GameStop is an interesting story, but there is a bigger and much more serious question about financial markets

As someone who studies finance, I know finance has tremendous potential to benefit society

But there is something serious to worry in the trend since the 80s

As someone who studies finance, I know finance has tremendous potential to benefit society

But there is something serious to worry in the trend since the 80s

Let's start with the story we like to tell students in finance 101

"financial markets take money from savers and give it to entrepreneurs who invest it to make economic growth possible"

This is indeed a very important function of financial markets

However ....

"financial markets take money from savers and give it to entrepreneurs who invest it to make economic growth possible"

This is indeed a very important function of financial markets

However ....

Since the 80s financial market has increasingly been doing something quite different

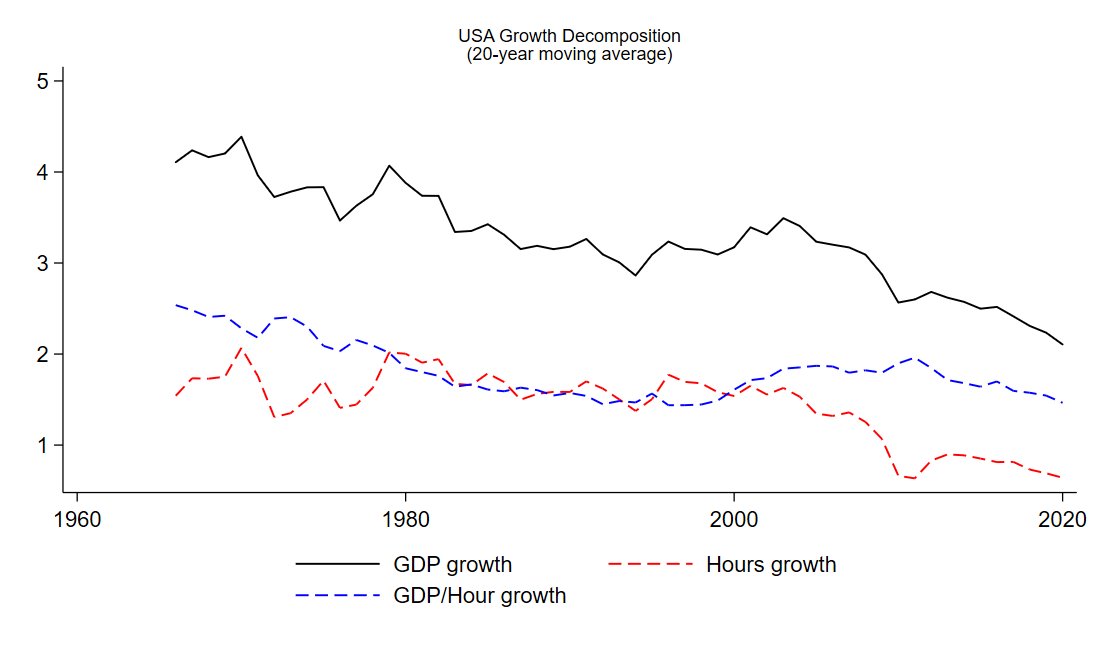

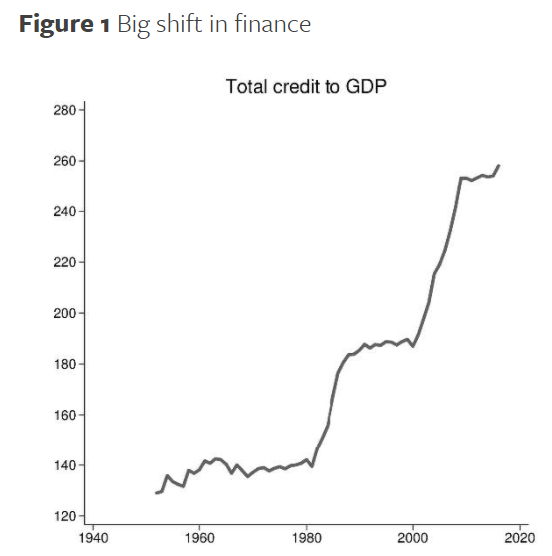

The size of financial sector has almost *doubled* in terms of credit given out per $ of output

Yet, investment has not risen at all and in fact been trending down

The size of financial sector has almost *doubled* in terms of credit given out per $ of output

Yet, investment has not risen at all and in fact been trending down

So what is all this credit creation for?

