1/ Thread: $GOOG 4Q'20 Update

For the first time, GOOG segmented its cloud revenues/income separately, and overall revenue was >20% in 4Q which led to +7% after-hours reaction yesterday.

Here are my notes from earnings/press release.

For the first time, GOOG segmented its cloud revenues/income separately, and overall revenue was >20% in 4Q which led to +7% after-hours reaction yesterday.

Here are my notes from earnings/press release.

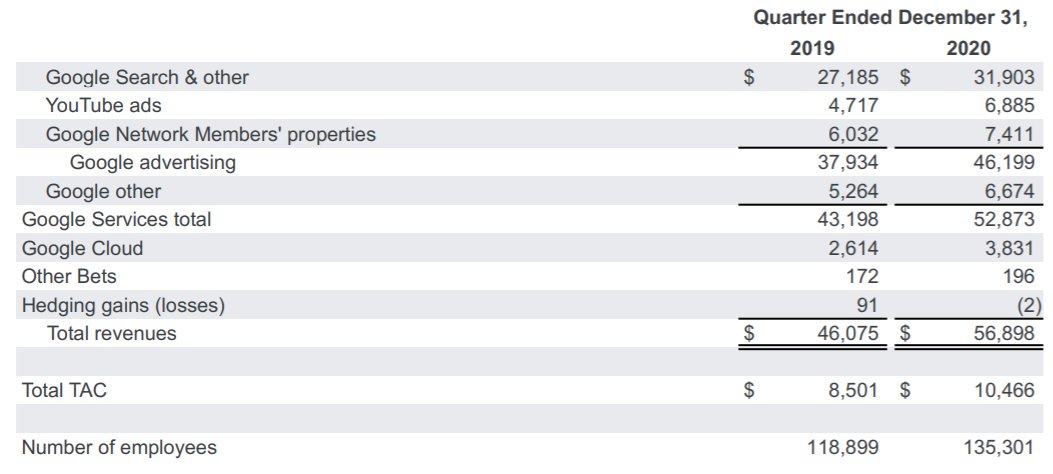

2/ In the last quarter, here is the segment-wise growth:

Search +17.4%

YouTube ads +46.0%

Google Network Members +22.9%

Cloud +46.6%

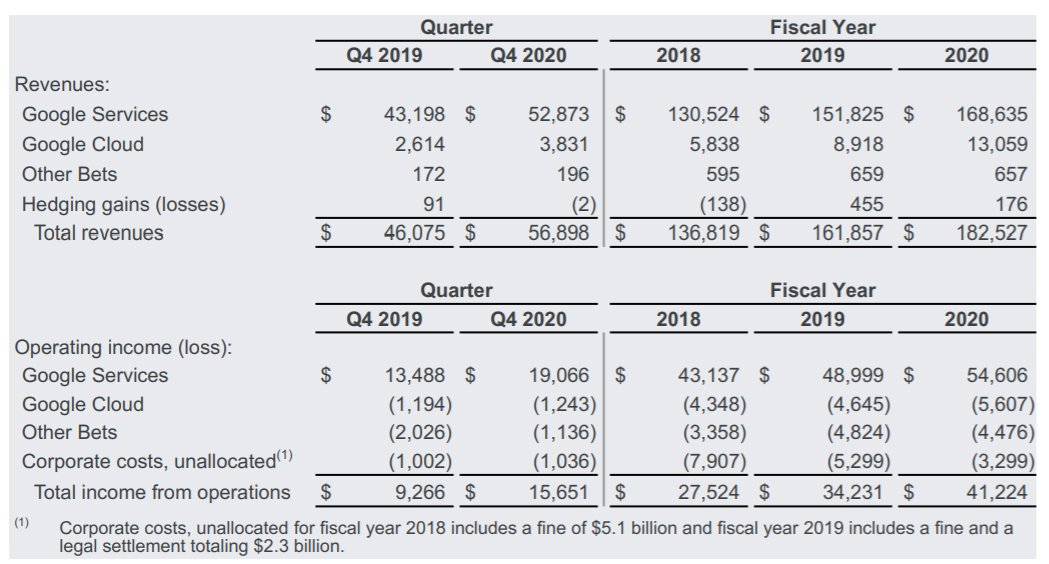

Cloud more than doubled in the last two years.

Other bets losses $4.5 Bn in 2020 (vs $4.8 Bn in 2019)

Search +17.4%

YouTube ads +46.0%

Google Network Members +22.9%

Cloud +46.6%

Cloud more than doubled in the last two years.

Other bets losses $4.5 Bn in 2020 (vs $4.8 Bn in 2019)

3/ Operating margin in Q4 ~28%

FCF margin in Q4 ~30%

One of the big takeaways was the core business was even MORE profitable than most investors thought since cloud had -42.9% operating margin.

$GOOG's search business is a good comp for Fed in terms of "printing" money. JK.

FCF margin in Q4 ~30%

One of the big takeaways was the core business was even MORE profitable than most investors thought since cloud had -42.9% operating margin.

$GOOG's search business is a good comp for Fed in terms of "printing" money. JK.

4/ "you can track takeout and delivery orders when you book or order from Google Maps"

"More than 0.5 million channels livestreamed on YouTube for the first time in 2020"

"videos in our new Shorts player are receiving 3.5 billion daily views."

"More than 0.5 million channels livestreamed on YouTube for the first time in 2020"

"videos in our new Shorts player are receiving 3.5 billion daily views."

5/ Google Pay app is now used by >150 mn people in 30 countries.

Cloud backlog $30 Bn now (from $19 Bn in Q3)

# of Deals >$250 Mn became >3x

Waymo is providing hundreds of fully AV rides per week

Retail searches >3x YoY

Cloud operating losses flat YoY

Cloud backlog $30 Bn now (from $19 Bn in Q3)

# of Deals >$250 Mn became >3x

Waymo is providing hundreds of fully AV rides per week

Retail searches >3x YoY

Cloud operating losses flat YoY

6/ No direct answer to the question of long-term cloud margins; mostly just focusing on investing given the large TAM. Scale benefits will come later.

7/ Direct Response, nonexistent 3 years ago, has been a smashing success.

There's a reason Masterclass was flooding YouTube. It simply works.

"We now reach more 18- to 49-year-olds than all linear TV networks combined."

There's a reason Masterclass was flooding YouTube. It simply works.

"We now reach more 18- to 49-year-olds than all linear TV networks combined."

8/ Advertising on YouTube TV is still "very very early"

"we heard from customers, they have a very strong interest in advertising and streaming environments."

"we heard from customers, they have a very strong interest in advertising and streaming environments."

End/ Thanks to @theTIKR for the transcript. Feel free to join by clicking this (no affiliation): tikr.com/MBI

I also publish one deep dive every month on a publicly listed company.

Subscribe here: mbi-deepdives.com/plans/subscrib…

I also publish one deep dive every month on a publicly listed company.

Subscribe here: mbi-deepdives.com/plans/subscrib…

• • •

Missing some Tweet in this thread? You can try to

force a refresh