How To Pick Stocks That Are Actually Worth Owning Long-Term

A Thread

(FOR ENTERTAINMENT ONLY. NOT FINANCIAL ADVICE. DO YOUR OWN RESEARCH)

A Thread

(FOR ENTERTAINMENT ONLY. NOT FINANCIAL ADVICE. DO YOUR OWN RESEARCH)

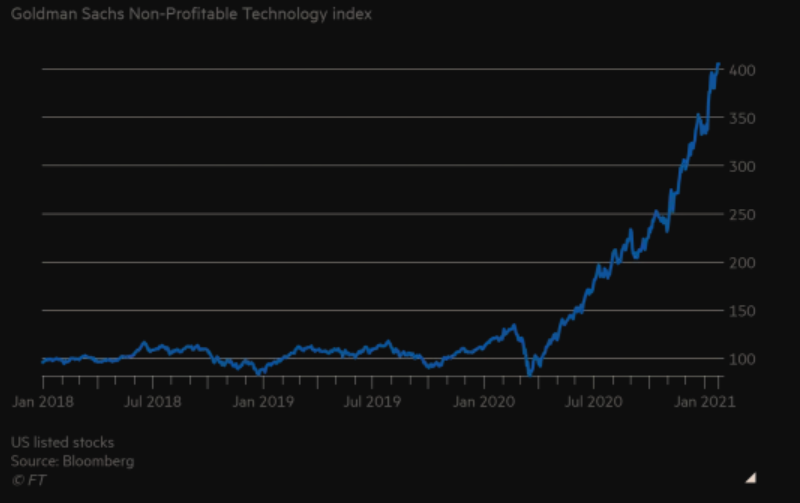

High-flying zero-profit businesses dominate the news (GameStop, NIO, AMC). This, in combination with many investor's focus on stock price, leads many people to believe that trading is the only way to make money in the stock market.

As such, you see a lot of junk companies selling at inflated prices.

Goldman Sachs even released a chart showcasing the rise in non-profitable tech stock investments.

Goldman Sachs even released a chart showcasing the rise in non-profitable tech stock investments.

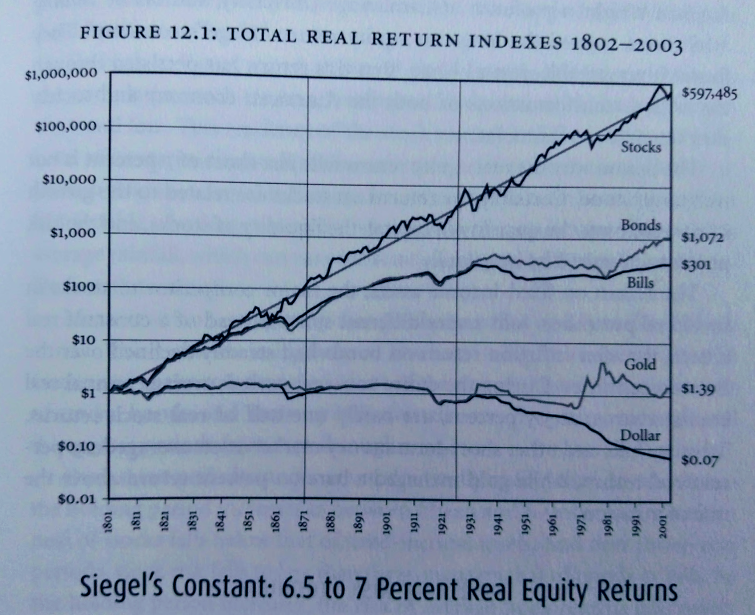

In reality, most long-term gains come from buying and holding quality businesses. You enjoy capital gains from the company growing its earnings per share, and you collect dividends.

Of course, not all quality business are good investments. And nobody wants to wait 20 years to double their money.

