This is how the system is rigged.

The elites aren't even trying to hide it.

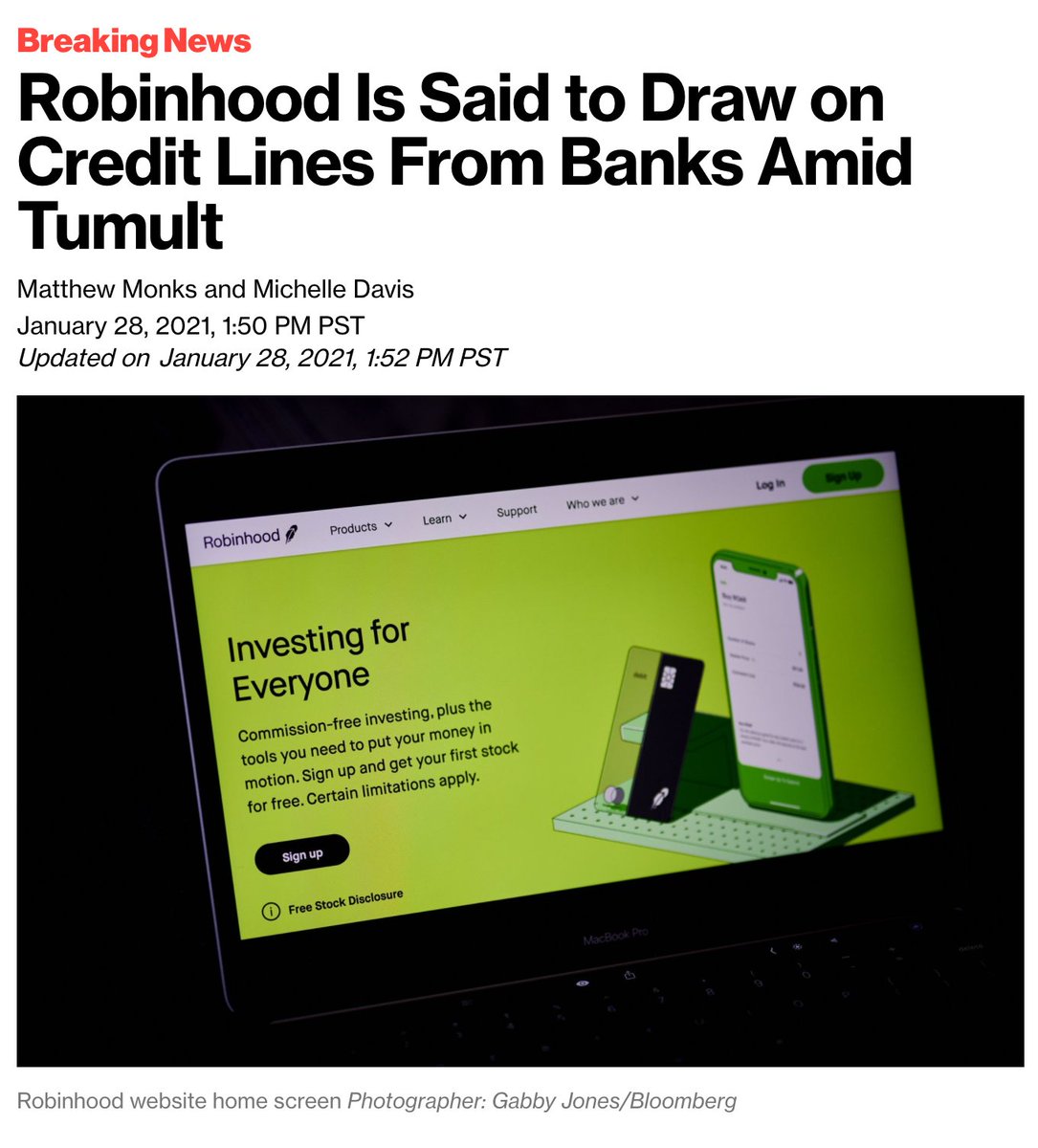

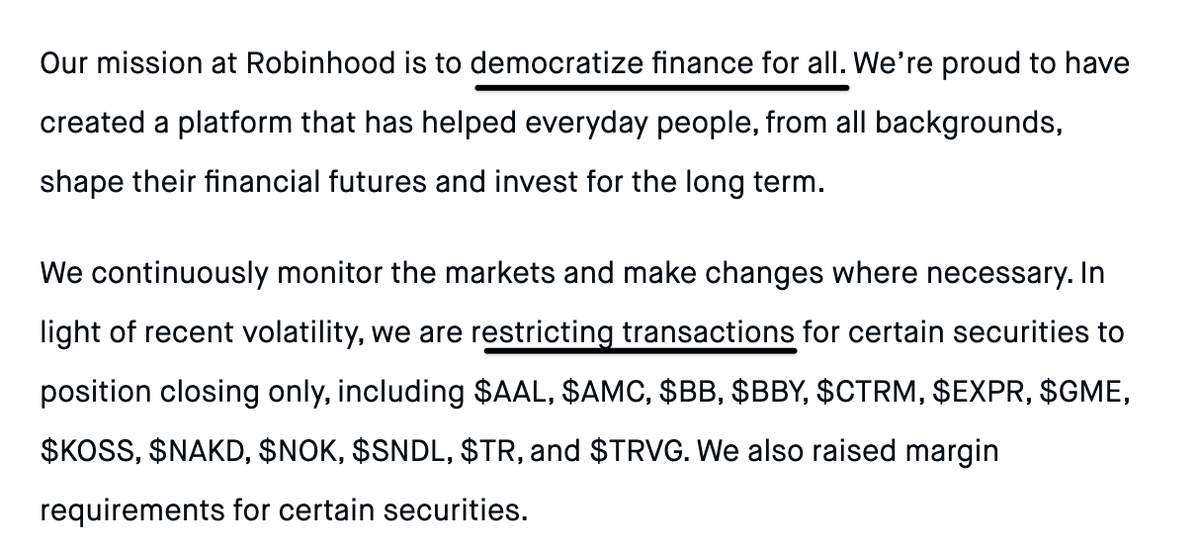

Robinhood, who's revenue is largely tied to Citadel, restricts trading in $GME, $AMC, and $NOK.

Users can only sell, not buy.

seekingalpha.com/news/3655535-w…

The elites aren't even trying to hide it.

Robinhood, who's revenue is largely tied to Citadel, restricts trading in $GME, $AMC, and $NOK.

Users can only sell, not buy.

seekingalpha.com/news/3655535-w…

Jeffries is restricting trading in the most shorted stocks group (source to be added).

