🚨 $DGNR/@CCCInfoServices: Leading SaaS platform in the auto insurance economy.

- 2020 Revenue: $600m

- $100bn in transaction volume

- $6.5bn valuation

- Network of 300+ insurance companies

- AI, IoT, Machine Learning (Potential Ark play?)

Time for a thread 🧵⬇️

- 2020 Revenue: $600m

- $100bn in transaction volume

- $6.5bn valuation

- Network of 300+ insurance companies

- AI, IoT, Machine Learning (Potential Ark play?)

Time for a thread 🧵⬇️

CCC's solutions and big data insights are delivered through the CCC ONE® platform to a vibrant network of 300+ insurance companies, 25,000+ repair facilities, OEMs, hundreds of parts suppliers, and dozens of third-party data and service providers. $DGNR

CCC voted by @BuiltIn as top 100 Best Large Companies to Work For in 2021. $DGNR

"CCC is setting the bar in these industries for AI-powered data insights, machine learning, IoT and telematics."

builtin.com/corporate-inno…

"CCC is setting the bar in these industries for AI-powered data insights, machine learning, IoT and telematics."

builtin.com/corporate-inno…

CCC and Volkswagen Car-Net announced that CCC has become the automaker’s exclusive provider of insurance telematics services for the newest generation of VW Car-Net, included in most model year 2020 and 2021 vehicles.

media.vw.com/en-us/releases… $DGNR

media.vw.com/en-us/releases… $DGNR

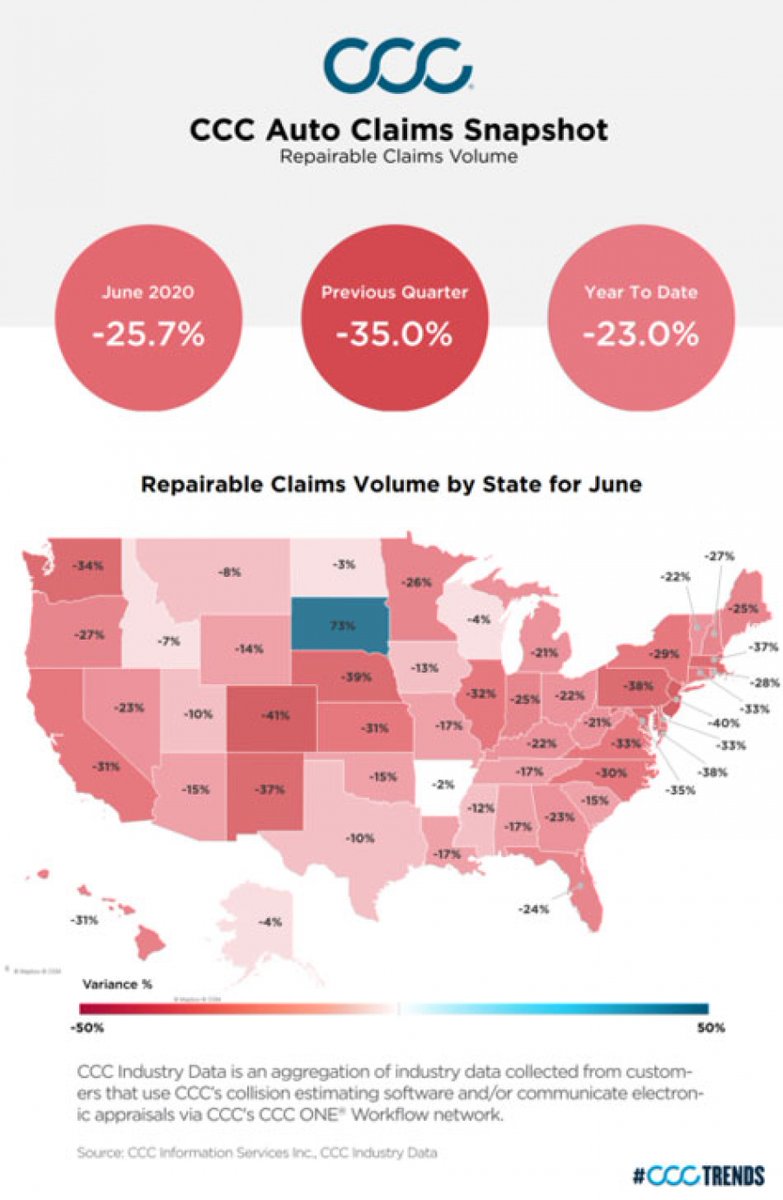

"CCC estimates and AI-supported claims have expanded at record pace exceeding double-digit growth since the beginning of the year. The rapid adoption of digital technology is in direct response to social distancing and work-from-home protocols."

