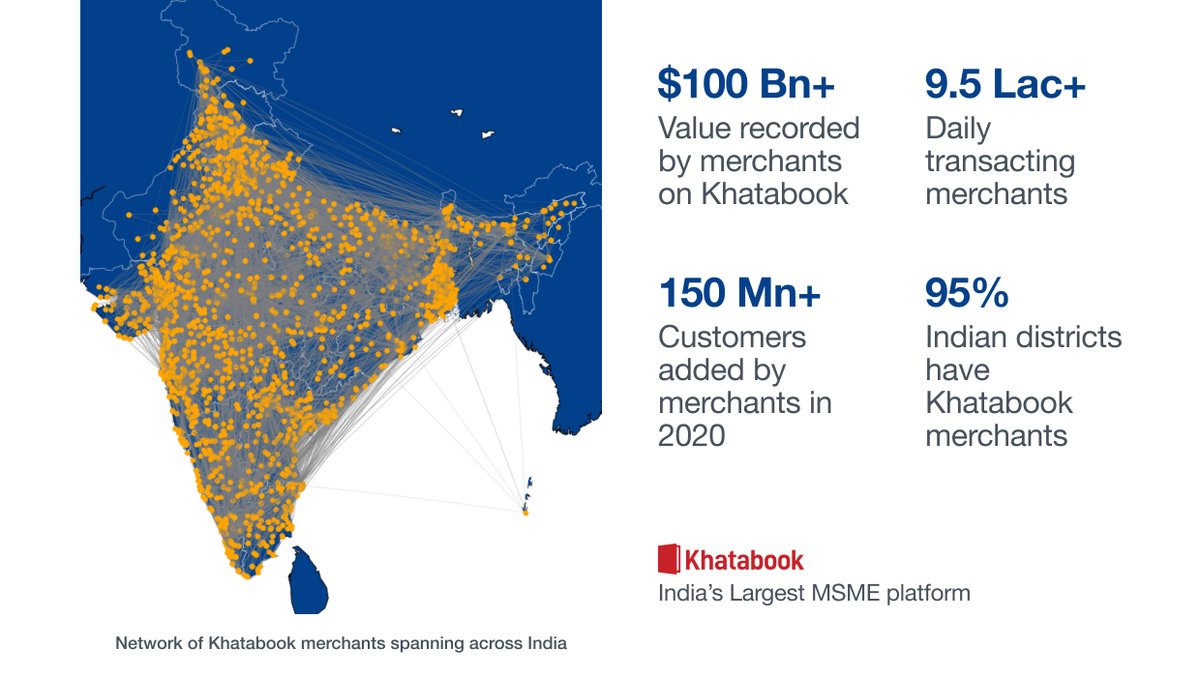

Over 2020 @Khatabook activated merchants in >95% Indian districts, recording over $100Bn+ in transactions with over 150Mn+ customers. A good chunk of India's retail GDP is already being recorded on the platform and trade flows from across the country are getting digitized.

Based on this largest active data set of Indian MSMEs, we did an analysis on the credit behavior across geographies and the impact of COVID on the small business in 2020.