TD Ameritrade has restricted trading in Wall Street Bets names like $GME, etc.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

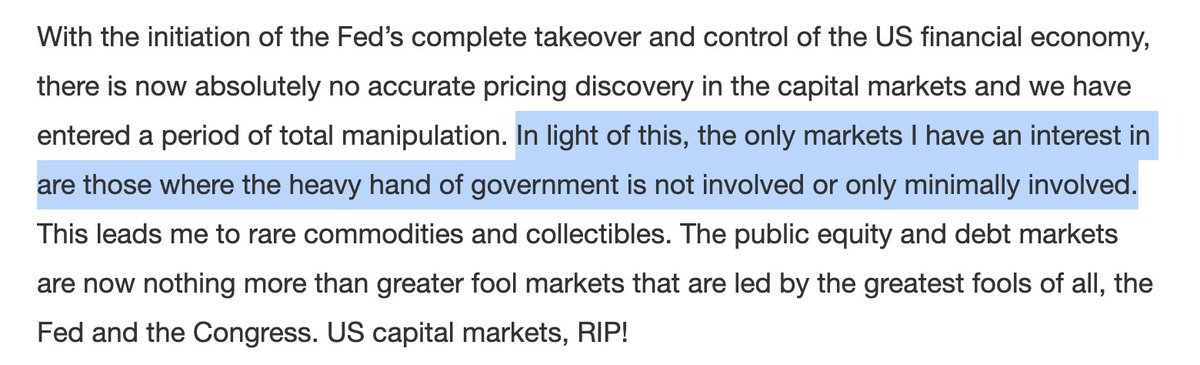

The CEO of the Nasdaq is considering changing the rules for institutions so they can "recalibrate" their positions

https://twitter.com/Mediaite/status/1354504710695362563

These are all "coercible entities" that can rig the system and is wildly bullish for DeFi and Cryptocurrencies in general.

A free market should be just that. Free.

A free market should be just that. Free.

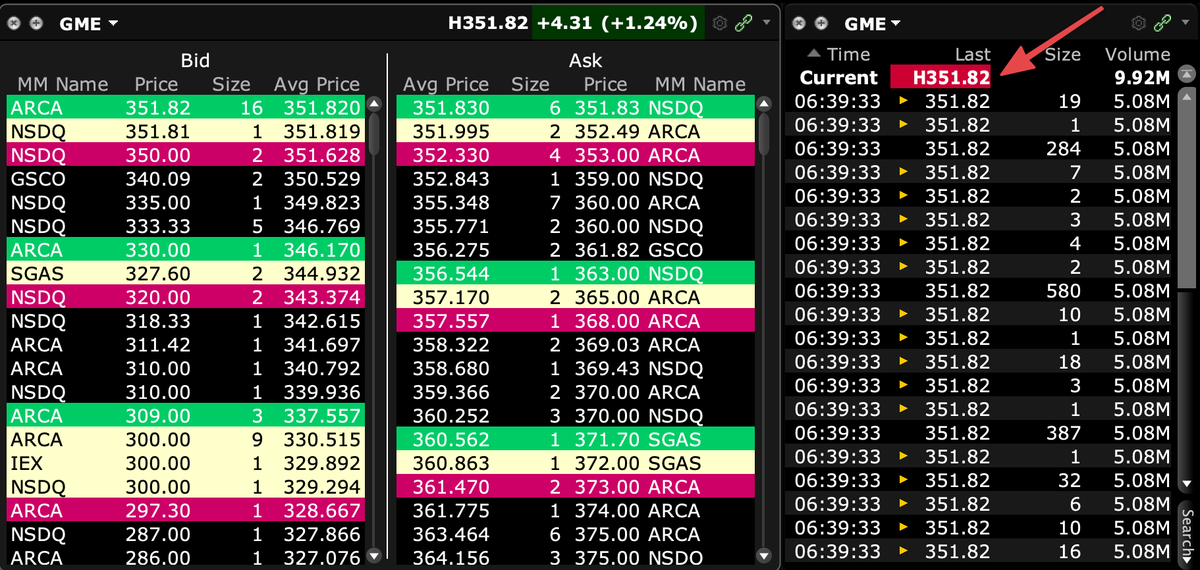

$GME stock halted 3 minutes into trading.

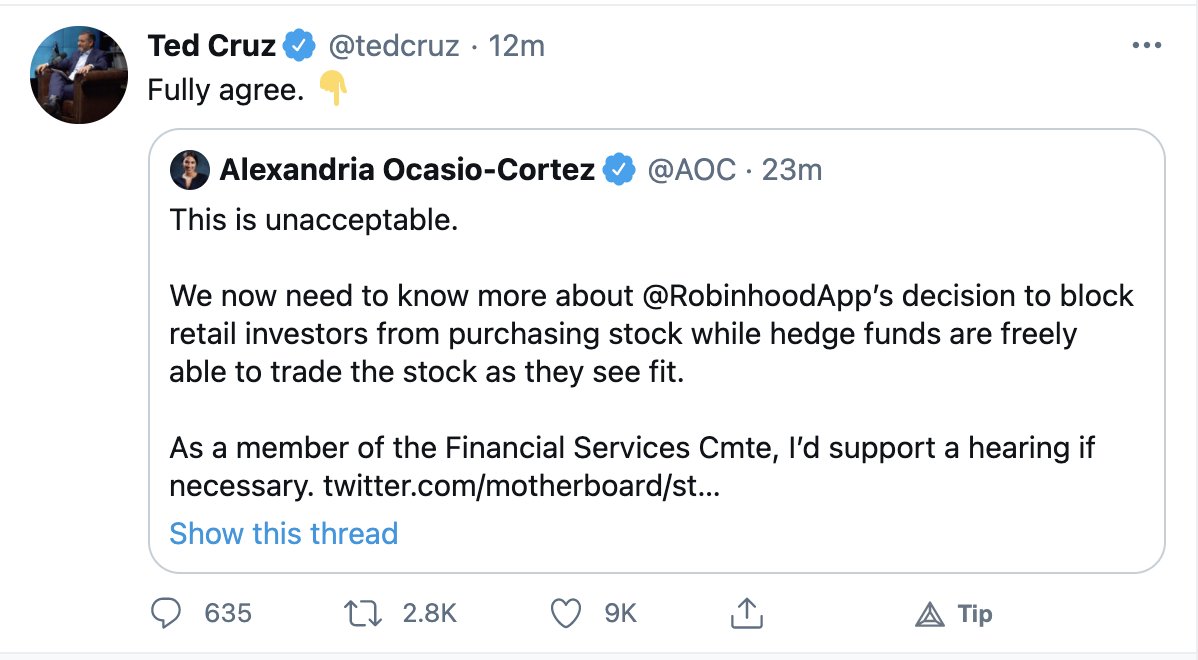

This is non-partisan: AOC and Don Trump Jr. are in fierce agreement over this rigging of the system.

