Many say $GME/RH situation is a "problem in the plumbing," implicating the structural integrity/complexity of our financial systems. If the SEC/government wants to "fix the plumbing" the number one thing they should do is ban Payment for Order Flow. [more] en.wikipedia.org/wiki/Payment_f…

PFOF is a practice that "smells bad" the moment you hear about it. Only through contorted mental gymnastics can one come up with "pro" arguments, but never in a clear enough way that you could pass it along yourself. UK outlawed it in 2012. Illegal in Canada. Why...? [more]

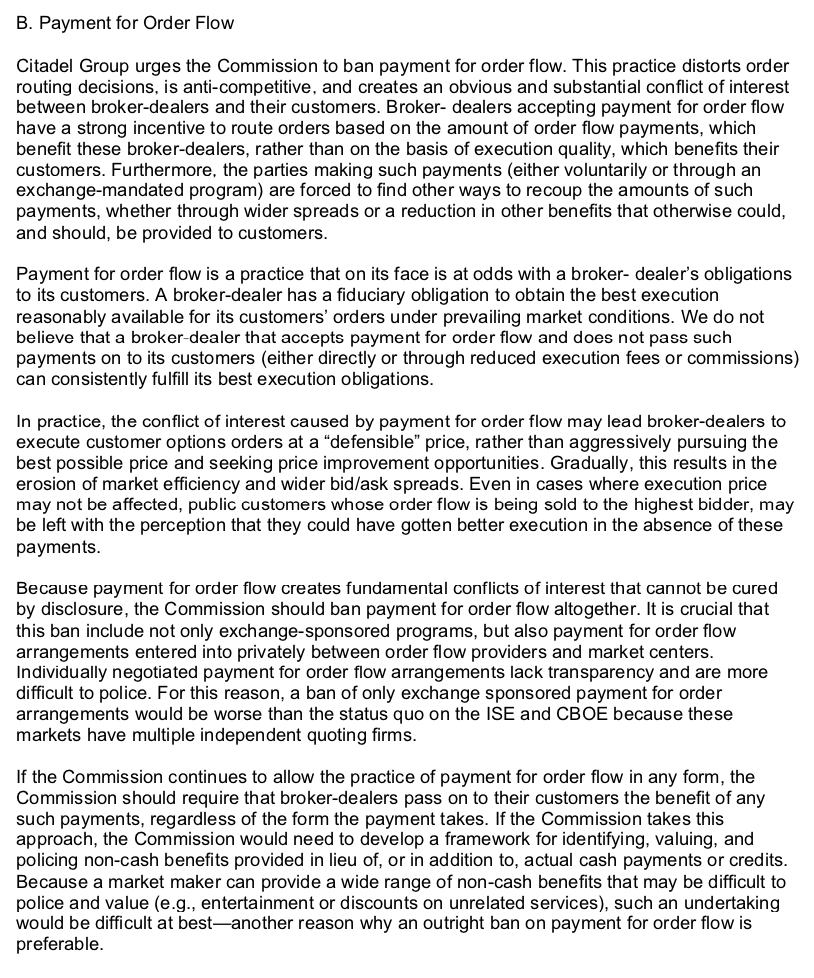

In 2004 letter from Citadel's attorney Jonathan G. Katz to SEC, he makes a a definitive & eloquent list of all the reasons that, "The practice of payment for order flow creates serious conflicts of interest and should be banned." Please read detail. [more] sec.gov/rules/concept/…

PFOF is at the heart of today's retail trading. Some argue PFOF should be OK as "everyone's doing it." You don't have systematic failure because one party did something in the corner. It happens exactly when everyone does it. It "smells bad" because it is bad. We can do better.

• • •

Missing some Tweet in this thread? You can try to

force a refresh