automotiveworld.com/news-releases/… $DGNR

automotiveworld.com/news-releases/… $DGNR

CCC announced the availability of CCC® Quick View (Quick View), enabling auto underwriters to efficiently and affordably complete vehicle inspections virtually by offering policyholders a mobile app to easily capture photos."

prnewswire.com/news-releases/… $DGNR

prnewswire.com/news-releases/… $DGNR

"CCC has signed an agreement with PDP Group (PDP) to digitally connect lenders on the PDP platform to insurers as part of the CCC® Total Loss Care workflow."

prnewswire.com/news-releases/… $DGNR

prnewswire.com/news-releases/… $DGNR

State Auto has selected CCC as its first-party casualty solution provider, extending the companies' relationship. Now State Auto can manage auto physical damage and first- and third-party casualty claims through a single digital workflow.

prnewswire.com/news-releases/… $DGNR

prnewswire.com/news-releases/… $DGNR

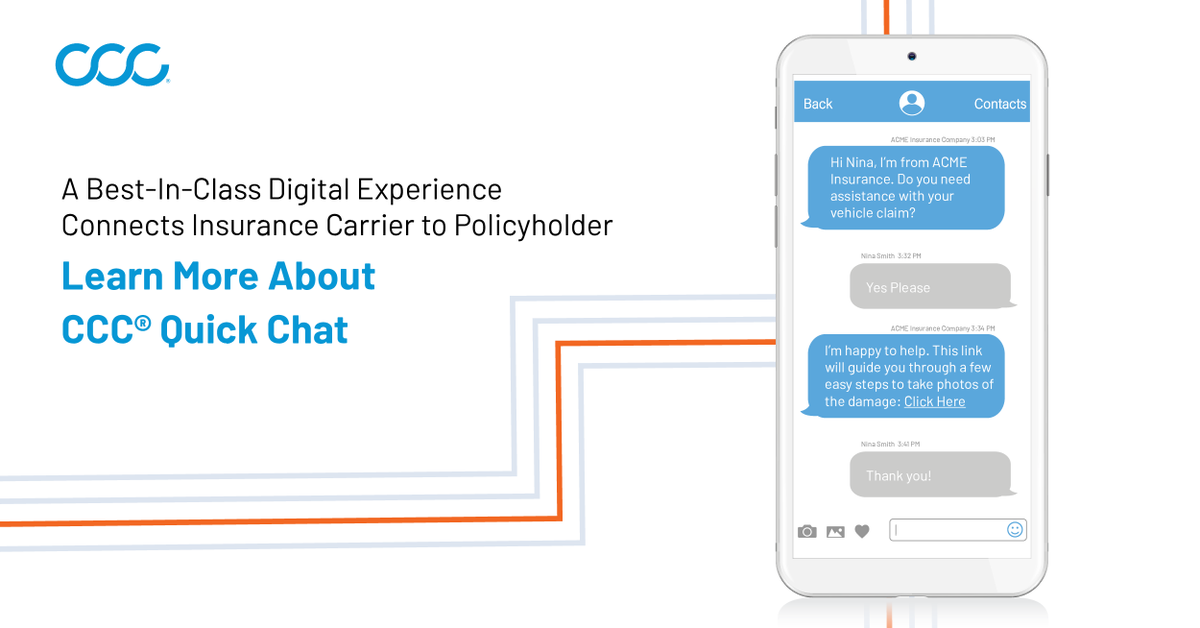

CCC announced the expansion of its digital customer experience offering to include two-way, real-time text capabilities.

prnewswire.com/news-releases/… $DGNR

prnewswire.com/news-releases/… $DGNR

More Partnerships: Service King Accelerates Innovation and Streamlines Operations with Systemwide Transition to CCC ONE® Repair Management Technology and the CCC® Parts Network

prnewswire.com/news-releases/… $DGNR

prnewswire.com/news-releases/… $DGNR

AI and telematics deliver smarter risk analysis and stronger customer loyalty, as Jason Verlen of CCC Information Services explains.

intelligentinsurer.com/article/how-ai… $DGNR

intelligentinsurer.com/article/how-ai… $DGNR

'20 est. - $598M rev. / 5%

'21 proj. - $675M rev. / 13%

$7.05B EV / $150M PIPE

Credits: @DJohnson_CPA

$DGNR Investor Presentation: dragoneergrowth.com/wp-content/upl…

'21 proj. - $675M rev. / 13%

$7.05B EV / $150M PIPE

Credits: @DJohnson_CPA

$DGNR Investor Presentation: dragoneergrowth.com/wp-content/upl…

To wrap it up, a slide from Ark Invest's Big Ideas 2021. Deep learning could be the most important software breakthrough of our time, adding $30 trillion to global equity market cap during the next 15-20 years. $DGNR

🚨 Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh