As we await Bank of England decision and new forecast at midday - some interesting new data. Car sales suffering in lockdown -

https://twitter.com/smmt/status/1357254500243881984

ONS put out detailed set of near real time economic indicators - including:

- weekly CHAPS data from Bank of England on debit and credit cards .. 32% down on last year...

-18% of workforce on furlough,

- 44% at normal place of work,

- online job ads down 22% on same week 2020

- weekly CHAPS data from Bank of England on debit and credit cards .. 32% down on last year...

-18% of workforce on furlough,

- 44% at normal place of work,

- online job ads down 22% on same week 2020

It’s here - very good effort from ONS: ons.gov.uk/peoplepopulati…

Bank of England on hold as expected on rates and asset purchases/ QE - unanimous: bankofengland.co.uk/-/media/boe/fi…

After fairly involved discussion seeking not to send a signal that it intends to set negative rates in future, MPC asks PRA to get banks to take steps necessary for the step to be an option in six months time

Bank assumes higher growth in Q4 2020, lower in this quarter “with restrictions in effect in UK as of 27 Jan remain in place throughout 2021 Q1”.

Vaccination programmes are assumed to enable restrictions to be eased -central projections, restrictions assumed to ease over Q2 & Q3”

Vaccination programmes are assumed to enable restrictions to be eased -central projections, restrictions assumed to ease over Q2 & Q3”

Economy will “pick up strongly” during 2021 as a result of reopening and vaccination. But from worse base in early 2021 because of lockdown as well as “temporary lowering of activity” from post Brexit trade barriers - Bank of England