Here's what we found 👇

Here's what we found 👇

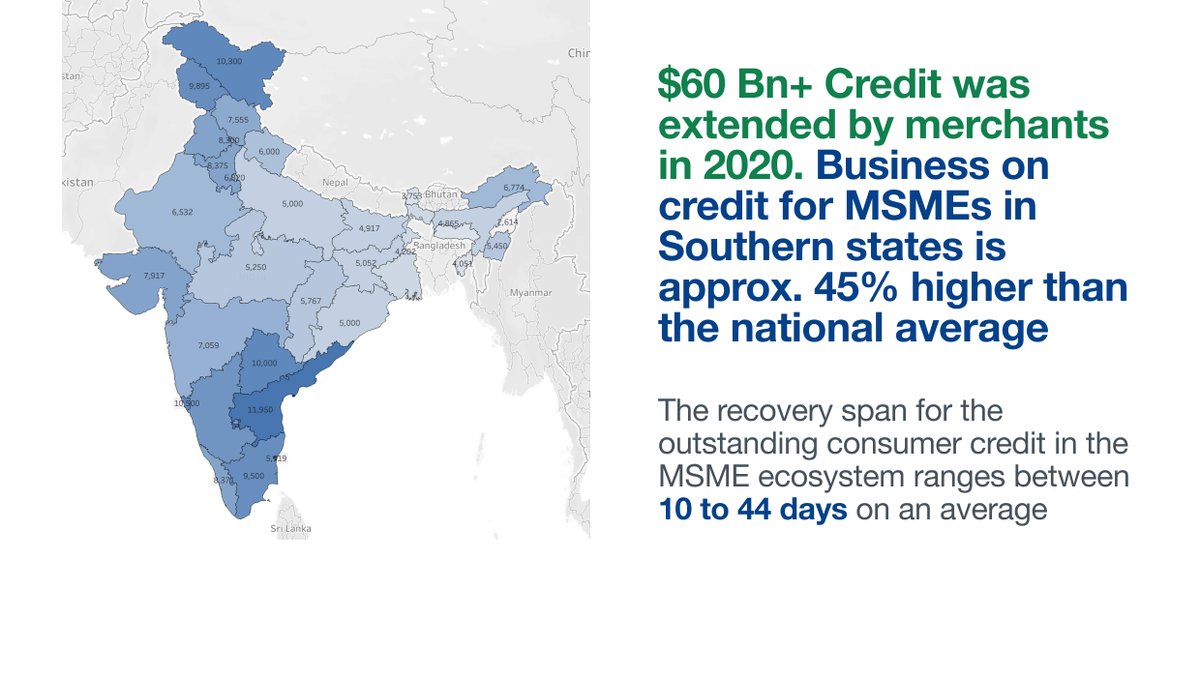

Business volumes on credit are 45% higher for South Indian states vs the national average. Top cities with the fastest credit recovery time: Thrissur, Kochi, Ernakulam, Salem, Coimbatore, Bhubaneswar, Chennai, Kolkata, Imphal, Vijayawada are also heavily dominated by South India.

