China Leads Africa’s Digital Currency Race via @pesa_africa

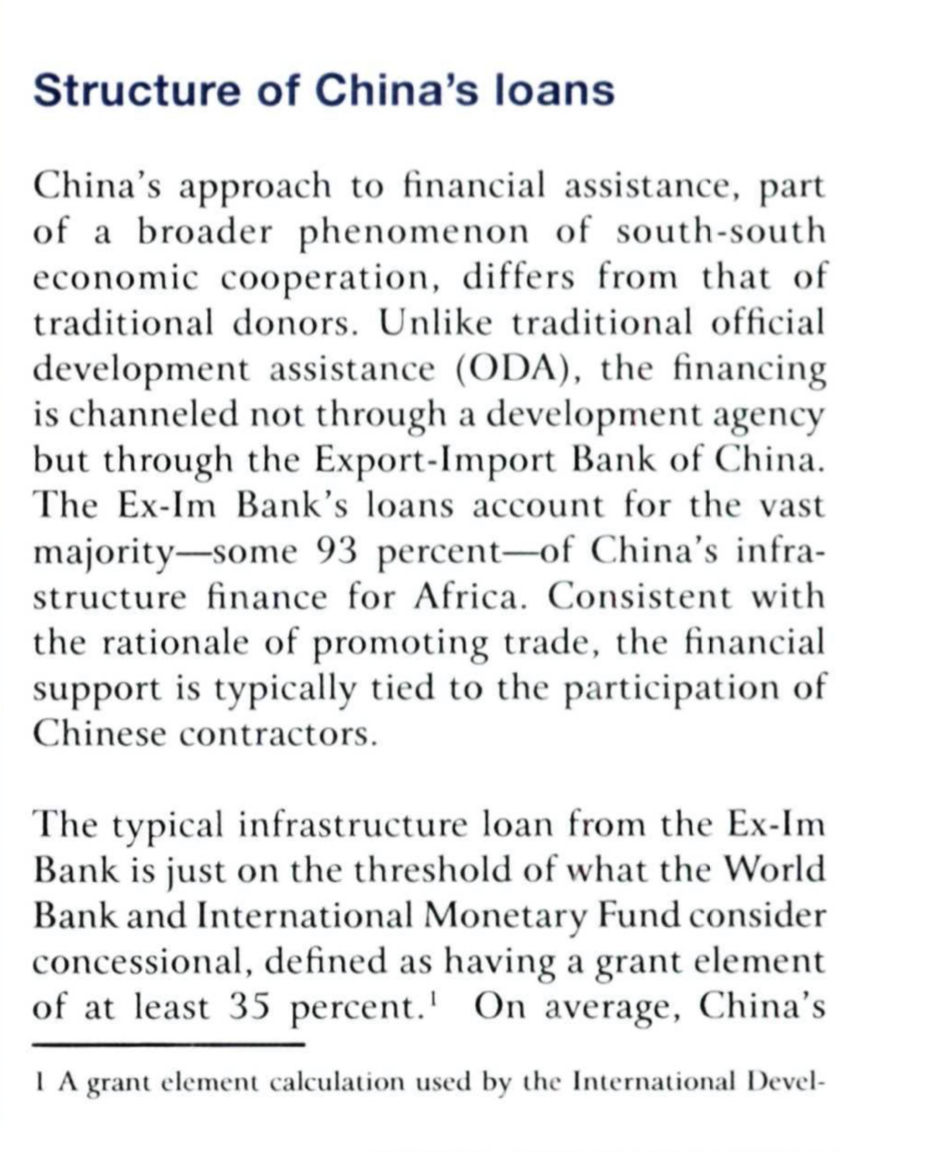

“With years of public investment and plenty of penetration for its phone makers, China is well placed to establish a digital currency in Africa.”

coindesk.com/china-leads-af…

“With years of public investment and plenty of penetration for its phone makers, China is well placed to establish a digital currency in Africa.”

coindesk.com/china-leads-af…

💯 “The intelligence of the chinese goes beyond anything we can think of, they think 100 moves ahead everything they do is about getting more power and influence and it works.”

“Chinese tech was a Trojan horse after all”

• • •

Missing some Tweet in this thread? You can try to

force a refresh