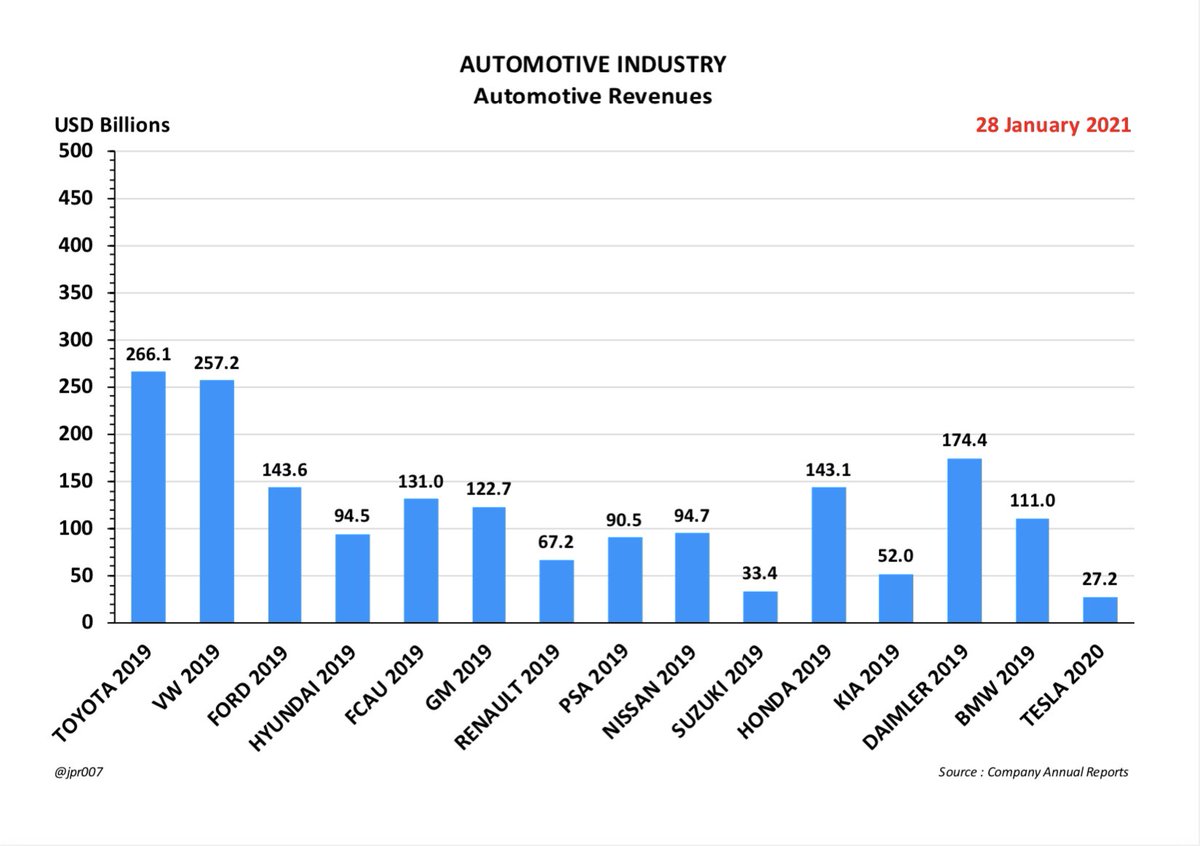

Tesla’s lofty market cap has less to do with financial engineering than with the automaker working through production problems and achieving major expansions of output, plus growing concern about climate change and a wave of EV mania on Wall Street based on Tesla’s success

But Kirkhorn has capitalized on the company’s success by building a fortress balance sheet, with $12 billion of new Cash raised in 2020 alone

The company has reported profits but also beat analysts at the game of expectations, often now exceeding their consensus estimates

The company has reported profits but also beat analysts at the game of expectations, often now exceeding their consensus estimates

“I don’t know Zach personally, but he’s taught Tesla to under-promise and over-deliver,” said Gary Black, a bullish private investor

“They seem much more disciplined”

“They seem much more disciplined”

Not everyone is a fan

Hedge fund manager David Einhorn, a long-time critic of Tesla who has shorted the carmaker’s stock, has publicly questioned the company’s accounting practices

Hedge fund manager David Einhorn, a long-time critic of Tesla who has shorted the carmaker’s stock, has publicly questioned the company’s accounting practices

