Lost in the entire discussion about banning shorts is this: What do clients want?

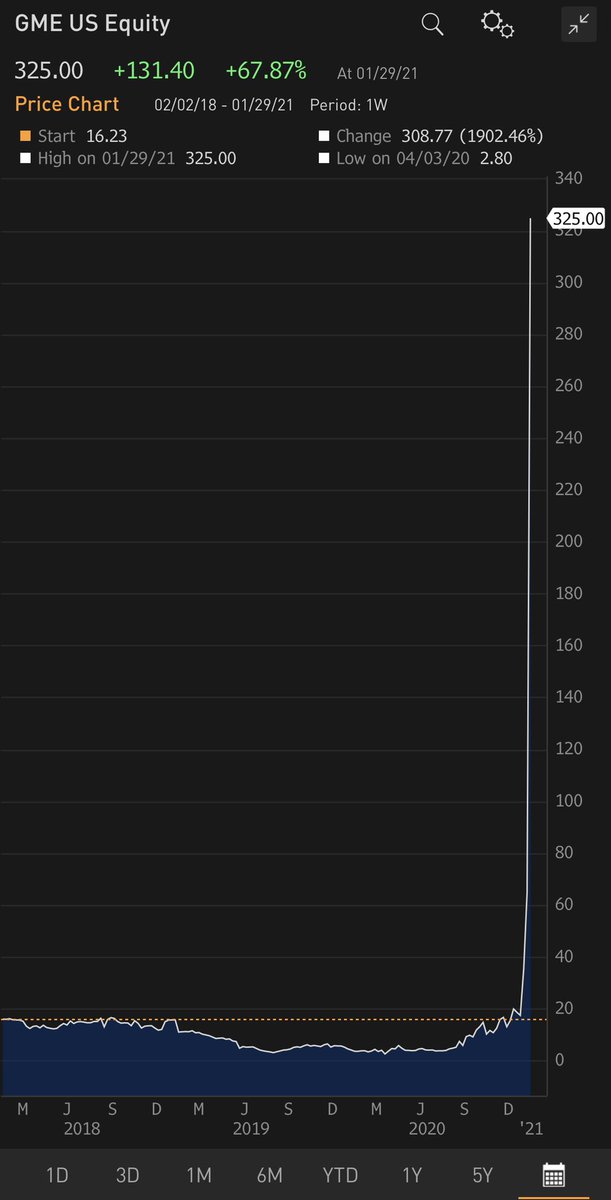

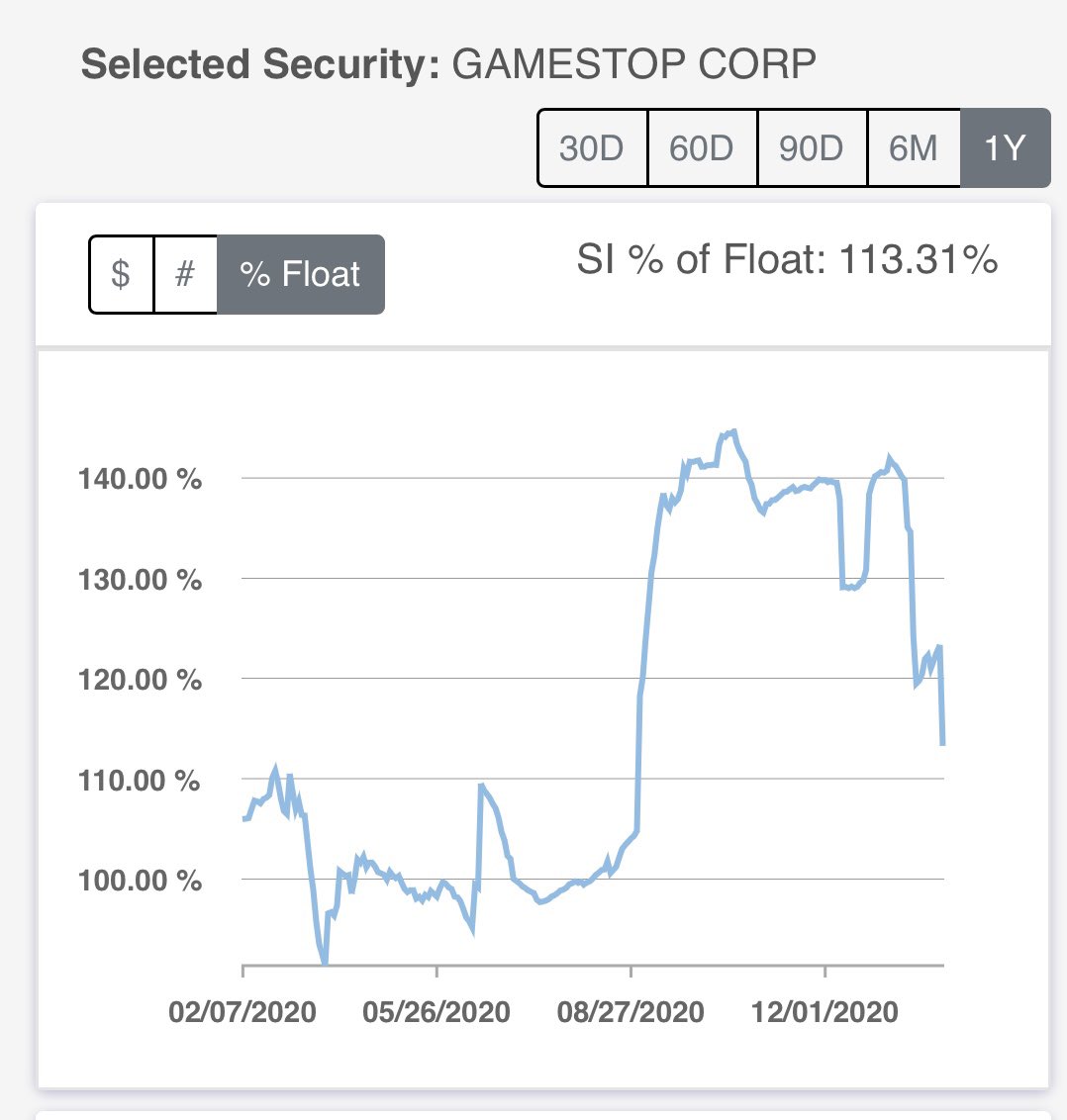

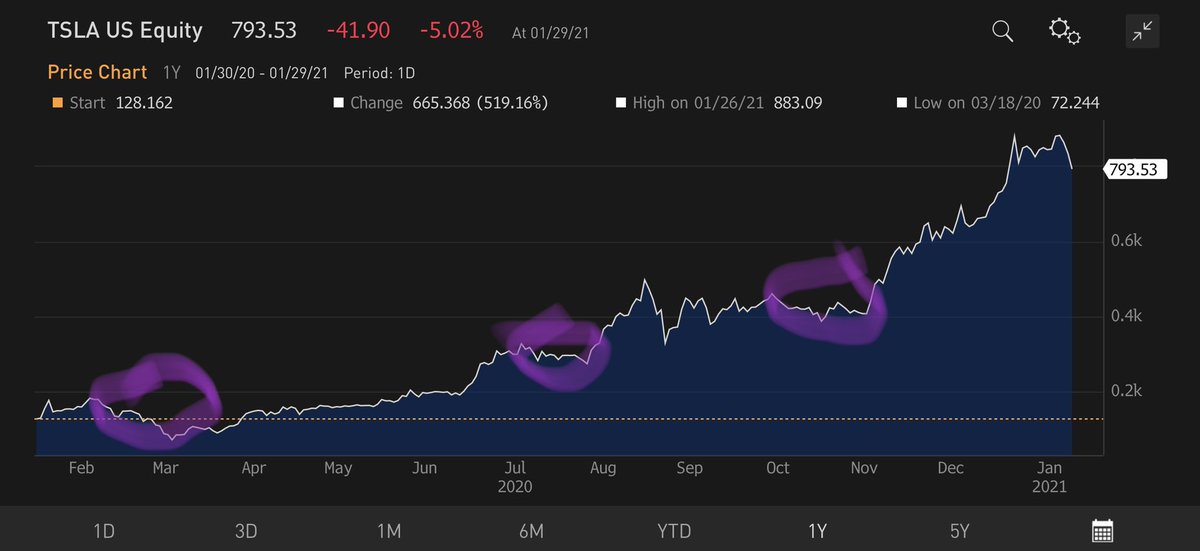

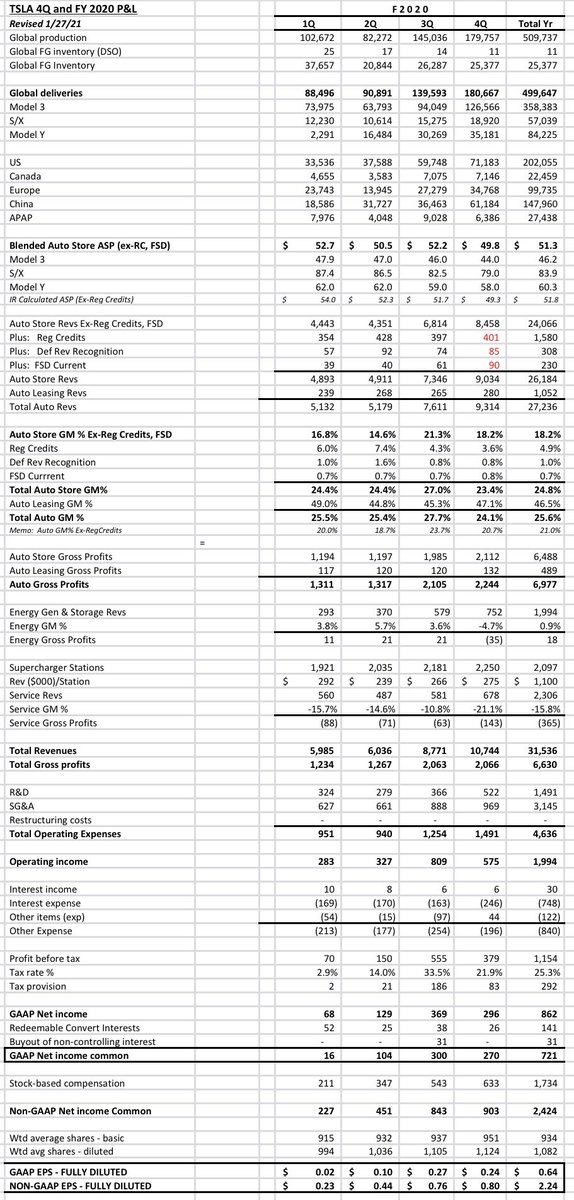

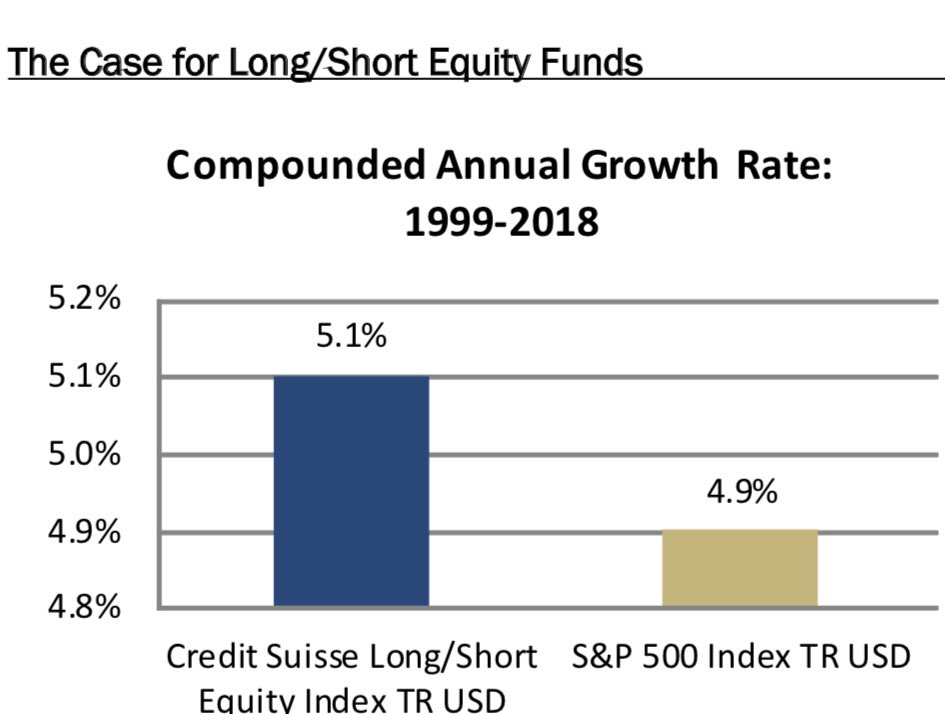

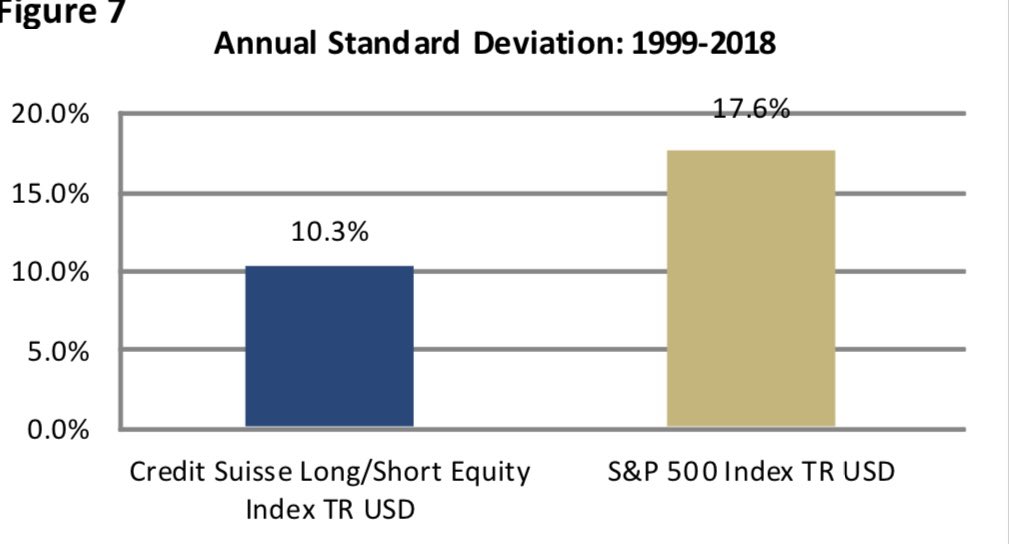

1/ Over the past 20 yrs, long/short equity funds delivered about the same absolute