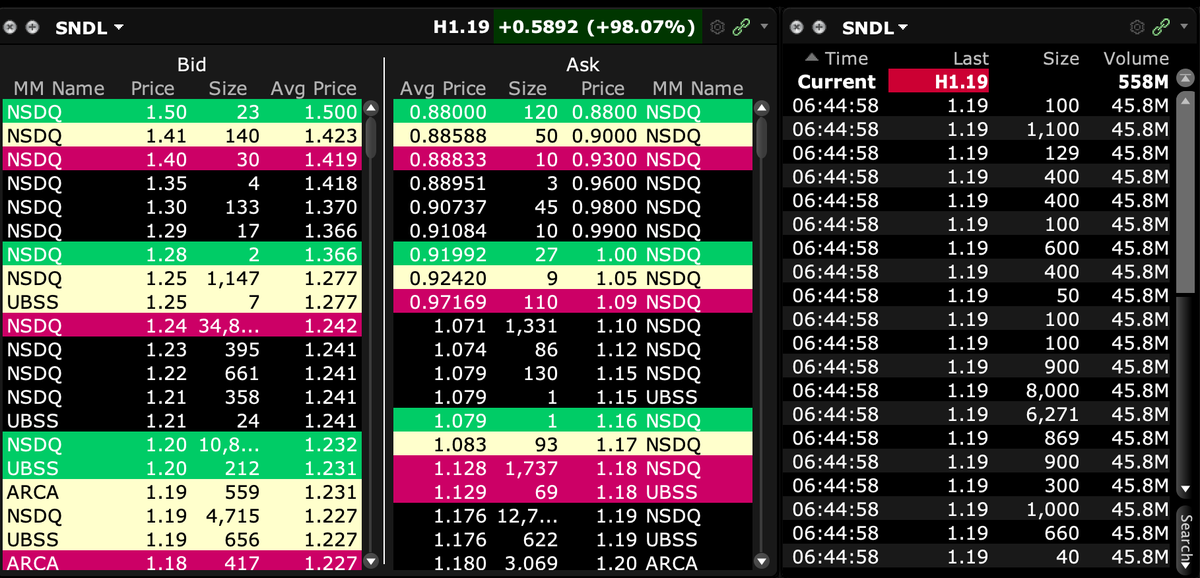

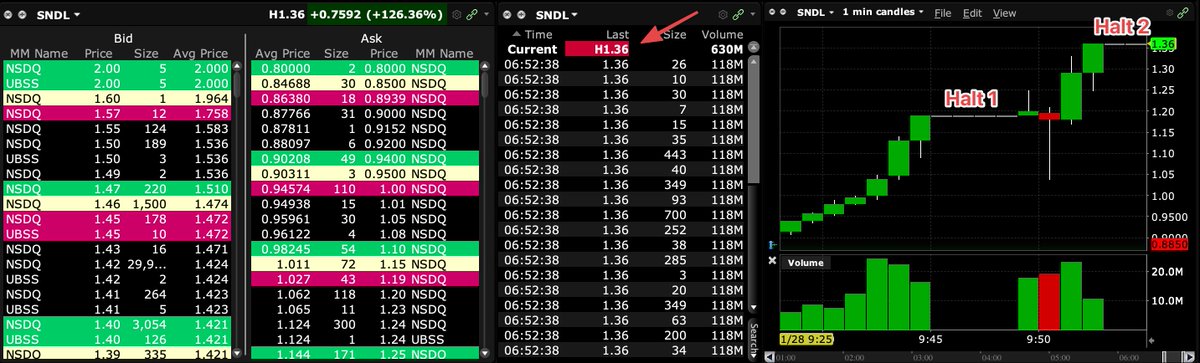

$SNDL, another meme stock, up 88%, but will almost certainly be halted.

More evidence of rigging. "Recalibrate" as the CEO of Nasdaq says

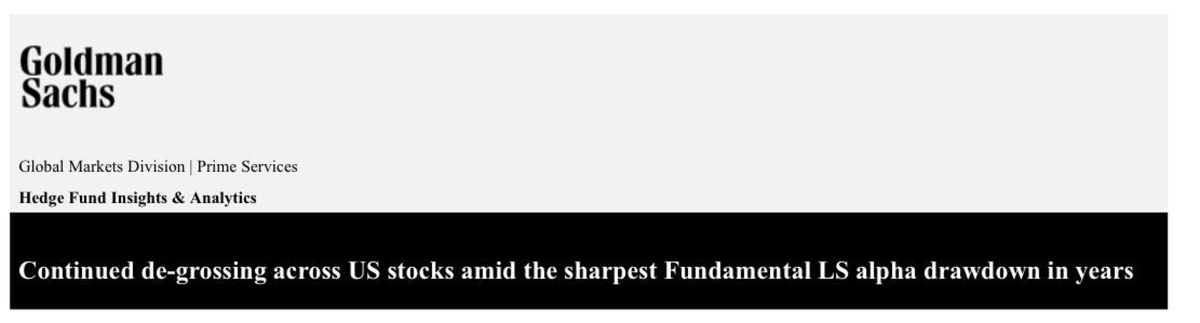

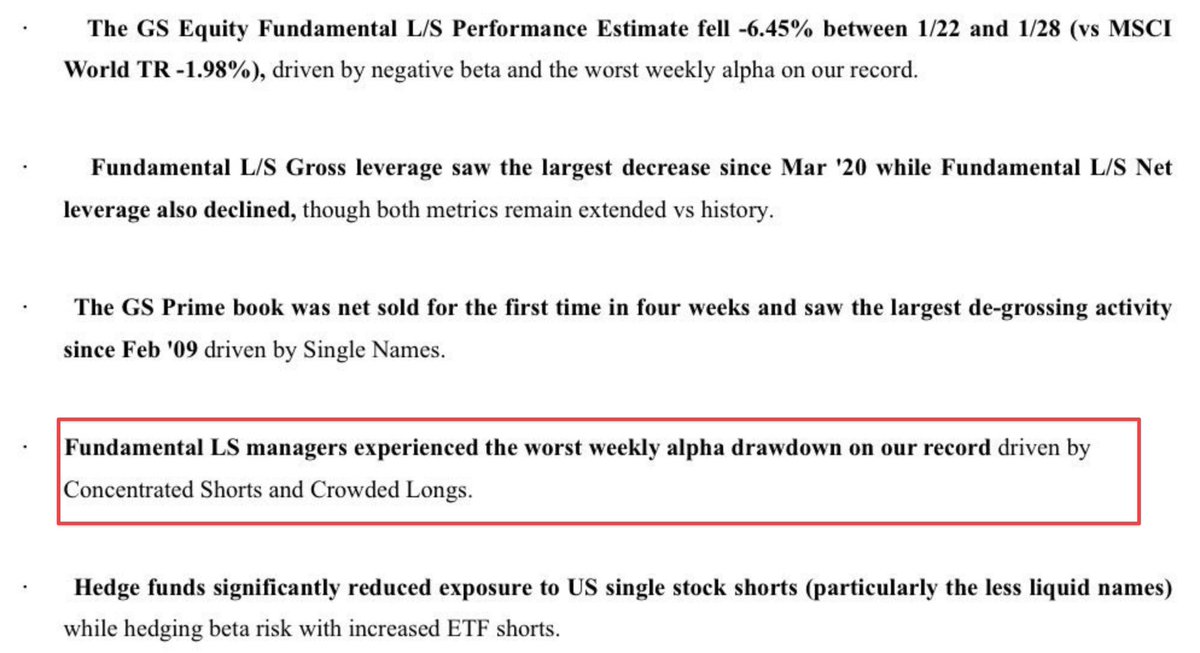

According to Goldman Sachs, Hedge funds are "de-grossing" (selling longs, covering shorts) amidst the sharpest Fundamental Long/Short alpha drawdown in years

According to Goldman Sachs, Hedge funds are "de-grossing" (selling longs, covering shorts) amidst the sharpest Fundamental Long/Short alpha drawdown in years

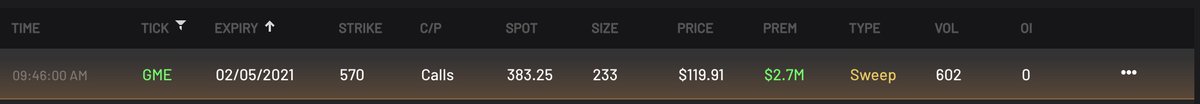

The Reddit Army is not playing. Someone paid $119.91 for the $570 call strike expiring next week (!) in $GME for a total of $2.3M on one trade.

This means the price has to trade above $689.91 for the options to be in the money.

This is why hedge funds are shaking in their boots

This means the price has to trade above $689.91 for the options to be in the money.

