How to get URL link on X (Twitter) App

"But Bitcoin is too volatile."

"But Bitcoin is too volatile."

Why does this matter? Good forecasting helps us understand risk.

Why does this matter? Good forecasting helps us understand risk.

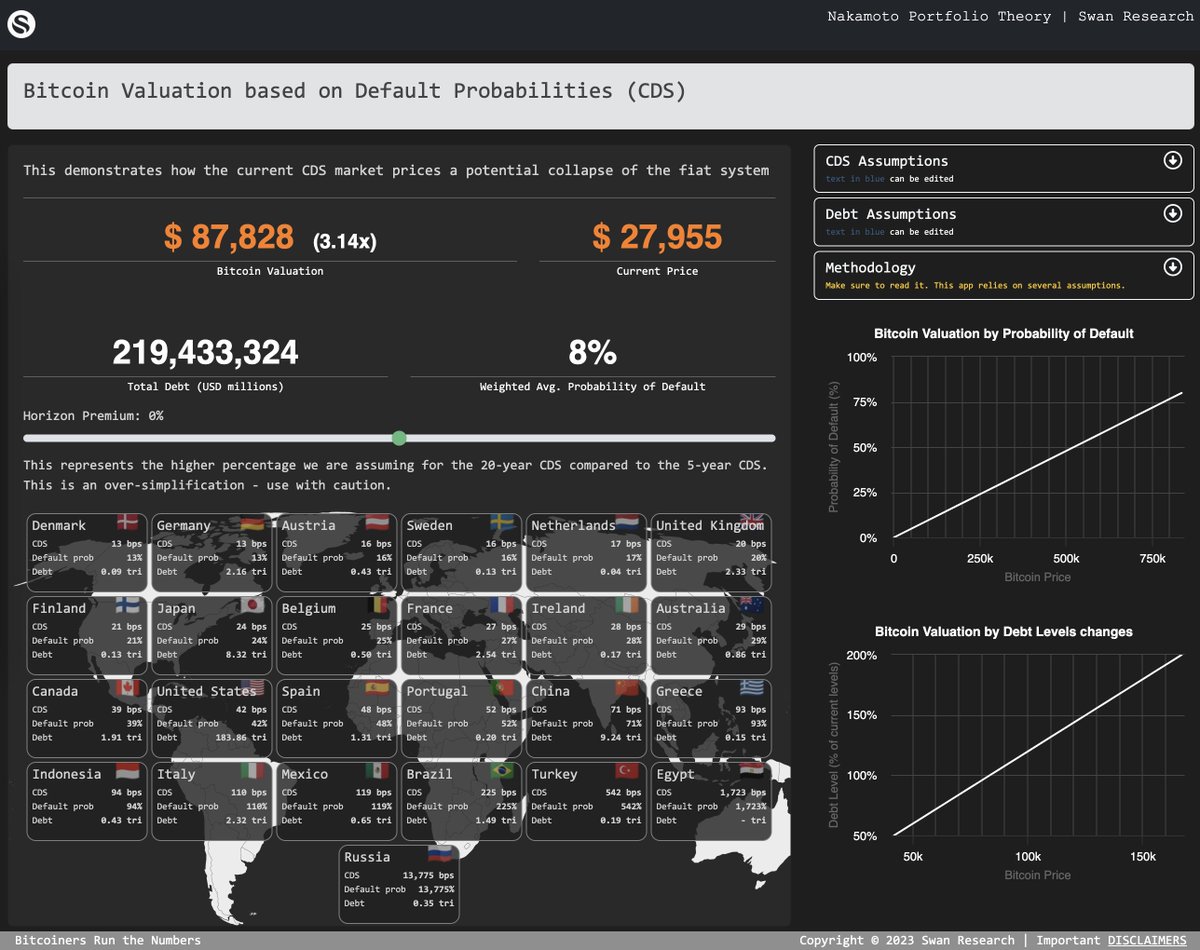

In line with our other research pieces, this one comes with a web app so you can also run the numbers.

In line with our other research pieces, this one comes with a web app so you can also run the numbers.

Since 2014, that portfolio returned 16% annualized (assuming quarterly rebalancing). Not bad.

Since 2014, that portfolio returned 16% annualized (assuming quarterly rebalancing). Not bad.

https://twitter.com/alphaazeta/status/1638226302216839178?s=20

2/ First off, an Individual Retirement Account (IRA) is a tax-advantaged investment vehicle designed to encourage saving for retirement. It offers potential tax benefits, and versions of these accounts exist all around the world. 🌍

2/ First off, an Individual Retirement Account (IRA) is a tax-advantaged investment vehicle designed to encourage saving for retirement. It offers potential tax benefits, and versions of these accounts exist all around the world. 🌍

This model considers Bitcoin's potential to capture the monetary premium of traditional assets like real estate, stocks, and bonds, leading to a shift in capital allocation and reevaluation of their worth ▶️

This model considers Bitcoin's potential to capture the monetary premium of traditional assets like real estate, stocks, and bonds, leading to a shift in capital allocation and reevaluation of their worth ▶️

2/ 🌐 Greenpeace is known to have spread misinformation on various topics like nuclear energy [1], GMOs [2], and its controversial Indian Government stand [3]. They often present a one-sided view, ignoring scientific evidence that contradicts their narrative.

2/ 🌐 Greenpeace is known to have spread misinformation on various topics like nuclear energy [1], GMOs [2], and its controversial Indian Government stand [3]. They often present a one-sided view, ignoring scientific evidence that contradicts their narrative.

I’ve been a critic of services like @BlockFi for a while. Not getting too much into that. And the below is a guess on my part.

I’ve been a critic of services like @BlockFi for a while. Not getting too much into that. And the below is a guess on my part.

GBTC gives an option for investors to contribute "in-kind". This means that you can buy BTC at market price and convert into an instrument that trades at a premium. This premium oscillates but it's been >20% recently. So, theoretically investors could "arb" this spead.

GBTC gives an option for investors to contribute "in-kind". This means that you can buy BTC at market price and convert into an instrument that trades at a premium. This premium oscillates but it's been >20% recently. So, theoretically investors could "arb" this spead.