1/ Exploiting Closed-End Fund Discounts: A Systematic Examination of Alphas (Patro, Piccotti, Wu)

"We estimate CEF expected returns as a function of the history of premiums and current premium. Previous studies understated the value of this information."

papers.ssrn.com/sol3/papers.cf…

"We estimate CEF expected returns as a function of the history of premiums and current premium. Previous studies understated the value of this information."

papers.ssrn.com/sol3/papers.cf…

2/ "We employ current information to forecast future returns using the parametric model estimated with prior data. By allowing 𝛼𝑖 and 𝛽𝑖 to be freely estimated parameters, we consider valuable information in the premium mean-reversion speeds, which previous studies ignore."

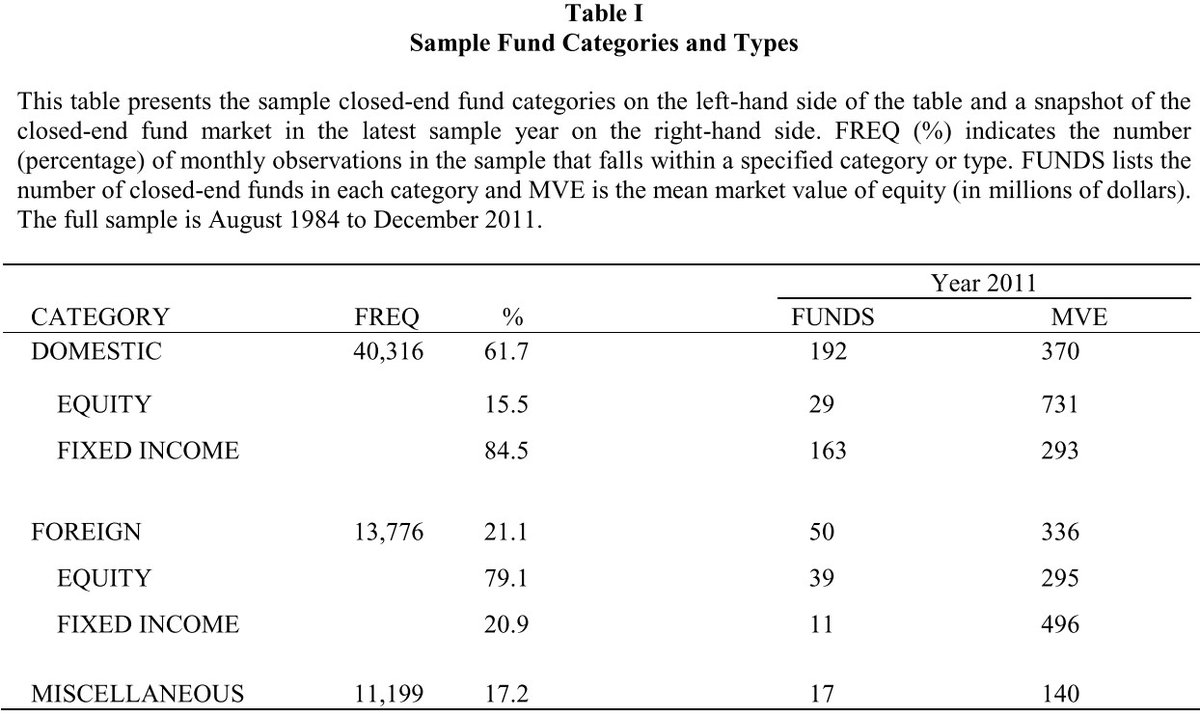

3/ "CEF fund type classifications are obtained from Morningstar.

"In 2011, the mean market value of equity was $370 million for domestic CEFs, $336 million for foreign CEFs, and $140 million for miscellaneous CEFs."

"In 2011, the mean market value of equity was $370 million for domestic CEFs, $336 million for foreign CEFs, and $140 million for miscellaneous CEFs."

4/ "The finding that funds investing internationally trade at larger premiums is consistent with the model of Cherkes, et al. (2009), in which investors trade in the more easily accessible CEFs rather than trade in the less accessible underlying assets directly."

5/ "A minimum fund life of 120 months is a good compromise between parameter estimation precision and avoiding survivorship bias. We estimated exp. returns with a cumulative rolling regression.

"Null is rejected (at 5%) in favor of mean reversion in premium for half of CEFs."

"Null is rejected (at 5%) in favor of mean reversion in premium for half of CEFs."

6/ "The long-short portfolio turns over at an annualized rate of 2.939 times.

"CEF share turnover and dollar trading volume do not appear to be large; they coincide with the fourth and fifth deciles of NYSE stocks over the same sample period."

"CEF share turnover and dollar trading volume do not appear to be large; they coincide with the fourth and fifth deciles of NYSE stocks over the same sample period."

7/ "Mean reversion parameters correspond to a premium half-life of 8.2 months for the full sample of CEFs and 6.4 months for CEFs in the Q5-Q1 L-S portfolio.

"Median CEF bid-ask spreads during the sample period are 0.678%, amounting to an annualized transaction cost of 2%."

"Median CEF bid-ask spreads during the sample period are 0.678%, amounting to an annualized transaction cost of 2%."