The Greenlight Capital president challenged Tesla in an April 2020 tweet to explain what Einhorn claimed are discrepancies in Tesla’s accounts receivable

He recently called the rally in its stock a “fad”

But Einhorn has been a noisemaker while Tesla has been a profitmaker [Ed]

He recently called the rally in its stock a “fad”

But Einhorn has been a noisemaker while Tesla has been a profitmaker [Ed]

Kirkhorn is one of four executive officers at the helm of the world’s most valuable automaker

Musk, 49, is naturally the public face and voice of the company

Musk, 49, is naturally the public face and voice of the company

Drew Baglino, the senior vice president of powertrain and energy engineering, shared the stage with Musk at last fall’s Battery Day event

Jerome Guillen, the president of automotive, previously led sales and is beloved by early customers who still have emails from him

Jerome Guillen, the president of automotive, previously led sales and is beloved by early customers who still have emails from him

Kirkhorn attended the University of Pennsylvania, where he was enrolled in the Jerome Fisher Program in Management & Technology

This allowed him to graduate in 2006 with two bachelor of science degrees :

- economics from the Wharton School

- and mechanical engineering and applied mechanics from Penn Engineering

Musk also went to Penn

- economics from the Wharton School

- and mechanical engineering and applied mechanics from Penn Engineering

Musk also went to Penn

Kirkhorn interned briefly at Microsoft Corp. then took a position as a business analyst at McKinsey & Co

That’s also where he met his husband, according to a 2018 wedding announcement in The New York Times

That’s also where he met his husband, according to a 2018 wedding announcement in The New York Times

The couple own a home in the hills of Oakland, Calif., not far from Tesla’s Palo Alto, Calif., headquarters, according to public records

He joined Tesla in March 2010 as a senior analyst in the finance department

He joined Tesla in March 2010 as a senior analyst in the finance department

Eighteen months later, he left to pursue an MBA at Harvard Business School -- which Musk said wasn’t necessary

After graduating, Kirkhorn returned and worked under Ahuja and Jason Wheeler, who served as CFO from 2015 to 2017 when Ahuja returned

After graduating, Kirkhorn returned and worked under Ahuja and Jason Wheeler, who served as CFO from 2015 to 2017 when Ahuja returned

Tesla released its first ever report on diversity and inclusion last month and Kirkhorn was featured in a section called “Pride in Our Employees”

It noted he has been promoted five times

It noted he has been promoted five times

Several former colleagues and multi-year investors who know Kirkhorn said he is deeply committed to Tesla’s clean energy mission

They describe him as being very close to Tesla’s products, mindful of engineering and manufacturing as well as finance

They describe him as being very close to Tesla’s products, mindful of engineering and manufacturing as well as finance

On earnings calls he talks in detail about Tesla’s other revenue streams, from the sale of regulatory credits to what the company terms “Full Self Driving” software and future insurance products