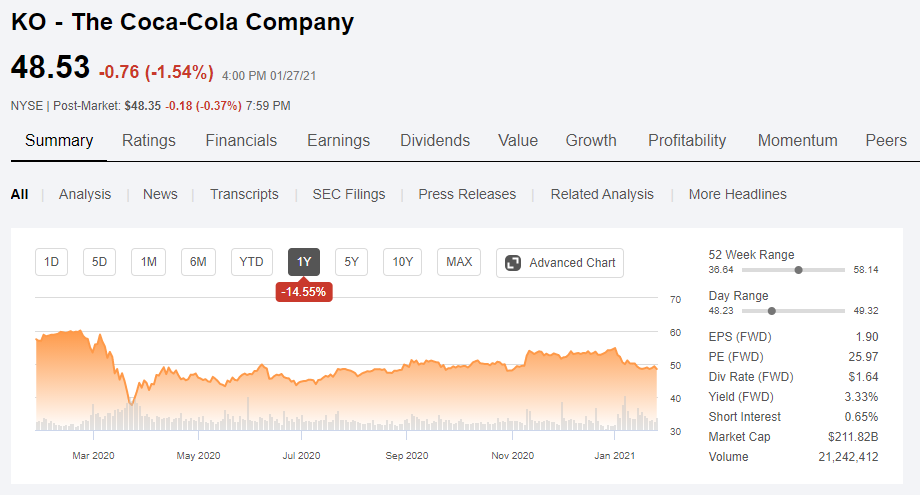

Coca-Cola is a fantastic behemoth of a business, but its stock has underperformed the S&P 500 for years.

Why?

Coca-Cola is a fantastic behemoth of a business, but its stock has underperformed the S&P 500 for years.

Why?

Because everyone knows and owns this stock. In turn, they've driven the price up so high that Coca-Cola trades at a premium of 25 - 30 times its earnings.

In many situations, you're actually paying more for a single share of Coca-Cola stock than you would be if you bought an S&P 500 ETF.

Unloved and overlooked sectors are one easy place to find value.

For much of 2020, banking was a DEAD sector and nobody wanted to invest.

You could buy perfectly healthy banks with stable dividend yields at insanely low prices.

For much of 2020, banking was a DEAD sector and nobody wanted to invest.

You could buy perfectly healthy banks with stable dividend yields at insanely low prices.

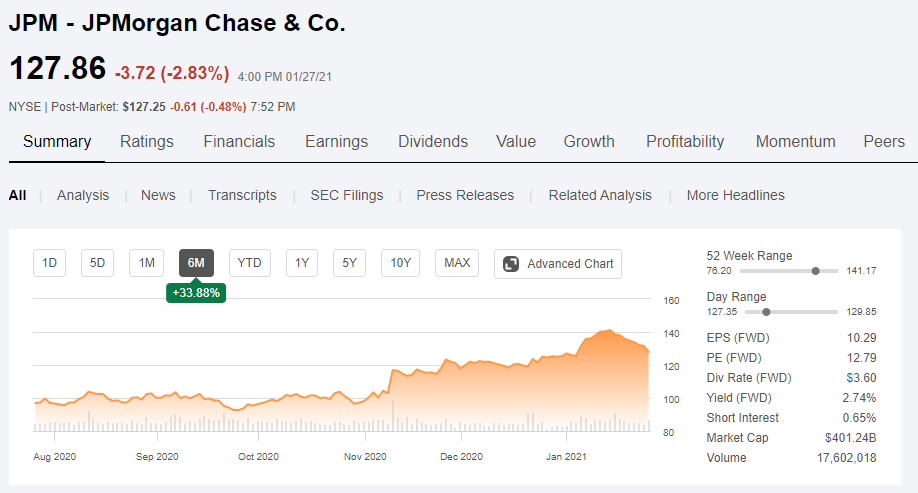

JP Morgan traded under $100 per share, with a price to earnings ratio of about 10.

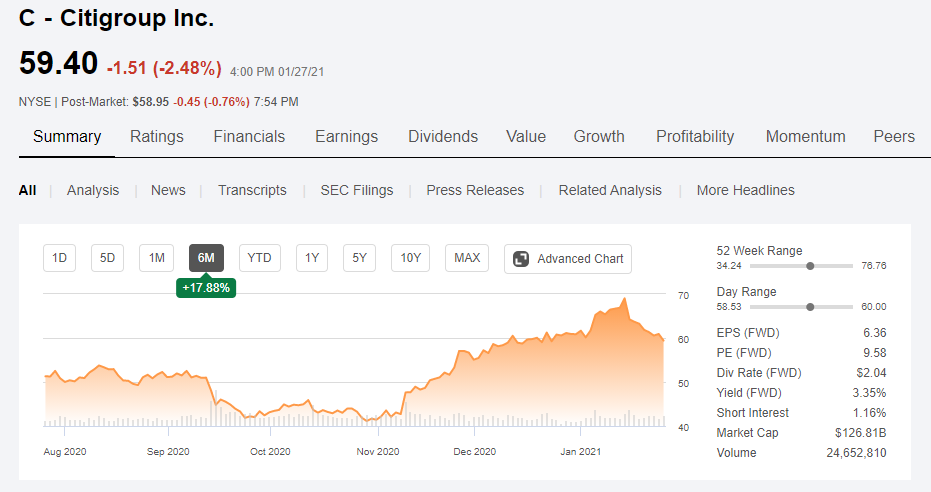

And Citi Bank was even lower, trading at less than $45.

