“Only a fool trips on what’s behind them.” — Iceberg Slim ◢ Founder, CEO, Asymmetric Financial & Asymmetric Information

3 subscribers

How to get URL link on X (Twitter) App

With data going back to November 2014, a handful of Golden Crosses have occurred, with one most recently in February of this year.

With data going back to November 2014, a handful of Golden Crosses have occurred, with one most recently in February of this year.

Remember what music was like in the 1990s? You would go to Tower Records or your local music shop, and buy a CD, in some cases, in an oversized cardboard box, you’d get maybe 12-14 tracks of music, and the cost was around $16.

Remember what music was like in the 1990s? You would go to Tower Records or your local music shop, and buy a CD, in some cases, in an oversized cardboard box, you’d get maybe 12-14 tracks of music, and the cost was around $16.

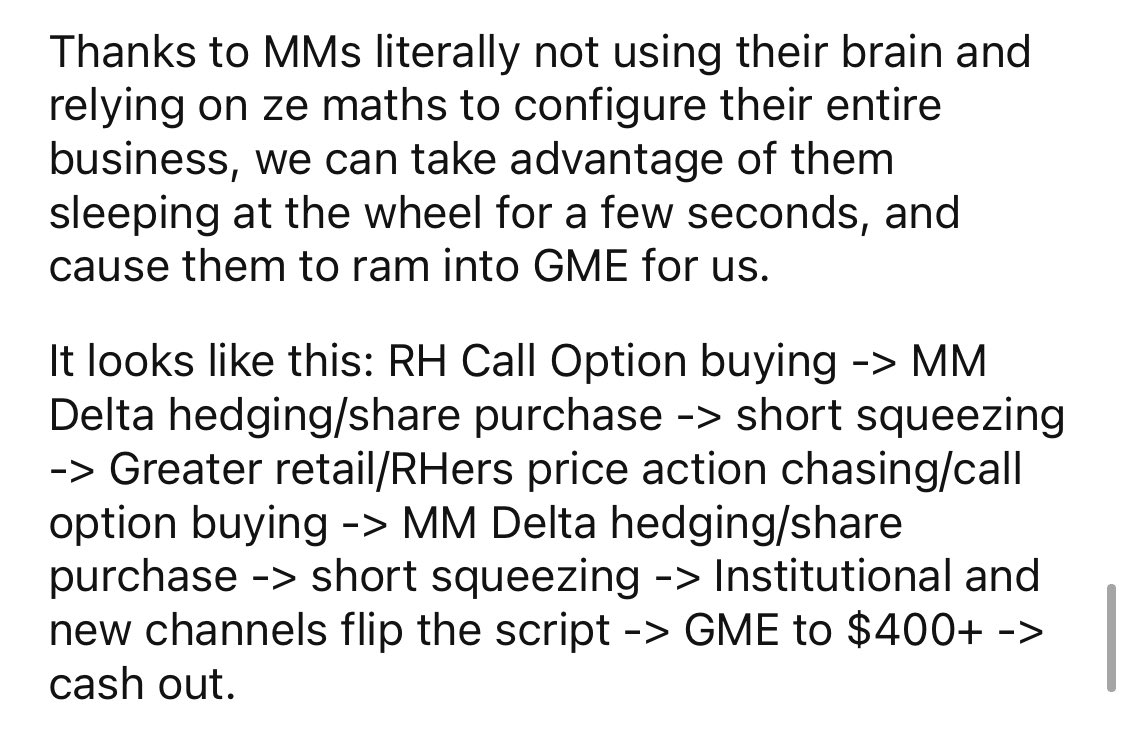

The #silversqueeze is the next example.

The #silversqueeze is the next example. https://twitter.com/QTRResearch/status/1355898843485724673

https://twitter.com/JohnStCapital/status/1355612053730447362

And here's @chamath explaining it to the suits...

And here's @chamath explaining it to the suits...

“With the initiation of the Fed’s complete takeover and control of the US financial economy, there is now absolutely no accurate pricing discovery in the capital markets and we have entered a period of total manipulation.”

“With the initiation of the Fed’s complete takeover and control of the US financial economy, there is now absolutely no accurate pricing discovery in the capital markets and we have entered a period of total manipulation.”