This is why hedge funds are shaking in their boots

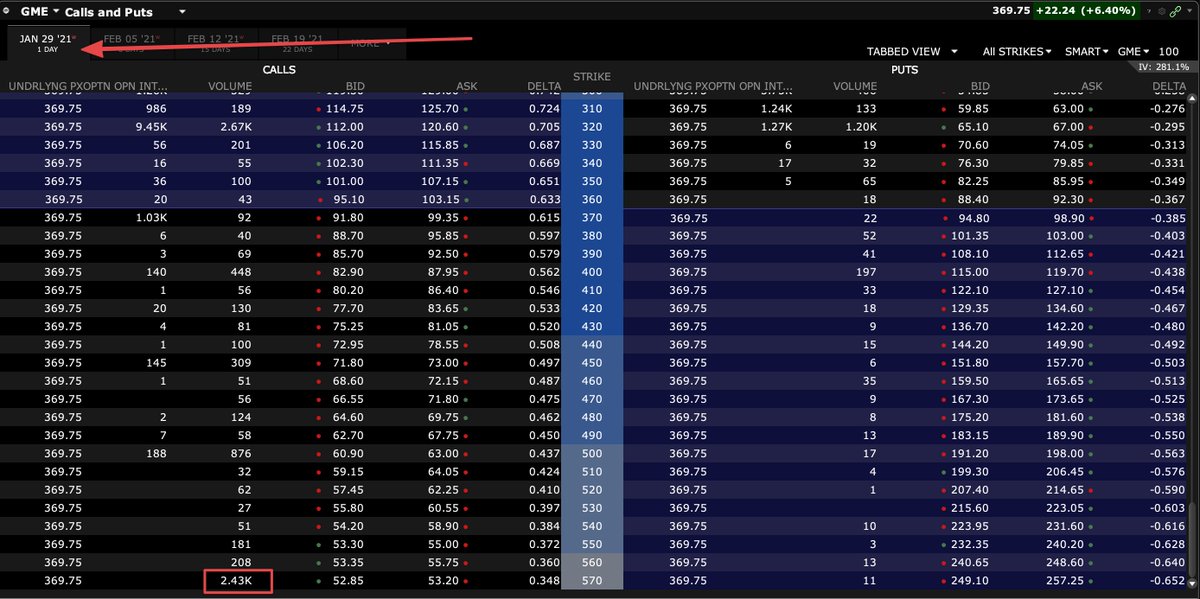

Of all the available out of the money calls in $GME, the highest strike possible, $570, has the highest volume by far.

These expire TOMORROW.

This is what the makings of a gamma squeeze look like.

These expire TOMORROW.

This is what the makings of a gamma squeeze look like.

"In USD terms, US single stocks on the Goldman Sachs Prime book saw the largest de-grossing flow on our record"

"Yesterday's short covers (+11.2 SDs) and long sales (-8.5 SDs) in US Single Stocks were both the largest on our record."

A -10.9 standard deviation move.

Wow.

"Yesterday's short covers (+11.2 SDs) and long sales (-8.5 SDs) in US Single Stocks were both the largest on our record."

A -10.9 standard deviation move.

Wow.

GERMAN ONLINE BROKER TRADE REPUBLIC SUFFERS PARTIAL OUTAGE; DUE TO EXTREMELY HIGH TRADING VOLUMES

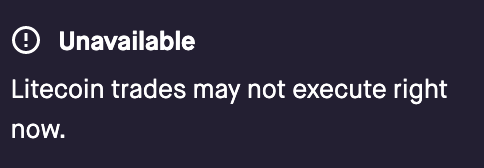

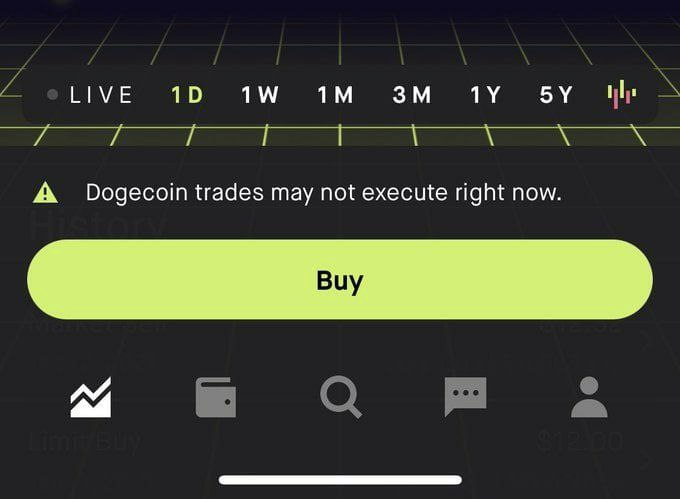

Robinhood now restricting trading in $DOGE, a meme-coin cryptocurrency.

Another reason why Decentralized exchanges will soon be having their moment

Another reason why Decentralized exchanges will soon be having their moment

I recommend @ftx_us for US Investors: bit.ly/ftx-us

I recommend @FTX_Official for everyone else: bit.ly/ftx-ftw

Robinhood aims to "democratize finance for all" which is why they are restricting you from trading "certain securities"?

blog.robinhood.com/news/2021/1/28…

blog.robinhood.com/news/2021/1/28…

Lots more being discussed here: bit.ly/market-mercena…

This is coordinated rigging.

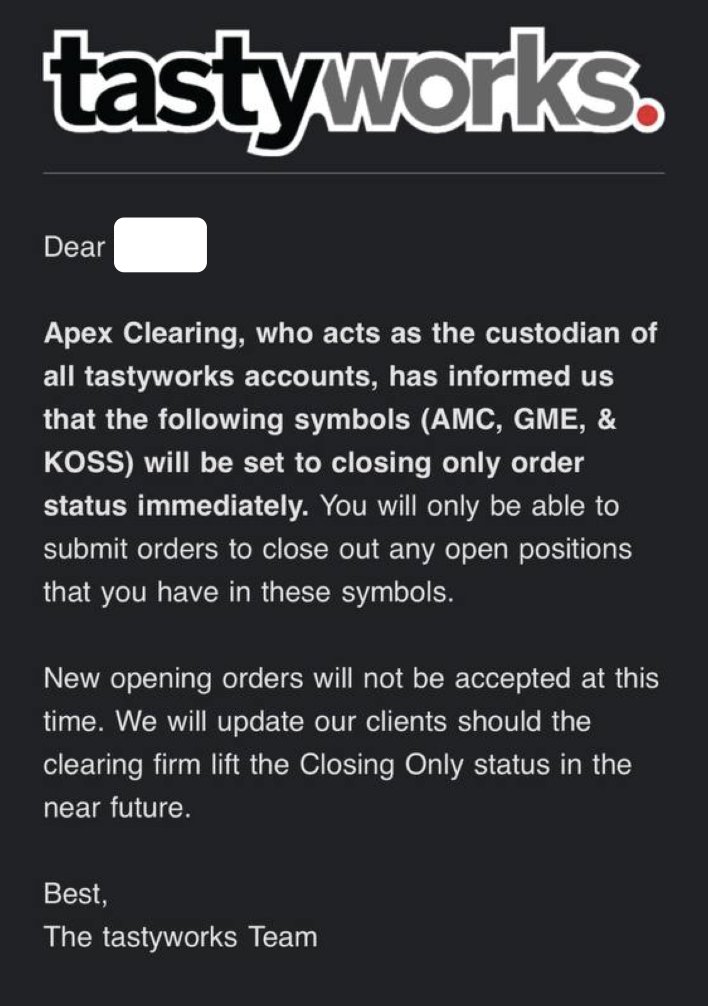

Now another broker, Tastyworks, is restricting trading in $GME, $AMC, $KOSS, etc.