8/ "While increased turnover for the RADF strategy relative to BMR makes it unlikely that RADF continues to outperform BMR after transaction costs, the differential gross expected returns shed light on the value of the information contained in the history of premiums."

9/ "Trading returns appear to be randomly distributed over time, providing evidence that the excess returns from our L/S strategy are not being driven by tax-loss selling. Large return outliers are also not present in the time series, suggesting no evidence of a peso problem."

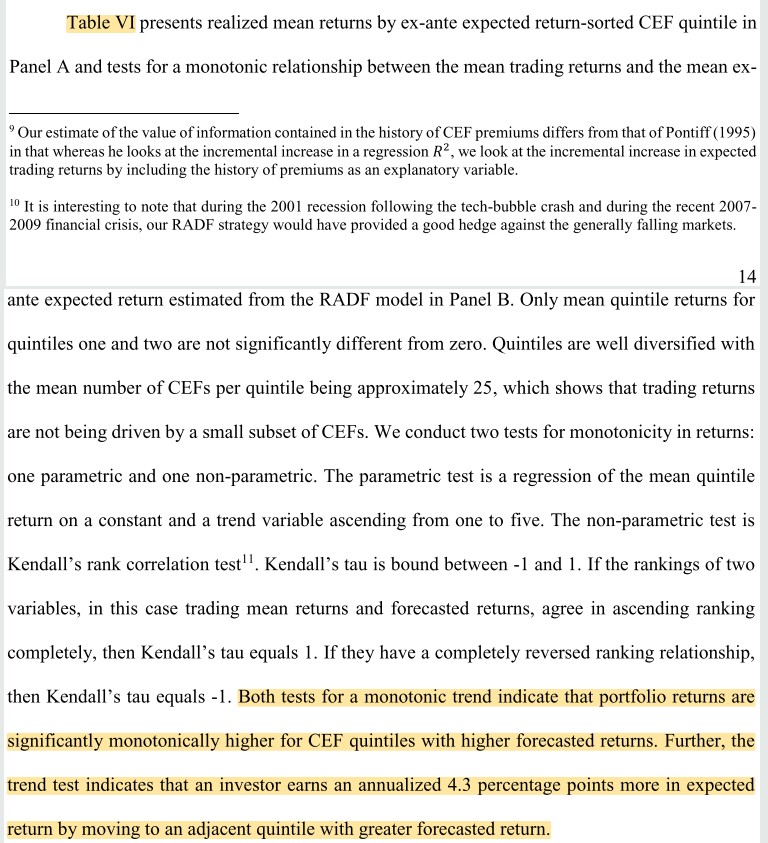

10/ "Both tests for a monotonic trend indicate that portfolio returns are monotonically higher for quintiles with higher forecasted returns.

"An investor earns an annualized 4.3 pct points more in expected return by moving to an adjacent quintile with greater forecasted return."

"An investor earns an annualized 4.3 pct points more in expected return by moving to an adjacent quintile with greater forecasted return."

11/ "Table VII presents the mean returns for the BMR and RADF trading strategies, conditioned on the minimum number of observations a CEF is required to have prior to entering the sample. The RADF model outperforms the BMR model for all minimum observation criteria."

12/ "The information contained in premiums is orthogonal to systematic risk factors.

"Time varying risk premia cannot explain the abnormal returns attainable from exploiting CEF premiums."

"Time varying risk premia cannot explain the abnormal returns attainable from exploiting CEF premiums."

13/ "The large arbitrage trading strategy returns cannot be explained by commonly used risk factors and cannot be explained by selling domestic CEFs and buying foreign CEFs to obtain a market segmentation premium."

14/ "Our long-short portfolio returns may hypothetically be an artifact of the equity premium by systematically buying equities CEFs and selling fixed-income CEFs.... but we show that the trading returns cannot be attributed to biased holdings in equities or fixed-income CEFs."

15/ "That the CEF discount continues to be exploitable is puzzling, since it was first documented more than 30 years ago.

"However, we do not find a statistically significant difference between mean returns in the first and second sub-periods."

"However, we do not find a statistically significant difference between mean returns in the first and second sub-periods."

16/ "Returns continue to be statistically >0 for up to 3 months: evidence of return continuation. Whereas the L/S mean return for a 1-month holding period is 1.5%, the mean cumulative return for a 3-month holding period is 2%."

(entire holding period returns annualized ones)

(entire holding period returns annualized ones)

17/ "The annualized mean return for the long-short momentum portfolio in CEFs is never significantly higher than zero for any holding period.

"Momentum effects do not seem to exist in the CEF market, which is to be expected if premiums mean revert due to risky arbitrage."

"Momentum effects do not seem to exist in the CEF market, which is to be expected if premiums mean revert due to risky arbitrage."

18/ "CEFs are initially issued with their share price at a premium, but that their share price then quickly falls to a discount.

"However, the alpha for the RADF trading strategy is generally unchanged after dropping the first h months of a CEF's life from the sample."

"However, the alpha for the RADF trading strategy is generally unchanged after dropping the first h months of a CEF's life from the sample."

• • •

Missing some Tweet in this thread? You can try to

force a refresh