SEC should investigate the following:

1. Did Citadel’s hedge funds (Citadel Global Equities and Citadel Wellington) hold any short positions in stocks heavily owned by Robinhood users? And did they increase them in the past few days?

1. Did Citadel’s hedge funds (Citadel Global Equities and Citadel Wellington) hold any short positions in stocks heavily owned by Robinhood users? And did they increase them in the past few days?

2. Subpoena all emails and phone calls between Citadel Securities and Robinhood

3. Subpoena all emails and phone calls between the Wall Street banks and Robinhood (Robinhood gives its shares to Wall Street banks to lend out to hedge fund clients to short through prime brokerage).

Did the Wall Street banks communicate with Robinhood to stop trading GME otherwise they’d cut them off from their short borrow revenues?

4. Subpoena all emails and communications between the hedge funds who were taking huge losses who are investors in Robinhood (example: D1 Capital. D1 was down $4bn on its shorts and only has $200mn investment in Robinhood.

Thus D1 profits more by having Robinhood cease trading in their shorts than their Robinhood investment)

5. Subpoena all of the emails and phone calls between Ken Griffin and people in his Citadel Securities and Citadel hedge fund businesses

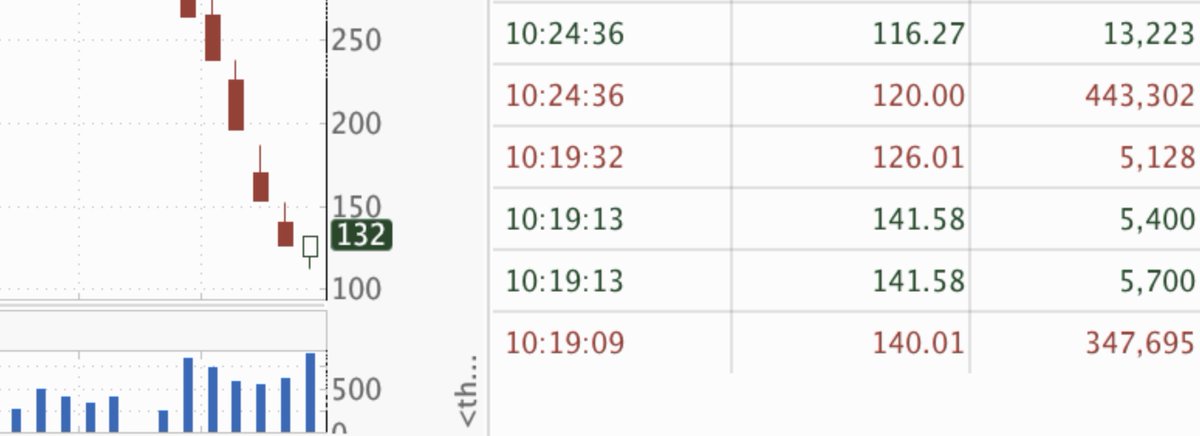

During today's short ladder...

•There was 443k shares sold in a single batch at $120 at 11:24:36 AM EST.

• There was 347k shares sold in a single batch at $140 at 11:19:09 AM EST.

Someone took a total loss of $300M from the price an hour prior OR that is a $100M short sale.

•There was 443k shares sold in a single batch at $120 at 11:24:36 AM EST.

• There was 347k shares sold in a single batch at $140 at 11:19:09 AM EST.

Someone took a total loss of $300M from the price an hour prior OR that is a $100M short sale.

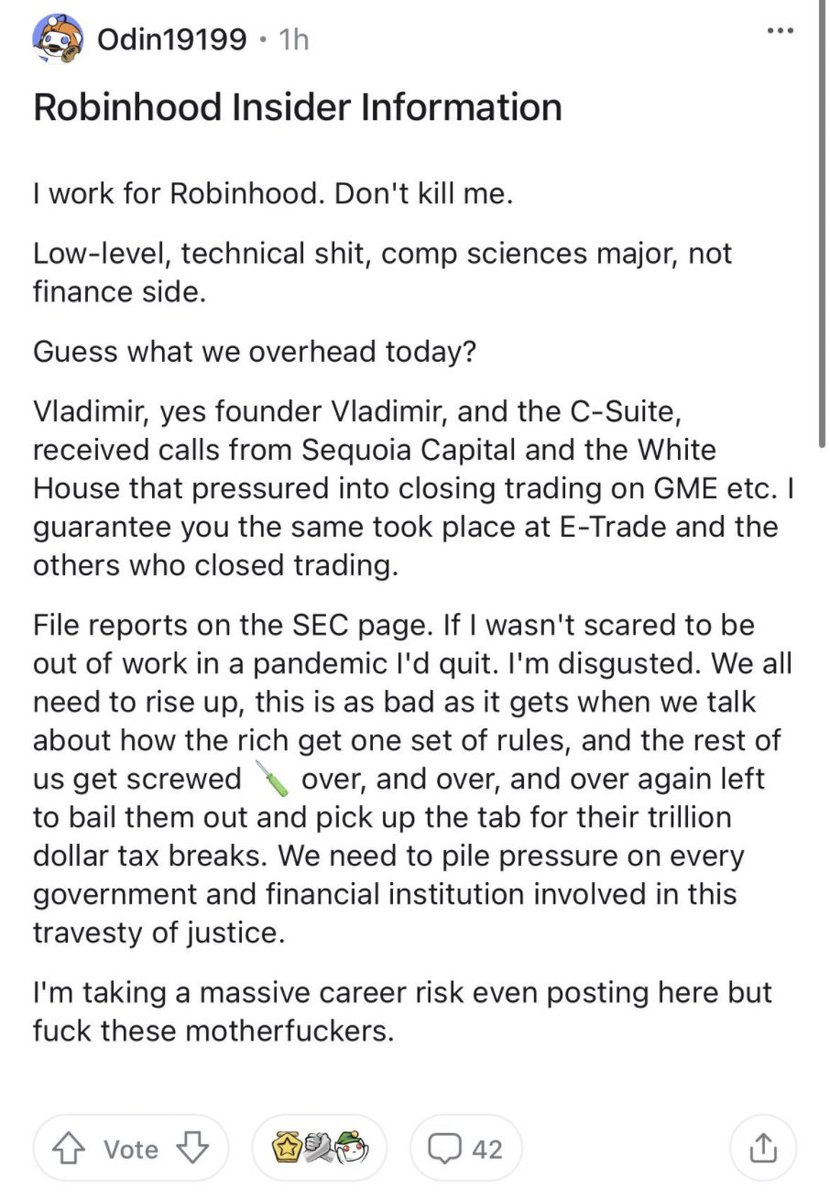

Any other brave Robinhood employees who are willing to whistleblow should come forward anonymously to reporters. I can put you in touch.

Class action lawsuit filed in NY against Robinhood

https://twitter.com/LJMoynihan/status/1354836830169006081

Join the class from @DoNotPayLaw now!

https://twitter.com/jbrowder1/status/1354871260459589633

Robinhood allowing trades again starting tomorrow: blog.robinhood.com/news/2021/1/28…

To be clear, Robinhood is just one brokerage. This is an endemic problem across TD Ameritrade, Schwab, ETrade and more.

To be clear, Robinhood is just one brokerage. This is an endemic problem across TD Ameritrade, Schwab, ETrade and more.

• • •

Missing some Tweet in this thread? You can try to

force a refresh