Now another broker, Tastyworks, is restricting trading in $GME, $AMC, $KOSS, etc.

ROBINHOOD PLACING FREEZES AND SEIZING CAPITAL ON ACCOUNTS THEY SUSPECT OF MARKET MANIPULATION PER SEC ORDER

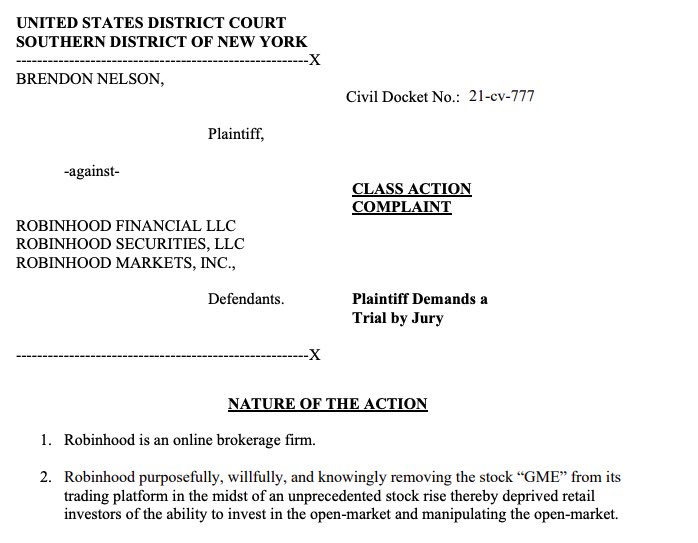

And the real winners have arrived, the lawyers.

A class-action lawsuit against Robinhood has been filed in the Southern District of NY

ecf.nysd.uscourts.gov/doc1/127128425…

A class-action lawsuit against Robinhood has been filed in the Southern District of NY

ecf.nysd.uscourts.gov/doc1/127128425…

Meanwhile, the cryptoassets representing the decentralized exchanges are ripping higher.

What's that tell you?

$1INCH $SUSHI $UNI

app.uniswap.org/#/swap

sushiswap.fi

1inch.exchange

What's that tell you?

$1INCH $SUSHI $UNI

app.uniswap.org/#/swap

sushiswap.fi

1inch.exchange

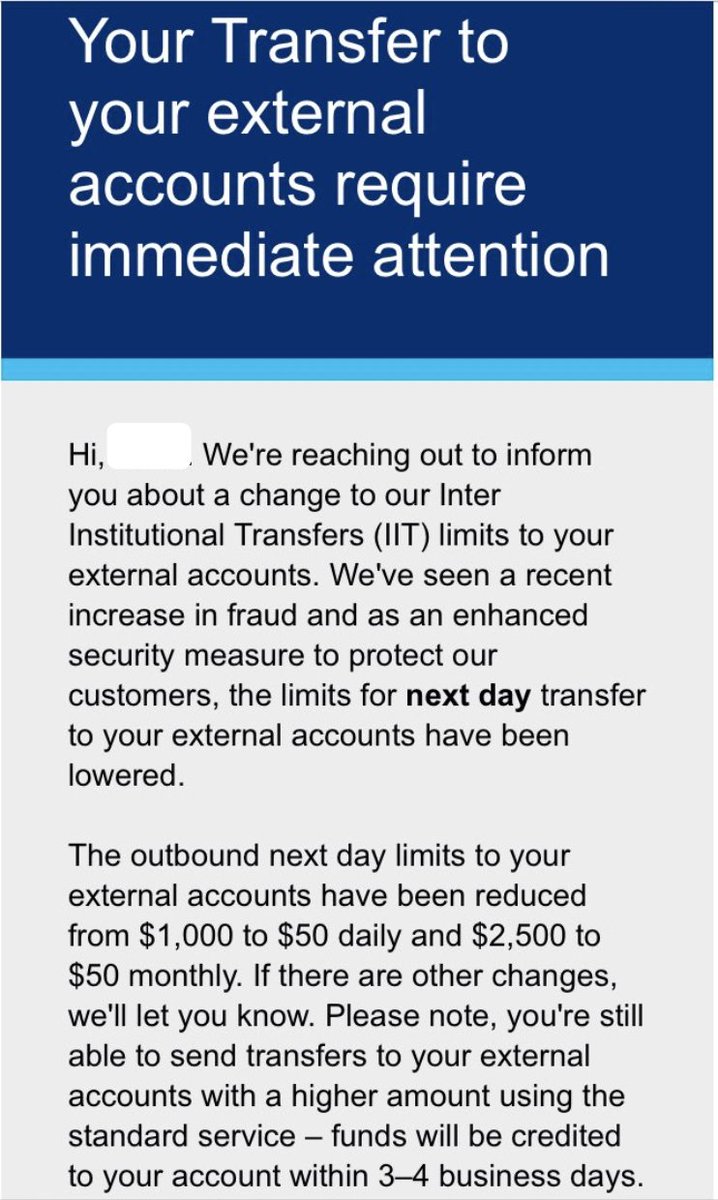

Merrill Edge now joins in on the trading restriction of $GME and $AMC

streetinsider.com/Momentum+Mover…

streetinsider.com/Momentum+Mover…

Citadel accounts for 40 out of every 100 shares traded by individual/retail investors in the United States.

That's one company responsible for 40% of market-making.

When volatility increases, spreads widen, and they make even more money.

Citadel made $4.1B in profit last year.

That's one company responsible for 40% of market-making.

When volatility increases, spreads widen, and they make even more money.

Citadel made $4.1B in profit last year.

Look who is on Citadel's Advisory Board - Ben Bernanke, the Fed Chairman responsible for the first bank bailouts.

Just a coincidence right?

citadel.com/leadership/dr-…

Just a coincidence right?

citadel.com/leadership/dr-…

The elites are only fanning the flames.

Read the room, Leon.

Read the room, Leon.