return as long only funds (5.1% vs 4.9% CAGR) with just under 60% of the risk (10.3% vs 17.6%). $TSLA $GME

1/ Over the past 20 yrs, long/short equity funds delivered about the same absolute return as long only funds (5.1% vs 4.9% CAGR) with just under 60% of the risk (10.3% vs 17.6%). $TSLA $GME

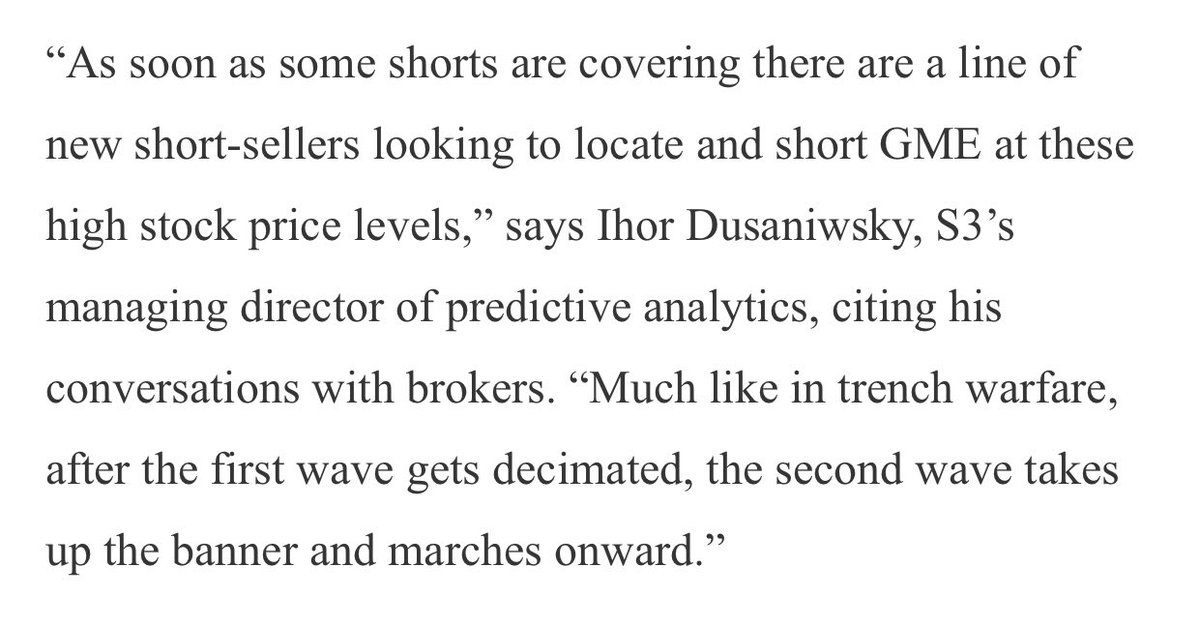

2/ As one would expect, long only funds do better in bull markets, and long/short better in bear markets. The appeal of long/short is they protect clients on the downside (because they short), and thus deliver better overall risk-adjusted returns, the metric clients prize most.

3/ According to Morningstar, clients pay 3x as much for long/short equity funds (1.9%) as for long only equity funds (0.57%), given the expected risk-adjusted return benefits. Growth in long/short equity assets has far outpaced growth in long only equity assets the past 20 years.

4/ Many calling for a ban on short selling haven’t thought once about this issue from the client’s perspective, which normally drives the decision (CEOs and investors are NOT the clients). This speaks volumes about the enormous self-interests by many in this debate. $TSLA $GME

• • •

Missing some Tweet in this thread? You can try to

force a refresh