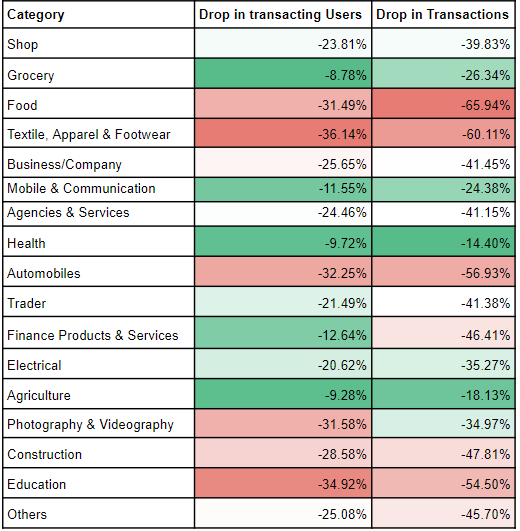

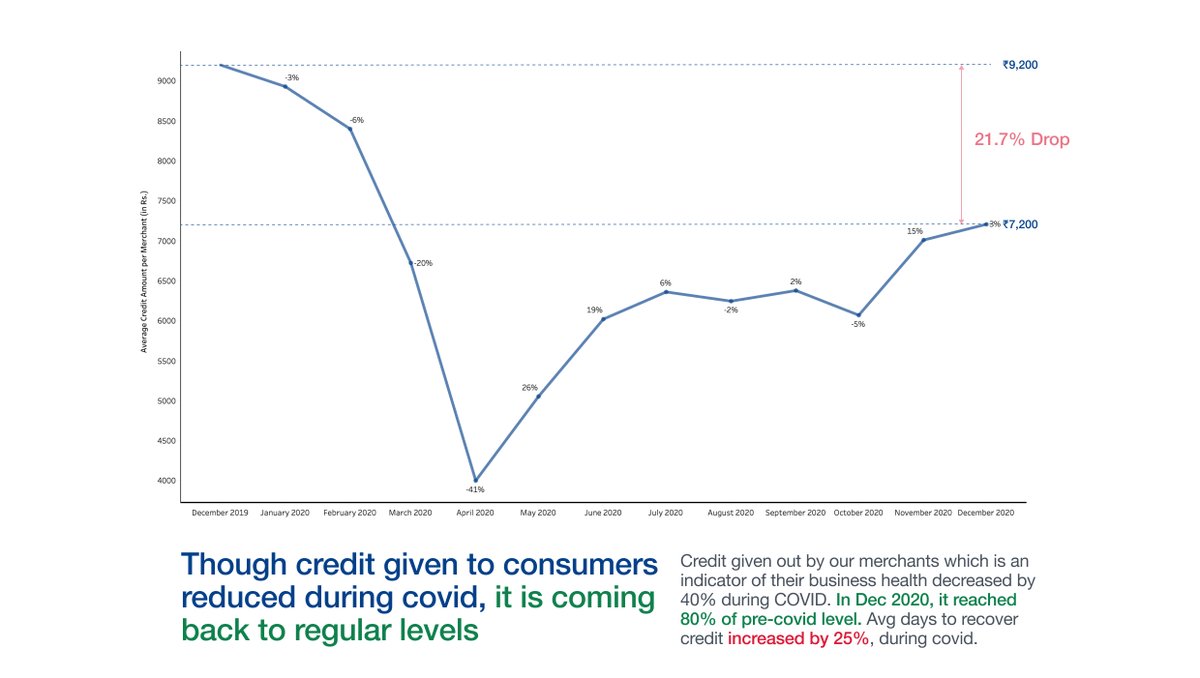

COVID impact: Credit given out by our merchants, which is an indicator of their business health, dropped by 40% during the initial months of COVID. It has continued to recover to 80% of pre-pandemic levels by December. Average days to recover debts increased by 25% during COVID.

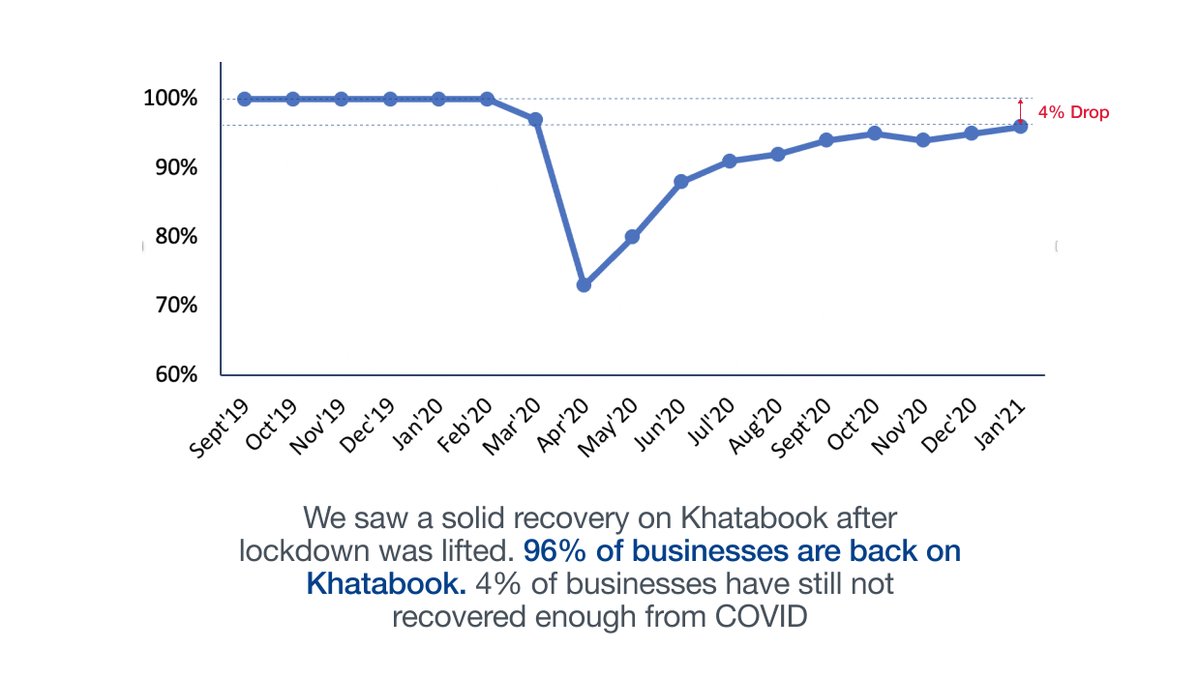

Our retention curves become flat after the first few months, so when our older retained users stop transacting, it means business has stopped. We saw most businesses start again post the worst of lockdown hit starting late March, but nearly 4% of the business are still under.

These are the ones whom the COVID crisis has hit the most and we should explore the possibility of govt enabled credit schemes reaching them directly.

2020 was definitely a challenging year for small businesses. While recovery has been fast and ongoing, certain small businesses of affected sectors still remain hit.

@Khatabook has enabled millions of businesses to recover their credit faster during the pandemic. We will continue on our efforts to digitize all the offline flows in the shop and further enable efficiency for the 60Mn small Indian businesses that are the backbone of our economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh