1/ Thread: Notes from $IAC+ $ANGI Earnings call 4Q'20

Lots of interesting data points related to Vimeo on this call. Continued conviction on fixed price at ANGI+ real excitement about Dotdash.

Here are my notes.

Lots of interesting data points related to Vimeo on this call. Continued conviction on fixed price at ANGI+ real excitement about Dotdash.

Here are my notes.

2/ Let's start with Vimeo.

$IAC owns 88% of Vimeo. 1 IAC share = ~1.6 Vimeo share

"TAM is every professional, every team, every organization in the world who now needs to use video to reach their customers"

70% of Fortune 500 companies use Vimeo. Total enterprise customers <4k

$IAC owns 88% of Vimeo. 1 IAC share = ~1.6 Vimeo share

"TAM is every professional, every team, every organization in the world who now needs to use video to reach their customers"

70% of Fortune 500 companies use Vimeo. Total enterprise customers <4k

3/ 60% paying subs start as free first, and 60% of enterprise customers come from free or self-serve base. Most enterprise customers are SMBs.

Recent partnership with $SHOP, $GDDY, $HUBS, Mailchimp

Net revenue retention increased for 7 consecutive quarters.

Recent partnership with $SHOP, $GDDY, $HUBS, Mailchimp

Net revenue retention increased for 7 consecutive quarters.

4/ Vimeo was rule of 40 business in 2020; rule of 50 in Q4. Gross margin >70%. LT EBITDA margin target ~20%, prefers to invest in the business now since LTV/CACC is really strong.

FCF positive:~$30 Mn in 2020. Spin-off likely in April, worst case early May.

FCF positive:~$30 Mn in 2020. Spin-off likely in April, worst case early May.

5/ $ANGI

January deceleration primarily because of changes in accounting treatment (the logic works backwards for the Q4 acceleration though)

9-10% topline growth till Q3, expect to hit ~20% in Q4

January deceleration primarily because of changes in accounting treatment (the logic works backwards for the Q4 acceleration though)

9-10% topline growth till Q3, expect to hit ~20% in Q4

6/ Fixed price ended at 11% of total business in 2020, ahead of expectation. Target is to make it half the size of overall business.

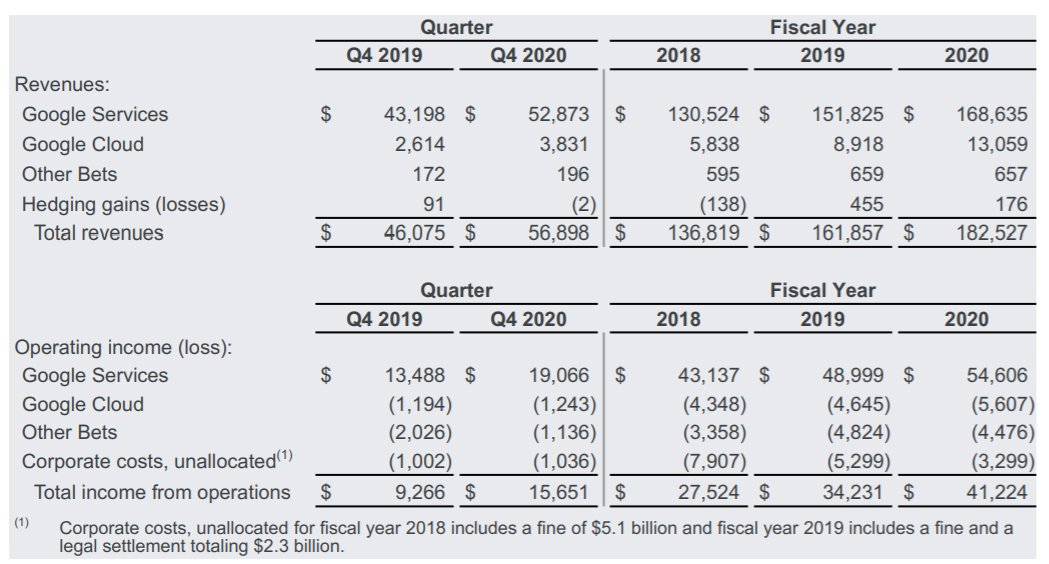

Expect to hit 35% EBITDA (currently 10-15%) for traditional segment (will be lower for fixed price). How? See second image.

Expect to hit 35% EBITDA (currently 10-15%) for traditional segment (will be lower for fixed price). How? See second image.

7/ Fixed price gives potential price leverage.

If you want to explore more on $ANGI, here's my deep dive (paywall): mbi-deepdives.com/angi/

If you want to explore more on $ANGI, here's my deep dive (paywall): mbi-deepdives.com/angi/

8/ Dotdash

If Dotdash were a SaaS business (it's not)...

100% renewal rate, >100% net revenue retention

Jason from Oppenheimer suggested to brand Dotdash as "ad tech" business 😂

If you don't know what Dotdash is, go here: dotdash.com/our-brands/

If Dotdash were a SaaS business (it's not)...

100% renewal rate, >100% net revenue retention

Jason from Oppenheimer suggested to brand Dotdash as "ad tech" business 😂

If you don't know what Dotdash is, go here: dotdash.com/our-brands/

9/ Care.com potential TAM $30-40 Bn

After Vimeo spin-off, IAC will have ~3 Bn cash, some of which will be deployed to Care and Dotdash.

Also, $IAC seems pretty pleased with how things turned out with $MGM

After Vimeo spin-off, IAC will have ~3 Bn cash, some of which will be deployed to Care and Dotdash.

Also, $IAC seems pretty pleased with how things turned out with $MGM

• • •

Missing some Tweet in this thread? You can try to

force a refresh