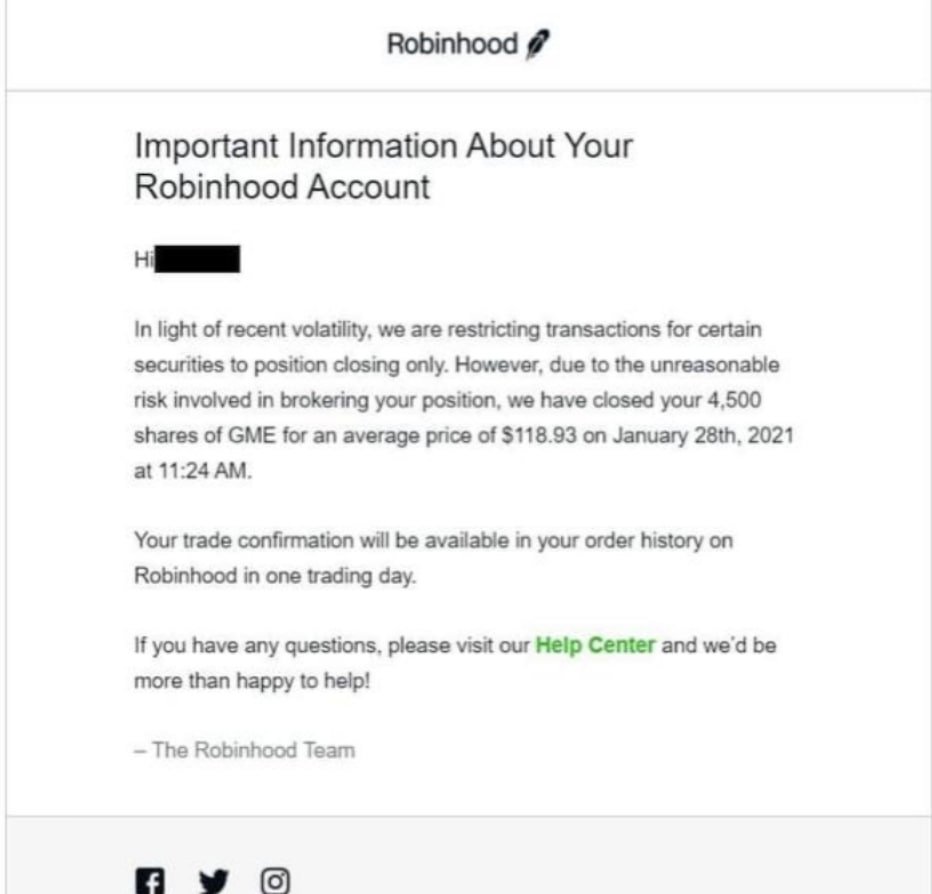

Robinhood literally closing out positions against the user's will in $GME.

I'm sure they have something in their ToS about this, but wow.

I'm sure they have something in their ToS about this, but wow.

Fox News' Gasparino: Regulatory sources say SEC will be looking at a market manipulation case on Robinhood and Reddit issues; expect SEC to ask for Robinhood's blue sheets trading data, and try to match it up with suspicious comments on Reddit - Source TradeTheNews.com

In other words, they are going to go after retail investors instead of Citadel, Melvin Capital, Point 72, D1, etc.

This is how it is rigged.

This is how it is rigged.

Another reason you should trade on decentralized exchanges or those that support cryptocurrencies:

bit.ly/ftx-us

or

bit.ly/ftx-ftw (outside of USA)

bit.ly/ftx-us

or

bit.ly/ftx-ftw (outside of USA)

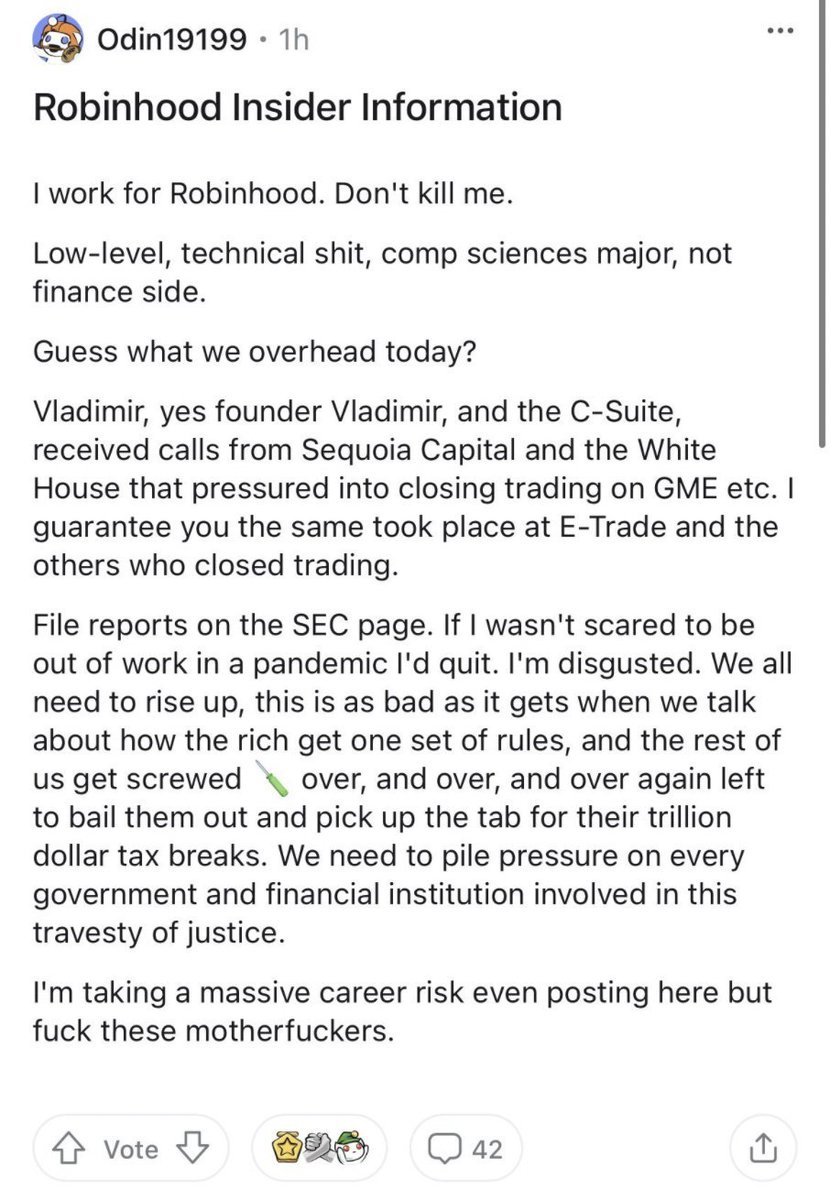

Big if true.

Sequoia (VC) and the White House called Robinhood's CEO to stop the $GME orders.

This is how the elites rig it.

Sequoia (VC) and the White House called Robinhood's CEO to stop the $GME orders.

This is how the elites rig it.

This is what it looks like when they rig the system.

The daily trading volume on a day where $GME made a new all time high is anemic.

The volume was so low it was below its 50 day moving average.

The daily trading volume on a day where $GME made a new all time high is anemic.

The volume was so low it was below its 50 day moving average.

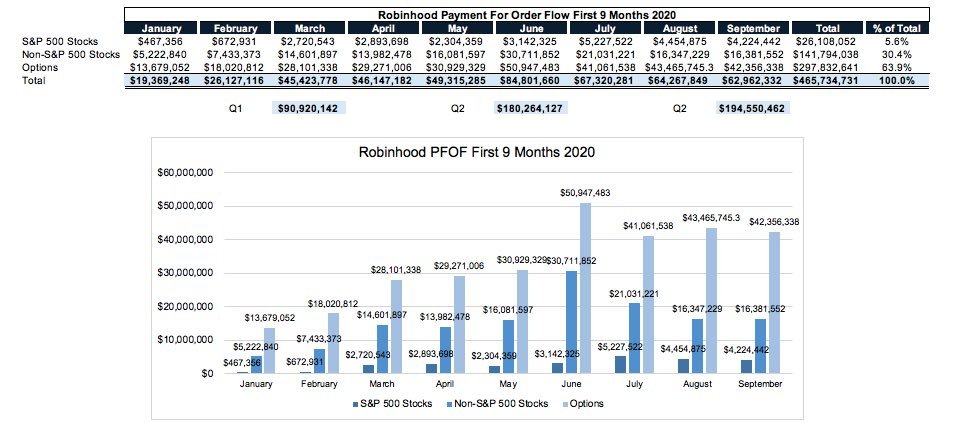

Citadel paid Robinhood $98M last quarter alone for order flow (PFOF), most of that was options.

Robinhood's business is tightly coupled to PFOF.