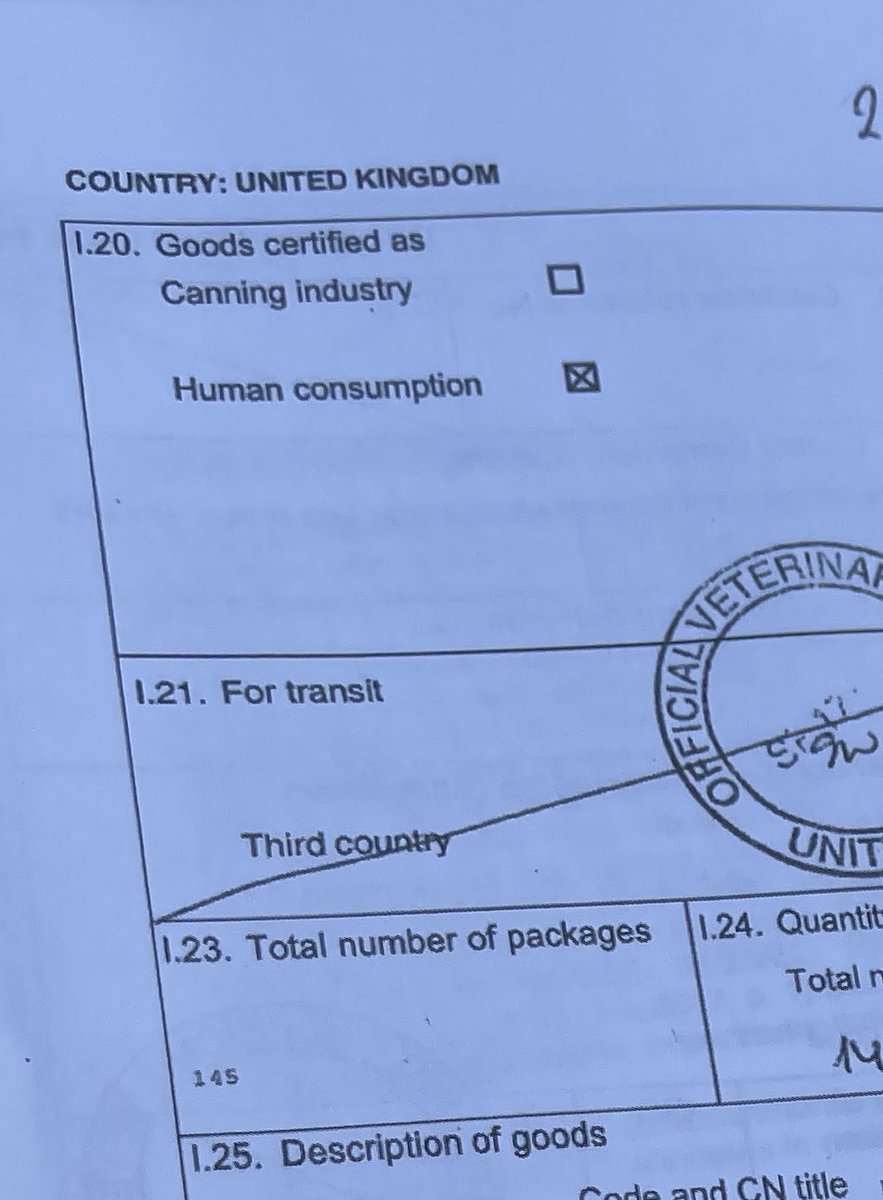

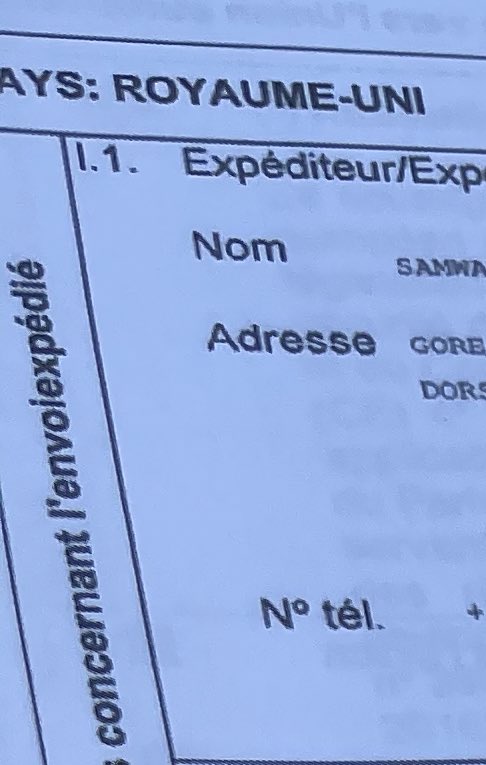

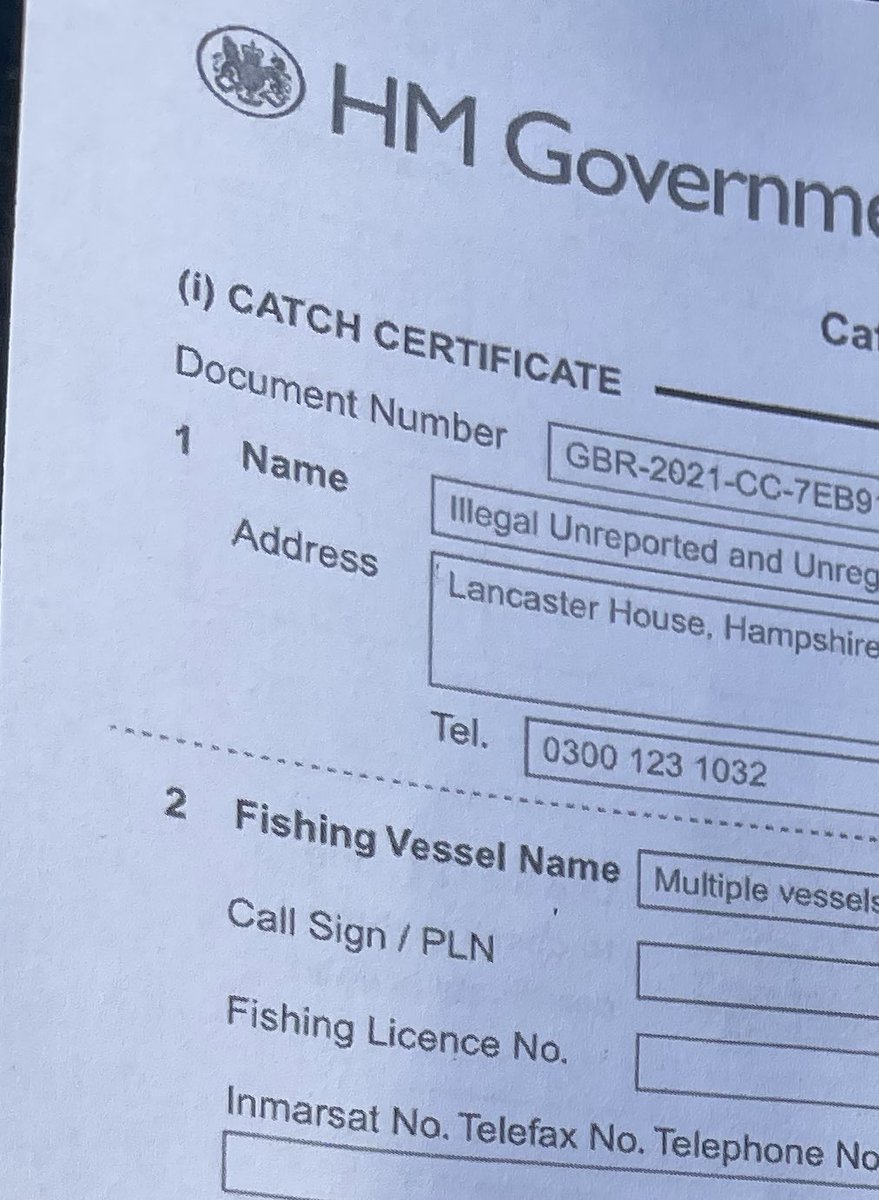

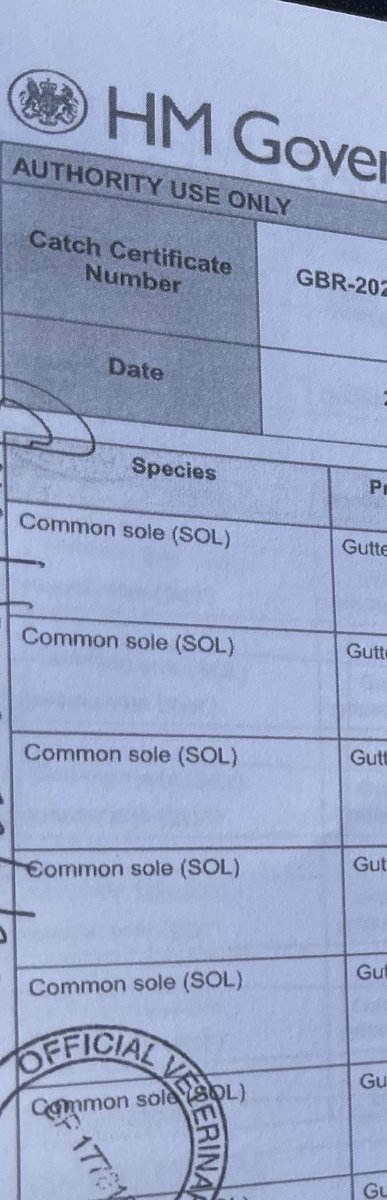

“New trading arrangements will result in barriers to trade some of which are now in place” - “customs, rules of origin and regulatory checks”... “other trade frictions such as divergence in regulatory standards likely to emerge” so “trade likely to be lower” - Bank of England

My general take is that this was rather negative rates-negative - if things go to plan now with vaccine rollout, as they have been, can’t see why they’ll be needed when the economy is forecast to be growing at 5% per quarter...

In the back pocket though as an option

In the back pocket though as an option

• • •

Missing some Tweet in this thread? You can try to

force a refresh