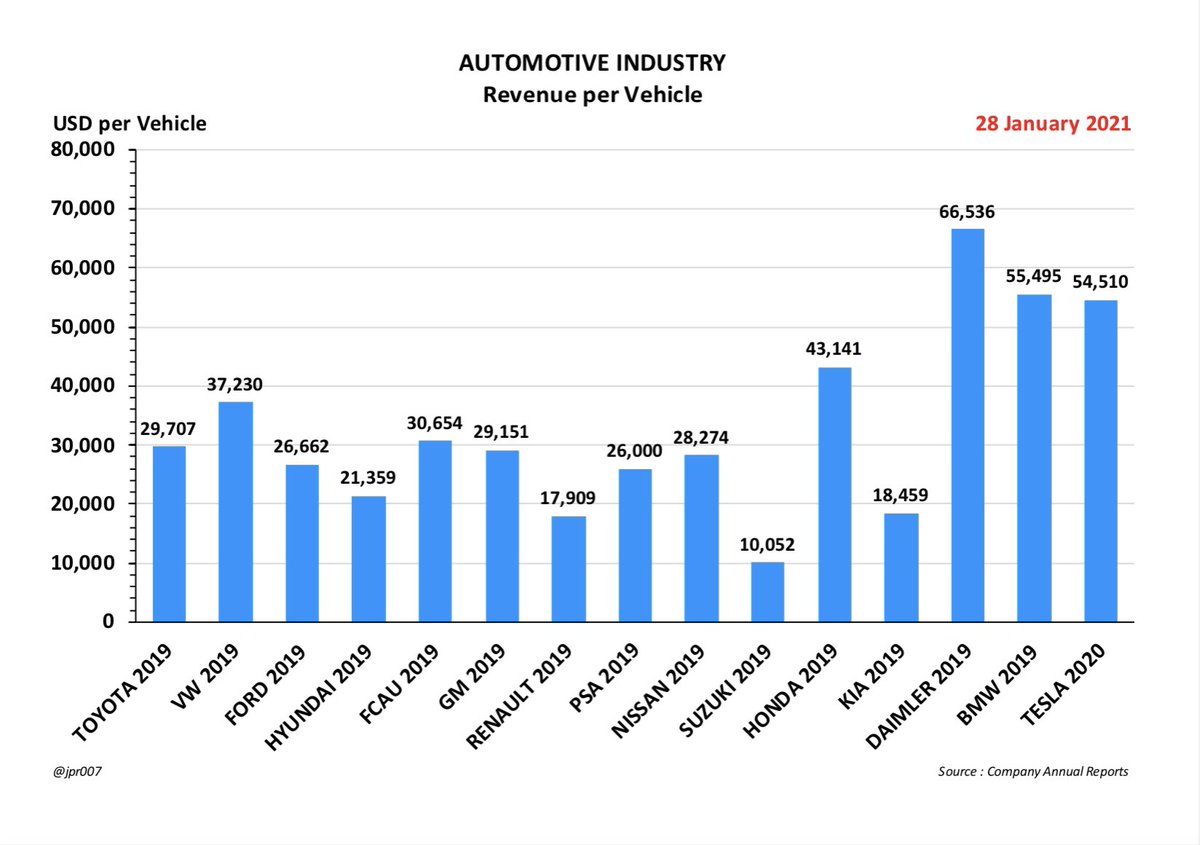

“The auto business is capital intensive and under Zach, Tesla has been more capital efficient,” said Dick Amacher, a former engineer and product planner at General Motors who says he owns two Tesla models and stock in the company

“A finance leader is supposed to provide guidance for future strategy, and the results speak for themselves”

The first half of 2019 was marred by Musk’s sudden decision to close stores -- a move he walked back days later -- but one that shook Tesla’s sales staff and puzzled shareholders

A bullish Wall Street broker rued the carmaker’s sliding stock price as “humbling” in June of that year, and two others warned about a deteriorating sales outlook

That unease was further stoked when veteran Chief Technology Officer J.B. Straubel unexpectedly departed in July

That unease was further stoked when veteran Chief Technology Officer J.B. Straubel unexpectedly departed in July

“When Zach came on as CFO, he had the world’s worst job,” said Munster

“He had to deal with Elon and save a really complicated company”

By the third quarter of 2019, Tesla was showing progress toward improving its balance sheet

“He had to deal with Elon and save a really complicated company”

By the third quarter of 2019, Tesla was showing progress toward improving its balance sheet

In a key turning point, the automaker reported the first profit in almost a year, beating analysts’ expectations for a loss, and stunned close observers with news the Model Y crossover would launch months earlier than expected, a big deal for a company known for blowing deadlines

“We are quickly turning the corner for our next phase of growth, and our financial health continues to strengthen,” Kirkhorn told analysts on an October 2019 earnings call

“We remain focused on reducing cost, which enables rapid investments in future programs and growth”

“We remain focused on reducing cost, which enables rapid investments in future programs and growth”

Tesla’s $3.7 billion in cash on hand at the end of 2018 ballooned to $14.5 billion at the end of the third quarter of 2020, the most recent figure available

Musk recently called that a “war chest”

Musk recently called that a “war chest”

Tesla is spending money on global expansion, with new auto and battery plants under construction in Austin, Texas, and Berlin

But Cash Flows from Operations are already larger than the Capital Spending rates

Kirkhorn has a Twitter account, but his tweets are protected

But Cash Flows from Operations are already larger than the Capital Spending rates

Kirkhorn has a Twitter account, but his tweets are protected

When Tesla reported its delivery totals earlier this month he shared the release on LinkedIn

“Half a million cars in 2020! Congratulations to the Tesla team, our new customers and those who support our journey,” he wrote in the post

“Looking forward to another exciting year”

“Half a million cars in 2020! Congratulations to the Tesla team, our new customers and those who support our journey,” he wrote in the post

“Looking forward to another exciting year”

• • •

Missing some Tweet in this thread? You can try to

force a refresh