This is how they rig it.

(Hat tip @JohnStCapital)

Robinhood's business is tightly coupled to PFOF.

This is how they rig it.

(Hat tip @JohnStCapital)

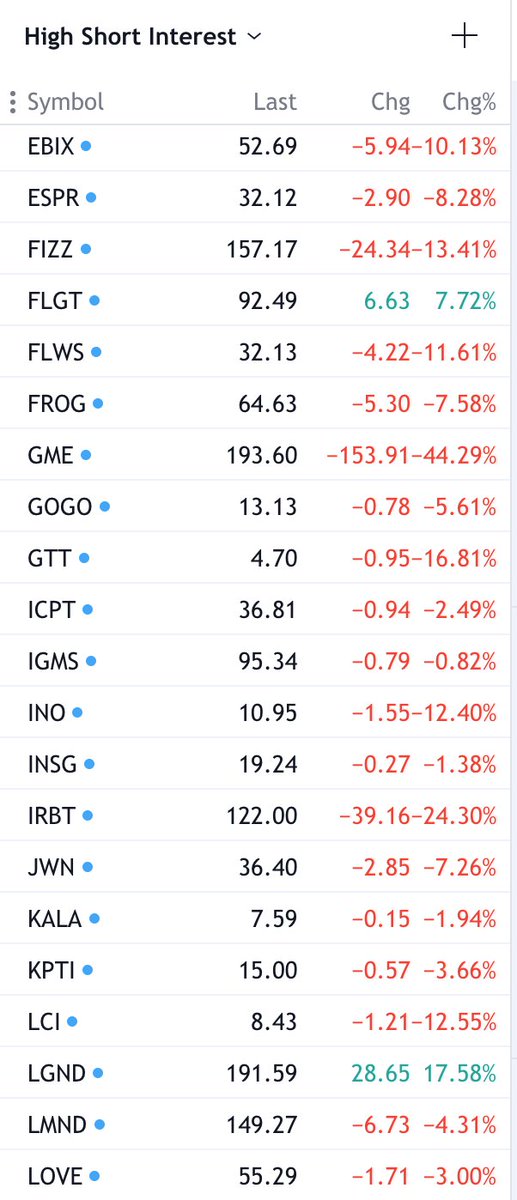

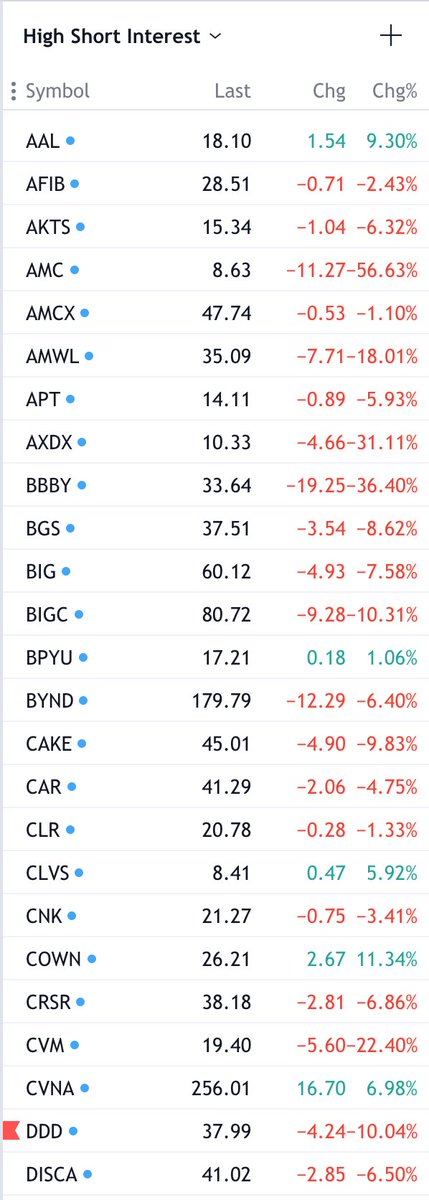

Oh weird, the day you can only sell highly shorted stocks they are almost ALL down huge.

These are the top 50 most shorted stocks on the market.

This is how it's rigged.

These are the top 50 most shorted stocks on the market.

This is how it's rigged.

New York Attorney General Letitia James today released the following statement:

“We are aware of concerns raised regarding activity on the Robinhood app, including trading related to the GameStop stock. We are reviewing this matter.”

“We are aware of concerns raised regarding activity on the Robinhood app, including trading related to the GameStop stock. We are reviewing this matter.”

ROBINHOOD LIKELY TO RAISE MARGIN REQUIREMENTS, SYSTEM IS UNDER STRESS - CNBC

This is the man who brought the "smartest guys" on Wall Street to their knees.

His Reddit username is "deepfuckingvalue".

He's up nearly $33M from an investment of $53,000.

Wall Street "geniuses" have lost billions.

wsj.com/articles/keith…

His Reddit username is "deepfuckingvalue".

He's up nearly $33M from an investment of $53,000.

Wall Street "geniuses" have lost billions.

wsj.com/articles/keith…

In 2019, I presented at a trading conference about how video gaming and trading would merge and become more like a social online sport.

/u/deepfuckingvalue has a professional gaming setup in his pic.

We've arrived.

Deck from the conference is here:

bit.ly/trading-is-a-v…

/u/deepfuckingvalue has a professional gaming setup in his pic.

We've arrived.

Deck from the conference is here:

