A threat on potential risks on this market and why we may see more asset price volatility and failing companies.

I haven't been involved in swap markets for a long time and I am admittedly making a few leaps here to draw some conclusions but I don't think these are too off.

I haven't been involved in swap markets for a long time and I am admittedly making a few leaps here to draw some conclusions but I don't think these are too off.

Let's use Robinhood and their "crypto" platform as an example. A user logs into their RH account and buys $500 worth of bitcoin. What happens next?

Most would intuitively think:

"Well... Of course RH goes out, finds a seller of the same amount of bitcoin and holds those bitcoins in their custody under my name."

Right?

Nope...

"Well... Of course RH goes out, finds a seller of the same amount of bitcoin and holds those bitcoins in their custody under my name."

Right?

Nope...

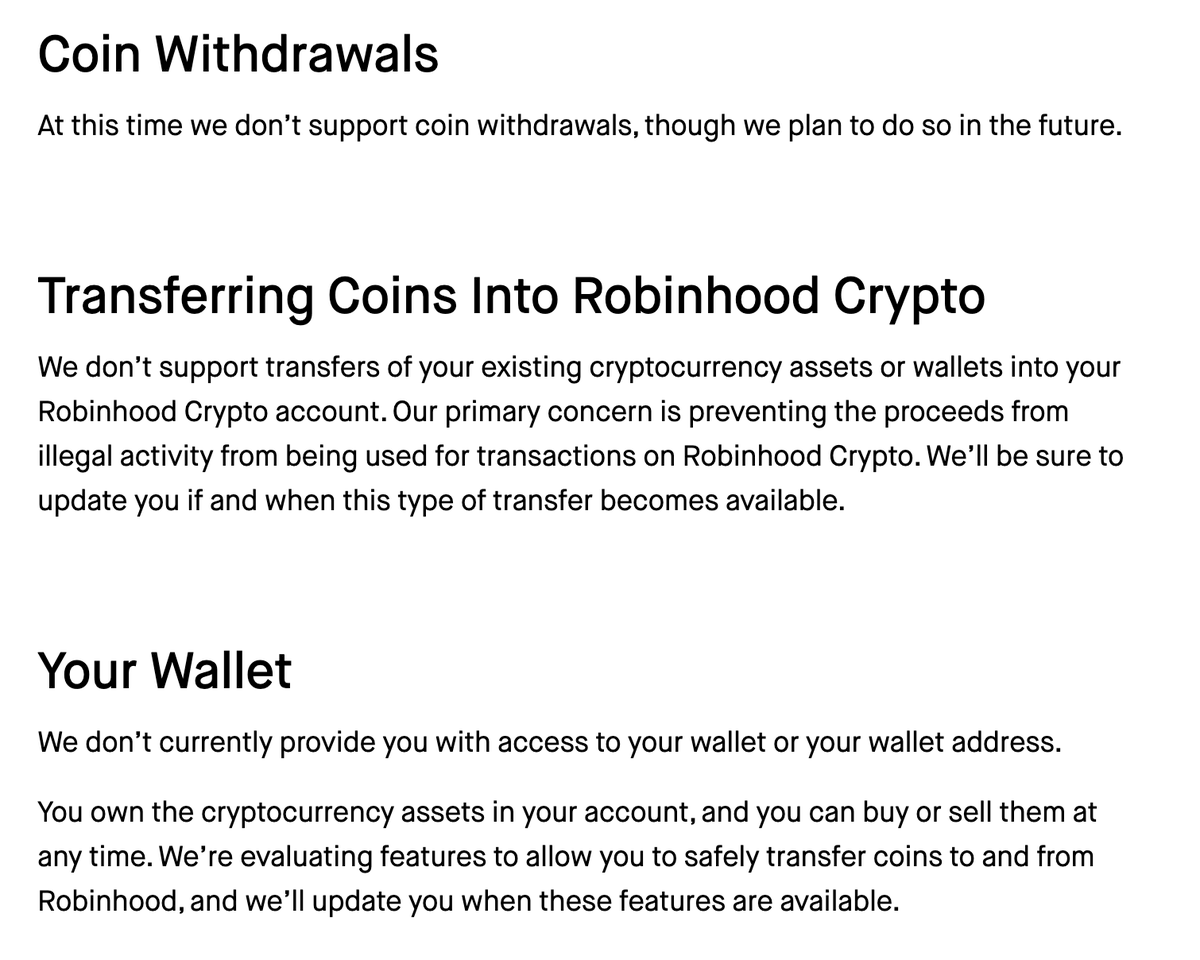

One of the main reasons why you can't withdraw the BTC from your RH account is because.... wait for it.... there is no real bitcoin in their balance sheet!

[This is where I admit I am making a leap but keep reading]

[This is where I admit I am making a leap but keep reading]

What RH probably does when you purchase a bitcoin in their account is to enter into a total return swap with a counterparty. Let's use an example to make it easier to understand.