You could have bought a well established blue chip business and gained 50% on your investment by December.

And Citi Bank was even lower, trading at less than $45.

You could have bought a well established blue chip business and gained 50% on your investment by December.

Right now, a lot of healthcare stocks are trading at low PE ratios.

Abbvie, Pfizer, Gilead Sciences, and Bristol-Myers Squibb all have price to earnings ratios around the 10 range.

And each is kicking off a steady stream of dividends too.

Abbvie, Pfizer, Gilead Sciences, and Bristol-Myers Squibb all have price to earnings ratios around the 10 range.

And each is kicking off a steady stream of dividends too.

In addition to low PE stocks in unfavorable sectors, you can always look at foreign companies (many trade at surprising low price to earnings ratios) and cyclical commodities.

Over the summer, when China was flooding, I bought shares of Rio Tinto, expecting an increase in metal demands (for rebuilding roads, bridges, buildings, etc).

At the time, shares were trading at a fairly low value (under $60) and today my position is up +38.77%.

At the time, shares were trading at a fairly low value (under $60) and today my position is up +38.77%.

Of course, metals and mining are not the only commodities. There are other sectors like grains and oil. If you keep your eye on these and use some common sense, you can buy quality commodity producers during a cyclical lull and then enjoy big gains once demand increases.

Lastly, I want to mention why I personally do not trade meme stocks.

These junk companies often become a game of hot potato. Some traders do great with them, but if you're left holding the bag you have nothing of value.

These junk companies often become a game of hot potato. Some traders do great with them, but if you're left holding the bag you have nothing of value.

To give a personal example, I bought 100 shares of Urstadt Biddle Properties in 2019.

At the time I was reading "Snowball" and wanted to make an early Warren Buffett like investment.

This business was a regional landlord with 25 years of consistent dividend increases.

At the time I was reading "Snowball" and wanted to make an early Warren Buffett like investment.

This business was a regional landlord with 25 years of consistent dividend increases.

In 2020, the pandemic happened and Urstadt Biddle cut their dividend significantly. Share prices fell and haven't recovered, but there's still value in the business.

I still collect quarterly dividends and can sell long-date calls that exceed my initial purchasing price.

I still collect quarterly dividends and can sell long-date calls that exceed my initial purchasing price.

These factors help diminish the lose and provide a silver lining to the situation.

Call me a cynic but, six months from now, I don't think anyone is selling $300 GameStop calls.

Call me a cynic but, six months from now, I don't think anyone is selling $300 GameStop calls.

Investing doesn't have to be gabling on meme stocks for a short-term pump.

By the same token, you don't have to skip drinking coffee and put the extra $5 a day into some broad market index fund so that you have an additional $3,000 when you're 95.

By the same token, you don't have to skip drinking coffee and put the extra $5 a day into some broad market index fund so that you have an additional $3,000 when you're 95.

With a little research and critical thinking, you can easily find undervalued assets or currently unpopular sectors. Doing something like this allows you to buy quality businesses that grow, while also limiting your risk in a downturn.

P.S. This wouldn't be a proper Twitter thread without plugging something at the end. Below are a handful of referral links to books and resources on investing:

One Up On Wall Street - Peter Lynch the world's most successful investor, shares his wisdom.

amzn.to/39ngo8x

Investment Biker - Fascinating book by market legend Jim Rogers, covers economics on a global scale.

amzn.to/3iRl7T8

amzn.to/39ngo8x

Investment Biker - Fascinating book by market legend Jim Rogers, covers economics on a global scale.

amzn.to/3iRl7T8

Also plugging Robinhood. It's easily the most popular retail investing app now, and mainly because of how streamlined it is. I actually like it more than some of more complex trading platforms.

You also get a free stock when you sign up.

join.robinhood.com/robertk1582

You also get a free stock when you sign up.

join.robinhood.com/robertk1582

• • •

Missing some Tweet in this thread? You can try to

force a refresh