bit.ly/trading-is-a-v…

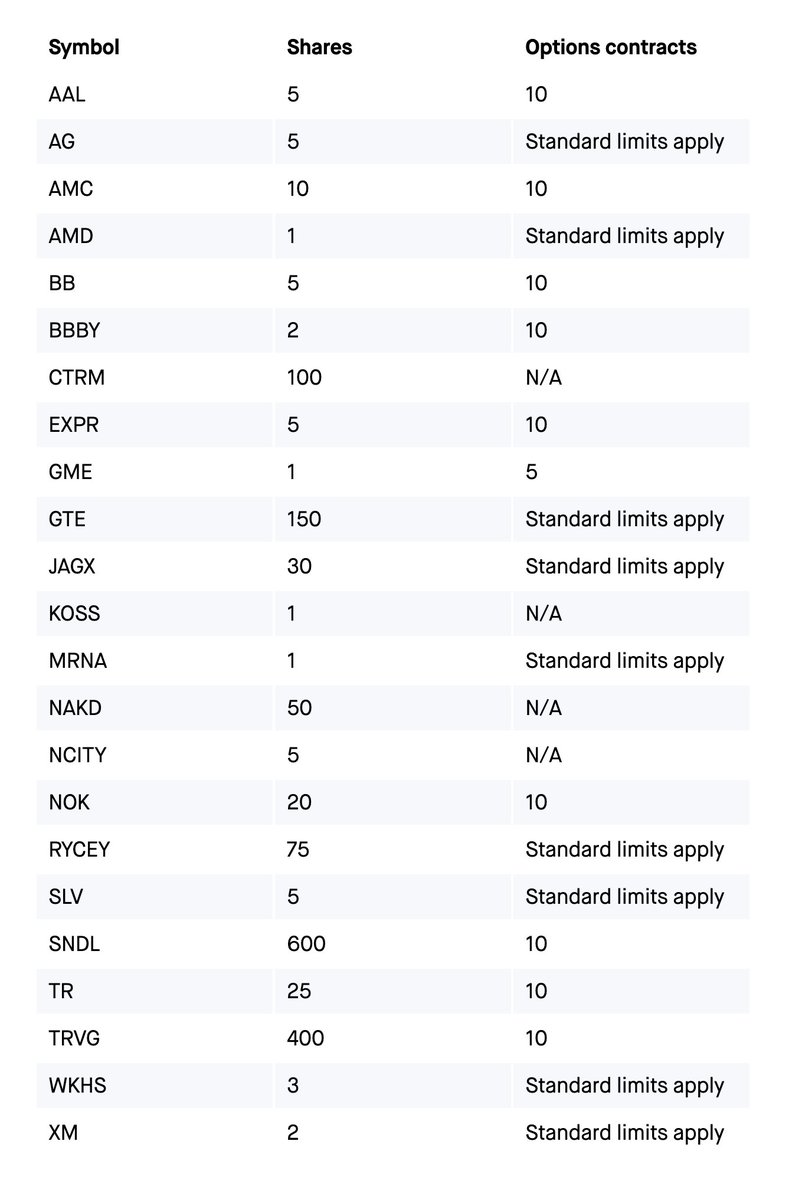

ROBINHOOD LIMITING BUY LIMIT FOR 23 STOCKS

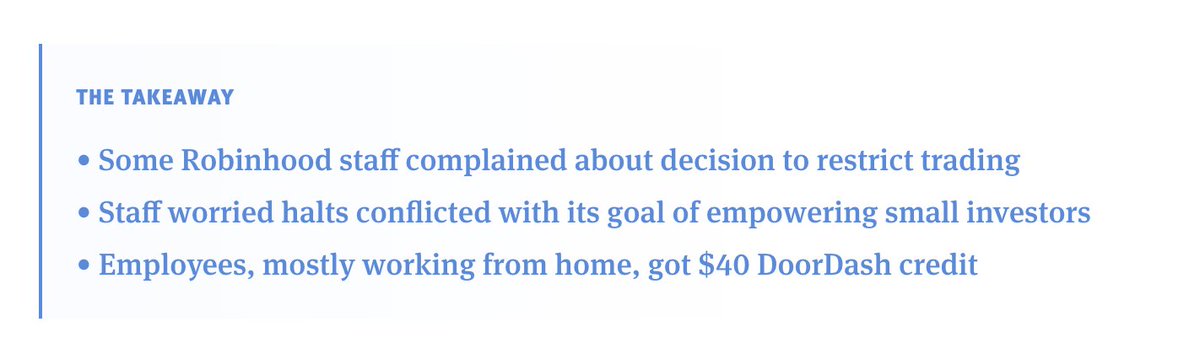

Robinhood gave employees a $40 @doordash credit yesterday when they raised concerns with trading restrictions.

bit.ly/39vkvjb

bit.ly/39vkvjb

TEXAS AG ISSUES CIDS TO E-TRADE, WEBULL, CITADEL, APEX, M1

Wow it's getting real

Wow it's getting real

PAXTON SAYS WALL STREET FIRMS CANNOT LIMIT PUBLIC ACCESS TO THE MARKET, CITES APPARENT COORDINATION BETWEEN HEDGE FUNDS AND OTHERS TO SHUT DOWN THREATS TO THEIR MARKET DOMINANCE

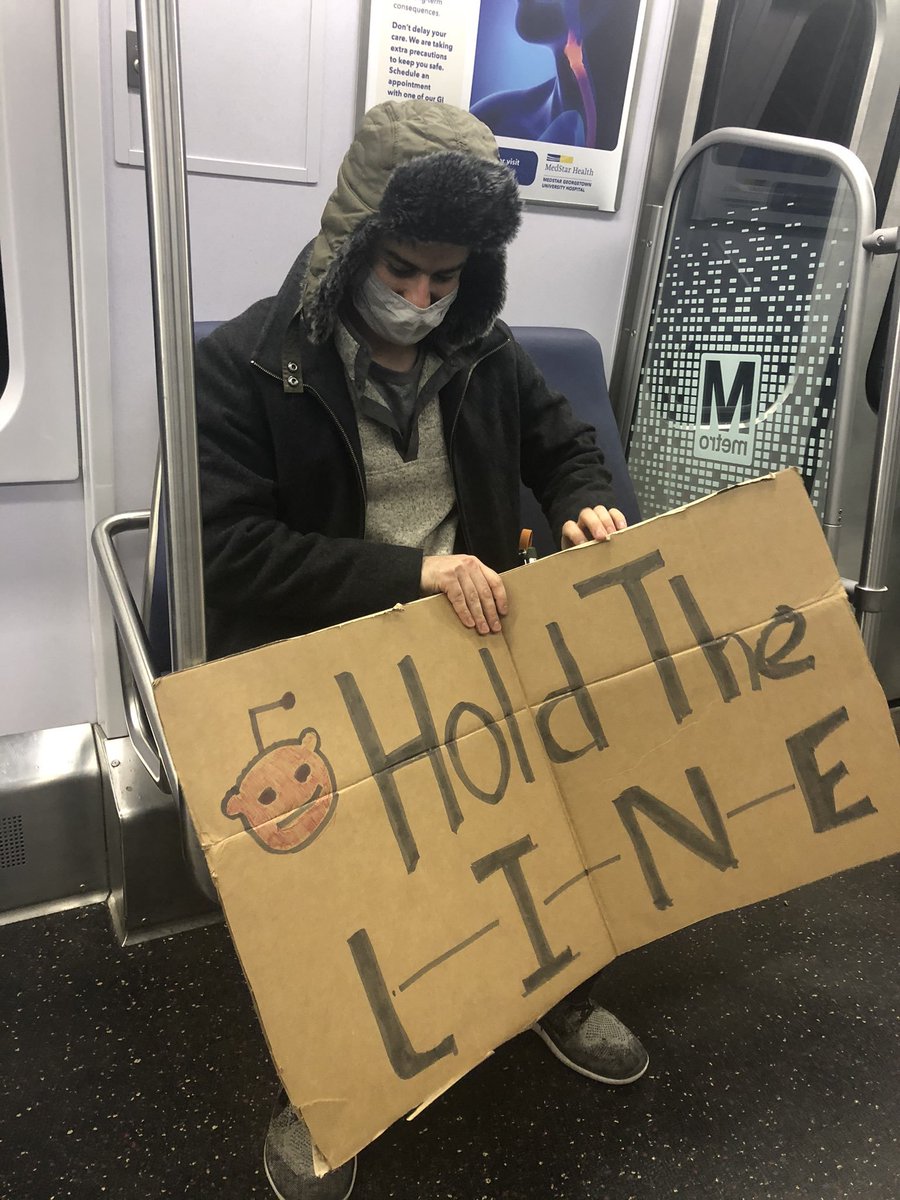

Wow, the Reddit Army did it.

They rekt the hedge funds this week.

Goldman Sachs admits it - the worst weekly alpha drawdown on record!

$GME @wsbmod

They rekt the hedge funds this week.

Goldman Sachs admits it - the worst weekly alpha drawdown on record!

$GME @wsbmod

And if this week couldn't any more bizarre, Louise Linton, the wife of former Treasury Secretary Steven Mnuchin, will release a self-written and -directed movie in which she plays a murderous, sex-addicted hedge fund manager.

Cannot make this stuff up.

trib.al/9kPjrMO

Cannot make this stuff up.

trib.al/9kPjrMO

• • •

Missing some Tweet in this thread? You can try to

force a refresh