Made up Total Return Swap

---------------------------

Notional: $500

Maturity: 1 week

Citadel pays/receive: BTC price return (+ / -)

RH pays: 3mo Libor + spread

Collateral: 10% (daily margin call)

---------------------------

Notional: $500

Maturity: 1 week

Citadel pays/receive: BTC price return (+ / -)

RH pays: 3mo Libor + spread

Collateral: 10% (daily margin call)

What does that mean?

After 1 week, Citadel will pay the positive return on BTC (or receive if negative).

RH will pay interest (why? because there is no cash exchange on a swap. When you buy BTC you have to pay upfront, on a swap you don't.)

RH will place 10% collateral ($50)

After 1 week, Citadel will pay the positive return on BTC (or receive if negative).

RH will pay interest (why? because there is no cash exchange on a swap. When you buy BTC you have to pay upfront, on a swap you don't.)

RH will place 10% collateral ($50)

OK, by now you may have started to see some problems with this...

Now, RH is hedged. If your Bitcoin goes up, Citadel pays them and you get your money (assuming you sell also in a week).

Citadel, on the other hand.... Now is short BTC. Price goes up, they have to pay RH.

Citadel, on the other hand.... Now is short BTC. Price goes up, they have to pay RH.

But Citadel is not in the business of going long or short BTC. So they either go out, find the real thing and perfectly hedge their positions or....

They call another exchange to do a similar swap they did with RH (with a better spread). Let's say they trade with Square.

They call another exchange to do a similar swap they did with RH (with a better spread). Let's say they trade with Square.

Before complicating things a bit more (trust me, these things have more layers than a Russian nesting doll on LSD) let's start pointing some obvious and not-so-obvious risks here.

Risk 1: Counterparty risk

Square goes under (for any reason) => they don't pay Citadel => Citadel still needs to pay RH

= Citadel in trouble

Square goes under (for any reason) => they don't pay Citadel => Citadel still needs to pay RH

= Citadel in trouble

Risk 1.a: The never ending hedge

Let's say Square does another swap with another counterparty, that does it with another and another and another. Technically, this thing can keep going without anyone ever buying a single satoshi. A compounding risk of counterparty risks!

Let's say Square does another swap with another counterparty, that does it with another and another and another. Technically, this thing can keep going without anyone ever buying a single satoshi. A compounding risk of counterparty risks!

There may be 10x, 100x, nx the notional in swaps than there are in sats positions at any given point.

Risk 3: Matching duration (smaller risk)

Remember RH did a 1 week swap? What if after day one every single RH user sells their bitcoin? Usually, in large numbers and in normal markets these risks are small and manageable but managing this gets complicated fast.

Remember RH did a 1 week swap? What if after day one every single RH user sells their bitcoin? Usually, in large numbers and in normal markets these risks are small and manageable but managing this gets complicated fast.

Risk 4: Margin Calls

Let's say Bitcoin price goes down by a lot. RH will need to pay Citadel a lot of money. To reduce the risk, Citadel calls them up and asks for margin. ASSUMING they still have the $500 you paid them, they should be fine. But usually they use this capital.

Let's say Bitcoin price goes down by a lot. RH will need to pay Citadel a lot of money. To reduce the risk, Citadel calls them up and asks for margin. ASSUMING they still have the $500 you paid them, they should be fine. But usually they use this capital.

There are other risks but I'm trying to keep this thread simple (otherwise I would have written a blog). I am leaving a lot of details out...

After 2008, swap desks started getting a bit more sophisticated and cute by developing products that could be more "efficient" in terms of taxes, protection and collateral.

Some, for example, would have embedded leverage where the collateral is fixed and can never be margin called (but with the risk of a gap move in price).

Other systems were created to net collateral so it is also more "efficient". Others can be converted to the underlying asset.

Other systems were created to net collateral so it is also more "efficient". Others can be converted to the underlying asset.

This created a black box of risk. It is a nightmare for regulators trying to monitor systemic risk. Sometimes a small hedge fund going under triggers a cascade of defaults in the swap markets. No one knows where the risk ends and how it compounds.

With exchanges offering fractional shares and trying to optimize for low fees (since trades are all zero commission) they have used swaps more. But someone, somewhere, at some point, still needs to buy the real asset. Market gets nervous, liquidations happen...

... all of the sudden swap participants are scrambling to find the underlying asset (maybe what happened with Dogecoin?). Low liquidity + need to delivery = prices explode.

Bottom line. The size of this event is unknown. Do not use any exchanges to hold bitcoin. Buy the real thing, keep in cold storage and let the financial markets shenanigans happen while you enjoy some popcorn.

• • •

Missing some Tweet in this thread? You can try to

force a refresh