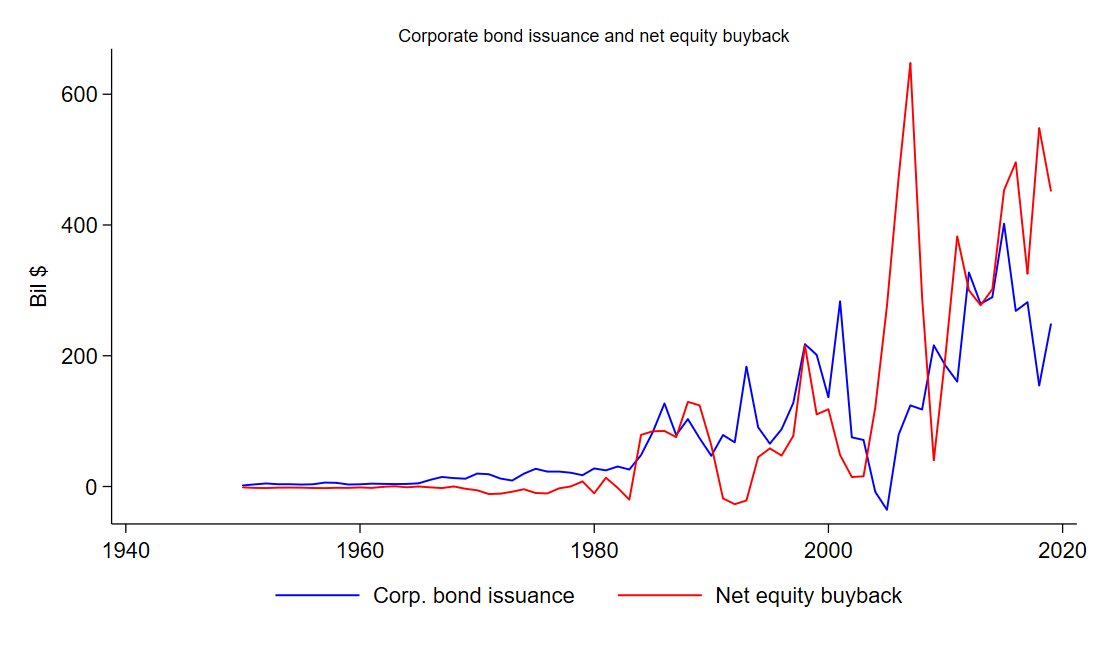

As an example, let's looking at corporate credit, and in particular corporate bonds: these are $'s that large corporations borrow from financial markets

Surely this money must be used as finance 101 predicts?

As an example, let's looking at corporate credit, and in particular corporate bonds: these are $'s that large corporations borrow from financial markets

Surely this money must be used as finance 101 predicts?

Not really

While there's been a large increase in corporate bond issuance, on net its all gone back to shareholders via stock buybacks

In fact the red line here is *net* equity buy back - which means even after accounting for new equity issuance, buy backs dominate

While there's been a large increase in corporate bond issuance, on net its all gone back to shareholders via stock buybacks

In fact the red line here is *net* equity buy back - which means even after accounting for new equity issuance, buy backs dominate

The Bils of $ borrowed every year are used to buy back stock and not to make any real investment

Why go through the hassle of borrowing if you don't need the money? It helps to save on taxes

Why go through the hassle of borrowing if you don't need the money? It helps to save on taxes

There is a lot more that's going on here

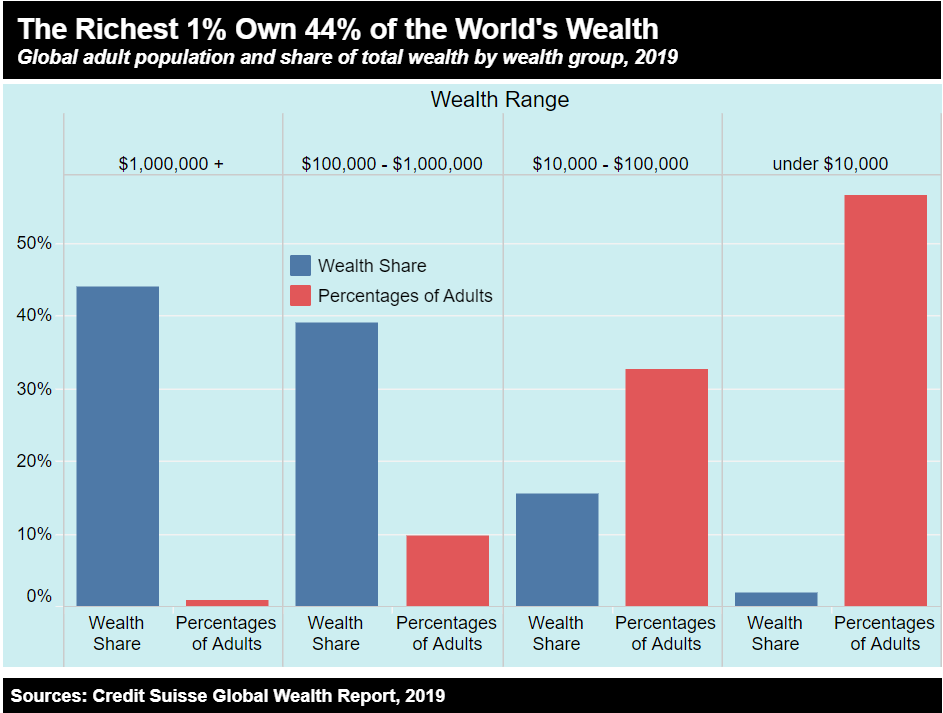

For example, the big rise of finance since the 80's is closely related to the rise in inequality that has produced a "saving glut of the rich" (see paper)

GameStop is just a canary in the coal mine

scholar.harvard.edu/files/straub/f…

For example, the big rise of finance since the 80's is closely related to the rise in inequality that has produced a "saving glut of the rich" (see paper)

GameStop is just a canary in the coal mine

scholar.harvard.edu/files/straub/f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh